AN ABSTRACT OF THE DISSERTATION OF

Shuping Jiang for the degree of Doctor of Philosophy in Statistics presented on

June 5, 2013.

Title: Variable Selection in Semi-parametric Models.

Abstract approved:

Lan Xue

We consider two semiparametric regression models for data analysis, the stochastic

additive model (SAM) for nonlinear time series data and the additive coefficient model

(ACM) for randomly sampled data with nonparametric structure. We employ the SCADpenalized polynomial spline estimation method for estimation and simultaneous variable

selection in both models. It approximates the nonparametric functions by polynomial

splines, and minimizes the sum of squared errors subject to an additive penalty on norms

of spline functions. A coordinate-wise algorithm is developed for finding the solution for

the penalized polynomial spline problem. For SAM, we establish that, under geometrically

α−mixing, the resulting estimator enjoys the optimal rate of convergence for estimating

the nonparametric functions. It also selects the correct model with probability approach­

ing to one as the sample size increases. For ACM, we investigate the asymptotic properties

of the global solution of the non-convex objective function. We establish explicitly that the

oracle estimator is the global solution with probability approaching to one. Therefore, the

global solution enjoys both model estimation and selection consistency. In the literature,

the asymptotic properties of local solutions rather than global solutions are well estab­

lished for non-convex penalty functions. Our theoretical results broaden the traditional

understandings of the penalized polynomial spline method. For both models, extensive

Monte Carlo studies have been conducted and show the proposed procedure works effec­

tively even with moderate sample size. We also illustrate the use of the proposed methods

by analyzing the US unemployment time series under SAM, and the Tucson housing price

data under ACM.

c

©

Copyright by Shuping Jiang

June 5, 2013

All Rights Reserved

Variable Selection in Semi-parametric Models

by

Shuping Jiang

A DISSERTATION

submitted to

Oregon State University

in partial fulfillment of

the requirements for the

degree of

Doctor of Philosophy

Presented June 5, 2013

Commencement June 2014

Doctor of Philosophy dissertation of Shuping Jiang presented on June 5, 2013

APPROVED:

Major Professor, representing Statistics

Chair of the Department of Statistics

Dean of the Graduate School

I understand that my dissertation will become part of the permanent collection of Oregon

State University libraries. My signature below authorizes release of my dissertation to

any reader upon request.

Shuping Jiang, Author

ACKNOWLEDGEMENTS

I would like to take this opportunity to express my deepest appreciation to many people

that helped me in the past five years.

I firstly want to thank my advisor, Professor Lan Xue, for her continuous and

unreserved guidance, support and encouragement during the past five years. I was lucky

to have her as my advisor. With endless patience and full responsibility, she taught me

every single step of how to do research. She was always helpful and insightful when I

needed guidance, totally understanding and considerate when I came across difficulties,

and especially proactive and supportive for any possible opportunities for me. As my

advisor, she has not only helped me in my Ph.D. research, but also set a high standard

for me to pursue in my future life by her personal example.

I would also like to thank Professors Yanming Di, Virginia Lesser, Sinisa Todorovic,

and Bo Zhang for serving on my committee. Professor Lesser helped me a lot for my

attendance of conferences last year, as well as during my job searching process. I am

really grateful about it. Professor Zhang has provided me one year of important research

experience as his research assistant. This has granted me a precious chance of studying

an area that is totally different from the area of my Ph.D. research. He also gave me

many advises of looking for an internship. I deeply appreciate it. Professor Di is always

supportive for serving on both of my Ph.D. and master’s committee.

I would like to thank all other professors in the department for teaching me statistics:

Professors David Birkes, Alix Gitelman, Lisa Madsen, Paul Murtaugh, Cliff Pereira, Dan

Schafer, and Bob Smythe. Your teaching has opened the door of statistics to me, and

showed me a beautiful world. I would also like to thank Professor Yuan Jiang’s help when

I had theoretical questions. Your passion in statistics is impressive and influential.

Finally, I would like thank all of my friends, especially Meian, Zoey, Xuan, Gu and

Yan, for helping me, being with me, and trusting me. It’s my honor to know you all.

TABLE OF CONTENTS

Page

1

INTRODUCTION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

LAG SELECTION IN STOCHASTIC ADDITIVE MODELS . . . . . . . . . . . . . . . . .

8

2.1

Model and Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

2.2

Polynomial spline estimation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

2.2.1 An initial estimator . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.2.2 Penalized polynomial spline estimation . . . . . . . . . . . . . . . . . . . . . . . . . .

