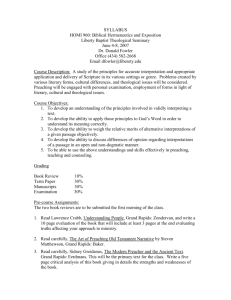

Grand Rapids Area Metropolitics: Myron Orfield Metropolitan Area Research Corporation

advertisement