COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS

advertisement

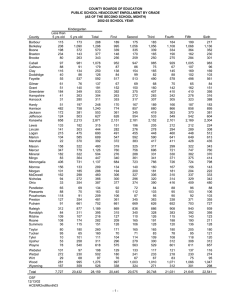

COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS FOR THE 2010-11 FISCAL YEAR County Class I Proj Tax Collections Class II Proj Tax Collections Class III Proj Tax Collections Class IV Proj Tax Collections Total Projected Gross Tax Collections Barbour Berkeley Boone Braxton Brooke - 14,134,093 896,166 1,189,804 13,038,232 11,949,460 810,476 4,418,160 580,772 3,715,466 31,590,485 13,426,398 5,715,746 Cabell Calhoun Clay Doddridge Fayette - 5,902,695 7,577 84,790 534,454 1,949,373 7,078,755 32,813 575,482 3,048,094 5,547,728 9,767,731 2,006 31,920 83,131 2,114,658 22,749,181 42,396 692,192 3,665,679 9,611,759 Gilmer Grant Greenbrier Hampshire Hancock - 136,019 1,618,021 1,620,538 830,693 2,864,056 3,212,705 74,576 950,784 2,272,730 1,041,288 5,432,861 7,105,973 Hardy Harrison Jackson Jefferson Kanawha - 4,296,581 1,927,924 9,729,192 11,057,904 9,836,709 5,261,565 7,972,105 17,323,967 6,662,719 1,229,630 3,665,330 19,518,420 20,796,009 8,419,119 21,366,627 47,900,291 Lewis Lincoln Logan Marion Marshall - 494,713 603,325 1,147,343 4,069,877 1,660,551 2,768,350 3,609,336 10,420,791 6,822,159 10,714,713 240,573 166,106 993,462 4,573,996 2,023,805 3,503,636 4,378,767 12,561,596 15,466,032 14,399,069 Mason McDowell Mercer Mineral Mingo - 1,450,888 213,066 2,933,145 2,430,892 641,451 4,976,018 7,813,780 5,391,948 3,068,465 8,352,479 733,850 817,987 2,862,621 776,055 843,444 7,160,756 8,844,833 11,187,714 6,275,412 9,837,374 Monongalia Monroe Morgan Nicholas Ohio - 5,369,461 685,618 2,921,262 818,248 3,326,963 11,750,534 941,138 2,512,393 2,548,997 2,529,293 5,673,788 101,792 344,945 606,406 5,245,695 22,793,783 1,728,548 5,778,600 3,973,651 11,101,951 Pendleton Pleasants Pocahontas Preston Putnam - 404,575 449,621 5,923,299 3,305,274 802,400 11,060,293 270,765 187,174 1,570,633 3,980,614 1,439,195 18,554,225 Raleigh Randolph Ritchie Roane Summers - 4,503,463 523,354 - 12,750,691 1,678,690 - 4,181,995 266,967 - 21,436,149 2,469,011 - Taylor Tucker Tyler Upshur Wayne - 643,191 581,538 738,163 1,729,928 1,025,627 2,012,864 2,040,045 5,768,415 283,538 283,187 414,589 1,220,937 1,952,356 2,877,589 3,192,797 8,719,280 Webster Wetzel Wirt Wood Wyoming - 860,225 287,359 5,764,192 353,151 3,114,249 400,461 5,592,308 7,658,321 1,053,935 78,772 5,632,899 447,968 5,028,409 766,592 16,989,399 8,459,440 106,613,993 230,812,872 96,985,917 434,412,782 Total 0 Source: Levy Order and Rate Sheet submitted by each county board for the 2009-10 fiscal year. OSF2 05/20/10 Taxable Assessed Valuations 11 -1- COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS 2009-10 AND 2010-11 YEARS Projected Excess Levy Tax Collections 2008-09 Projected Excess Levy Tax Collections 2009-10 Barbour Berkeley Boone Braxton Brooke 33,241,297 13,304,700 5,975,405 31,590,485 13,426,398 5,715,746 (1,650,812) 121,698 (259,659) 0.00% -4.97% 0.91% 0.00% -4.35% Cabell Calhoun Clay Doddridge Fayette 22,365,240 40,346 708,477 3,276,459 9,007,433 22,749,181 42,396 692,192 3,665,679 9,611,759 383,941 2,050 (16,285) 389,220 604,326 1.72% 5.08% -2.30% 11.88% 6.71% Gilmer Grant Greenbrier Hampshire Hancock 990,000 5,540,315 7,109,783 1,041,288 5,432,861 7,105,973 51,288 (107,454) (3,810) 5.18% 0.00% -1.94% 0.00% -0.05% Hardy Harrison Jackson Jefferson Kanawha 19,693,760 8,624,870 24,439,294 48,016,220 20,796,009 8,419,119 21,366,627 47,900,291 1,102,249 (205,751) (3,072,667) (115,929) 0.00% 5.60% -2.39% -12.57% -0.24% Lewis Lincoln Logan Marion Marshall 3,940,998 3,887,156 11,581,592 15,020,626 12,815,483 3,503,636 4,378,767 12,561,596 15,466,032 14,399,069 (437,362) 491,611 980,004 445,406 1,583,586 -11.10% 12.65% 8.46% 2.97% 12.36% Mason McDowell Mercer Mineral Mingo 7,268,262 8,463,973 10,996,135 6,252,877 8,985,736 7,160,756 8,844,833 11,187,714 6,275,412 9,837,374 (107,506) 380,860 191,579 22,535 851,638 -1.48% 4.50% 1.74% 0.36% 9.48% Monongalia Monroe Morgan Nicholas Ohio 21,162,859 1,702,792 5,448,719 3,816,571 10,998,617 22,793,783 1,728,548 5,778,600 3,973,651 11,101,951 Pendleton Pleasants Pocahontas Preston Putnam 4,042,201 1,610,442 18,538,336 3,980,614 1,439,195 18,554,225 Raleigh Randolph Ritchie Roane Summers 20,172,176 2,314,019 - 21,436,149 2,469,011 - 1,263,973 154,992 - 6.27% 0.00% 6.70% 0.00% 0.00% 1,870,690 2,804,452 2,767,794 8,130,433 1,952,356 2,877,589 3,192,797 8,719,280 81,666 73,137 425,003 588,847 4.37% 0.00% 2.61% 15.36% 7.24% 4,810,343 759,281 17,081,159 8,364,851 5,028,409 766,592 16,989,399 8,459,440 218,066 7,311 (91,760) 94,589 0.00% 4.53% 0.96% -0.54% 1.13% 427,942,172 434,412,782 County Taylor Tucker Tyler Upshur Wayne Webster Wetzel Wirt Wood Wyoming Total Difference 1,630,924 25,756 329,881 157,080 103,334 (61,587) (171,247) 15,889 6,470,610 Source: Levy Order and Rate Sheet submitted by each county board for the 2009-10 fiscal year. OSF2 05/20/10 Taxable Assessed Valuations 11 -2- Percent Change 7.71% 1.51% 6.05% 4.12% 0.94% 0.00% -1.52% 0.00% -10.63% 0.09% 1.51% COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY NET TAX COLLECTIONS FOR THE 2010-11 FISCAL YEAR County Total Projected Gross Tax Collections Allowance for Exonerations & Delinquencies Allowance for Discounts Projected Net Tax Collections for Excess Levy Barbour Berkeley Boone Braxton Brooke 31,590,485 13,426,398 5,715,746 1,579,524 671,320 228,630 600,219 255,102 54,871 29,410,742 12,499,976 5,432,245 Cabell Calhoun Clay Doddridge Fayette 22,749,181 42,396 692,192 3,665,679 9,611,759 1,137,459 2,120 55,375 146,627 672,823 432,234 604 6,368 35,191 178,779 21,179,488 39,672 630,449 3,483,861 8,760,157 Gilmer Grant Greenbrier Hampshire Hancock 1,041,288 5,432,861 7,105,973 52,064 190,150 284,239 19,784 52,427 102,326 969,440 5,190,284 6,719,408 Hardy Harrison Jackson Jefferson Kanawha 20,796,009 8,419,119 21,366,627 47,900,291 623,880 420,956 1,068,331 2,395,015 403,443 159,963 202,983 910,106 19,768,686 7,838,200 20,095,313 44,595,170 Lewis Lincoln Logan Marion Marshall 3,503,636 4,378,767 12,561,596 15,466,032 14,399,069 175,182 175,151 1,004,928 773,302 431,972 66,569 42,036 231,133 293,855 279,342 3,261,885 4,161,580 11,325,535 14,398,875 13,687,755 Mason McDowell Mercer Mineral Mingo 7,160,756 8,844,833 11,187,714 6,275,412 9,837,374 358,038 619,138 559,386 251,016 983,737 136,054 164,514 212,567 60,244 177,073 6,666,664 8,061,181 10,415,761 5,964,152 8,676,564 Monongalia Monroe Morgan Nicholas Ohio 22,793,783 1,728,548 5,778,600 3,973,651 11,101,951 1,139,689 86,427 288,930 258,287 333,059 433,082 32,842 109,793 74,307 107,689 21,221,012 1,609,279 5,379,877 3,641,057 10,661,203 Pendleton Pleasants Pocahontas Preston Putnam 3,980,614 1,439,195 18,554,225 119,418 71,960 1,669,880 77,224 27,345 168,843 3,783,972 1,339,890 16,715,502 Raleigh Randolph Ritchie Roane Summers 21,436,149 2,469,011 - 857,446 123,451 - 411,574 58,639 - 20,167,129 2,286,921 - 1,952,356 