10

12

2.3

Algorithm . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

2.3.1 Tuning Parameter and Knots Selection . . . . . . . . . . . . . . . . . . . . . . . . .

2.4

Simulation studies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

2.5

Real data analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

2.6

Assumptions and Proofs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

2.6.1

2.6.2

2.6.3

2.6.4

3

14

Notation and Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Assumptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Proof of Preliminary Lemmas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Proof of Theorems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20

20

26

CONSISTENT MODEL SELECTION IN ADDITIVE COEFFICIENT MOD­

ELS WITH GLOBAL OPTIMALITY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

3.1

The Model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

3.2

Penalized Polynomial Spline Estimation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

3.3

Optimal Properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

3.4

Implementation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

3.4.1 The local linear approximation algorithm . . . . . . . . . . . . . . . . . . . . . . . .

3.4.2 Selection of tuning parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.5

43

44

Simulation studies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

3.5.1 Example 1: Low dimensional case . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.5.2 Example 2: High dimensional case with intercept. . . . . . . . . . . . . . . .

46

47

TABLE OF CONTENTS (Continued)

Page

3.6

Real data analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

3.7

Proof of Lemmas and Theorems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

3.7.1 Preliminary Lemmas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.7.2 Proof of Theorem 3.3.1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.7.3 Proof of Theorem 3.3.2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

51

53

56

CONCLUSIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

BIBLIOGRAPHY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

LIST OF FIGURES

Figure

2.1

2.2

3.1

3.2

3.3

3.4

Page

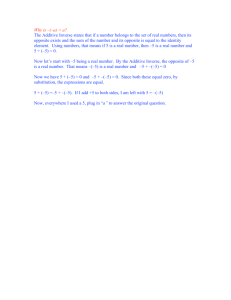

The empirical norms of all estimated additive components are plotted

against the tuning parameter λn . We simulated data from both linear

AR3 model (left) and a nonlinear NLAR1 model (right side) in Table

2.1 for one run with n = 500. The location of the optimal parameter λ̂n

selected by BIC are marked by the dashed line. . . . . . . . . . . . . . . . . . . . . . . . . .

35

The estimated relevant component functions for model NLAR1 ((a) and

(b)) and NLAR2 ((c) and (d)) using three approaches. Model NLAR1 is

fitted in linear spline space while model NLAR2 is fitted in cubic spline

space. The dash-dotted lines and the dotted lines represent polynomial

spline estimation of the oracle and full models respectively. The dashed

lines represent the penalized polynomial spline estimators. The true com­

ponent functions are also plotted in solid lines. . . . . . . . . . . . . . . . . . . . . . . . . . .

36

Fitted curves for each αls (·), l = 1, 2, s = 1, 2 in Example 1. Plots

(a1)-(a4) show the 100 fitted curves for α11 (x) = sin(x), α12 (x) = x,

α21 (x) = sin(x), α22 (x) = 0 respectively when sample size n = 100.

Plots (b1)-(b4) and (c1)-(c4) are for n = 250 and n = 500 respectively.

(d1)-(d4) plot the true model functions (solid) as well as the typically

estimated curves of different sample sizes: dashed lines (n = 100), dotted

lines (n = 250), and the dot-dashed lines (n = 500). . . . . . . . . . . . . . . . . . . . .

63

Fitted curves for α11 (·), α12 (·), and α21 (·) in Example 2. Plotted are

the true functions (solid), typical oracle estimates (dashed) and typical

SCAD estimates (dotted). The typical estimated curve is the one whose

ISE is the median among the 100 ISEs from replications. . . . . . . . . . . . . . . . .

64

Graphs of estimated curves of all fifteen additive coefficient components

αls , l = 1, · · · , 5, s = 1, 2, 3. SCAD estimators are plotted in solid

curves, and full estimators are plotted in dashed curves. The non-zero

components selected by SCAD are α11 , α12 , α13 , α21 , α41 . . . . . . . . . . . . . . . .

65

Plots of actual housing prices against predicted values from SCAD, FULL

and a linear regression model. In order to reduce crowding of all the 891

points, we randomly selected only 80 points for plotting. For each plot,

dotted line is the symmetric axis y = x. Two dashed lines respectively

represent y = x + 0.1 |x| and y = x − 0.1 |x|. Any point enclosed within

the two dashed lines represents a “good” predicted price. . . . . . . . . . . . . . . .

