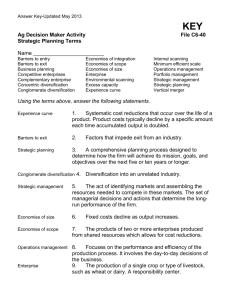

a I THE JAPAN

advertisement