Screening for Patent Quality: Examination, Fees, and the Courts ∗ Mark Schankerman

advertisement

Screening for Patent Quality:

Examination, Fees, and the Courts∗

Mark Schankerman†

Florian Schuett‡

December 2015

PRELIMINARY: DO NOT QUOTE WITHOUT PERMISSION

Abstract

This paper studies how government policy instruments can be used

to improve the quality of patent screening. We focus on four key policy instruments: patent office examination, application fees, activation

(renewal) fees and post-examination challenges in the courts. We show

that there are important complementarities among these policy levers

and identify conditions under which they can be used to achieve either

partial or complete screening. We also examine the welfare implications of different instruments, and the sensitivity of conclusions to the

way in which courts are modelled.

1

Introduction

The patent system is one of the main devices governments use to increase

innovation incentives. However, there is growing concern among academic

scholars and policy makers that patent rights are becoming an impediment,

rather than an incentive, to innovation. Critics claim that the proliferation of patents, and the fragmentation of ownership among firms, raise the

transaction costs of doing R&D and expose firms to holdup through patent

litigation (Heller and Eisenberg, 1998; Bessen and Maskin, 2009). These

dangers have been prominently voiced in public debates on patent policy in

∗

We are grateful to Jay Pil Choi, Vincenzo Denicolò, Bernhard Ganglmair, Patrick

Legros, and participants of the MaCCI Workshop “Economics of Innovation” in Bad

Homburg (2015) for useful comments and suggestions. All errors are our own.

†

London School of Economics and Centre for Economic Policy Research, E-mail:

m.schankerman@lse.ac.uk

‡

TILEC & CentER, Tilburg University. E-mail: f.schuett@uvt.nl

1

the United States (Federal Trade Commission, 2011) and recent decisions by

the Supreme Court (e.g., eBay Inc. v. MercExchange, L.L.C., 547 U.S. 338,

2006). Many of these problems, critics claim, arise from ineffective screening by patent offices, granting property rights to obvious inventions that do

not represent a substantial inventive step, especially but not only in new

areas such as business methods and software. In the presence of costly (and

probabilistic) review by courts, weak patents – obvious ones that should not

be granted – may end up being strong (Farrell and Shapiro, 2008).

There is no shortage of criticism about patentability standards being

too low, and the need to make screening more effective. But how does

one achieve this goal? The economic theory literature focuses primarily on

patent design features – e.g., duration and scope of patents (Scotchmer,

1999; Cornelli and Schankerman, 1999; Klemperer, 1990; Hopenhayn and

Mitchell, 2000) – but only recently have economists examined ways to enhance the effectiveness of patent screening. In a series of papers, Schuett

(2013a, 2013b) studies how patent examination intensity, examiner incentives, and application fees affect ex ante research choices of inventors. In

related work, Kou, Rey and Wang (2013) study how the non-obviousness

threshold for patenting affects adverse selection in ex ante R&D choices

by inventors.1 Legal scholars have written extensively on ways to improve

patent screening, including on the use of external peer review (Noveck,

2006), appropriate standard and application of the non-obviousness criterion (Eisenberg, 2004; Dreyfuss, 2008), and presumption of validity and

evidentiary standards for invalidation in the courts (Lichtman and Lemley, 2007). At the other extreme, it has been suggested that we should

move to a registration system for patents (with effectively no examination

for quality) and shift the entire burden of screening to the courts (Lemley,

2001). These proposals by legal scholars have not been subjected to formal

economic analysis, embedding them in an equilibrium framework in which

policy instruments affect optimal strategies of inventors and competitors.

In this paper we study how policy-makers can most effectively use the

instruments at their disposal to improve the quality of patent screening.

1

Other related studies include Caillaud and Duchene (2011) and Atal and Bar (2012).

2

We focus on four key screening instruments: the intensity of patent office

examination, application fees paid before patent examination, activation (renewal) fees paid by inventions that have passed examination, and review by

the courts for patents challenged by a competitor. For most of the analysis,

we assume that courts invalidate obvious inventions with certainty (we relax

this and study how results change with the characterization of courts later).

To our knowledge, we are the first to provide a theoretical analysis of this

full set of policy instruments, and to study how these instruments interact

with each other.

We develop a model in which an inventor faces a competitor. The inventor is endowed with an idea for an invention which can be either obvious

(‘bad type’) or nonobvious (‘good type’). The invention type is private information to the inventor. An obvious invention is profitable to develop in

the absence of a patent while a nonobvious one requires patent protection

to be profitable. Since patent protection increases the profit for both types,

however, owners of obvious inventions also have a private incentive to seek

a patent. There is a net social cost (benefit) of granting patents for obvious (non-obvious) inventions, so effective screening is important for welfare.

The inventor chooses whether to pay an application fee and, if subsequently

approved (screening by the patent office is imperfect), whether to pay the

activation fee. If the patent is activated, the inventor may choose to license the invention to the competitor and the competitor chooses whether

to challenge the validity of the patent in court. Formally, this is a signaling

game in which each decision by the inventor can reveal information about

the invention type, and the competitor Bayesian updates.

The key results from the analysis are as follows. First, we show that

the characterization of equilibrium turns on whether patent challenges are

credible, and this depends on the examination intensity (quality of patent

office screening) and the cost of going to court. If challenges are not credible,

bad types do not have to fear challenges; thus depending on the level of fees

and examination, they either pool with good types by applying for patents

and proposing a high license fee to the competitor, or they do not apply. If

challenges are credible, there is no pooling equilibrium. Instead, whenever

fees and examination intensity are such that the bad type would apply when

3

challenges are not credible, he also applies with strictly positive probability

when challenges are credible. The equilibrium is in mixed strategies, with

bad types either randomizing between high and low license fees or between

applying and not applying for patents. Over which decision they randomize

depends on the level of application and activation fees as well as on the

examination intensity and the cost of going to court. This highlights the

fact that the policy instruments interact in shaping the equilibrium.

Second, we show that if the patent office makes no examination effort (a

pure registration system), or if the activation fee is zero and examination

is imperfect, complete screening (where only the good type applies) cannot be achieved. This is important because it emphasizes that fees cannot

completely screen in a pure registration system. Complete screening can be

achieved by a combination of an application fee and an examination that is

sufficiently rigorous (even though not perfect). Moreover, the examination

intensity required to induce self-screening of inventors is increasing in the

activation fee (activation fees and examination are not substitutes). We also

show that, despite our assumption that courts are mistake-free, they cannot

eliminate all bad patents that are issued. This is because in equilibrium not

all bad patents are challenged by the competitor. This result raises serious

doubts about over-reliance on the court system to weed out bad patents.

Third, we perform a welfare analysis to further investigate the optimal

structure of fees, taking the examination intensity as exogenously given.2

The most interesting case arises when examination is not sufficiently rigorous for complete screening to be achievable. In that case, we show that a

social planner would always frontload fees, i.e., rely on application rather

than activation fees. The intuition for frontloading of fees is that, while

application and activation fees are perfect substitutes for the good type,

the bad type prefers activation fees, which are due only after having passed

examination.

When we relax our assumption that courts are mistake-free (i.e., always

invalidate obvious inventions) and allow courts to randomly uphold a fraction of patents (‘probabilistic patents’), we show that it is again possible

2

We have yet to complete the welfare analysis when the examination intensity is a

choice variable.

4

fully to screen out bad patents by a combination of application fees and sufficiently stringent examination intensity, but doing so requires more rigorous

examination by the patent office than when courts are mistake-free.

Our results about the virtues of frontloading fees call into question the

current structure of fees at the major patent offices around the world. Patent

offices often backload a substantial portion of their fees by charging a variety

of post-grant fees such as issuance and renewal or maintenance fees. At the

USPTO, for example, a patent application with three claims or less costs

the applicant a total of $1,740 in pre-grant fees. If the application is granted

and the resulting patent renewed to full term, the applicant pays a total of

$13,560 (ignoring discounting) in post-grant fees.3

It should be noted that there may be reasons outside of our model for

backloading fees. A system of renewal fees essentially ensures that more

valuable inventions receive longer protection. Scotchmer (1999) and Cornelli

and Schankerman (1999) identify conditions under which society wants to

give longer patents for more valuable inventions. In Scotchmer (1999), this

occurs if R&D costs are convex in value, while in Cornelli and Schankerman

(1999), it improves the incentives of the most productive inventors.

Throughout the paper, we take the existence of a patent system as given.

It is not a priori clear whether a patent system is the optimal mechanism

in the environment we consider; an alternative incentive mechanism such as

prizes may perform better. Since abolishing the patent system is not on the

table in the foreseeable future, we believe that exploring how to improve

the functioning of the existing system is a worthwhile endeavor in its own

right. Note also that a patent system with the patentability requirement we

will consider below may well place lower informational requirements on the

government than a prize system. A prize system requires the government

to know the R&D costs of the invention, its value, or the difference between

R&D costs and competitive profits, whereas the patent system we envisage

only requires knowledge of the sign of the difference between R&D costs and

competitive profits.

