“Projected Earnings Fixation”

advertisement

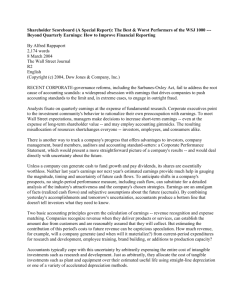

“Projected Earnings Fixation” Paul E. Fischer Mirko S. Heinle Robert E. Verrecchia University of Pennsylvania November 2012 Abstract We consider the implications that arise from investors believing that investors in the future will place too much emphasis on earnings information: we refer to this phenomenon as “projected earnings …xation” (PEF). Our results show that periods of PEF lead to greater price volatility, and price behavior inconsistent with standard valuation frameworks. We also show that investors who exhibit PEF achieve a higher ex ante expected utility. The reason for this is that PEF results in greater price volatility and investors bene…t from the increased risk premium inherent in stock price. In other words, our analysis extends beyond simply positing that investors project that other investors place too much emphasis on earnings, to show why investors might gravitate toward this projection. We thank workshop participants at Baruch College, Carnegie Mellon University, the Chicago-Minnesota Theory Conference 2012, the Tel Aviv International Conference in Accounting, and UC Berkeley for helpful comments. 1 Introduction Keynes is credited with the observation that short-horizon investors will attempt to predict future beliefs about a …rm’s equity value, as opposed to making predictions about the …rm’s fundamental value. As a consequence, beliefs-about-beliefs – and not beliefs about fundamentals –may drive …rm share prices. Various theoretical analyses have demonstrated that beliefs-about-beliefs can foster pricing bubbles in the marketplace, thereby causing share prices to rise temporarily above fundamental value and manifest excess share-price volatility. In most of these theoretical models, beliefs-about-beliefs pertains to the …rst moment (mean) of beliefs: if investors believe that some investors will view share prices more favorably in subsequent periods, prices will rise each period to re‡ect these beliefs. This results in an equilibrium where shares are overvalued relative to fundamentals. The purpose of this paper is to consider a variation on Keynes’observation, one that pertains to the second moment (variance) of beliefs. Speci…cally, we consider the implications that arise from investors believing that investors in subsequent periods will place too much emphasis on earnings in their beliefs formation. We refer to the phenomenon where investors in the current period believe that investors in subsequent periods place too much emphasis on earnings as “projected earnings …xation”(PEF). The chief goal of this paper is to demonstrate that PEF can be self-ful…lling: that is, a belief by current investors that investors in subsequent periods will place too much emphasis on earnings leads to current investors also placing too much emphasis on earnings. As a consequence, equilibrium price paths can exhibit excessive volatility relative to the volatility of underlying economic fundamentals. The notion that users of accounting information place undue, or disproportionate, em- 1 phasis on accounting measures of performance has a long tradition in accounting (see, for example, Ijiri, Jaedicke, and Knight 1966 and Ashton 1976). Although undue emphasis might arise in the context of a variety of measures, research has focused primarily on investors’…xation on earnings. For example, Hand (1990) examines the stock price reaction to quarterly earnings announcements of …rms that undertook debt-equity swaps, which increased earnings by about 20%. Hand …nds an abnormal stock return at the time of the announcement, consistent with the earnings …xation hypothesis. In a similar vein, Sloan (1996) …nds that stock prices act as if investors “…xate” on earnings, to the exclusion of information contained in the accrual and cash ‡ow components of current earnings. While much of that literature alludes to cognitive limitations or biases as the driver of …xation, our analysis suggests that …xation can arise as an equilibrium phenomenon among investors who are not inhibited cognitively.1 Our intention in coining the expression “projected earnings …xation”is to make reference to the phenomenon in Psychology of a person denying his own attributes, thoughts, and emotions, and instead projecting the belief that others originate those feelings. In Psychology projecting thoughts or emotions onto others allows the person to evaluate them and the extent to which they are dysfunctional, but without feeling the attendant discomfort of knowing that these thoughts and emotions are his own. For example, projection allows a person to criticize another person, while distancing him from his own dysfunction. We transport this idea into the realm of equity markets by suggesting that a person who exhibits 1 The overemphasis on earnings discussed here is related to the notion that with privately informed investors, public information (i) facilitates coordination among traders and (ii) shapes higher order beliefs, both of which lead to an overreaction on public information (e.g., Morris and Shin 2002, Allen, Morris, and Shin 2006, and Gao 2008). 2 projected earnings …xation projects that investors in subsequent periods will place too much emphasis on earnings: in other words, investors believe that investors in subsequent periods will be dysfunctional in the emphasis they place on earnings. To study the role of PEF in pricing, we posit a parsimonious, overlapping generations (OLG) model common to the literature. Identical investors with constant absolute risk aversion (CARA) utility functions live for two periods. These investors are savers (buyers) in the …rst period of life, and consumers (sellers) in the second period of life. The investment opportunity set includes a risky asset and a risk-free asset, where the risky asset generates earnings each period that are paid out immediately as a dividend and the risk-free asset yields a …xed return each period. The earnings of the risky asset follow a simple, one-period, autoregressive time series process. Within the context of this model, the only news that arrives each period is the most recent earnings information. To establish a benchmark, we …rst characterize a steady-state linear equilibrium where the equilibrium price is a linear function of earnings, and the intercept and coe¢ cient on earnings both remain unchanged over time; this is consistent with a stable earnings process. We depart from the existing literature by also characterizing alternative linear equilibria where the coe¢ cient on earnings and the intercept term vary over time. Our analysis shows that when current investors project that investors in the future will place too much emphasis on earnings information –in e¤ect, current investors exhibit PEF – current investors themselves place too much emphasis on current earnings. As a consequence, equilibria can arise where investors’response to earnings information becomes more exaggerated than the variability of the fundamentals would suggest. In addition, our analysis demonstrates that the reaction to information about stochastically stable fundamentals can 3 vary over time, with, for example, some periods of PEF and other periods with a steady-state equilibrium that re‡ects investors responding in a fashion that is consistent with the stable variation in fundamentals. Periods of PEF lead to greater price volatility and price behavior