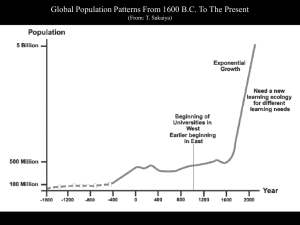

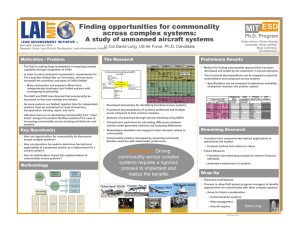

Fisher College of Business Working Paper Series Common Patterns in Commonality

advertisement