3

See

www.uspto.gov/learning-and-resources/fees-and-payment/uspto-fee-schedule,

accessed on 10 November 2015. Every claim in excess of three costs an additional $420

in pre-grant fees.

5

The paper is organized as follows. Section 2 presents the setup of the

model. Section 3 derives the equilibrium. Section 4 provides conditions for

full screening as well as some comparative statics, while Section 5 develops

the welfare analysis. Section 6 analyzes a number of alternative settings,

including exogenous challenges and a more general screening technology. We

conclude with a short summary of results and discussion of their implications

for policy (to be completed).

2

Model

There is a unit mass of inventors. Each inventor is endowed with an idea

(v, θ) for an invention. Inventions differ in two dimensions: value, indexed

by v, and R&D cost, indexed by θ. The characteristics (v, θ) of the inventor’s idea are his private information. Developing an idea into an invention

requires an R&D investment kθ . Once an invention has been developed,

the inventor can apply for a patent (i.e., patent applications can only be

submitted on inventions, not ideas).

Each inventor has a single competitor. Both firms are initially symmetric, and industry profits and consumer surplus prior to the invention are

normalized to zero. To fix ideas, consider a cost-reducing invention. In the

absence of a patent, once the invention has been developed it can be freely

copied (notice that this implies that the competitor learns v). Both firms

thus benefit from the cost reduction and obtain a profit πv > 0 each (i.e.,

total industry profit is 2πv ).4 Total welfare (gross of R&D costs) is 2πv + Sv ,

where Sv ≥ 0 is consumer surplus. If instead the invention is protected by a

patent the inventor obtains πv +∆v , where ∆v is the patent premium, which

will be endogenized below, and welfare is 2πv +Sv −Dv ≡ Wv , where Dv ≥ 0

is deadweight loss. We assume that Wv ≥ πv + ∆v for all v. This assumption says that the social returns exceed the private returns to R&D, which

is consistent with the evidence in Bloom, Schankerman and Van Reenen

(2013).

In what follows, we postulate that the requirement for an invention to be

4

For the inventor to benefit from the cost reduction even absent patent protection,

competition must not be too fierce. An example under which firms earn higher profits

post-invention is Cournot competition.

6

patentable is kθ > πv , i.e., R&D costs must be larger than the competitive

profits the inventor can obtain without a patent. Such a patentability requirement can be justified as follows. Consider a social planner maximizing

welfare. Which types of inventors does the planner want to give patents

to in our environment? From an ex post perspective, the answer is clearly

none at all, since patents create deadweight loss. From an ex ante perspective, the planner is still worried about deadweight loss, but also realizes that

some socially valuable inventions will not be developed in the absence of the

promise of a patent. But ideas with kθ ≤ πv are developed even without a

patent. Hence, due to deadweight loss, it cannot be optimal to give them a

patent. A second concern for the planner may be that giving patents to some

ideas with kθ > πv might lead to development of these ideas even though

they are not socially valuable, i.e., kθ > Wv . However, our assumption that

Wv > πv + ∆v rules this out, as it implies that ideas that are not socially

valuable are not privately valuable either.5

Our patentability requirement corresponds to the notion that patents

should be given only to those inventions that require the patent incentive

to be developed, and not those that society would have benefited from even

absent a patent. This is in line with the rationale courts and legal scholars

typically give for the nonobviousness requirement in patent law (see, e.g.,

Eisenberg, 2004).

In what follows, we simplify the analysis by considering a single v.6

5

A further objection to the patentability requirement we impose is that it encourages

high-cost inventions. This corresponds to a different environment, in which ideas are

endogenous. However, even in such an environment, the patentability requirement kθ > πv

can often be justified. To see this, suppose the inventor can choose (or influence, possibly

at a cost) θ but not (directly) v. Let v ∈ {L, H} and θ ∈ {G, B}, with kG > kB .

Assume θ is a signal of value: letting pθ ≡ Pr(v = H|θ), this implies pG > pB . We have

E(Wv |θ) = pθ WH + (1 − pθ )WL . If E(Wv |G) − kG > E(Wv |B) − kB , or

(pG − pB )(WH − WL ) > kG − kB ,

the planner wants to encourage the inventor to go for ideas with θ = G, which have

high R&D cost. That is, the planner would like to promote “ambitious” research. She

can achieve this by promising patents only to type θ = G. Depending on parameters

and information structure, it may or may not be optimal to base patentability on kθ − πv ,

rather than kθ only; however, in the simplified environment we consider in the basic model

below, these rules coincide.

6

The extension to multiple v has yet to be added, but is not fundamentally different as long as the competitor observes v; the signaling game then only involves private

information about θ.

7

Hence, we drop the index v from all expressions. Moreover, we consider

θ ∈ {G, B}, with kG > π > kB . Inventions of type θ = B occur with probability 1 − λ and will be referred to as obvious while inventions of type θ = G

occur with probability λ and will be referred to as nonobvious. Obvious inventions would be developed even in the absence of patent protection, while

nonobvious ones would not. Thus, society should award patent protection

only to nonobvious inventions. Because for an inventor whose idea is obvious the decision whether to develop does not depend on whether he expects

to obtain patent protection, we can normalize kB = 0 without loss of generality and assume kG = k > π. In order to ensure that patent protection

can provide sufficient incentive for nonobvious inventions to be developed,

we assume ∆ ≥ k − π.

We now endogenize the patent premium ∆ by considering an explicit

licensing game between the inventor and the competitor. Without a license

agreement, the firms compete with asymmetric costs, so that the inventor

earns π + ∆I and the competitor π − ∆C . Assume ∆I > 0 and ∆C > 0

(the patent benefits the inventor and hurts the competitor). With a license

agreement, so that both firms use the invention but are able to (jointly)

exercise market power, the inventor earns π + m + F and the competitor

π − F , where m ≥ 0 is the extra profit due to market power and F is the

license fee paid by the competitor to the inventor.7 Thus, total industry

profit becomes 2π + m. The parameter m can be interpreted as a measure

of how lenient or restrictive antitrust policy is towards license agreements

(e.g., which kind of pricing schemes are allowed – royalties or lump-sum fees

only). We assume that m + ∆C ≥ ∆I , which will ensure that the inventor

prefers to license his invention as long as he has sufficient bargaining power.

Hence, ∆ = m + ∆C .

Letting S − ∆S denote consumer surplus after innovation when there

is a patent, we have D ≡ ∆S − m. The assumption that deadweight loss

is positive amounts to ∆S ≥ m. We assume S + 2π − D ≥ kG , so that

investment in nonobvious innovation is socially valuable even if it comes at

7

Below we will assume that the inventor has all the bargaining power, so that it does

not matter how the extra profit m from reaching agreement is distributed between inventor

and competitor.

8

the expense of deadweight loss.

To obtain a patent, the inventor must submit an application to the patent

office and pay an application fee φA ≥ 0. The patent office then examines the

application. Nonobvious inventions always pass the examination. Obvious

inventions pass the examination only with probability 1 − e, where e ∈

[0, 1] represents the patent office’s examination intensity; with probability

e obvious inventions are detected and refused patent protection. Inventions

that pass the examination must pay a fee φP ≥ 0 in order to be issued

a patent. This payment thus occurs after the patent office has decided

whether to allow or reject the application, and has to be paid only in case

of allowance. We will refer to payment of φP as the inventor activating the

patent and to φP as the activation fee.8 If the inventor does not apply, does

not pass the examination, or does not pay φP , the invention falls into the

public domain.

An inventor holding a patent on his invention can enter into a license

agreement with his competitor. We assume that the inventor makes a takeit-or-leave-it offer to the competitor to license the cost-reducing invention

for a license fee of F .9 After receiving the inventor’s offer, the competitor

decides whether to accept or reject. If the competitor accepts, she pays the

license fee and can use the invention in production. If the competitor rejects

the license contract, she has the option of challenging the patent in court

at cost l.10 We assume l < ∆C ; otherwise, the competitor never has any

incentive to challenge. The court then determines the validity of the patent.

We assume that during litigation the court learns the invention’s true type

θ. If the invention is obvious (θ = B), the court invalidates the patent and

both firms can freely use the invention. If the invention is nonobvious, the

court upholds the patent and the inventor can offer a new license contract

to the competitor.11

8

One can think of the activation fee as a renewal fee paid in lump sum, whereby the

inventor chooses to maintain his patent for some duration in exchange for payment of φP .