inconsistent with standard valuation frameworks. Steady-state periods, on the other hand, result in pricing patterns consistent with standard valuation frameworks; accordingly, we refer to steady-state price as the asset’s fundamental value. By way of motivating why investors might gravitate toward projecting that investors in the future will place too much emphasis on earnings information, we show that investors’ ex ante expected utility is higher when they exhibit PEF. The reason for this is that PEF results in more price volatility, and investors’ex ante welfare increases as volatility increases. In other words, our analysis extends beyond simply positing that investors project that other investors place too much emphasis on earnings to show why investors might gravitate toward this projection. Our study contributes to the literature on excess stock price volatility initiated by LeRoy and Porter (1981) and Shiller (1981), two papers that argue that stock prices exhibit excessive volatility relative to fundamental cash ‡ows and discount rates. One strand of the literature on excess volatility that is related to ours studies sunspot equilibria: this literature includes, but is not limited to, Azariadis (1981), Cass and Shell (1983), Peck (1988), Jackson and Peck (1991), and Jackson (1994). In sunspot equilibria, prices are determined in part by stochastic events unrelated to economic fundamentals (so called “sunspots”). In overlapping generations models, security prices are a function of sunspots because investors believe they will be a function of sunspots. As a consequence, sunspots create volatility that is unrelated to underlying fundamental volatility. Similar to sunspot models, in our model investors’ 4 projected earnings …xation is sustained because investors believe it will continue into the subsequent period. Unlike sunspot models, however, projected earnings …xation is based on an economic fundamental –namely, earnings –and thus is not entirely spurious. Another strand of the literature on excess volatility related to ours relies on the introduction of noise trade, or some other form of irrational trade, to drive excess volatility.2 Within this literature, the study most related to ours is Spiegel (1998); this paper also employs an overlapping generations framework and focuses on the role of alternative excess volatility equilibria. Spiegel (1998) shows that, in addition to an equilibrium where security prices are driven solely by fundamentals, a small amount of noise in security supply (or noise trade) can lead to high volatility equilibria where the noise is the primary driver of security prices. Unlike the analysis in Spiegel (1998) and other studies that rely on noise trade, the volatility in our study is attributable to how investors respond to earnings information, as opposed to how they respond to noise: in other words, our model does not introduce an additional source of noise (additional to fundamental uncertainty).3 The remainder of the paper proceeds as follows. In the next section we describe our model and characterize the benchmark steady-state equilibrium. In Section 3 we identify another class of linear equilibria characterized by projected earning …xation, and characterize how equilibrium prices behave when investors exhibit PEF. In Section 4, we show the existence of additional equilibrium paths and discuss how the equilibrium can revert back to the steady 2 Studies that rely on noise trade, or some other form of irrational trade, to drive prices away from fundamental values include: Spiegel (1998), Delong, Shleifer, Summers and Waldmann (1990A) and (1990B); Allen and Gale (1994); Bhushan, Brown, and Mello (1997); Abreu and Bunnermeier (2002) and (2003); and Watanabe (2008). 3 A …nal study worth noting is Dow and Gorton (1993), which shows that prices can deviate from fundamentals as a consequence of fund managers being given incentives to take on risk. Such incentives are not present in our model. 5 state. Welfare considerations are addressed in Section 5. In Section 6 we extend the model to consider spillover e¤ects. Section 7 concludes 2 Model Consider an overlapping generations model where a continuum of atomless investors invest in a one-period, risk-free asset with a rate of return, r, and shares of an in…nitely-lived risky asset. At the beginning of each period, the principal and interest for the risk-free asset are paid, and the risky asset’s earnings are disclosed and paid out as a dividend. After the interest and dividend payments, the investment market opens and investors form portfolios of new, one-period risk-free asset claims and shares of the in…nitely-lived risky asset. Investors live for two periods and have wealth w to invest in the …rst period of life.4 In the …nal period of life investors liquidate their investments and consume their wealth. Investors are risk averse, and have preferences characterized by a negative exponential utility function with coe¢ cient of risk aversion , where = 0 corresponds to the case of risk neutrality. Hence, at time t an investor in the …rst period of life chooses the quantity of shares, q, to maximize the expectation of 1 exp h q(~ et+1 + P~t+1 ) + (1 + r) (w qPt ) i 1 , (1) where Pt and P~t+1 are the time t and t + 1 share prices, “~” combined with a time t + 1 subscript denotes a random variable from the perspective of an investor at time t, and the absence of “~” denotes either a realization of that variable or a …xed parameter. Because the single-period investment horizon might seem arti…cial, note that we can obtain identical 4 Note that we assume that each period investors arrive at the market with a constant amount of wealth. Thus, the high volatility equilibria in our model are not due to changes in the amount of capital available for investment (i.e., there is no in‡uence of volatility on production or vice versa). 6 results by allowing each investor to live (and trade) for a …nite number of periods and maximize his expected utility in his …nal period of life, which is when investors liquidate their portfolios. There is 1 risky asset share per-capita in each generation, which yields an earnings/dividends per share that follows a time series process of the form e~t+1 = e + ~"t+1 , (2) where e is a positive constant that represents the permanent component of earnings and ~"t+1 is the variable component of earnings in period t + 1. Henceforth we refer to ~"t+1 as “abnormal earnings.”Abnormal earnings has the following time series property: ~"t+1 = "t + ~t+1 , where (3) 2 (0; 1) is a persistence parameter and ~t+1 is the “abnormal earnings innovation”in period t + 1. The innovations are independent and identically, normally distributed random variables with mean 0 and variance v. 2.1 Linear Equilibria We de…ne an equilibrium to our game as the following three conditions: (i) each investor chooses his demand by maximizing his expected utility conditional on his expectations; (ii) expectations are rational and met in equilibrium; (iii) markets clear. We initially focus on equilibria that have the feature that end-of-period price can be written as a linear function of abnormal earnings: P~t+1 = t+1 + 7 "t+1 . t+1 ~ (4) While we do not require that intercepts and slope coe¢ cients, and t+1 t+1 respectively, be constant over time, in the next section we study an equilibrium where this is the case (i.e., t+1 = and t+1 = ). We refer to the latter as the “steady state equilibrium.” In