1980-82 in New Mexico, fuel production

advertisement

in NewMexico,1980-82

Mineralandmineralfuelproduction

byRobeftW.

and

Eveleth,

Mining

Engineer,

first time. The natural gas industry was parA. Bieberman,

Roben

Senior

Petroleum

Geologist, ticularly affectedby lesseneddemand:an oil

NewMexico

Bureau

of Mines

andMineral

Resources, and gassurpluscauseda downturnin drilling

Socorro,

NM

activity during 1982,althoughactivity did inPreliminary 1982mineral and mineral-fuel creasesignificantlyduringthe last quarter.An

production data are presentedin table I com- estimated2,300wellsweredrilledduring 1982,

paredto both 1980and 1981.All major com- representing

comparedto 1981,

a 690decrease

moditiesshowproductionand dollar valuede- but still l79o above1980.

veryslightly,

Whilecoalproductiondecreased

creases(with the exceptionof coal) during the

2-yr period thus reflecting the generally de- overallvalueis up 2ltlo over 1981,and is the

pressedcondition of New Mexico's (and the only real bright spot in New Mexico'smining

that of both copper

nation's) economy.During 1980-81,overall industry: value exceeded

value increased220/oto the all-time high of and uranium combined for the first time.

$7.24 billion. Nearly all of this increasewas However,KaiserSteel'sYork Canyonunderderived from the oil and gas industry. How- ground coal mine was forcedto closein early

ever, both quantity and value of petroleum Septemberas a result of losing a major

and gas products decreasedduring 1982. coking-coalconsumerin Texas.

While oil and gas production has decreased

Copper, traditionally New Mexico's numsteadily for severalyears, higher energycosts ber one hardrock commodity, decreasedin

as a result of both demandand inflation had value7l9o from 1980'shigh to just underthe

more than offset the difference-until 1982. $100million mark in 1982.Copperas well as

productioncoup- many other commoditiesis adverselyaffected

During that year decreasing

programsand in- by high ratesof inflation and interest,both of

led with energyconservation

dustrial consumersturning to alternatefuel which result in poor demand for housing,

in valuefor the automobiles,and appliances.Copper miners

sourcesresultedin the decrease

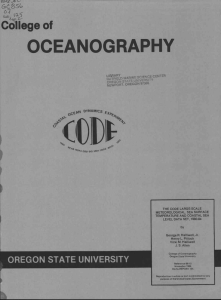

pRoDucrroN rN NEw MExlco Short tons unless noted: NA. not

TABLE l-MTNERAL AND MTNERAL-FUEL

available; XX, not applicable; W, withheld to avoid disclosing individual company data; P, preliminary,

subject to revision; R, revised; -, no production. Data sources:U.S. Bureau of Mines; U.S. Department

of Energy; Oil Conservation Division, New Mexico Department of Energy and Minerals; Oil and Gas Accounting Division and Property Tax Division, New Mexico Department of Taxation and Revenue; and

Keystone Coal Industry Manual ( I 98 I , I 982).

192

(h'd

&ll&s)

Qdlty

(fruqd

6a1

(tons)

6!per

bE)

(uoy

oz)

@ld

(busd

GyF€s

bre)

(lonq)

hgeifero[s

ore, F35l

h

btural

ftr)

sas (ntllton

(thousrd

gas ltquids

Natural

bbls)

(toG)

EE

bns)

Frlite

{uoud

(fr|,d

crde

bls)

Ftrolew,

(&uqnl

tons)

btash

(lbousd

ircluding

clrder

hlce,

bre)

(tJbuerd

$rd

and grave1

hs)

(tlb6ard

Sllver

lroy oz)

(ftusd

crlffi

tons)

Sbne,

(fr6d

stone,

dimreid

bns)

(fr6d

lbs)

r$ve($le

u<ilis,

uloi

ffilnd

brite,

cor, Eeient,

lead,

fir{lay,

sulfur,

1ire, mica, mlybalsm,

slt,

vedim,

zirc,

d

W

MM

60

19,481

164,619

M

15,187

182

R35,r98

r,r32.316

4f tgg3

2,SOg

269,031

150

9,610

r,688

75,324

2,660

44

7 ,956

2,926,846

133,948

4g

14,494

r,794,2LO

249,0\\

3,O24

r7 t676

2,211

l8

15.500

7,259

9I

311tOtA

(tlFE-d

&llaF)

Q$tity

64

r4,194

r69,88I

NA

65,149

166

1 2t 14 r

t, r18,589

489

12 tr55

1,765

93

n t3go

t,632

4,162

26

12,42O

g

8?,845

#

u

5,954,363

fr

P

(M

&Uc)

edlty

rt9

342,935

289,294

209

30,22r

2,256

49

rs,76s

65,805

s

54| A0O

162

2,4r5,933

958,837

974,600

56,635

2,rg3,494

90r,391

14,981

2,414,196

26t,2OO

919

Pra,665

11tIlS

12,445

173

356,454

433

1I r4gS

r,676

93

4,606

14,239

2,449,454

2lg,oog

936

14,ags

2,645

tg

ro,30o

r38

24a,r3t

2,312

x

41,'141

1,24r,232

4r2,72O

91,384

240

g

6,522,AOA

attemptedto weatherthe storm by announcing

extended"vacations" and a few layoffs during 1981,but the market situationcontinued

to worsen.This resultedin major layoffs at all

the producingmines.Additionally, Quintana

Mineralswas forcedto closedown after shipping someconcentratefrom their new Copper

Flat mine during May and June 1982.Understandably,little explorationand development

althoughBolidenCoris underwayelsewhere

poration, the new proprietors at the Pinos

Altos property formerly under Exxon, began

surface preparations preliminary to underground development.Exxon is still active in

in

the area,conductinggeologicinvestigations

the Burro Mountains near the Flying A

Ranch.

Precious-metalmining was limited to just

two locations: Goldfield Corporation's St.

Cloud mine near Chloride in Sierra County

and Gold FieldsLtd.'s Ortiz mine at Cerrillos

in Santa Fe County. Silver production decreasedsignificantlyprimarily becauseof the

shutdownat Tyrone. Much of the gold decreasewas largely offset by production from

the Ortiz mine. Molybdenumproductionalso

droppeddramatically-open-pitmining came

to an end at Questain August 1982.Development is ongoing at the new undergroundmine

complexhowever,and the companystill plans

to be in productionby July 1983.

Potashproductionwasdown approximately

590 for 1982.Demand is adverselyaffected,

again,by high interestrates:farmersarereluctant to borrow money for fertilizer purchases

until the last possiblemoment.Additionally,

foreignproducersmay be "dumping" potash

in the Americanmarket.SenatorDomenicirequestedthat the CommerceDepartmentinvestigatethepossibilities.

Uranium production decreasedapproximately 260/ocompared to 1981, and is down

419ofrom 1980'sall-time high. The low production resulting from the continued depressed

stateof theU.S. uraniumindustrywas

anticipated-approximatelythree-fourthsof

the minesactiveduring 1980haveclosed. o

i6 ftoft oBn'rrls

USPOSTAGE

PAIII

NtwMExrc0

s0c0RR0,

NO9

PERMII