9

Elsewhere in the literature, this licence negotiation stage is sometimes referred to as

a settlement stage (see, e.g., Meurer, 1989).

10

In the baseline model we assume that the inventor does not incur litigation costs. This

simplifies the analysis and avoids multiplicity of equilibria. We relax this assumption in

Section 6.2.

11

In other words, courts do not make mistakes in assessing patent validity. In Section

9

Our equilibrium concept is Perfect Bayesian Equilibrium.

3

Equilibrium

3.1

Nonobvious inventions

We start by analyzing the problem of an inventor of type G. Consider first

the licensing stage. Suppose that it is common knowledge that the patent

is valid (θ = G), so that the competitor has no incentive to challenge.

Consider a license fee offer F . If the competitor rejects the license, the firms

will have asymmetric costs and earn π + ∆I and π − ∆C , respectively. If

the competitor accepts the license, they will have symmetric costs and earn

π + m + F and π − F . Thus the maximum license fee the competitor is

willing to pay is F = ∆C . At this fee, the inventor is better off licensing

than not if ∆I ≤ m + ∆C , which we have assumed to hold. This leads to

the following lemma.

Lemma 1. If it is common knowledge that the patent is valid, the inventor

will offer to license it at a fee of F G = ∆C , which the competitor accepts.

The inventor earns π + ∆ and the competitor earns π − ∆C .

Now suppose it is not common knowledge that θ = G. Let λ̃(F ) denote

the competitor’s belief that the patent is valid given that the inventor offers

her a license at fee F . Yet, regardless of the competitor’s beliefs, the type-G

inventor will offer the exact same license contract identified in Lemma 1.

The reason is that he does not care about the competitor challenging the

patent: he does not incur litigation costs, and he knows that in the event

of a validity challenge his patent will be upheld in court, after which the

outcome identified in the lemma will materialize.12

It follows that the behavior of an inventor of type G is simple and can

be summarized as follows.

Lemma 2. An inventor of type G will invest in R&D, apply for a patent,

pay the activation fee and offer a license at fee F G to the competitor if

∆ − (k − π) − φP − φA ≥ 0;

(1)

6.2, we examine a more general screening technology in which both patent office and courts

can make errors (of both type I and type II).

12

We relax both of these assumptions in Section 6.2.

10

otherwise he will not invest (and hence cannot apply for a patent).

3.2

Obvious inventions

Contrary to type-G inventors, type-B inventors care about challenges and

thus about the competitor’s beliefs. Suppose type G always invests, applies,

activates, and offers to license his patent at fee F G . Denote by α the probability that a type-B inventor applies for a patent. Similarly, denote by ρ

the probability that a type-B inventor activates the patent in case he passes

examination, and by y the probability that she offers a license contract with

fee F G . Indeed, all three of these decisions – whether to apply for a patent,

pay the activation fee, and which license fee to offer – potentially provide

information about the inventor’s type. In addition, the outcome of examination also provides information. The competitor’s belief that an activated

patent is valid when offered a license contract at fee F G is

λ̂ ≡ λ̃(F G ) =

λ

.

λ + (1 − λ)(1 − e)αρy

Now consider the competitor’s decision whether to challenge the patent when

offered a license contract at fee F G = ∆C . If she accepts the contract or

rejects it but does not challenge, her payoff is π − ∆C ; if she challenges, her

expected payoff is

λ̂(π − ∆C ) + 1 − λ̂ π − l.

With probability λ̂ the invention is nonobvious, in which case the court

upholds the patent, and the inventor holds the competitor down to a payoff

of π −∆C (see Lemma 1). With probability 1− λ̂ the invention is obvious, in

which case the court invalidates the patent, and the competitor obtains π.

In either case the competitor incurs litigation costs of l. Thus the competitor

prefers challenging to not challenging if and only if

1 − λ̂ ∆C ≥ l.

(2)

The lower bound on λ̂ occurs if the type-B inventor pools with the typeG inventor, i.e., if α = ρ = y = 1, and is denoted

λ(e) ≡

λ

.

λ + (1 − λ)(1 − e)

11

Because this is the lowest value that λ̂ can take it is the one that makes

challenges most attractive from the competitor’s point of view. If challenging

the patent is not worthwhile for the competitor under pooling, it will never

be worthwhile. Hence, we will say that a validity challenge is credible if and

only if

(1 − λ(e)) ∆C ≥ l.

(3)

That is, if the type-B inventor mimics the type-G inventor, challenging the

validity of the patent is a credible threat.

Remark: Note that (1 − λ(e)) is decreasing in e, implying that, as

the patent office steps up its examination efforts, it may crowd out private

challenges. The reason is that higher e makes it less likely that a type-B

inventor passes the examination, and therefore strengthens the competitor’s

belief that a successful patent applicant is of type G.

The following lemma characterizes the type-B inventor’s and competitor’s equilibrium behavior in the case where challenges are not credible.

Lemma 3. Suppose (3) does not hold. Then, the type-B inventor applies,

activates and proposes F G (i.e., α = ρ = y = 1) if

(1 − e) [∆ − φP ] − φA ≥ 0,

(4)

and does not apply otherwise. The competitor never challenges.

Proof. Since challenges are not credible, the type-B inventor can obtain the

same payoff as a type-G inventor once he passes the examination, which

is the highest payoff he could ever hope to secure. Thus we do not have

to consider deviations to other license fees, regardless of the competitor’s

beliefs λ̃(F ). The type-B inventor’s only relevant decision is whether to

apply. He prefers applying to not applying if and only if

eπ + (1 − e) [π + ∆ − φP ] − φA ≥ π,

which after rearranging yields (4).

When challenges are not credible, the type-B inventor either applies for

(and activates) a patent and then pools with the type-G inventor by offering

F = F G , or he does not apply at all. By contrast, when challenges are

12

credible, pooling with type G cannot be an equilibrium. The reason is that

the competitor would then have belief λ(e) and would therefore challenge

the patent with probability 1, in which case the type-B inventor would be

sure to have his patent invalidated. To avoid being challenged, the type-B

inventor can offer to license his patent at a fee that is low enough for the

competitor to prefer not to challenge. Consider a candidate equilibrium in

which type G proposes F G = ∆C and type B proposes F̃ < ∆C (i.e., a

separating equilibrium). The competitor correctly infers that λ̃(F̃ ) = 0.

For the competitor to prefer not to challenge although he believes that the

patent is invalid with certainty, it must be that π − F̃ ≤ π − l, or F̃ ≤ l.

The out-of-equilibrium belief most likely to support this as an equilibrium

is λ̃(F ) = 0 for any F ∈

/ {F G , F̃ }. Given these beliefs, the competitor’s best

response is not to challenge if F ≤ l; thus, the type-B inventor might as

well propose F̃ = l. This is not an equilibrium, however, as type B could

do better by deviating to F G . Observing F G would lead the competitor to

believe that the patent is valid with certainty, and therefore refrain from

challenging. Hence, the equilibrium can be neither pooling nor separating.

What this argument suggests is that, when challenges are credible, the

only equilibrium is a semi-separating one in which the type-B inventor randomizes over one of his decisions (applying, activating, license fee) and the

competitor randomizes over challenging and not when observing a license

offer at fee F G . To determine over which decision the type-B inventor will

randomize, suppose first that application and activation fee, φA and φP , are

sufficiently low (in a sense yet to be made precise). Then, type B always

applies and activates; the randomization will occur over the license fee to

propose. As in Meurer (1989), the type-B inventor will propose

∆C with probability y

FB =

l

with probability 1 − y,

where y is chosen so as to make the competitor indifferent between challenging and not. Denote by x the probability that the competitor challenges the

patent when faced with a license offer F = F G . The competitor chooses x so

as to make the type-B inventor indifferent between proposing ∆C and l. This

is an equilibrium if it allows type B to break even, i.e., if his payoff from applying exceeds his payoff from not applying: π +(1−e)(m+l−φP )−φA > π.

13

If type B cannot break even proposing l but could break even proposing ∆C ,

the randomization must instead occur over the application decision (or the

activation decision). The competitor then chooses the probability of challenges x so as to make type B indifferent between applying and not (or

between activating and not).

The following lemma characterizes the equilibrium. The lemma is based

on the condition for type G to invest, (1), being satisfied, which requires

in particular φP ≤ ∆. Below we examine under what assumptions the

various conditions characterizing type B’s behavior given in the lemma are

compatible with (1).13

Lemma 4. Suppose (3) holds. Then, the equilibrium behavior of the type-B

inventor and the competitor can be characterized as follows:

(i) If φA ≥ (1 − e)(∆ − φP ), the type-B inventor does not apply (α = 0),

and the competitor does not challenge (x = 0).

(ii) If φA < (1 − e)(∆ − φP ), the type-B inventor applies with strictly

positive probability (α > 0) and randomizes such that

λ(e)

∆C = l.