any equilibrium where price is a linear function of abnormal earnings, a new investor’s maximization of his expected utility function in period t yields a demand of qt , where qt is de…ned by qt = e + "t + t+1 + t+1 v 1+ "t (1 + r) Pt 2 . (5) t+1 As re‡ected in eqn. (5), an investor’s demand increases in the expectation of next period’s earnings/dividend, e + "t , and share price, t+1 + t+1 "t , and decreases in the risk-free return that an investor forgoes to invest in shares of the risky asset, (1 + r) Pt . Note that demand is more sensitive to current abnormal earnings when abnormal earnings persistence, , is greater because the expectation of earnings/dividend and price are more sensitive to current abnormal earnings when is greater, and is greater in magnitude as investors’risk aversion decreases. Because there is 1 share of the risky asset per investor, market clearing for period t requires that qt = 1 for all investors, which implies an equilibrium price of Pt = e + "t + t+1 + "t 1+r t+1 v 1+ 2 t+1 . (6) The pricing condition implies that the price at time t is equal to the discounted expected value of next period’s earnings/dividend plus the price at which shares will be sold next period, e + "t + t+1 + t+1 "t , minus a risk premium, v 1 + 2 t+1 (assuming that investors are risk averse). The risk premium arises because the dividend investors receive and the price at which they will sell their shares are both determined by the realization of next period’s 8 earnings, e~t+1 . The equilibrium pricing condition, eqn. (6), implies that a linear equilibrium is de…ned by any at and t that satisfy the following two conditions for all t: t t 1 + t+1 1+r t+1 + e = = and v 1+ 1+r (7) 2 t+1 . (8) Note that the possibility of a time-dependent earnings response coe¢ cient implies that the intercept term can also vary over time. This happens because the risk that time t investors bear depends on the price reaction of time t + 1 earnings, and therefore the risk premium that time t investors demand. 2.2 Steady-State Equilibria First we establish a steady-state benchmark equilibrium by characterizing an equilibrium where the coe¢ cient and intercept are stable over time; this approach is consistent with some antecedent research that employs a overlapping generations framework in conjunction with the requirement that the process driving fundamentals be stochastically stable over time.5 Speci…cally, we restrict attention to an equilibrium of the form Pt = + "t . (9) For such an equilibrium to exist, the equilibrium pricing condition, eqns. (7) and (8), implies: = = (1 + ) and 1+r +e v(1 + )2 . 1+r Solving the two equations above yields the following observation. 5 See, for example, Allen and Gale (1997) and Spiegel (1998). 9 (10) (11) Observation 1. There exists a unique, steady-state linear equilibrium of the form Pt = + "t , where , and 1+r e v (1 + r)2 . = r r (1 + r )2 = (12) (13) The steady-state coe¢ cient and intercept have some intuitive properties. The coe¢ cient on abnormal earnings increases in the persistence of abnormal earnings and decreases in the risk-free rate, r, which e¤ectively serves as the discount rate. The intercept has two components, one tied to permanent earnings, e, and one tied to the variation in payo¤s associated with the evolution of abnormal earnings. The component tied to the permanent earnings, re , is merely a capitalization of permanent earnings, which is decreasing in r. The second component tied to the variability of payo¤s, v(1+r)2 , r(1+r ) captures the “haircut” in price for risk. The haircut is larger in magnitude (i.e., more negative) when earnings are more persistent or the discount rate is lower because the uncertain earnings innovation has a greater impact on future price when earnings are more persistent or the discount rate is lower. Obviously, it is also increasing in magnitude if the variance of the innovation, v, is larger, or the degree of risk aversion, , is larger. 3 PEF Equilibria The steady-state linear equilibrium is simple and intuitive; it relies on an assumption that each generation believes that the subsequent generation’s response to next period’s abnormal earnings is characterized by the steady-state value . When we consider other beliefs, however, we open up the possibility of equilibria with time-varying volatility, which we demon10 strate below. To do so, we initially consider a class of equilibria where current investors exhibit projected earnings …xation (PEF). 3.1 Characterization of PEF Equilibria PEF describes the phenomenon where investors in the current period project or believe that investors in subsequent periods will place too much emphasis on earnings. We operationalize PEF as follows. Given that abnormal earnings exhibit some persistence, if an investor in period t projects that investors in period t + 1 will place too much emphasis on earnings, a period-t investor’s expectation of price at t + 1 will be larger if period-t abnormal earnings, "t , are positive and smaller if "t is negative. Because a period-t investor’s expectation of future price places more emphasis on "t when period-t + 1 investors place more emphasis on t + 1 abnormal earnings, it follows that a period-t investor’s demands will also place more emphasis on "t ; this, in turn, implies period-t price will also place more emphasis on "t . We build o¤ of this partial-equilibrium intuition to characterize equilibria where the price response, or emphasis, on abnormal earnings grows each generation. In other words, each generation’s “over-emphasis” on earnings becomes a rational response to the even-moreexaggerated emphasis on earnings of subsequent generations. Lemma 1. For any 0 and 0 2 <, there exists an equilibrium pricing function Pt = t + with the following coe¢ cient and intercept for all t 1+r t = + t = + (1 + r)t ( (14) t "t : 0: t , and 0 11 ) + v (2Jt + Kt ) , (15) (16) where = 1+r equilibrium, Jt = and = t (1+r)t 1 1 t e r 1+r v(1+r)2 r(1+r )2 (1+r)t 1+r , and Kt = Note that the equilibrium de…ned by interpret are the coe¢ cient and intercept in the steady state = 0 and 2t (1+r)t+1 2 0 2t . is the steady-state equilibrium. We = > 0 as a phenomenon where investors place increasingly greater emphasis on abnormal earnings because the price response to abnormal earnings, t, increases over time. As noted above, such equilibria arise when generation-t investors project or believe that generation-t + 1 investors will “over-emphasize” earnings; this, in turn, causes generation-t investors to “over-emphasize”earnings in period t. The over-emphasis on earnings, which is captured by the coe¢ cient on in t (i.e., 1+r t ), increases by a factor of 1+r over any two periods. This increase is necessary to sustain the equilibrium. For example, suppose that the over-emphasis in period t + 1 is given by (i.e., t+1 = + ). A period t investor who impounds the t + 1 price movement in his period-t demand expects that a fraction of this period’s earnings surprise persists. Therefore, in period t the discounted value of the asset that pertains to the projected over-emphasis is given by 1+r . The fact that the emphasis on abnormal earnings grows implies that the variance of price also grows over time. In equilibrium, risk averse investors are compensated for additional variation in payo¤s with a higher expected return or risk premium. In the equilibrium characterization of many modeling frameworks, the risk premium is achieved through a