Fun Times Are Not Always Free GRADE

advertisement

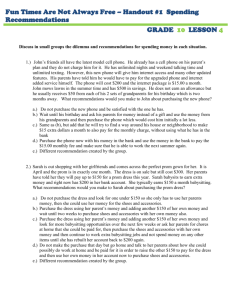

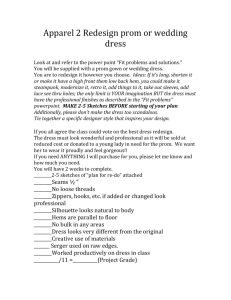

Fun Times Are Not Always Free GRADE 10 LESSON 4 Discuss in small groups each dilemma and recommendations for spending money in each situation. 1.) John’s friends all have the latest model cell phone. He already has a cell phone on his parent’s plan and they do not charge him for it. He has unlimited nights and weekend talking time and unlimited texting. However, this new phone will give him internet access and many other updated features. His parents have told him he would have to pay for the upgraded phone and internet added service himself. The phone will cost $200 and the internet package is $15.00 a month. John mows lawns in the summer time and has $500 in savings. He does not earn an allowance but he usually receives $50 from each of his 2 sets of grandparents for his birthday which is two months away. What recommendations would you make to John about purchasing the new phone? a.) Do not purchase the new phone and be satisfied with the one he has. b.) Wait until his birthday and ask his parents for money instead of a gift and use the money from his grandparents and then purchase the phone which would cost him initially a lot less. c.) Same as (b), but add that he will try to find a way around his house or neighborhood to make $15 extra dollars a month to also pay for the monthly charge, without using what he has in the bank d.) Purchase the phone now with his money in the bank and use the money in the bank to pay the $15.00 monthly fee and make sure that he is able to work the next summer again. e.) Different recommendation created by the group. 2.) Sarah is out shopping with her girlfriends and comes across the perfect prom gown for her. It is April and the prom is in exactly one month. The dress is on sale but still cost $300. Her parents have told her they will pay up to $150 for a prom dress this year. Sarah babysits to earn extra money and right now has $200 in her bank account. She typically earns $150 a month babysitting. What recommendations would you make to Sarah about purchasing the prom dress? a.) Do not purchase the dress and look for one under $150 so she only has to use her parents money, then she could use her money for the shoes and accessories. b.) Purchase the dress using her parent’s money and adding another $150 of her own money and wait until two weeks to purchase shoes and accessories with her own money also. c.) Purchase the dress using her parent’s money and adding another $150 of her own money and look for more babysitting opportunities over the next few weeks or ask her parents for chores at home that she could be paid for, then purchase the shoes and accessories with her own money and then continue to work extra babysitting jobs and not spend money on any other items until she has rebuilt her account back to $200 again. d.) Do not make the purchase that day but go home and talk to her parents about how she could possibly do work at home and be paid for it in order to raise the other $150 to pay for the dress and then use her own money in her account now to purchase shoes and accessories. e.) Different recommendation created by the group. Fun Times Are Not Always Free GRADE 10 LESSON 4 3.) Matthew works part time (approximately 20 hours a week) at the local grocery store. He makes minimum wage and his take-home pay is approximately $120 a week. He has $500 in his savings account and $100 in his checking account. He pays for his car insurance which is $100 a month and he pays for gas in his car which is approximately $30 a week for driving to school and work only. He also gives his parents $20 a month toward his cell phone cost. Matthew goes to pizza parlors and fast food places often with his friends. He has a girlfriend and they go out at least once a week to the movies or bowling or out to eat and he always pays because she does not have a part-time job so he knows she doesn’t really have any money. Matthew does not want to increase his current work hours because he is concerned it would lower his academic performance. Matthew is saving money for college. He is a sophomore now and he knows that the more money he saves now the less he will have to work while in college and his goal is to not have to work his freshman year in college. He wants to save at least $2000 by the end of his senior year. How much money will he need to put in his savings account each month to reach his goal? What kind of budget will he need to create? In what categories do you recommend he reduce his spending in order to meet his goal? What alternative recommendations do you have for not spending money in those categories? What recommendations do you have about increasing his income?