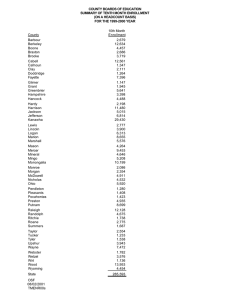

COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS Total

advertisement

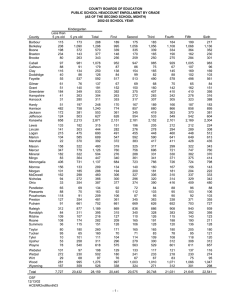

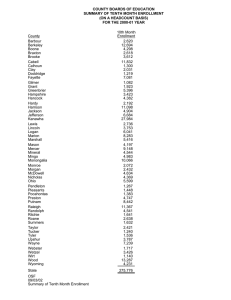

COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS FOR THE 2009-10 FISCAL YEAR County Class I Proj Tax Collections Class II Proj Tax Collections Class III Proj Tax Collections Class IV Proj Tax Collections Total Projected Gross Tax Collections Barbour Berkeley Boone Braxton Brooke - 15,212,319 856,888 1,196,486 13,589,338 11,870,326 873,099 4,439,640 577,486 3,905,820 33,241,297 13,304,700 5,975,405 Cabell Calhoun Clay Doddridge Fayette - 5,867,831 7,440 81,671 521,503 1,843,591 6,863,036 30,932 593,617 2,674,517 5,223,127 9,634,373 1,974 33,189 80,439 1,940,715 22,365,240 40,346 708,477 3,276,459 9,007,433 Gilmer Grant Greenbrier Hampshire Hancock - 128,601 1,573,643 1,627,953 779,247 3,014,445 3,154,400 82,152 952,227 2,327,430 990,000 5,540,315 7,109,783 Hardy Harrison Jackson Jefferson Kanawha - 4,218,868 1,849,704 11,570,176 11,010,891 9,221,474 5,609,862 8,847,128 17,017,583 6,253,418 1,165,304 4,021,990 19,987,746 19,693,760 8,624,870 24,439,294 48,016,220 Lewis Lincoln Logan Marion Marshall - 566,037 580,107 1,035,450 3,963,544 1,599,807 3,080,292 3,148,109 9,540,788 6,520,506 9,320,584 294,669 158,940 1,005,354 4,536,576 1,895,092 3,940,998 3,887,156 11,581,592 15,020,626 12,815,483 Mason McDowell Mercer Mineral Mingo - 1,403,083 211,131 2,847,955 2,354,713 633,531 5,134,669 7,428,390 5,283,400 3,099,757 7,500,138 730,510 824,452 2,864,780 798,407 852,067 7,268,262 8,463,973 10,996,135 6,252,877 8,985,736 Monongalia Monroe Morgan Nicholas Ohio - 5,158,987 637,759 2,804,626 791,589 3,274,452 10,679,680 972,136 2,323,033 2,435,735 2,411,237 5,324,192 92,897 321,060 589,247 5,312,928 21,162,859 1,702,792 5,448,719 3,816,571 10,998,617 Pendleton Pleasants Pocahontas Preston Putnam - 399,064 475,205 5,793,267 3,377,244 939,469 11,224,125 265,893 195,768 1,520,944 4,042,201 1,610,442 18,538,336 Raleigh Randolph Ritchie Roane Summers - 4,265,665 508,174 - 11,754,563 1,537,919 - 4,151,948 267,926 - 20,172,176 2,314,019 - Taylor Tucker Tyler Upshur Wayne - 586,877 551,610 684,799 1,678,327 998,743 1,964,647 1,670,314 5,286,886 285,070 288,195 412,681 1,165,220 1,870,690 2,804,452 2,767,794 8,130,433 Webster Wetzel Wirt Wood Wyoming - 849,234 281,458 5,656,363 330,837 2,628,176 393,582 5,686,326 7,574,929 1,332,933 84,241 5,738,470 459,085 4,810,343 759,281 17,081,159 8,364,851 107,491,216 223,277,508 97,173,448 427,942,172 Total 0 Source: Levy Order and Rate Sheet submitted by each county board for the 2009-10 fiscal year. OSF2 05/20/09 Taxable Assessed Valuations 10 -1- COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS 2008-09 AND 2009-10 YEARS Projected Excess Levy Tax Collections 2008-09 Projected Excess Levy Tax Collections 2009-10 Barbour Berkeley Boone Braxton Brooke 32,522,578 12,664,380 5,820,233 33,241,297 13,304,700 5,975,405 718,719 640,320 155,172 0.00% 2.21% 5.06% 0.00% 2.67% Cabell Calhoun Clay Doddridge Fayette 21,337,381 38,322 712,711 3,048,106 8,356,918 22,365,240 