reduction in the current price. In contrast, in the equilibria involving investors exhibiting PEF, the risk premium associated with increasing variance is achieved through an incremental upward drift in price. Formally, the intercept in the pricing function impounds the upward drift captured by the term v (2Jt + Kt ), which is increasing over time. Hence, when investors 12 exhibit PEF, price drifts upwards relative to investors not exhibiting PEF. This result is a consequence of an in…nite time span: when the time span is in…nite, whether today’s price is lower or tomorrow’s price is higher is irrelevant, provided that price behaves in a fashion consistent with an equilibrium. Finally, note that the initial value for , 0, seems somewhat ad hoc in that the initial price level is not relevant to investors –what matters to investors is the dividend payout and the change in price level. As a consequence, any deviation from the steady state must be compensated for with the risk-free return each period, which is why the deviation is multiplied by a factor of 1 + r each period. This part of the upward drift is similar to the one that explains the existence of …rst-moment bubbles in prior work: investors are willing to pay a higher price if they expect next period’s investors to pay an even higher price.6 3.2 Price Variation with PEF Price variation in period t equals 2 t v, which implies it is driven by the variation in abnormal earnings, v, as well as the coe¢ cient on abnormal earnings in the pricing function, discussed previously, the steady state t, 1+r t As , is increasing in the persistence of abnormal earnings, , and the discount rate, r. In an equilibrium where investors exhibit PEF, + t. t = , the coe¢ cient is greater than the steady-state coe¢ cient, and it grows at an increasing rate over time. Not surprisingly, the wedge between the steady-state coe¢ cient and the PEF-induced coe¢ cient is tied to : we interpret as the extent of PEF. The growth, 6 We should note that we have restricted attention to cases where > 0, which is consistent with investors exhibiting PEF. We could also consider the possibility of investors “under-emphasizing”abnormal earnings by allowing < 0. While initially leading to equilibria in which volatility is lower than the steady state volatility, investor “under-emphasis” would ultimately lead to a high volatility equilibrium in which investors respond negatively to abnormal earnings because t becomes increasingly negative when < 0 and t is su¢ ciently large. 13 however, is determined by the risk-free rate and the degree of persistence. In particular, the rate of growth in the abnormal earnings response is higher when the risk-free rate is higher and the persistence of earnings is lower. To understand why, note that an investor at time t over-emphasizes abnormal earnings by if and only if his over-emphasis is supported by a su¢ cient expected over-emphasis by time-t+1 investors. Because a time-t investor discounts expected payo¤s by r, the su¢ cient expected over-emphasis must be larger if the discount rate is higher. Further, because the over-emphasis pertains to an expectation of the reaction to realized t + 1 abnormal earnings, the t + 1 over-emphasis can be lower if the abnormal earnings at time t are more persistent. Formally, we have Corollary 1. Corollary 1. Assume the equilibrium price path is characterized by PEF, i.e., > 0: The growth in the variation in prices along that path is increasing in the risk-free interest rate, r, and decreasing in the degree of persistence in abnormal earning, . 3.3 Expected Price Levels with PEF While an important characteristic of PEF is greater price volatility, PEF results in price levels that di¤er from the steady-state price level. More interestingly, the expected price level only di¤ers if investors are strictly risk averse. Corollary 2. Assume the equilibrium price path is characterized by some PEF, i.e., > 0: The time-0 expectation of price at time m > 0 is greater for the PEF path than for a steadystate path beginning at the same initial price if investors are strictly risk averse, and the same if investors are risk neutral. Corollary 2 holds because, when prices are more volatile, risk investors are compensated with greater expected payo¤s, which is achieved in equilibrium by an upward drift in prices. To 14 better understand why Corollary 2 holds, note that in any equilibrium the expected return earned by an investor buying at time t equals " # v 1+ e~t+1 + P~t+1 Pt E j"t = r + Pt Pt 2 t+1 . (17) The …rst term implies that investors’expected return is at least equal to the expected return investors can earn by investing in the risk-free asset. When investors are risk averse, the second term captures the additional risk premium they earn because returns are variable. Because the variability of asset returns is strictly higher when investors exhibit PEF (relative to the steady state), it follows that the expected returns must be higher. From an empirical perspective, Corollary 2 also implies that periods of high volatility are associated with higher price-to-earnings ratios (on average) despite the fact that earnings are no more informative about the …rm’s future cash ‡ows. This observation must be viewed with caution, however, because a price path could involve periods of high volatility and high price level, followed by periods of steady-state volatility and steady-state price level. Here, one might associate the higher price level with the steady-state volatility once the price path returns to steady state. 3.4 Numerical Example To illustrate how PEF a¤ects the path of prices, price levels, and price volatility, we consider a numerical example and plot di¤erent price paths for randomly generated data. Speci…cally, we illustrate the steady-state price path and a path with PEF (i.e., = 1 > 0) to illustrate how both paths play out for a case with risk neutral investors versus risk averse investors. Figure 1 displays these four price paths for the generated data, using the following parameter values: 1 = 0:2, = 4, = 0:9, and "0 = 0. The paths with risk averse investors are based 15 upon a coe¢ cient of risk aversion of = 0:005. The value for constant earnings is normalized such that initial prices for the case with risk averse investors equal zero. — Insert Figure 1 around here — When investors are risk neutral, the …gure illustrates how volatility increases in t at a fairly high rate. This increase in volatility can also be seen algebraically in eqn. (15). As discussed above, investors only increase their weight on the earnings surprise when they expect the next period’s investors to do the same. However, in order for investors in period t to “over-emphasize”earnings by , it is necessary that investors in period t+1 over-emphasize earnings by more than , 1+r > , because t-period investors discount the expected over- emphasis. This implies that the over-emphasis has to increase over time, which leads to increasing price volatility. Furthermore, with risk neutral investors, high volatility price ‡uctuates around the steady-state price without drift to become either higher or lower. In other words, the increase of t is a mean-preserving spread of prices. When investors are risk averse, they demand a risk premium as speci…ed in eqn. (11). The risk premium implies that the prices with risk averse investors start at a lower value in comparison to the prices with risk neutral investors. Due to the fact that t and the associ- ated volatility in prices increases over time, when investors exhibit PEF, they are rewarded with a risk premium that increases over time. As is evident in the …gure, the increasing risk premium causes substantial drift in prices above the steady-state price. Algebraically, the risk premium is convex in t+1 , which implies the risk premium grows faster than the coe¢ cient on abnormal earnings that determines it. Hence, in contrast to the risk neutral case, the increase of t is far from a simple, mean-preserving spread of prices. 