Growing the success of Irish food & horticulture HEAD OFFICE Clanwilliam Court

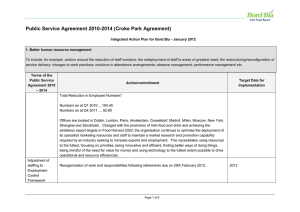

advertisement