40,346 708,477 3,276,459 9,007,433 1,027,859 2,024 (4,234) 228,353 650,515 4.82% 5.28% -0.59% 7.49% 7.78% Gilmer Grant Greenbrier Hampshire Hancock 994,229 5,297,013 6,166,332 990,000 5,540,315 7,109,783 (4,229) 243,302 943,451 -0.43% 0.00% 4.59% 0.00% 15.30% Hardy Harrison Jackson Jefferson Kanawha 18,871,374 8,553,590 24,986,087 47,651,617 19,693,760 8,624,870 24,439,294 48,016,220 822,386 71,280 (546,793) 364,603 0.00% 4.36% 0.83% -2.19% 0.77% Lewis Lincoln Logan Marion Marshall 3,788,116 3,552,484 10,878,406 12,525,944 11,622,785 3,940,998 3,887,156 11,581,592 15,020,626 12,815,483 152,882 334,672 703,186 2,494,682 1,192,698 4.04% 9.42% 6.46% 19.92% 10.26% Mason McDowell Mercer Mineral Mingo 7,463,336 7,324,147 10,685,633 5,716,594 8,708,722 7,268,262 8,463,973 10,996,135 6,252,877 8,985,736 (195,074) 1,139,826 310,502 536,283 277,014 -2.61% 15.56% 2.91% 9.38% 3.18% Monongalia Monroe Morgan Nicholas Ohio 20,299,907 1,310,870 4,986,444 3,568,096 10,500,175 21,162,859 1,702,792 5,448,719 3,816,571 10,998,617 862,952 391,922 462,275 248,475 498,442 4.25% 29.90% 9.27% 6.96% 4.75% Pendleton Pleasants Pocahontas Preston Putnam 3,914,614 1,611,913 17,515,916 4,042,201 1,610,442 18,538,336 127,587 (1,471) 1,022,420 0.00% 3.26% 0.00% -0.09% 5.84% Raleigh Randolph Ritchie Roane Summers 18,615,368 2,022,128 - 20,172,176 2,314,019 - 1,556,808 291,891 - 8.36% 0.00% 14.43% 0.00% 0.00% 1,705,538 275,772 2,618,686 2,517,994 7,929,434 1,870,690 2,804,452 2,767,794 8,130,433 165,152 (275,772) 185,766 249,800 200,999 4,562,221 719,783 16,983,570 7,584,734 4,810,343 759,281 17,081,159 8,364,851 248,122 39,498 97,589 780,117 0.00% 5.44% 5.49% 0.57% 10.29% 408,530,201 427,942,172 19,411,971 4.75% County Taylor Tucker Tyler Upshur Wayne Webster Wetzel Wirt Wood Wyoming Total Difference Source: Levy Order and Rate Sheet submitted by each county board for the 2009-10 fiscal year. OSF2 05/20/09 Taxable Assessed Valuations 10 -2- Percent Change 9.68% -100.00% 7.09% 9.92% 2.53% COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY NET TAX COLLECTIONS FOR THE 2009-10 FISCAL YEAR County Total Projected Gross Tax Collections Allowance for Exonerations & Delinquencies Allowance for Discounts Projected Net Tax Collections for Excess Levy Barbour Berkeley Boone Braxton Brooke 33,241,297 13,304,700 5,975,405 1,662,065 665,235 239,016 631,585 252,789 57,364 30,947,647 12,386,676 5,679,025 Cabell Calhoun Clay Doddridge Fayette 22,365,240 40,346 708,477 3,276,459 9,007,433 1,118,262 2,017 56,678 131,058 450,372 424,940 575 6,518 31,454 171,141 20,822,038 37,754 645,281 3,113,947 8,385,920 Gilmer Grant Greenbrier Hampshire Hancock 990,000 5,540,315 7,109,783 49,500 193,911 284,391 18,810 53,464 102,381 921,690 5,292,940 6,723,011 Hardy Harrison Jackson Jefferson Kanawha 19,693,760 8,624,870 24,439,294 48,016,220 590,813 431,244 1,221,965 2,400,811 382,059 163,873 232,173 912,308 18,720,888 8,029,753 22,985,156 44,703,101 Lewis Lincoln Logan Marion Marshall 3,940,998 3,887,156 11,581,592 15,020,626 12,815,483 197,050 291,537 926,527 751,031 384,464 74,879 89,890 213,101 285,392 248,620 3,669,069 3,505,729 10,441,964 