Title

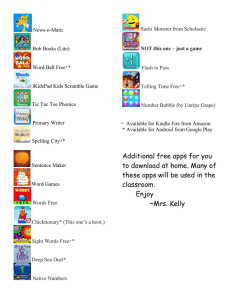

advertisement