Debt Covenant Design and Creditor Control Rights:

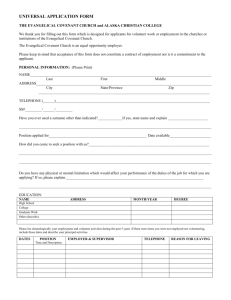

advertisement