13,984,203 12,182,399 Mason McDowell Mercer Mineral Mingo 7,268,262 8,463,973 10,996,135 6,252,877 8,985,736 363,413 592,478 549,807 250,115 898,574 138,097 157,430 208,927 60,028 161,743 6,766,752 7,714,065 10,237,401 5,942,734 7,925,419 Monongalia Monroe Morgan Nicholas Ohio 21,162,859 1,702,792 5,448,719 3,816,571 10,998,617 1,058,143 85,140 272,436 248,077 329,959 402,094 32,353 103,526 71,370 106,687 19,702,622 1,585,299 5,072,757 3,497,124 10,561,971 Pendleton Pleasants Pocahontas Preston Putnam 4,042,201 1,610,442 18,538,336 121,266 80,522 1,668,450 78,419 30,598 168,699 3,842,516 1,499,322 16,701,187 Raleigh Randolph Ritchie Roane Summers 20,172,176 2,314,019 - 806,887 115,701 - 387,306 54,958 - 18,977,983 2,143,360 - 1,870,690 2,804,452 2,767,794 8,130,433 93,535 140,223 138,390 609,782 35,543 26,642 52,588 150,413 1,741,612 2,637,587 2,576,816 7,370,238 4,810,343 759,281 17,081,159 8,364,851 240,517 30,371 341,623 167,297 45,698 14,578 334,791 163,951 4,524,128 714,332 16,404,745 8,033,603 427,942,172 21,250,653 7,339,755 399,351,764 Taylor Tucker Tyler Upshur Wayne Webster Wetzel Wirt Wood Wyoming Total Source: Levy Order and Rate Sheet submitted by each county board for the 2009-10 fiscal year. OSF2 05/20/09 Taxable Assessed Valuations 10 -3- COUNTY BOARDS OF EDUCATION PROJECTED EXCESS LEVY GROSS TAX COLLECTIONS @ MAXIMUM RATES FOR THE 2009-10 FISCAL YEAR County Class I Proj Tax at Maximum 22.95 Class II Proj Tax at Maximum 45.90 Class III Proj Tax at Maximum 91.80 Class IV Proj Tax at Maximum 91.80 Total Projected Gross Tax Collections at Max Rates Barbour Berkeley Boone Braxton Brooke - 650,877 15,516,566 856,888 718,411 1,196,486 1,821,638 13,861,125 11,870,326 2,575,043 873,099 427,933 4,528,433 577,486 356,666 3,905,820 2,900,448 33,906,124 13,304,700 3,650,120 5,975,405 Cabell Calhoun Clay Doddridge Fayette - 5,867,831 322,154 288,362 521,503 1,843,591 6,863,036 1,339,408 2,095,926 2,674,517 5,223,127 9,634,373 85,492 117,181 80,439 1,940,715 22,365,240 1,747,054 2,501,469 3,276,459 9,007,433 Gilmer Grant Greenbrier Hampshire Hancock - 341,202 1,064,610 3,147,286 3,814,451 1,627,953 2,067,483 4,731,312 6,028,891 4,682,240 3,154,400 217,963 420,650 1,904,453 517,401 2,327,430 2,626,648 6,216,572 11,080,630 9,014,092 7,109,783 Hardy Harrison Jackson Jefferson Kanawha - 1,990,561 4,762,568 1,849,704 11,570,176 14,220,594 2,910,944 10,409,879 5,609,862 8,847,128 21,978,251 957,602 7,059,319 1,165,304 4,021,990 25,814,224 5,859,107 22,231,766 8,624,870 24,439,294 62,013,069 Lewis Lincoln Logan Marion Marshall - 1,029,362 580,107 1,035,450 3,963,544 1,632,529 5,601,640 3,148,109 9,540,788 6,520,506 9,511,222 535,868 158,940 1,005,354 4,536,576 1,933,853 7,166,870 3,887,156 11,581,592 15,020,626 13,077,604 Mason McDowell Mercer Mineral Mingo - 1,572,302 211,131 2,847,955 2,354,713 633,531 5,753,939 7,428,390 5,283,400 3,099,757 7,500,138 818,613 824,452 2,864,780 798,407 852,067 8,144,854 8,463,973 10,996,135 6,252,877 8,985,736 Monongalia Monroe Morgan Nicholas Ohio - 6,879,648 850,469 3,359,403 1,364,911 3,428,315 14,241,642 1,296,370 2,782,547 4,199,858 2,524,539 7,099,954 123,881 