annual report 2008 Growing the success of Irish food & horticulture

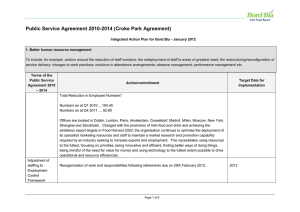

advertisement