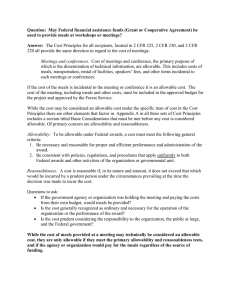

F FNS INSTRUCTION N S

advertisement