1−

λ(e) + (1 − λ(e)) αρy

(5)

The competitor always accepts when offered F = l (x = 0); she always challenges the patent when offered F ∈

/ {l, F G } (x = 1). When

offered F = F G she randomizes between accepting and challenging.

Specifically:

(a) for φP < l + m and φA < (1 − e)(l + m − φP ), the type-B inventor

chooses α = ρ = 1 and y ∈ (0, 1) solving (5). The competitor

challenges with probability x such that

(1 − x)∆ = l + m;

13

(6)

The uniqueness of the equilibrium is due to our assumption that the inventor does not

incur litigation costs. If litigation were costly to the inventor, there would be a continuum

of semi-separating equilibria with F G ≤ ∆C and (depending on parameters) also pooling

equilibria. Note, however, that a semi-separating equilibrium with F G = ∆C always

exists.

14

(b) for φP > l + m and φA = 0, the type-B inventor chooses y = 1

and (α, ρ) ∈ [0, 1]2 solving (5). The competitor challenges with

probability x such that

(1 − x)∆ = φP ;

(7)

(c) for max{0, (1 − e)(l + m − φP )} < φA < (1 − e) (∆ − φP ), the

type-B inventor chooses ρ = y = 1 and α ∈ (0, 1) solving (5).

The competitor challenges with probability x such that

(1 − e) [(1 − x)∆ − φP ] = φA .

(8)

Proof. For φA ≥ (1 − e)(∆ − φP ), type B’s payoff from applying is weakly

less than his payoff from not applying even if there are no challenges, so

(α = 0, x = 0) is an equilibrium, establishing (i). (This equilibrium is

unique for φA > (1 − e)(∆ − φP ).) In what follows, we first show that for

φA < (1 − e)(∆ − φP ), there is no equilibrium in which α = 0, ρ = 0, or

y = 0, that there is none in which α = ρ = y = 1, and that there is also none

in which x = 0 or x = 1, implying that the equilibrium must be in mixed

strategies. We then prove the more specific claims made in (ii.a)-(ii.c).

Suppose first there were an equilibrium with α = 0, ρ = 0, or y = 0

when φA < (1 − e)(∆ − φP ). Then the competitor’s belief would be λ̂ = 1,

and hence she would not challenge. But this means that the type-B inventor

could secure a strictly positive expected payoff of (1−e)(∆−φP )−φA > 0 by

applying, activating and offering F G , contradicting the optimality of α = 0

or ρ = 0. Moreover, by offering F = F G = ∆C type B obtains a higher

payoff than by offering F = l (because ∆C > l), contradicting the optimality

of y = 0. Hence, under the assumed condition on φA , in any equilibrium we

must have α > 0, ρ > 0 and y > 0. Next, suppose there were an equilibrium

with α = ρ = y = 1. Then λ̂ = λ(e), and by (3), the challenger would

always challenge. But then type B would be better off deviating in some

dimension. (If φP > 0, type B would be better off not activating or not

applying. If φP = 0 < l + m, type B would be better off offering F = l.)

Now consider the competitor’s decision to challenge. If there were an

equilibrium in which she never challenges (x = 0), then all type-B inventors

15

would apply, activate and offer F G (α = ρ = y = 1). But in that case, (3)

implies that the competitor would strictly prefer to challenge. If there were

an equilibrium in which she always challenges (x = 1), then type B would

prefer not to apply, in which case the competitor would be better off not

challenging.

Hence, the only equilibrium is in mixed strategies. For the competitor

to be indifferent between challenging or not, his beliefs about the type of

inventor he faces must be such that the payoff from challenging is the same

as the payoff from not challenging, i.e., (2) must hold with equality. Using

the definition of λ̂ yields (5). The conditions for the type-B inventor to be

indifferent depend on parameters and are specified below.

Claim (ii.a) [φP < l + m and φA < (1 − e)(l + m − φP )]: Because

the competitor always accepts the offer F = l, the type-B inventor can

guarantee himself a payoff of l+m following activation. Hence, if φP < l+m,

type B strictly prefers activating to not activating, implying ρ = 1. By

the same argument, if φA < (1 − e)(l + m − φP ), type B strictly prefers

applying to not applying, so α = 1. The only randomization variable that

remains is y. For the type-B inventor to be indifferent between offering

F = l and F = ∆C , both must procure him the same payoff. This requires

π + l + m = π + (1 − x)∆, or (6).

Claim (ii.b) [φP > l + m and φA = 0]: Because φP > l + m, the

inventor will never offer F = l, as he would be sure to make a loss then.

Hence, y = 1. In any equilibrium in which the type-B inventor is indifferent

between activating and not, which requires π = π +(1−e)[(1−x)∆−φP ], or

(7), his payoff from applying for a patent will be zero. Because φA = 0, he

will also be indifferent between applying and not. Hence, any combination

of α and ρ which (given y = 1) solves (5) constitutes an equilibrium.

Claim (ii.c) [max{0, (1 − e)(l + m − φP )} < φA < (1 − e) (∆ − φP )]:

Because (1 − e)(l + m − φP ) < φA , the type-B inventor cannot break even

offering F = l; hence, y = 1. To see that type B will necessarily randomize

over the application decision rather than the activation decision, suppose to

the contrary ρ < 1. This would require (1 − x)∆ = φP . But in that case,

type B’s payoff from applying would be zero, and given φA > 0 he would

prefer not to apply. Hence, ρ = 1. The only randomization variable that

16

remains is α. For type B to be indifferent between applying and not, it must

be that π = π + (1 − e)[(1 − x)∆ − φP ] − φA , or (8).

Let us denote

α̃ = ỹ ≡

λl

.

(1 − λ)(1 − e)(∆C − l)

That is, α̃ (ỹ) is the value of α (y) solving (5) when y = 1 (α = 1) and

ρ = 1. Notice that α̃, ỹ ∈ (0, 1) when challenges are credible. Furthermore,

let

x̃ ≡ 1 −

and

x̂ ≡

l+m

∆

(1 − e)(∆ − φP ) − φA

.

(1 − e)∆

That is, x̃ is the value of x solving (6) while x̂ is the value of x solving (8).

Notice that x̃ ∈ (0, 1) (because l < ∆C ) and x̂ ∈ (0, 1) when φP < ∆ and

0 < φA < (1 − e)(∆ − φP ).

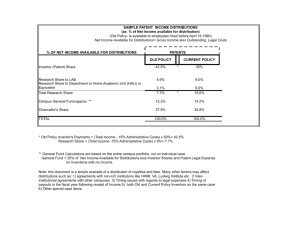

Figure 1 depicts how the equilibrium that arises when challenges are

credible depends on φA and φP . The figure is drawn under the implicit

assumption that φA > 0 so that ρ = 1. In region 1, where φP ≤ l + m

and φA ≤ (1 − e)(l + m − φP ), fees are sufficiently low for the type-B

inventor to always find it worthwhile to apply and activate (α = ρ = 1) while

randomizing over the license fee to offer, with y = ỹ; the rate of challenges

is given by x̃. Moving toward the north-east into region 2, type B can no

longer break even by offering the low fee F = l; he now randomizes over

the application decision, applying with probability α = α̃ while activating

and offering the high license fee F G with certainty (ρ = y = 1). The rate of

challenges is given by x̂. As fees increase further and we reach region 3, the

type-B inventor no longer applies (α = 0) and the rate of challenges drops

to zero (x = 0).

The figure also shows the condition under which type G finds it profitable

to invest, (1). The φA = ∆−(k −π)−φP line is drawn under the assumption

that e > ē(0) (to be defined below), which implies existence of region 3.

If instead e < ē(0), then region 3 does not exist. That is, there is no

combination of φA and φP such that type G (invests and) applies and type

B does not. We investigate this point in more detail in the next section.

17

φA

∆ − (k − π)

φ

A

(1 − e)∆

α = 0,

x=0

=

3

∆

−

(k

No investment by type G

−

π)

−

φ

P

α = α̃,

y = 1, x = x̂

(1 − e)(l + m)

φA

=(

2

1−

e)(

l+

m

α = 1, 1

−φ

P)

y = ỹ, x = x̃

0

l+m

φA

=(

1−

e)(

∆

−φ

P)

∆ − (k − π)

∆

φP

Figure 1: The equilibrium as a function of φP and φA when ē(0) < e < 1

4

Fees and screening

In this section we look at the effect of fees on screening of inventors, taking

the patent office’s examination intensity e as exogenously given. We first

study under what conditions we can achieve full screening, i.e., deterring

applications by type B without discouraging investment by type G. We

then derive comparative statics results for the case where full screening is

not possible.

