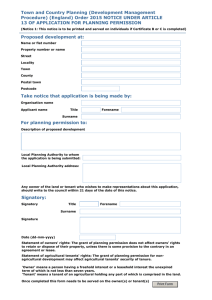

ARCHNE 20 AUG 2015

advertisement