16 4 Time-Varying PEF The class of linear equilibria with PEF (i.e., > 0) introduces the plausibility of greater price volatility relative to fundamentals volatility, but these equilibria also have the unappealing property that volatility grows at an increasing rate in the sense that t grows at an increasing rate over time. In essence, once investors exhibit PEF, investors over-emphasis on earnings grows inde…nitely. By expanding on the class of equilibria characterized in Lemma 1, however, we can demonstrate the possibility of time varying degrees of PEF. For example, the degree of PEF could begin at a positive level and then revert at some time to a steady state level ( = 0). 4.1 Alternative Price Paths To characterize a equilibrium in which the degree of PEF varies over time we must expand the set of equilibrium beyond all PEF equilibria characterized in Lemma 1. To do so, we combine PEF equilibrium pricing paths to create a new equilibrium price path exhibiting variation in PEF. These alternative price paths are not simple linear equilibria, although they are linear with the exception of any point in time at which the pricing function changes from one PEF pricing function to another. Before proceeding, it is useful to de…ne a bit of notation by letting P ("t ; 0; ) denote a PEF equilibrium pricing function as described in Lemma 1 that is characterized by the an initial constant term of 0 and a degree of PEF . With this notation established, conjecture an equilibrium pricing that is characterized by a shift in the degree of PEF from 17 1 to 2 at time > 1: Pt = where P ("t ; 01 ; 1 ) P ("t ; 02 (" for all t < , ); for all t 2) satis…es 02 ("T ) P (" ; 02 (" ); 2) = P (" ; 01 ; 1 ) for all realizations "T , which implies that 02 ("T ) = 01 + v ( (1 + r) 1 (2J + K 1) 2 The conjectured equilibrium exhibits shifts at time acterized by a degree of …xation 1, acterized by degree of …xation P ("t ; 2, of the pricing function at time of the constant term, time 02 (" P ("t ; 01 ; 1 ), 02 (" ); 2) 2 )) + 1 ( 1 2 )" : from one PEF pricing function charto another PEF pricing function char- 02 ("T ); 2 ), although a complete parameterization is not known until " is realized because the initial value ), is a function of " . Furthermore, the pricing function at yields an identical distribution for time cause P (" ; (2J + K = P (" ; 01 ; 1 ) the pricing function anticipated at time prices as the initial pricing function be- for all realizations for " :Because of this feature, by young investors at time 1 can still be expressed as a simple linear function of the realization of abnormal earnings at time as P (" ; 01 ; 1 )). The time (i.e., + 1 linear pricing function anticipated by investors at time , however, is a function of the realization " because the intercept is a function of " . Nonetheless, the pricing function at time + 1 is still linear in " +1 . In order to prove that the conjectured equilibrium is indeed an equilibrium, we must show that supply equals demand at every point in time, consistent with the earlier de…nition of an equilibrium. It follows directly from Lemma 1 that supply must equal demand for t < 18 1: Otherwise, P ("t ; 01 ; 1 ) would not be an equilibrium pricing function. In addition, it follows directly from Lemma 1 that supply must equal demand for all t > is an equilibrium pricing function. Finally, at t = 1 if P ("t ; 01 ; 1 ) because P (" ; 02 (" ); ); 2) 1 young investor demands as a function of price are the same as they would be if the pricing function for characterized by P ("t ; 02 (" 2) " . As a consequence, the market also clears a time = P (" ; 01 ; 1 ) continued to be for any realization 1 at price P ("t ; 01 ; 1 ) so the conjectured equilibrium is indeed an equilibrium. Proposition 1 follows naturally from the fact that we have characterized an equilibrium exhibiting one degree of PEF initially followed by another degree of PEF. Proposition 1. There exists an equilibrium in which the extent of PEF and the associated price variability change over time. Proposition 1 has the important implication that equilibrium price paths exist where price volatility varies over time. In fact, we can use the same logic employed to derive the equilibrium price path with a single switch from degree of PEF to construct paths with any number n 2 f1; 2; 3; :::g of changes in the degree of PEF. Furthermore, in the path we constructed, we assume the degree of PEF changed with probability 1 at time . It is also possible to construct equilibrium price paths in which the degree of PEF changes with some probability less than 1 such as when, say, the change is conditioned upon the realization for "T (e.g., the change occurs when " is more or less than some value). Hence, our analysis suggests that the degree of PEF can vary over time. Unfortunately, there are no standard equilibrium conditions that allow us to predict when changes in the degree of PEF occur nor the direction of those changes if they do occur. 19 4.2 A Path with a Focal Steady State Proposition 1 suggests the possibility of an equilibrium price path characterized by periods exhibiting PEF and periods exhibiting the steady-state level of volatility (i.e., t ). = Among the paths exhibiting the steady state volatility, however, the steady state price path ( t = and t = a) might be viewed as focal due to its inherent simplicity and stability. To study the properties of an equilibrium pricing function in which the steady state path is “focal,” we consider an equilibrium in which the price path begins on the steady state, characterized by pricing function P ("t ; ; 0) ; and then enters a period with PEF of degree at time , characterized by the pricing function P ("t ; 0; ) where P (" ; ; 0). The pricing path continues to be de…ned by P ("t ; in which P (" +m ; ; 0) = P (" +m ; 0; 0; 0 satis…es P (" ; 0; )= ) until the …rst date +m ), after which the pricing function is again de…ned by the steady state pricing function P ("; ; 0). Assume at time t = investors deviate from the steady state path and begin to exhibit PEF. Therefore, we know that at time t = the prices along the steady-state and the PEF path must be equal, i.e., + " = " , + (18) or, equivalently, . " = (19) Similarly, in order for the two paths to meet again at some future date t = + m, it must be the case that " +m +m = . (20) +m It follows that the cumulative-innovations change in abnormal earnings between 20 and +m, Pm i=1 m i t+i =" m +m Xm " , must satisfy m i m +m m , (21) Corollary 3. Assume investors are strictly risk averse and at time t = the price path i=1 +i =" +m " = +m which we show in Corollary 3 is always negative. changes from steady state to one where investors exhibit PEF, i.e., price to converge back to the steady-state price at time t = earnings at t = +m must equal " +m where " +m < m > 0. For the equilibrium + m, where m > 0, abnormal " . Furthermore, " +m