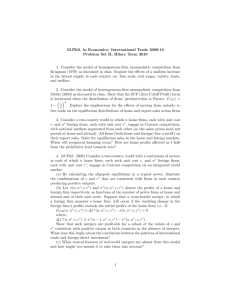

Research Division Federal Reserve Bank of St. Louis Working Paper Series

advertisement