4.1

Full screening

The two following propositions examine when and how it is possible to induce

complete self-screening of inventors, so that only nonobvious inventions are

applied for. The results show that the extent to which fees are effective

screening tools depends on the examination intensity e.

Proposition 1. If either e = 0 or φA = 0 and e < 1, there is no equilibrium

in which only the type-G inventor applies.

Proof. If e = 0, then by Part (i) of Lemma 4, deterring type B requires

18

φA + φP ≥ ∆. If φA = 0 and e < 1, then by Part (i) of Lemma 4, deterring

type B requires either e = 1 or φP ≥ ∆; since e < 1 by assumption, we

must have φP ≥ ∆. In either case, type G will not invest, as his payoff then

is ∆ − (k − π) − φP − φA ≤ −(k − π) < 0, where the last inequality is due

to the definition of a nonobvious invention.

This proposition makes two points. First, it underlines the importance

of patent examination. If there is no examination at all (e = 0), then

fees cannot completely screen out obvious inventions. This happens despite

the fact that we have assumed that courts are perfect at discriminating

between obvious and nonobvious inventions. One might have expected that

the resulting payoff differential at the litigation stage would suffice to screen

inventors through an appropriate choice of fees. The reason why this fails to

hold is that the competitor is Bayesian and updates her beliefs based on the

inventor’s equilibrium strategy. If there were an equilibrium in which only

type G applies, the competitor would rationally expect any applicant to be

of type G, and therefore refrain from challenging. But then, in the absence

of patent examination, type B would also find it worthwhile to apply, hence

such an outcome cannot be an equilibrium. Instead the equilibrium will

be in mixed strategies, implying that at least some type-B inventors apply.

In contrast to the competitor’s decision whether or not to challenge the

patent, the patent office examines all patents, regardless of the inventor’s

equilibrium strategy.

Second, we cannot rely exclusively on the activation fee φP if we want

to induce self-screening of inventors; screening relies crucially on the application fee φA being positive. This is related to the previous result. If

applications are costless (φA = 0) and examination is less than perfect

(e < 1), type-B inventors have nothing to lose from applying. But once

a patent passes examination, it is subject only to a possible challenge by the

competitor, whose decision depends on his beliefs, which in turn depend on

the inventor’s equilibrium strategy. Because of the mixed-strategy nature

of the equilibrium, completely deterring type B through the activation fee

is possible only by setting φP ≥ ∆, which also deters type G.

Proposition 2. For any activation fee φP < ∆ − (k − π), there exists an

19

application fee φA > 0 such that only the type-G inventor applies if and only

if e ≥ ē(φP ), where

ē(φP ) ≡

k−π

.

∆ − φP

(9)

Proof. By Lemma 2, investment by type G requires π − k + ∆ − φP ≥ φA .

By Part (i) of Lemma 4, deterrence of type B requires φA ≥ (1 − e)(∆ −

φP ). An application fee φA satisfying both inequalities exists if and only if

π − k + ∆ − φP ≥ (1 − e)(∆ − φP ), or

π − k + e(∆ − φP ) ≥ 0,

which can be arranged to yield e ≥ ē(φP ) defined in (9).

Proposition 2 says that complete screening of inventors is possible provided the examination intensity is sufficiently large. Note that, for any

φP < π + ∆ − k, the examination intensity required is strictly less than

one: the patent office does not have to be perfect. Exactly how rigorous the

patent office needs to be depends on φP , as the following corollary shows.

Corollary. The examination intensity required to achieve complete selfscreening of inventors, ē(φP ), is increasing in φP .

This result speaks to the relative effectiveness of application and activation fees in inducing inventors to self-screen. The higher the activation

fee φP , the higher the examination intensity needed for screening. In other

words, higher activation fees make it more difficult to induce inventors to

self-screen. The intuition is that, while application and activation fees are

perfect substitutes for type-G inventors, type-B inventors prefer activation

fees, which only need to be paid conditional on surviving examination. For

type G, all that matters is the sum φP + φA because he knows he will pass.

By contrast, for type B what matters is φA + (1 − e)φP .

A further result of our analysis is that despite the fact the courts are

mistake-free, they cannot eliminate all bad patents that are issued. To

see this point, note that eliminating all bad patents would require that

x = 1 whenever α > 0, i.e., all issued patents would need to be challenged.

Alternatively, type-B inventors would have to reveal themselves so that they

could be targeted by challenges. But as Lemma 4 shows, neither of these

20

is an equilibrium outcome. There is no equilibrium with α > 0 and x = 1.

There is also no equilibrium in which type-B inventors reveal themselves and

then get challenged. Although for φP < l and φA < (1 − e)(l − φP ), type

B sometimes reveals himself by offering F = l, the competitor optimally

responds to this by not challenging.

4.2

Partial screening

The previous subsection has shown that when e < ē(0), it is impossible to

achieve full screening. Nevertheless both application and activation fees can

be effective in achieving partial screening. In addition, fees and examination

will affect the rate of challenges and the licensing fees proposed by inventors.

The next proposition considers the effects of φA , φP and e on the equilibrium

variables α, x, and y.

Proposition 3. Suppose the type-G inventor invests and challenges are

credible, i.e., (1) and (3) hold. Then:

(i) An increase in φA or φP weakly decreases applications by type B (α),

weakly decreases the rate of challenges (x), and weakly increases the

license fee proposed by type B (y).

(ii) An increase in e has ambiguous effects on applications by type B (α),

the rate of challenges (x), and the license fee proposed by type B (y).

Proof. To be added.

Proposition 3 shows that an increase in fees unambiguously decreases

bad applications and challenges (in a weak sense). It also leads to higher

license fees, as type-B inventors switch from randomizing over the license

fee to randomizing over the application decision. Perhaps more surprisingly,

the effect of an increase in the examination intensity e has ambiguous effects

on applications by type-B inventors. Over some range, the application rate

of type-B inventors actually increases with e. The intuition is that more

rigorous examination makes it more likely that a granted patent is valid,

other things equal. That is, higher e raises the competitor’s posterior belief

λ̂. But in equilibrium, the competitor must be indifferent between challenging and not, which requires that λ̂ be held constant. Therefore, in region 2,

21

type B responds to an increase in e by adjusting the probability of applying

(α) upward.

5

Welfare

To be able to say more about the optimal structure of fees for a given e, let

us derive the expected welfare as a function of the equilibrium variables α,

x, and y.14 Assume that the cost of examining an application with intensity

e is γ(e). Denoting expected welfare by W , we have

W (α, x, y) = 2π + S + λ(−D − xl − k − γ(e))

+ (1 − λ)α (1 − e) (y(1 − x) + 1 − y)(−D) − xyl − γ(e) . (10)

With probability λ, the invention is nonobvious, in which case the inventor

always applies and society incurs the deadweight loss D, the cost of investment k and the cost of examination γ(e) with certainty, while it incurs the

cost of challenges l with probability x. With probability 1 − λ, the invention

is obvious, in which case the inventor applies with probability α. Conditional on application, society incurs the deadweight loss with probability

(1 − e)(y(1 − x) + 1 − y), the cost of challenges with probability (1 − e)xy,

and the cost of examination with certainty. To understand these probabilities, recall that with probability 1 − y, the type-B inventor offers F = l,

which is always accepted; with probability y, type B offers F = ∆C , which

is accepted with probability 1 − x and instead leads to a challenge with

probability x.

Expression (10) highlights several important points. First, holding everything else constant, welfare is decreasing in the application rate of type-B

inventors, α. This implies that welfare is maximized with complete screening (where α = x = 0). Second, if α > 0, the effect of the rate of challenges

x on welfare is ambiguous. Differentiating W with respect to x yields

∂W

= −λl + (1 − λ)(1 − e)αy(D − l).

∂x

(11)

On the one hand, challenges help society get rid of invalid patents (which

increases welfare provided deadweight loss exceeds litigation costs, D > l),

14

We are focusing on the case ρ = 1, i.e., we neglect situations in which φA = 0.

22

but on the other hand, they create wasteful litigation of valid patents. Third,

assuming deadweight loss exceeds litigation costs, welfare is increasing in y.

Taking the derivative of the term in square brackets with respect to y, we

obtain x(D − l), which is strictly positive for x > 0 and D > l.

Let e ≡ [k − π − (∆C − l)]/(l + m). If e < e, only region 1 is attainable,

and in region 1 welfare is unaffected by φA and φP because α = 1, x = x̃,

and y = ỹ, none of which depend on fees. To make the problem interesting,

assume in what follows that e < e < ē(0), so that both region 1 and region

2 are attainable but region 3 is not (i.e., full screening cannot be achieved).