is decreasing in m and approaches negative in…nity as m approaches in…nity. The …rst statement in Corollary 3 implies that earnings news must be bad for the PEF and steady-state paths to meet. Hence, once investors exhibit PEF, a return to steady-state fundamental pricing must be associated with bad news. The second statement implies that, as the period of PEF increases in duration, the worse the news needs to be to converge back to a steady state. Given that extreme realizations are less likely, this observation suggests that the “likelihood”of convergence back to steady-state prices “decreases”as the duration of PEF increases. Of course, given our assumption that abnormal earnings are distributed continuously whereas trading occurs in discrete intervals, the probability of precise convergence is always 0. If abnormal earnings were discrete or trading were continuous, however, the probability of precise convergence would not be 0 and we expect the insight in Corollary 3 would continue to hold. 21 5 Welfare Analysis While our analysis o¤ers a theoretical rationale for the possibility of periods of PEF, it also o¤ers a theoretical rationale for a wide variety of potential equilibria. A common approach for assessing which equilibria are more focal, and, hence, more likely to be played, is to assume that economic agents gravitate towards equilibria that are preferred. Consequently, we conduct a welfare analysis certain whether investors prefer one equilibrium over another. 5.1 Ex Ante Investor Welfare The expected utility at time t for a generation-t investor equals Xt = qt e + "t + Given Pt = t + t+1 + t+1 "t + (1 + r) (w as well as the solutions for qt , t "t t, qt2 q t Pt ) and 1 t (exp[ v 1+ 2 1) where Xt ] 2 t+1 . (22) as stated in equations (5), (7), and (8), respectively, we can rewrite Xt as follows: v Xt = 2 1+ + 1+r t+1 !2 + (1 + r) w. (23) Note that Xt is independent of "t in equilibrium, which implies that investor welfare is independent of "t in equilibrium. Hence, the expected utility of generation t investors prior to knowledge of "t is the same as with knowledge of "t . It follows from eqn. (23) that the investors prefer a more volatile equilibrium path because, within the context of this model, they receive su¢ cient compensation for the additional uncertainty assumed in equilibrium. It follows that, if investors could choose the equilibrium to play ex ante, they would be unlikely to choose the steady-state equilibrium, which minimizes the variation in prices. Formally, we have Corollary 4A. 22 Corollary 4A. Generation-t investors always prefer an equilibrium with where investors exhibit PEF over the steady-state equilibrium prior to observing "t+1 . 5.2 Ex Post Investor Welfare As should be clear, the realized utility of a generation t investor does not yield the same preferences over equilibrium paths. In particular, the realized utility of a generation t investor is 1 (exp[ 1), where Wt ] Wt = qt e + "t+1 + t+1 + t+1 "t+1 + (1 + r)(w (24) qt Pt ). Note that the di¤erence between Xt as de…ned in eqn. (22) and Wt as de…ned above is that qt2 "t+1 replaces "t and Given Pt = t + t "t v 2 1+ 2 t+1 drops out because the investor faces no risk. along with the solutions for qt , t, and t as stated in equations (5), (7), and (8), respectively, we can rewrite Wt as Wt = ("t+1 "t ) 1 + t+1 + v 1+ 2 t+1 + (1 + r) w. It follows that there is a unique value for "t+1 , ^", such that generation t investors prefer an equilibrium where investors exhibit PEF if "t+1 > ^", and the steady-state equilibrium otherwise. Noting that t+1 t is a function of 0 (i.e., it is increasing in 0 ), ^" could be either positive or negative. Corollary 4B. After observing "t+1 , generation-t investors prefer the steady-state equilibrium over the an equilibrium where investors exhibit PEF if and only if "t+1 is su¢ ciently small. Corollary 4B implies that if generation-t investors could in‡uence the equilibrium being played when they depart the market, they would wield their in‡uence in favor of the steady 23 state when times are relatively “bad,” and favor an equilibrium where investors exhibit greater PEF otherwise. This obviously happens because a shareholder who observes a very negative earnings surprise would like investors interested in buying shares to react as little as possible to the earnings news. 6 Spillover E¤ects To this point we have employed a single risky-asset framework to illustrate the possibility that when investors exhibit PEF, prices manifest more volatility tied to fundamentals than appears to be warranted by the fundamentals. A common interpretation of the single riskyasset case is that it represents the market portfolio and PEF pertains to economy-wide earnings disclosures (as opposed to, say, a single …rm’s disclosure). While the single riskyasset framework provides a parsimonious vehicle for illustrating the main points of this study, a drawback is that it does not provide insights into how PEF involving one risky asset, or class of risky assets, might spill over and a¤ect the pricing behavior of other assets. Here we attempt to provide some insights about spillover by extending the model to include two risky assets: this is su¢ cient to provide insights that involve n risky assets. Formally, consider our economy with two risky assets, 1 and 2, in addition to the risk-free asset. Similar to the single risky-asset setting, the earnings for asset i 2 f1; 2g for period t are eit = ei + "it , where "it = i "it 1 + We assume the innovation to abnormal earnings, 24 it . it , (25) (26) is normally distributed with mean 0 and variance vi for all i 2 f1; 2g and t, the covariance between it is independent of j 1t and 2t is c for all t, and for all i; j 2 f1; 2g, and t 6= . As the following analysis shows, the covariance of cash ‡ow innovations, c, is an important determinant of the spillover e¤ect. Finally, we assume that there are shares of risky asset 1 per-capita and 1 shares of risky asset 2 per-capita such that, in aggregate, the total number of risky asset shares per-capita is 1. This extension of the model re‡ects at least two spillover scenarios: one where each asset can be thought of as re‡ecting a large component of the market portfolio, and one where one asset is an in…nitely small component of a large market and the other is the residual of the market portfolio. The former setting, which is captured by assuming a strictly interior value, characterizes the relation between two industries. The latter setting, which is captured by approaching 0 or 1, characterizes the relation between a single risky asset as an arbitrarily small component of a large market portfolio and the market portfolio itself. We again restrict attention to the set of linear equilibria where the end-of-period price for …rm i is a linear function of its abnormal earnings: Pit = it + it "it . (27) We rule out equilibria where …rm i’s price is a function of j’s abnormal earnings, which would essentially be a sunspot equilibrium for …rm i. In particular, in the presence of …rm i’s abnormal earnings, …rm j’s abnormal earnings have no incremental information content for i’s future cash ‡ows. In any linear equilibrium of the form in (27), the demands by a new investor in period t are: q1t = q2t = e1 + 1 "1t + 1t+1 + 1t+1 1 "1t c 1+ v1 1 + e2 + 2 "2t + 2t+1 + 2t+1 2 "2t 1t+1 2 1t+1 c 1+ v2 1 + 25 1t+1 2 : 2t+1 1+ 2t+1 q2t (1 + r) P1t 1+ 2t+1 q1t (1 + r) P2t and . (28) (29) Market clearing