Rollover Risk and Credit Spreads in the Financial Crisis of 2008

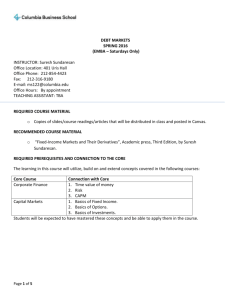

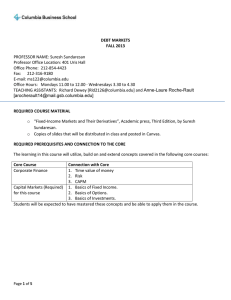

advertisement