Geometrically, region 3 in Figure 1 disappears as the φA = (1 − e)(∆ − φP )

line now shifts above the φA = ∆ − (k − π) − φP line. The social planner’s

problem is to choose φA and φP to maximize welfare subject to type G

investing, taking e as given:

max W (α, x, y)

(φA ,φP )

subject to φA ≤ ∆ − (k − π) − φP .

Although welfare does not depend directly on φA and φP , it depends on

them indirectly through their effect on the equilibrium values of α, x, and y.

The following proposition characterizes the welfare-maximizing combination

of fees.

Proposition 4. If e < e < ē(0) and ∆C > D > l, welfare is maximized for

φP = 0 and φA = ∆ − (k − π).

Proof. Notice that within region 1, welfare does not depend on either φA or

φP , as α = 1, x = x̃, and y = ỹ are all constant in φA and φP . Similarly,

within region 2, welfare depends on φA and φP only through x = x̂(φA , φP )

(which we make explicit by including the fees as arguments) and not through

α = α̃ or y = 1. Thus the welfare maximization problem is reduced to

a choice between W (1, x̃, ỹ) and maxφA ,φP W (α̃, x̂(φA , φP ), 1). Notice also

that αy is the same in regions 1 and 2, as αy = ỹ in region 1, αy = α̃ in

region 2, and α̃ = ỹ.

The proof proceeds as follows. We first show that, keeping αy fixed,

welfare is decreasing in α. Second, we show that fixing αy at its equilibrium

value in regions 1 and 2 (α̃ = ỹ), welfare is decreasing in x. Third, we show

that x̃ ≥ x̂(φA , φP ) for any (φA , φP ) in region 2. Together these claims

23

imply that the solution to the welfare maximization problem is obtained by

solving minφA ,φP x̂(φA , φP ) subject to φA ≤ ∆ − (k − π) − φP .

Claim 1: For any (α, y) ∈ (0, 1)2 and (α0 , y 0 ) ∈ (0, 1)2 such that αy =

α0 , y 0 , W (α, x, y) ≥ W (α0 , x, y 0 ) if and only if α ≤ α0 . Rewriting W we have

W (α, x, y) = 2π + S − λ(D + xl + k + γ(e))

+ (1 − λ) (1 − e)αyx(D − l) − α[(1 − e)D + γ(e)] . (12)

For αy = α0 y 0 , we have W (α, x, y) − W (α0 , x, y) = (1 − λ)(α0 − α)[(1 − e)D +

γ(e)] ≥ 0 if and only if α ≤ α0 .

Claim 2: (∂/∂x)W (α, x, y)|αy=α̃ < 0. Replacing αy by α̃ = λl/[(1 −

λ)(1 − e)(∆C − l)] in (11) yields

D−l

∂W = λl

− 1 < 0,

∂x αy=α̃

∆C − l

where the inequality follows from the assumption that l < D < ∆C .

Claim 3: x̃ ≥ x̂(φA , φP ) for any (φA , φP ) such that (1 − e)[l + m − φP ] ≤

φA (1 − e)[∆C + m − φP ]. Since x̂ is decreasing in φA and φP , its maximum

x̂max is attained for (1 − e)[l + m − φP ] = φA . We have

x̂max =

∆C − l

= x̃.

∆C + m

Hence, x̂(φA , φP ) < x̃ for (1 − e)[l + m − φP ] < φA .

Having established these claims, we now solve for the welfare-maximizing

fees, i.e., the fees that minimize x̂ subject to type G investing:

min x̂(φA , φP )

φA ,φP

subject to φA ≤ ∆ − (k − π) − φP .

Since x̂ is decreasing in φA , the constraint must bind at the optimum. The

problem becomes

min

φP

(1 − e)(∆ − φP ) − (∆ − (k − π) − φP )

k − π + e(φP − ∆)

=

.

(1 − e)∆

(1 − e)∆

Since this increases with φP , the minimum is reached at φP = 0, implying

φA = ∆ − (k − π).

This proposition shows that, if examination is not rigorous enough to

allow for full screening, the planner should set activation fees to zero and

24

use only application fees. The intuition is that, as discussed above, type B

prefers fees to be backloaded while type G is indifferent between application

and activation fees. Here, keeping the sum of fees φA + φP fixed, the rate

of challenges x decreases as we frontload fees, because fewer challenges are

necessary to make type B indifferent between applying and not. Moreover,

the planner should set application fees at the highest level compatible with

investment by type G. Again, this is related to the fact that higher fees

decrease x, which the proof shows to be welfare enhancing.

6

Alternative settings

6.1

Exogenous challenges

It is instructive to compare the results we have obtained when challenges

are endogenously triggered by a fully Bayesian competitor to the case where

challenges are exogenous. Specifically, suppose that all patents get challenged at a constant rate x̄ ∈ (0, 1) (independently of the inventor’s type θ)

and that courts do not make mistakes in determining validity.15 Then, the

type-G inventor activates iff ∆ ≥ φP while the type-B inventor activates iff

(1 − x̄)∆ ≥ φP . Clearly, for ∆ > φP > (1 − x̄)∆ and φA + φP ≤ ∆ − (k − π)

(which can both be satisfied provided x̄ is sufficiently large and φA sufficiently small), the activation fee screens out type-B inventors without dissuading type-G inventors. Moreover, no minimum level of patent examination is required to achieve this.

While this argument does not provide a reason why the activation fee

would be a better screening tool than the application fee, it is easy to construct an example where this is the case. To do this, let us extend the

basic model by introducing learning about the gains from patenting over

time. Suppose the type-G inventor does not know whether the gains from

patenting are high or low until after applying for a patent. For concreteness,

assume that the gains are either ∆ (with probability ν) or 0 (with probability

1 − ν). The type-B inventor knows his gains from patenting already at the

moment of applying. Assume that the application fee needed to screen out a

15

One could obtain similar results by assuming that challenges are more likely for type

θ = B and courts are random.

25

type-B inventor with high gains from patenting, φA = (1−e)[(1− x̄)∆−φP ],

is so large that the type-G inventor earns a negative expected profit from

investing even if φP = 0:

π + ν∆ − k − (1 − e)(1 − x̄)∆ ≤ 0,

or

k − π ≥ [ν − (1 − e)(1 − x̄)]∆

(13)

At the same time, assume that if φP is set so as to screen out the type-B

inventor, φP = (1 − x̄)∆, then it is profitable for the type-G inventor to

invest if φA = 0: ν[∆ − (1 − x̄)∆] ≥ k − π, or

ν x̄∆ ≥ k − π.

(14)

Inequalities (13) and (14) can only ever be simultaneously satisfied if

ν x̄∆ > [ν − (1 − e)(1 − x̄)]∆,

or

e < 1 − ν.

Thus, if patent examination is not too rigorous, then there exists a range

of values of (k − π) such that we can screen out type-B inventors through

the activation fee. At the same time, by construction, screening through the

application fee is not possible.

6.2

A more general screening technology

Many observers argue that patents are “probabilistic” in nature (Lemley and

Shapiro, 2005), suggesting that court decisions are subject to some amount

of randomness. We have so far assumed that courts do not make mistakes

in assessing validity. In this section, we look at a more general screening

technology whereby both patent office and courts sometimes make mistakes.

This technology encompasses both the basic model (with perfect courts) and

completely random courts (where the probability that a patent is upheld

does not depend on the inventor’s type θ) as special cases.

Suppose the patent office and the courts review applications with intensity e1 and e2 respectively. The intensity of review equals the probability

26

Table 1: Probability of acceptance and rejection at review stage i by type

Type G

Type B

Acceptance

ei + (1 − ei )qi

(1 − ei )qi

Rejection

(1 − ei )(1 − qi )

ei + (1 − ei )(1 − qi )

that they find out the inventor’s true type. With probability 1 − ei , i = 1, 2,

they find no strong evidence either way, in which case the patent office allows the application with probability q1 while the courts uphold the patent

with probability q2 . This leads to stage-i probabilities of acceptance and

rejection for each type of inventor given in Table 1, with i = 1, 2, stage 1

corresponding to patent office review and stage 2 corresponding to court

review. Our basic model is a special case of this setup with e1 = e, q1 = 1,

and e2 = 1.

In addition, suppose that both the inventor and the challenger incur

litigation costs. The inventor’s litigation costs are lI while the challenger’s

are lC . Assume (1−e2 )(1−q2 )∆C < lC < (e2 +(1−e2 )(1−q2 ))∆C ; otherwise

the competitor either would not want to challenge even when being sure of

facing a type-B inventor or would want to challenge even when being sure of

facing a type-G inventor. Everything else is the same as in the basic model.

