Document 10980686

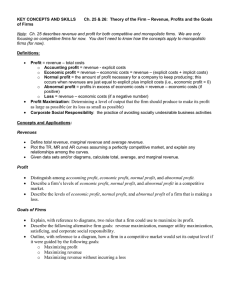

advertisement