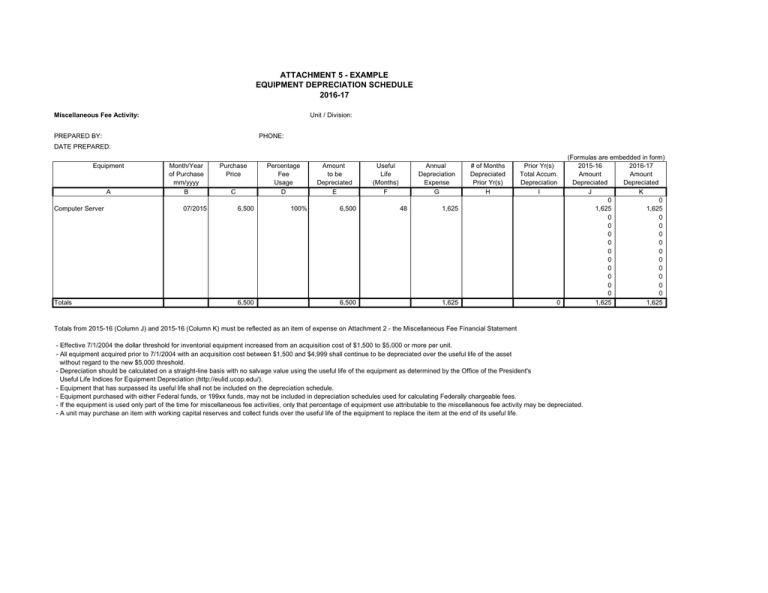

ATTACHMENT 5 - EXAMPLE EQUIPMENT DEPRECIATION SCHEDULE 2016-17

advertisement

ATTACHMENT 5 - EXAMPLE EQUIPMENT DEPRECIATION SCHEDULE 2016-17 Miscellaneous Fee Activity: Unit / Division: PREPARED BY: PHONE: DATE PREPARED: Equipment A Computer Server Totals Month/Year of Purchase mm/yyyy B 07/2015 Purchase Price C 6,500 6,500 Percentage Fee Usage D 100% Amount to be Depreciated E 6,500 6,500 Useful Life (Months) F Annual Depreciation Expense G 48 # of Months Depreciated Prior Yr(s) H Prior Yr(s) Total Accum. Depreciation I 1,625 1,625 0 (Formulas are embedded in form) 2015-16 2016-17 Amount Amount Depreciated Depreciated J K 0 0 1,625 1,625 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1,625 1,625 Totals from 2015-16 (Column J) and 2015-16 (Column K) must be reflected as an item of expense on Attachment 2 - the Miscellaneous Fee Financial Statement - Effective 7/1/2004 the dollar threshold for inventorial equipment increased from an acquisition cost of $1,500 to $5,000 or more per unit. - All equipment acquired prior to 7/1/2004 with an acquisition cost between $1,500 and $4,999 shall continue to be depreciated over the useful life of the asset without regard to the new $5,000 threshold. - Depreciation should be calculated on a straight-line basis with no salvage value using the useful life of the equipment as determined by the Office of the President's Useful Life Indices for Equipment Depreciation (http://eulid.ucop.edu/). - Equipment that has surpassed its useful life shall not be included on the depreciation schedule. - Equipment purchased with either Federal funds, or 199xx funds, may not be included in depreciation schedules used for calculating Federally chargeable fees. - If the equipment is used only part of the time for miscellaneous fee activities, only that percentage of equipment use attributable to the miscellaneous fee activity may be depreciated. - A unit may purchase an item with working capital reserves and collect funds over the useful life of the equipment to replace the item at the end of its useful life.