6.2.1

Random courts

Before considering the full-fledged generalization, let us look at the special

case in which e1 = e, e2 = 0, and q1 = q2 = q ∈ (0, 1). That is, courts

are random: the probability that a patent is upheld does not depend on the

inventor’s type. This implies that, once they pass the examination at the

patent office, both inventor types are equivalent, in the sense that they have

the same continuation payoff. Thus, either both or neither of the inventor

types activate the patent, and if they do, both types offer the same license

fee F . Assume also that lI = 0 and lC = l. The competitor’s payoff from

accepting then is π − F , while her payoff from rejecting and challenging is

q(π − ∆C ) + (1 − q)π − l. Hence, the competitor challenges iff F > l + q∆C .

If (1 − q)∆C < l, challenges are not credible; therefore the inventor

charges F = ∆C and earns the same payoff as the type-G inventor in the

27

baseline model. If instead (1 − q)∆C ≥ l, challenges are credible. The

inventor then faces a choice between asking for F = l + q∆C , which avoids

a challenge and yields π + m + l + q∆C , or asking for F > l + q∆C , which

triggers a challenge and yields q(π + ∆) + (1 − q)π. The inventor’s payoff

from activating the patent is thus V = max{q∆, l + m + q∆C }. It follows

that both types of inventors activate their patents iff V ≥ φP . As one might

expect, when courts cannot distinguish valid from invalid patents, activation

fees are ineffective as a screening tool.

The type-G inventor invests iff π + V − φP − φA − k ≥ 0. Assuming

challenges are credible, i.e., that l ≤ (1−q)∆C , we have l+m+q∆C ≤ ∆, and

hence V ≤ ∆. Thus, the type-G inventor earns a lower payoff with random

courts than with mistake-free courts. Not surprisingly, probabilistic patent

enforcement by the courts is a drag on innovation. The type-B inventor

applies for a patent iff (1 − e)[V − φP ] − φA ≥ 0. We therefore obtain the

following result.

Proposition 5. Suppose courts randomly uphold a fraction q of patents,

independent of θ, and that (1 − q)∆C ≥ l. For any activation fee φP <

π + V − k, there exists an application fee φA > 0 such that only the type-G

inventor applies if and only if

e≥

k−π

≥ ē(φP ).

V − φP

Proof. The threshold on e can be found using the same argument as for

Proposition 2, replacing ∆ by V . The inequality (k − π)/(V − φP ) ≥ ē(φP )

follows from the fact that, if (1 − q)∆C ≥ l, then V ≤ ∆.

Thus, while it is still possible to induce inventors to self-screen, doing so

requires more rigorous examination by the patent office than when courts

are mistake-free.

6.2.2

Imperfect but non-random courts

Now consider the full-fledged generalization. Type G’s expected payoff from

investing (and then applying for and activating the patent, if granted, and

28

offering a license at fee F G ) is

h πG = (e1 +(1−e1 )q1 ) x (e2 +(1−e2 )q2 )(π+m+∆C )+(1−e2 )(1−q2 )π−lI

i

+ (1 − x)(π + m + F G ) − φP + (1 − e1 )(1 − q1 )π − k − φA , (15)

where x is the rate of challenges given F G . To understand this expression,

note that the application is allowed by the patent office with probability

(e1 + (1 − e1 )q1 ), in which case the patent is either challenged (probability

x) or not (probability 1 − x). In the event of a challenge, the patentee wins

with probability (e2 + (1 − e2 )q2 ), in which case she earns π + m + ∆C ,

and loses with probability (1 − e2 )(1 − q2 ), in which case she earns only the

competitive profits π. In either case she incurs litigation costs of lI . If there

is no challenge the patentee earns π +m+F G . The application is rejected by

the patent office with probability (1 − e1 )(1 − q1 ), in which case the patentee

earns only π.

Suppose type G invests and applies; moreover, suppose that if he is

successful in obtaining a patent, he activates it and charges a license fee

F G = ∆C (we will later examine under what conditions this is an equilibrium). The competitor’s belief that an activated patent whose holder offers

a license fee of F G is valid is

λ̂ =

λ(e1 + (1 − e1 )q1 )

,

λ(e1 + (1 − e1 )q1 ) + (1 − λ)(1 − e1 )q1 αρy

where α, ρ, and y are the probabilities that type B applies, activates, and

offers to license at fee F G , respectively. The lower bound of λ̂ is attained at

αρy = 1 and given by

λ=

λ(e1 + (1 − e1 )q1 )

.

λ(e1 + (1 − e1 )q1 ) + (1 − λ)(1 − e1 )q1

Challenges are credible if and only if

π − ∆C ≤ λ [(e2 + (1 − e2 )q2 )(π − ∆C ) + (1 − e2 )(1 − q2 )π]

+ (1 − λ) [(1 − e2 )q2 (π − ∆C ) + (e2 + (1 − e2 )(1 − q2 ))π] − lC

(16)

[1 − (1 − e2 )q2 − e2 λ]∆C ≥ lC .

(17)

or

29

Consider the behavior of type B in the case where challenges are credible, i.e., (17) holds, and fees are sufficiently low as to make applying and

activating profitable (i.e., α = ρ = 1); we will later make this statement

more precise. Let us look for an equilibrium in which type B randomizes

over the license fee FB as follows:

G

F = ∆C

FB =

F̃

with probability y

with probability 1 − y,

where F̃ is chosen such that the competitor does not find it worthwhile to

challenge.

The competitor’s beliefs on the equilibrium path are λ̃(F G ) = λ̂ and

λ̃(F̃ ) = 0. The out-of-equilibrium belief most likely to support the equilibrium is λ̃(F ) = 0 for F 6= F G , F̃ . For the competitor to refrain from

challenging when observing F 6= F G despite assigning probability 1 to the

patent being invalid, it must be that

(1 − e2 )q2 (π − ∆C ) + (e2 + (1 − e2 )(1 − q2 ))π − lC ≤ π − F.

The highest fee that satisfies this inequality is

F = lC + (1 − e2 )q2 ∆C .

Let s(F ) ∈ [0, 1] denote the competitor’s probability of challenging the

patent when observing a license fee offer F . Sequential rationality requires

s(F ) = 0 for F ≤ F and s(F ) = 1 for F > F , F 6= F G . Thus, F̃ = F . We

also have s(F G ) = x, which depends on λ̂. For the type-B inventor to be

indifferent between offering F G and F̃ , it must be that

π + m + F̃ = x[(1 − e2 )q2 (π + m + ∆C ) + (e2 + (1 − e2 )(1 − q2 ))π − lI ]

+ (1 − x)(π + m + F G ).

Simplifying and using F G = ∆C yields

x=

(e2 + (1 − e2 )(1 − q2 ))∆C − lC

≡ x̃.

(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI

For the competitor to be willing to randomize between challenging and

not, it must be that (16) holds with equality when replacing λ by λ̂. After

simplifying we thus need

λ̂ =

(e2 + (1 − e2 )(1 − q2 ))∆C − lC

.

e 2 ∆C

30

Using the definition of λ̂, substituting α = ρ = 1, and solving for y yields

λ(e1 + (1 − e1 )q1 )

lC − (1 − e2 )(1 − q2 )∆C

y=

≡ ỹ.

(1 − λ)(1 − e1 )q1

(e2 + (1 − e2 )(1 − q2 ))∆C − lC

Finally, we need to check that the type-G inventor has no incentive to deviate. The best deviation would be to F = F̃ . But since x is chosen so as to

make the type-B inventor indifferent between F G and F̃ , and type G has a

higher probability of winning in court, type G must strictly prefer F G to F̃ .

The above equilibrium was derived under the assumption that fees are

sufficiently low for the type-B inventor to find it profitable to apply. Since

the type-B inventor’s payoff in this equilibrium is equal to his payoff when

offering F̃ , this requires

(1 − e1 )q1 [m + lC + (1 − e2 )q2 ∆C − φP ] > φA .

(18)

Suppose instead (18) does not hold. Then, the above strategy profile cannot

be part of an equilibrium. However, if the type-B inventor’s payoff from

applying is positive when there are no challenges, i.e.,

(1 − e1 )q1 [m + ∆C − φP ] > φA ,

(19)

then – rather than randomize over the license fee to offer – type B will randomize over the decision to apply.16 Since in equilibrium type B’s probability of applying (α) must be such that the competitor is indifferent between

challenging and not, we will have

lC − (1 − e2 )(1 − q2 )∆C

λ(e1 + (1 − e1 )q1 )

≡ α̃ = ỹ.

α=

(1 − λ)(1 − e1 )q1

(e2 + (1 − e2 )(1 − q2 ))∆C − lC

The competitor chooses x to make the type-B inventor indifferent between

applying and not:

π = (1 − e1 )q1 x[(1 − e2 )q2 (π + m + ∆C ) + (e2 + (1 − e2 )(1 − q2 ))π − lI ]

+ (1 − x)(π + m + ∆C ) + (e1 + (1 − e1 )(1 − q1 ))π − φA .