2,877,589 3,192,797 8,719,280 97,618 143,879 159,640 653,946 37,095 27,337 60,663 161,307 1,817,643 2,706,373 2,972,494 7,904,027 5,028,409 766,592 16,989,399 8,459,440 251,420 30,664 339,788 169,189 47,770 14,719 332,992 165,805 4,729,219 721,209 16,316,619 8,124,446 434,412,782 21,655,054 7,426,813 405,330,915 Taylor Tucker Tyler Upshur Wayne Webster Wetzel Wirt Wood Wyoming Total Source: Levy Order and Rate Sheet submitted by each county board for the 2009-10 fiscal year. OSF2 05/20/10 Taxable Assessed Valuations 11 -3- COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS @ MAXIMUM RATES FOR THE 2010-11 FISCAL YEAR County Class I Proj Tax at Maximum 22.95 Class II Proj Tax at Maximum 45.90 Class III Proj Tax at Maximum 91.80 Class IV Proj Tax at Maximum 91.80 Total Projected Gross Tax Collections at Max Rates Barbour Berkeley Boone Braxton Brooke - 737,706 14,416,775 896,166 734,847 1,189,804 1,951,202 13,298,996 11,949,460 2,571,762 810,476 468,486 4,506,523 580,772 351,331 3,715,466 3,157,394 32,222,294 13,426,398 3,657,940 5,715,746 Cabell Calhoun Clay Doddridge Fayette - 5,902,695 328,086 299,373 534,454 1,949,373 7,078,755 1,420,850 2,031,894 3,048,094 5,547,728 9,767,731 86,853 112,701 83,131 2,114,658 22,749,181 1,835,789 2,443,968 3,665,679 9,611,759 Gilmer Grant Greenbrier Hampshire Hancock - 386,340 1,089,090 3,236,041 3,802,491 1,620,538 2,359,457 4,923,080 5,728,113 4,593,022 3,212,705 211,821 404,852 1,901,568 532,252 2,272,730 2,957,618 6,417,022 10,865,722 8,927,765 7,105,973 Hardy Harrison Jackson Jefferson Kanawha - 1,999,204 4,850,296 1,927,924 9,729,192 14,754,587 3,020,892 11,104,401 5,261,565 7,972,105 23,115,410 952,070 7,521,367 1,229,630 3,665,330 26,043,473 5,972,166 23,476,064 8,419,119 21,366,627 63,913,470 Lewis Lincoln Logan Marion Marshall - 1,100,161 603,325 1,147,343 4,069,877 1,694,515 6,156,359 3,609,336 10,420,791 6,822,159 10,933,867 534,996 166,106 993,462 4,573,996 2,065,199 7,791,516 4,378,767 12,561,596 15,466,032 14,693,581 Mason McDowell Mercer Mineral Mingo - 1,625,873 213,066 2,933,145 2,430,892 641,451 5,576,153 7,813,780 5,391,948 3,068,465 8,352,479 822,357 817,987 2,862,621 776,055 843,444 8,024,383 8,844,833 11,187,714 6,275,412 9,837,374 Monongalia Monroe Morgan Nicholas Ohio - 7,160,322 914,290 3,300,982 1,410,879 3,483,294 15,669,655 1,255,033 2,838,967 4,395,152 2,648,142 7,566,150 135,742 389,783 1,045,606 5,492,185 30,396,127 2,305,065 6,529,732 6,851,637 11,623,621 Pendleton Pleasants Pocahontas Preston Putnam - 1,118,896 487,146 1,112,257 2,394,152 5,923,299 1,233,577 3,979,856 3,882,165 4,272,640 11,060,293 136,559 326,026 279,896 996,667 1,570,633 2,489,032 4,793,028 5,274,318 7,663,459 18,554,225 Raleigh Randolph Ritchie Roane Summers - 4,503,463 1,841,899 805,025 858,180 754,306 12,750,691 4,151,231 2,582,168 1,845,745 1,548,698 4,181,995 1,320,483 410,649 376,991 406,989 21,436,149 7,313,613 3,797,842 3,080,916 2,709,993 Taylor Tucker Tyler Upshur Wayne - 1,286,383 712,607 581,538 1,723,381 1,729,928 2,051,254 2,755,593 2,012,864 4,762,872 5,768,415 567,076 552,746 283,187 967,936 1,220,937 3,904,713 4,020,946 2,877,589 7,454,189 8,719,280 Webster Wetzel Wirt Wood Wyoming - 238,897 860,225 319,210 7,205,240 353,151 2,105,119 3,114,249 444,849 6,990,385 7,658,321 174,072 1,053,935 87,503 7,041,124 447,968 2,518,088 5,028,409 851,562 21,236,749 8,459,440 137,923,580 300,923,238 118,011,806 556,858,624 Total 0 OSF2 05/20/10 Taxable Assessed Valuations 11 -4-