66

LIST OF TABLES

Table

Page

2.1

Autoregressive models in the simulation study . . . . . . . . . . . . . . . . . . . . . . . . . .

31

2.2

Lag selection results for the simulation study. The columns of U, C,

O give respectively the percentages of under-fitting, correct-fitting and

over-fitting over 500 replications. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

The Penalty columns give MISEs from the penalized polynomial spline

method. The Oracle and Full columns give MISEs of the polynomial

spline estimation of the oracle and full models respectively. . . . . . . . . . . . . .

33

Analysis result of the US unemployment data. The Lags column gives

the selected significant lags of the quarterly US unemployment data. . . .

34

Variable selection results for Example 1. The columns of U, C, O give

respectively the numbers of under-fitting, correct-fitting and over-fitting

from 100 replications. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

61

Estimation accuracy for Example 1. The Mean(SE) columns give the

mean and standard errors of α̂10 and α̂20 . The AISE columns give AISEs

of α̂11 , α̂12 , α̂21 and α̂22 respectively. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

61

Estimation accuracy for Example 2. The AISE columns give AISEs of

α̂11 , α̂12 and α̂21 respectively. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

62

Analysis result of Tucson housing price data. . . . . . . . . . . . . . . . . . . . . . . . . . . .

62

2.3

2.4

3.1

3.2

3.3

3.4

FOR GRANDMOM.

VARIABLE SELECTION IN SEMI-PARAMETRIC MODELS

1

INTRODUCTION

Linear regression models are widely used in statistical analysis. It is a classical tool

for analyzing many types of data, including independent data such as randomly sampled

data, and dependent data such as time series data. However, like other parametric re­

gression models, it relies on an explicit parametric form of the regression function. This

usually restricts the availability of the model, and sometimes requires the pre-knowledge

of the data structure for correct modeling. An inappropriate application of parametric

models may result in estimation bias and erroneous inferences. On the contrary, nonpara­

metric models have provided great flexibility to explore hidden data structures, without

any prior knowledge of the structure of the data. Therefore, in recent years, nonpara­

metric models have gained increasing popularity as an alternative tool which avoids the

problems occurred using inappropriate parametric models.

While general nonparametric models are useful for exploring data structures, it

suffers the “curse of dimensionality” phenomenon. When there are a large number of

variables, the volume of space of predictive variables explodes so fast that the data becomes

sparse in the space, and therefore estimation becomes unreliable. In this case general

nonparametric models can rarely be used to make effective inferences. Therefore, a class

of semiparametric models was developed. Semiparametric models usually impose certain

structures to the general nonparametric model, while still reserve some nonparametric

components in the model. Therefore, semiparametric models can avoid the “curse of

dimensionality”. In the meantime, they can still be more flexible than the parametric

2

ones. This class of models include the partially linear model (Härdle, Liang and Gao 2000)

which allows part of the additive components in the linear regression to be nonparametric;

the additive model (Stone 1985, Hastie and Tibshirani 1990) which relaxes the strict linear

assumption but retains the interpretable additive form; the single index model (Härdle and

Stoker 1989, Ichimura 1993) which allows the mean of responses to be a nonparametric

function of the linear combinations of predictive variables; the varying coefficient model

(Hastie and Tibshirani 1993) which replaces the constant coefficient of each linear predictor

by a nonparametric function of another predictor; and the additive coefficient model (Xue

and Yang 2006 a & b) whose coefficients of linear predictors are additive nonparametric

functions of multiple predictors.

To estimate the semiparametric/nonparametric models, we used one classical tool,

polynomial splines. Compared to the local polynomial method, the polynomial spline

method enables global smoothing and estimation of all nonparametric components through

one single least square estimation, therefore reduces computational complexity. General

theories of polynomial spline smoothing were established in Stone (1985), de Boor (2001),

and Huang (1998 a & b, and 2000).