Solving for x yields

x=

m + ∆C − φP − φA /[(1 − e1 )q1 ]

≡ x̂.

(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI

16

As in the basic model, there is also the possibility of randomizing over activation, but

this can only be part of an equilibrium for φA = 0. In what follows we neglect this special

case.

31

If (19) is not satisfied, type B does not apply.

Now let us check whether type G finds it profitable to invest in R&D.

The expression for πG in (15) can be rewritten as

πG = (e1 + (1 − e1 )q1 ) (1 − x(1 − e2 )(1 − q2 ))(m + ∆C ) − xlI − φP

− (k − π) − φA .

This expression highlights several important points. First, the assumption

that m + ∆C > k − π no longer suffices to ensure that the type-G inventor

wants to invest when fees are zero. To see this, suppose φA = φP = 0.

Then, we have x = x̃ (i.e., the rate of challenges in region 1). Type G’s

profit becomes

πG = (e1 + (1 − e1 )q1 ) m + ∆C

[(e2 + (1 − e2 )(1 − q2 ))∆C − lC ][(1 − e2 )(1 − q2 )(m + ∆C ) + lI ]

−(k−π).

−

(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI

Even if the patent office does not wrongly reject applications (q1 = 1) and

courts are perfect (e2 = 1), as in the basic model, the presence of litigation

costs means that πG ≥ 0 if and only if

m + ∆C −

(∆C − lC )lI

≥ k − π.

m + ∆C + lI

An even more important difference with the basic model emerges as we let

fees increase to the point where x depends on φA and φP (region 2). Suppose

x=

m + ∆C − φP − φA /[(1 − e1 )q1 ]

,

(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI

which is the equivalent of x̂ (i.e., the rate of challenges in region 2). We

then have

(e1 + (1 − e1 )q1 )e2 (m + ∆C )

(m + ∆C − φP ) − (k − π)

(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI

(1 − e2 )(1 − q2 )(m + ∆C ) + lI

e1 + (1 − e1 )q1

− φA 1 −

(1 − e1 )q1

(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI

πG =

Hence, the type-G inventor’s profit is decreasing in φP but not necessarily

in φA . To see this, notice that we can further simplify the expression in

square brackets as

(e2 (1 − e1 )q1 − e1 (1 − e2 )(1 − q2 ))(m + ∆C ) − e1 lI

.

(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI

32

If

(e2 (1 − e1 )q1 − e1 (1 − e2 )(1 − q2 ))(m + ∆C ) − e1 lI > 0,

(20)

πG is decreasing in φA , but if (20) is violated, πG is actually increasing

in φA . The intuition as to why this can happen is likely related to the

argument in Atal and Bar (2011): increasing fees raises the perceived patent

quality, which benefits patent holders. However, while this argument is made

in a reduced-form way in Atal and Bar, here we endogenize the benefits

from higher perceived patent quality. In our setup, higher perceived patent

quality leads to fewer challenges. Under some conditions, the indirect effect

through a decrease in the rate of challenges can dominate the direct effect

of higher fees.

A necessary (but not sufficient) condition for (20) is that

e2

e1

<

.

(1 − e1 )q1

(1 − e2 )(1 − q2 )

(21)

The next result shows that this inequality can be linked to certain features

of the system of patent review, as discussed below.

Lemma 5. Suppose q2 ≥ q1 ≥ 1/2 and e2 > e1 . Then, there exists lI∗ such

that πG is decreasing in φA if and only if lI < lI∗ .

Proof. Suppose first that q1 = q2 = 1/2. Then (21) simplifies to

e1

e2

<

,

1 − e1

1 − e2

(22)

which is equivalent to e1 < e2 . The condition q2 ≥ q1 ≥ 1/2 implies q1 ≥

1−q2 . Dividing the left-hand side of (22) by something larger than its righthand side preserves the inequality. Thus, if the conditions in the lemma are

satisfied, (20) holds for lI = 0, while for lI → ∞, (20) can never be satisfied.

By continuity, there exists lI∗ as claimed.

The condition q2 ≥ q1 can be interpreted as the courts applying a presumption of validity: in the absence of strong evidence of obviousness, they

are (weakly) less likely to deny patent protection to an inventor than the

patent office. The condition q1 ≥ 1/2 means that most of the time also the

patent office does not reject an application without strong evidence. The

condition e2 > e1 says that the courts are more likely to find out the true

33

nature of an invention than the patent office. Hence, according to Lemma 5,

if patents benefit from a presumption of validity and courts are better at distinguishing obvious from nonobvious inventions than the patent office, the

type-G inventor’s profit is decreasing in φA if litigation costs are sufficiently

low.

In what follows we assume that (20) holds so that πG decreases with φA .

We then have πG ≥ 0 if and only if

φA ≤

(e1 + (1 − e1 )q1 )e2 (m + ∆C )(m + ∆C − φP )

(e2 (1 − e1 )q1 − e1 (1 − e2 )(1 − q2 ))(m + ∆C ) − e1 lI

− (k − π) [(e2 + (1 − e2 )(1 − q2 ))(m + ∆C ) + lI ] .

Let us check how the slope of the right-hand-side term in φP compares to

that of the corresponding condition for type B, i.e., (19). That is, we want

to know whether the following inequality holds:

(e1 + (1 − e1 )q1 )e2 (m + ∆C )

> (1 − e1 )q1 .

(e2 (1 − e1 )q1 − e1 (1 − e2 )(1 − q2 ))(m + ∆C ) − e1 lI

A sufficient condition for this is

e2 (m + ∆C ) ≥ (e2 (1 − e1 )q1 − e1 (1 − e2 )(1 − q2 ))(m + ∆C ),

which is always satisfied since (1 − e1 )q1 < 1. We conclude that, as in the

basic model, φA and φP are closer substitutes for type G than for type B.

That is, fixing φA + φP , type B prefers fees to be backloaded (in activation

fees) more strongly than type G. In fact, type G may even prefer fees to be

frontloaded.

34

References

[1] Atal, V. and T. Bar (2012), “Patent Quality and a Two-Tiered Patent

System,” Working Paper, Cornell University

[2] Bessen, James and Eric Maskin, “Sequential innovation, patents, and

imitation,” RAND Journal of Economics, 40 (2009), 611-635

[3] Caillaud, B. and A. Duchene (2011), “Patent Office in Innovation Policy: Nobody’s Perfect,” International Journal of Industrial Organization, 29: 242-252

[4] Cornelli, Francesca and Mark Schankerman (1999), “Patent Renewals

and R&D Incentives,” RAND Journal of Economics, 30: 197-213

[5] Dreyfuss, Rochelle Cooper (2008), “Nonobviousness: A Comment on

Three Learned Papers,” Lewis and Clark Law Review, 12: 431-441

[6] Eisenberg, Rebecca (2004), “Obvious to Whome – Evaluating Inventions from the Perspective of PHOSITA,” Berkeley Technology Law

Journal, 19(3): 885-906

[7] Farrell, Joseph and Carl Shapiro (2008), “How Strong are Weak

Patents?,” American Economic Review, 98: 1347-1369

[8] Federal Trade Commission (2011), The Evolving IP Marketplace: Aligning Patent Notice and Remedies with Competition, (Washington D.C.:

Government Printing Office)

[9] Heller, Mark and Rebecca Eisenberg, “Can Patents Deter Innovation?

The Anticommons in Biomedical Research,” Science, 280 (1998), 698701

[10] Klemperer, Paul (1990), “How Broad Should the Scope of Patent Protection Be?,” RAND Journal of Economics, 21: 113-130

[11] Kou, Zonglai, Patrick Rey and Tong Wang (2013), “Non-Obviousness

and Screening,” Journal of Industrial Economics, LXI(3): 700-732

35

[12] Lemley, Mark A. (2001), “Rational Ignorance at the Patent Office,”

Northwestern University Law Review, 95(4): 1495-1532

[13] Lemley, Mark A. and Carl Shapiro (2005), “Probabilistic Patents,”

Journal of Economic Perspectives, 19(2): 75-98

[14] Lichtman, Doug and Mark A. Lemley (2007), “Rethinking Patent Law’s

Presumption of Validity,” Stanford Law Review, 60(1): 42-72

[15] Meurer, Michael J. (1989), “The Settlement of Patent Litigation,”

RAND Journal of Economics, 20(1): 77-91

[16] Hopenhayn, Hugo and Matthew Mitchell (2000), “Innovation Variety

and Patent Breath,” RAND Journal of Economics, 32(1): 152-166

[17] Noveck, Beth (2006), “Peer to Patent: Collective Intelligence, Open

Review, and Patent Reform,” Harvard Journal of Law and Technology,

20(1): 123 - 162

[18] Scotchmer, Suzanne (1999), “On the Optimality of the Patent Renewal