384,568 1,016,020 5,562,577 28,221,244 2,270,720 6,526,518 6,580,789 11,515,431 Pendleton Pleasants Pocahontas Preston Putnam - 1,113,306 480,510 981,990 2,355,497 5,793,267 1,120,607 4,066,513 4,187,489 4,656,761 11,224,125 143,829 320,159 270,720 970,383 1,520,944 2,377,742 4,867,182 5,440,199 7,982,641 18,538,336 Raleigh Randolph Ritchie Roane Summers - 4,265,665 1,744,511 781,675 802,666 706,683 11,754,563 3,985,543 2,365,632 1,687,725 1,478,200 4,151,948 1,338,570 412,125 369,407 380,884 20,172,176 7,068,624 3,559,432 2,859,798 2,565,767 Taylor Tucker Tyler Upshur Wayne - 1,173,754 680,451 551,610 1,598,792 1,678,327 1,997,485 2,680,907 1,964,647 3,899,665 5,286,886 570,140 551,000 288,195 963,482 1,165,220 3,741,379 3,912,358 2,804,452 6,461,939 8,130,433 Webster Wetzel Wirt Wood Wyoming - 136,706 849,234 312,655 7,070,454 330,837 1,965,314 2,628,176 437,208 7,107,907 7,574,929 180,306 1,332,933 93,578 7,173,088 459,085 2,282,326 4,810,343 843,441 21,351,449 8,364,851 137,323,734 290,120,762 117,232,780 544,677,276 Total 0 OSF2 9/16/05 Taxable Assessed Valuations 10 -4- COUNTY BOARDS OF EDUCATION EXCESS LEVY TAXABLE CAPACITY FOR THE 2009-10 FISCAL YEAR Potential Excess Levy Collections at Max Rates Current Excess Levy Gross Tax Collections Unused Excess Levy Capacity Barbour Berkeley Boone Braxton Brooke 2,900,448 33,906,124 13,304,700 3,650,120 5,975,405 33,241,297 13,304,700 5,975,405 2,900,448 664,827 3,650,120 - Cabell Calhoun Clay Doddridge Fayette 22,365,240 1,747,054 2,501,469 3,276,459 9,007,433 22,365,240 40,346 708,477 3,276,459 9,007,433 1,706,708 1,792,992 - Gilmer Grant Greenbrier Hampshire Hancock 2,626,648 6,216,572 11,080,630 9,014,092 7,109,783 990,000 5,540,315 7,109,783 1,636,648 6,216,572 5,540,315 9,014,092 - Hardy Harrison Jackson Jefferson Kanawha 5,859,107 22,231,766 8,624,870 24,439,294 62,013,069 19,693,760 8,624,870 24,439,294 48,016,220 5,859,107 2,538,006 13,996,849 Lewis Lincoln Logan Marion Marshall 7,166,870 3,887,156 11,581,592 15,020,626 13,077,604 3,940,998 3,887,156 11,581,592 15,020,626 12,815,483 3,225,872 262,121 Mason McDowell Mercer Mineral Mingo 8,144,854 8,463,973 10,996,135 6,252,877 8,985,736 7,268,262 8,463,973 10,996,135 6,252,877 8,985,736 876,592 - Monongalia Monroe Morgan Nicholas Ohio 28,221,244 2,270,720 6,526,518 6,580,789 11,515,431 21,162,859 1,702,792 5,448,719 3,816,571 10,998,617 7,058,385 567,928 1,077,799 2,764,218 516,814 Pendleton Pleasants Pocahontas Preston Putnam 2,377,742 4,867,182 5,440,199 7,982,641 18,538,336 4,042,201 1,610,442 18,538,336 2,377,742 824,981 5,440,199 6,372,199 - Raleigh Randolph Ritchie Roane Summers 20,172,176 7,068,624 3,559,432 2,859,798 2,565,767 20,172,176 2,314,019 - 7,068,624 1,245,413 2,859,798 2,565,767 3,741,379 3,912,358 2,804,452 6,461,939 8,130,433 1,870,690 2,804,452 2,767,794 8,130,433 1,870,689 3,912,358 3,694,145 - 2,282,326 4,810,343 843,441 21,351,449 8,364,851 4,810,343 759,281 17,081,159 8,364,851 2,282,326 84,160 4,270,290 - 544,677,276 427,942,172 116,735,104 County Taylor Tucker Tyler Upshur Wayne Webster Wetzel Wirt Wood Wyoming Total OSF2 9/16/05 Taxable Assessed Valuations 10 -5-