requires that q1t = and q2t = 1 , which implies that following conditions have to hold in equilibrium 1t = 2t = 1 2 1 + 1t+1 , (1 + r) 1 + 2t+1 , (1 + r) e1 + 1t (31) v1 1t+1 = 1+ 2 1t+1 + c (1 ) 1+ 1t+1 1+ 1t+1 1+ 2t+1 (1 + r) e2 + 2t (30) v2 (1 2t+1 = ) 1+ 2 2t+1 +c 1+ 2t+1 (1 + r) Eqns. (30) and (31) are identical in structure to the equilibrium condition for t , and (32) . (33) in the single risky-asset setting, eqn. (7). This implies that we can apply results about PEF-coe¢ cient behavior derived in the single-asset setting to either …rm’s pricing function in the dual-asset setting. Furthermore, the fact that the two coe¢ cients on abnormal earnings do not interact with one another implies that each risky asset coe¢ cient exhibits di¤ering degrees of PEF. Finally, with any set of coe¢ cients for abnormal earnings, we can characterize the intercepts, (32) and (33), in the same manner as in the single risky-asset setting, with the caveat that two, as opposed to one, abnormal-earnings-asset coe¢ cients determine the value each period. Hence, we can derive dual-asset variations of Lemmas 1, 2, and 3. Given these dual-asset variations, we turn to discussing the spillover e¤ects of a change in the degree of PEF in the pricing behavior of one asset to the pricing behavior of the other asset. Due to the fact that the coe¢ cients on abnormal earnings do not interact, an increase in the degree of PEF for one asset, say asset 1, increases asset 1’s price response to its abnormal earnings, earnings, 2t , 1t , but has no e¤ect on asset 2’s price response to asset 2’s abnormal regardless of the degree of covariation in the innovations to abnormal earnings. 26 Hence, changes in the price volatility for asset 1 that are not due to changes in the volatility of fundamentals need not be associated with changes in the price volatility for asset 2. Inspection of eqns. (32) and (33), however, reveals a relation between the price level of asset 2 and the degree of PEF for asset 1. In particular, increasing the degree of PEF for asset 1 in‡uences the price level of the asset through the intercept in the pricing function, 2t . The e¤ect on the intercept depends critically on the covariance of the earnings/dividend ‡ows. In particular, for any linear equilibrium and any two degrees of PEF, equilibrium = 2t 2t 2 2 = ei r and 2, the satis…es + (1 + r)t ( + c where 1 2) 20 + v2 (1 (1 + r)t+1 1 (1 + r ) t (1 1+r 1+r 2 vi (1 )+c r t ) 2 (2Jt + Kt 2 ) (1 + r)t+1 (1 + r)t ( 1 + 2) + 2 2t ) 1+r is the steady-state intercept and 2t 1 2 20 ! ; (34) is the initial intercept. If the covariance between the earnings/dividends of the two risky assets is negative, increases in the degree of PEF for asset 1 cause the expected price level for asset 2 to be lower each period than would otherwise be the case. Furthermore, the degree to which the expected price level declines increases over time. The reasoning behind this price-level e¤ect stems directly from the fact that asset 2 serves as a hedge of asset 1 due to the assumed negative covariance between the two earnings ‡ows. In particular, as asset 1 becomes more sensitive to its earnings due to a higher degree of PEF, the variance of asset 1’s payo¤s increases. Because the covariance between the two earnings is negative, investments in asset 2 serve as an increasingly important hedge against the increasingly volatile asset 1, which causes asset 2’s price levels and associated expected price changes to decline. If, on the other 27 hand, the covariance between the earnings of the two risky assets are positive, the opposite e¤ect of asset 1’s PEF arises; the expected price level increases over time to compensate investors for the greater degree of undiversi…able risk caused by asset 1’s PEF. Note that in discussing spillover, we provided no context. That is, we do not distinguish between a setting where both assets represent a large component of the market (e.g., each represents a large sector of the economy) versus a setting where one asset represents a single equity security and the other represents the residual of a large, diversi…ed, equity market portfolio. The previous discussion explains well the former case. The latter case, however, requires that we set asset 1’s size to one of the extremes, case where = 0 or = 1. Consider …rst the = 1 so asset 1 represents the equity market portfolio and asset 2 represents a single equity security. Consistent with the traditional capital asset pricing model, asset 2’s price is not determined by its own variance. Instead, its price is determined by how its earnings covary with the market earnings, asset 1. Hence, consistent with our generic discussion above, any PEF with respect to asset 1 a¤ects asset 2 prices through the covariance of the two asset’s earnings. Consider next the case where = 0, so asset 1 now represents the single equity security and asset 2 represents the equity market portfolio. In this case, if investors exhibit PEF in response to asset 1 there is no e¤ect on asset 2 because asset 1 is an arbitrarily small element of the broader market. Note as well that asset 1’s price level (i.e., 1t ) is also not in‡uenced by the degree of PEF with respect to asset 1. This result arises because asset 1 is simply too small for its own price variance to matter. To summarize, the main insights generated by considering two risky assets are formalized in Observation 2. Observation 2. Allow for the possibility of two risky assets. One asset’s degree of PEF 28 has no direct e¤ect on the price volatility of the other asset: @ @ it j = 0, where i 6= j. One asset’s degree of PEF, however, a¤ects the price level and expected change in price of the other asset if and only if the asset that exhibits PEF is large and the earnings for each asset have a non-zero covariance: @ @ it j >0 @ @ it j < 0 and @ 2 it @ j @t >0 @ 2 it @ j @t < 0 , where i 6= j, if asset j is measurable and c > 0 (c < 0): 7 Conclusion Using an overlapping-generations modeling framework, we consider the implications that arise from investors projecting that investors in subsequent periods will place too much emphasis on earnings information. We describe this phenomenon as one where current investors exhibit “projected earnings …xation”(PEF). Our analysis shows that when current investors exhibit PEF, current investors themselves place too much emphasis on current earnings. As a consequence, equilibria can arise where the response to earnings disclosures becomes increasingly more exaggerated than the variability of fundamentals would suggest. In addition, our analysis demonstrates that the reaction to earnings disclosures of stochastically stable fundamentals can vary over time, with, for example, episodes of PEF where prices appear highly variable and inconsistent with standard valuation frameworks, and periods when prices are more stable and consistent with valuation frameworks. While our modeling framework does not provide predictions regarding the particular equilibrium price path investor trade takes, it does yield a number of empirical insights. First, our model suggests that volatility can be time varying even if fundamentals manifest constant volatility. Second, our model suggests that the associations between news events, such as earnings releases, and equity prices can be time varying, even if the relation between 29 the news events and economic fundamentals is stable. Third, our model predicts returns will be higher over periods