ANNUAL REPORT & ACCOUNTS Growing the success of Irish food & horticulture

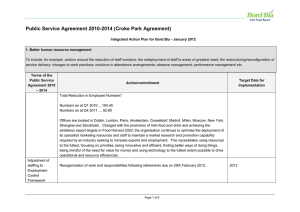

advertisement