of higher volatility, which is consistent with empirical evidence. Finally, our model predicts that price levels are expected, on average, to be higher in periods of high volatility and will converge back towards fundamental steady-state prices when news is bad. As an extension, we consider a setting with two risky assets in order to assess how PEF in the market for one asset can spill over to a¤ect the pricing of another asset. We show that increasing PEF with respect to one asset need not have any impact on the price volatility of the other asset, irrespective of the correlation between the assets’fundamental earnings ‡ows. Increasing PEF with respect to one asset, however, does in‡uence the price level and expected price change of the other asset if the former asset is large and the correlation between the assets’fundamental ‡ows are non zero. 30 References Abreu, D. and M.K. Bunnermeier (2002) “Synchronization risk and delayed arbitrage” Journal of Financial Economics 66, 341-360. Abreu, D. and M.K. Bunnermeier (2003) “Bubbles and crashes”Econometrica 71, 173-204. Allen, F. and D. Gale (1994) “Limited market participation and volatility of asset prices” American Economic Review 84, 933-955. Allen, F. and D. Gale (1997) “Financial markets, intermediaries, and intertemporal smoothing”Journal of Political Economy 105, 523-546. Allen, F., S. Morris, and H.S. Shin (2006) “Beauty contest and iterated expectations in asset markets”Review of Financial Studies 19, 719-752. Ashton, R.H. (1976) “Cognitive changes induced by accounting changes: Experimental evidence on the functional …xation hypothesis” Journal of Accounting Research 14, 1-17. Azariadis, C. (1981) “Self-ful…lling prophecies”Journal of Economic Theory 25, 380-396. Bhushan, R., D.P. Brown, and A.S. Mello (1997) “Do noise traders ‘create their own space?’”Journal of Financial and Quantitative Analysis 32, 25-45. Cass, D. and K. Shell (1983) “Do sunspots matter?” Journal of Political Economy 91, 193-227. Delong, J., A. Shleifer, L. Summers, and R. Waldmann (1990A) “Noise trader risk in …nancial markets”Journal of Political Economy 98, 703-738. Delong, J., A. Shleifer, L. Summers, and R. Waldmann (1990B) “Positive feedback investment strategies and destabilizing rational speculation”Journal of Finance 45, 379-395. 31 Dow, J. and Gorton, G. (1993) “Trading, communication and the response of asset prices to news”The Economic Journal 103, 639-646. Gao, P. (2008) “Keynesian beauty contest, accounting disclosure, and market e¢ ciency” Journal of Accounting Research 46, 785-807. Hand, J. (1990) “A test of the extended functional …xation hypothesis” The Accounting Review 65, 740-763. Ijiri, Y., Jaedicke, R., and Knight, K. (1966) “The e¤ects of accounting alternatives on management decisions,”In Research in Accounting Measurement, edited by R. K. Jaedicke et al., 186-199. New York: American Accounting Association. Jackson, M.O. (1994) “A proof of the existence of speculative equilibria” Journal of Economic Theory 64, 221-233. Jackson M.O. and J. Peck (1991) “Speculation and price ‡uctuations with private, extrinsic signals”Journal of Economic Theory 55, 274-295. LeRoy, S.F. and R.D. Porter (1981) “The present-value relation: Tests based on implied variance bounds”Econometrica 49, 555-574. Morris, S. and H.S. Shin (2002) “The social value of public information” American Economic Review 92, 1521-1534. Peck, J. (1988) “On the existence of sunspot equilibria in an overlapping generations model” Journal of Economic Theory 44, 19-42. Shiller, R.J. (1981) “Do stock prices move too much to be justi…ed by subsequent changes in dividends?”American Economic Review 71, 421-436. Sloan, R. (1996) “Do stock prices fully re‡ect information in accruals and cash ‡ows about future earnings?”The Accounting Review 71, 289-315. 32 Spiegel, M. (1998) “Stock price volatility in a multiple security overlapping generations model”Review of Financial Studies 11, 419–447. Watanabe (2008) “Price volatility and investor behavior in an overlapping generations model with information asymmetry”Journal of Finance 63, 229-272. Proofs Lemma 1. The proof follows directly from the fact that the coe¢ cient speci…cations satisfy the equilibrium conditions (7) and (8) for any t. Corollary 1. The variance in price at time t equals 1+r t growth in variation between t 1 and t equals 2 tv = + 2 1+r t 1 v= 1+r t 2 v, so the 1+r 2(t 1) 1+r which is increasing in r and decreasing in . Corollary 2. At time 0 it must be the case that the price in the steady state equals the price in the presence of PEF or: 0 + v (2J0 + K0 ) + ( + ) "0 = (35) + "0 or, given that J0 = 0 and K0 = 0, ( 0 (36) ) + "0 = 0. The time-0 expected time-m > 0 price when investors exhibit PEF less that for the steady state equals + (1 + r)m ( 0 ) + v (2Jm + Km ) + + 1+r m m "0 ( + m "0 ) , (37) which is proportional to ( 0 )+ v (2Jm + Km ) + "0 . (1 + r)m 33 (38) 2 v, Relying on eqn. (36), eqn. (38) can be shown to be proportional to: v (2Jm + Km ) , (1 + r)m which is strictly positive if (39) > 0 because Jm > 0 and Km > 0, and 0 if = 0. Proposition 1 Conjecture an equilibrium pricing function such that, for all t 2 f0; 1; 2; ::: g, the price is P ("t ; + (1 + r)t ( 1t ; 1t ; 01 ) )+ v 01 1 = 1t "t , + 1t where (2Jt + Kt 1 ) ;and 01 1+r t 2, 0, 2 is set so that P (" ; 02 = 01 + 1 ( 6= ; 1 2 )" 1 lieve that at time degree of PEF, 1 2 1, ; 01 ) + v (1+r) + (1 + r)t ( = 2t = + 1 2J ( " = 1 2) 1 + 1+r t 1, 0, 1 1t = is the initial value for the constant, and, for all t 2 f ; + 1; + 2; :::g, the price is P ("t ; + = 1t 2t ; 2t ; +K ( = )+ v 02 2 02 ) + 2 1 2 2t 2 + 2t "t 1t (2Jt + Kt 2 ), and " = P (" ; 2 2) where 2 ; ; 2 02 ) = 02 or . Hence, all investors be- the pricing function changes so that it is characterized by a di¤erent as opposed to 2 1, and that the constant term adjusts at time so that the time price is identical to the price that would be realized under the initial pricing function P ("t ; 1t ; 1t ; 10 ). In order for this path to constitute an equilibrium, markets have to clear at any point in time. For t < Lemma 1. At t = 1 the market clears at price P ("t ; 1 ; clears a time P ("t ; 1t ; 1t ; 1t ; 01 ) following 1 young investor demands as a function of price are the same as they would be if the pricing function for because P (" ; 1t ; 1 ; 01 ) = P (" ; 1 at price P (" ; 01 ) continued to be characterized by P (" ; 2 1 ; ; 2 1 ; ; 02 ) 1 ; 1 ; 10 ) for any realization " . Hence, the market 01 ) :Finally, for all t , the market clears at following Lemma 1. Corollary 3. Similar to eqn. (35), following equation has to hold for the two price paths 34 to meet at time t: t (1 + r) ( ) + v (2Jt + Kt ) + 0 t 1+r (40) "t = 0. Additionally, in order for the steady-state price path to meet the one where investors exhibit PEF at date t + m, it must be the case that (1 + r)t+m ( 0 v )+ (2Jt+m + Kt+m ) + (1 + r)m t (1 + r) ( 0 Using eqn. (40) and the fact that "t+m = 1+r 1+r ) + v (2Jt+m + Kt+m ) + t Xm i=1 i t+i = Pm m i i=1 v t+i + t+m 1+r "t+m = 0 or t "t+m m m 2Jt+m + Kt+m (1 + r)m = 0. (41) "t , we can re-express (41) as (2Jt + Kt ) . (42) The proof to Corollary 2 shows that the right hand (42) is negative, which completes the proof. Observation 2. The proof follows directly from inspect of eqn. (34). 35 600 High Volatility Steady State High Volatility, Risk Neutral Steady State, Risk Neutral 500 400 300 200 100 0 0 10 20 30 -100 -200 Figure 1: Steady State and High Volatility 40 50