Besides estimation, model/variable selection is also crucial in semiparametric mod­

eling. A large number of predictors are often introduced at the beginning of modeling

process to avoid missing any potentially important explanatory elements. Consequently,

selection of significant predictors becomes necessary. The variable selection process not

only simplifies the model complexity and its interpretation, but also greatly enhances

model predictability. However, according to Breiman (1996), traditional approaches of

variable selection including stepwise and subset selection methods are computationally

intensive, unstable, and difficult to summarize the sampling properties. This manual

selection process also brings in some uninterpretable stochastic errors in the stages of

variable selection. Therefore, since the 1990s, a number of penalization methods emerged

3

as an alternative approach to variable selection in linear regression models. These pe­

nalization methods conduct the estimation and variable selection in the same modeling

process, in which the coefficients are appropriately estimated, and the significant variables

are simultaneously and automatically selected. These penalization estimation methods in­

clude the bridge regression methods proposed by Frank and Friedman (1993), the least

absolute shrinkage and selection operator (LASSO) proposed by Tibshirani (1996, 1997)

and Efron, Hastie, Johnstone, and Tibshirani (2004), the smoothly clipped absolute de­

viation (SCAD) penalty method proposed by Fan and Li (2001), the adaptive LASSO

proposed by Zou (2006), the Dantzig selector by Candés and Tao (2007), the minimum

concave penalty by Zhang (2010) and the threshold L1 penalty by Shen, Pan, and Zhu

(2012). All those work assumed a linear or parametric form for the regression model. Some

more recent work extends the aforementioned penalization methods to the nonparametric

additive models. In particular, Lin and Zhang (2006) proposed the component selection

and smoothing operator for model selection in a more general nonparametric ANOVA

model. Meier, van de Geer, and Bühlmann (2009), Xue (2009), Huang, Horowitz, and

Wei (2010) Xue, Qu and Zhou (2010), and Wang, Liu, Liang, and Carroll (2011) proposed

to approximate the nonparametric components using B-spline basis and conduct variable

selection using group-wise model selection approach (Yuan and Lin 2006).

Among all the penalization methods, the one with SCAD penalty (Fan and Li 2001)

is our focus in this thesis. Fan and Li (2001) have shown that the SCAD penalty has all

the three properties of a desirable penalty function: sparsity, unbiasedness and continuity.

That is, for a given tuning parameter, on one hand, the SCAD penalty shrinks insignifi­

cant variables to zero; and on the other hand, leaves relatively large significant variables

unbiased after the shrinkage. In addition, the shrinkage for estimators is continuous under

SCAD penalties. Combining the SCAD penalty method with polynomial spline estima­

tion, results in a penalized polynomial spline (PPS) method. In this method, for a given

4

tuning parameter, we define the PPS estimator as the global minimizer of the objective

function, which equals to the sum of squared errors plus the sum of dimensional-wise

SCAD penalty functions. In the literature, the PPS method has recently been used for

variable/model selection in various semiparametric models. For example, Wang, Li and

Huang (2008), Wei, Huang and Li (2011), Lian (2012) and Xue and Qu (2012) considered

PPS for variable selection in the varying-coefficient models. Xue (2009), Huang, Horowitz

and Wei (2010), and Xue, Qu and Zhou (2010) applied PPS for variable selection in (gen­

eralized) additive models. Ma, Song and Wang (2013) used PPS for variable selection in

the single index models.

In the PPS method, the minimization of the objective function is challenging since

the SCAD penalty has a non-convex form. An approximation method is required to

solve the minimization problem. The local quadratic approximation (LQA) method in

the nonparametric framework has been proposed by Xue (2009). Another local linear

approximation (LLA) method under linear regression has been provided by Zou and Li

(2008). Zou and Li (2008) has shown in theory that this method is computationally

efficient, since the one-step approximator is already consistent to the oracle estimator. In

our research, we extended this LLA method to semiparametric models.

Finally, the tuning parameter involved in the PPS methods needs to be deter­

mined via a model selection criterion such as the final prediction error (FPE, Akaike

1969), Akaike information criterion (AIC, Akaike 1974), Bayes information criterion (BIC,

Schwarz 1978), or a model selection method such as cross-validation (CV) and generalized

cross-validation (GCV). These criteria/methods were originally proposed for the selection

of parametric models for independent and identically distributed data. Recently it has

been proved that some of these are also consistent for the selection of nonparametric mod­

els for weakly dependent time series data. For example, Huang and Yang (2004) provided

the theoretical justification of the consistency of BIC in variable selection of nonlinear

5

stochastic regression model, providing the data are from a strongly mixing (i.e. α-mixing)

and strictly stationary stochastic process. The consistency of the cross-validation and

FPE methods have been shown using stronger mixing conditions (i.e. β-mixing) in other

literature (Tschernig and Yang 2000).

The specific contribution of our research is the study of the theoretical properties,

as well as numerical performances of the PPS method on variable selection under two

semi-parametric models: the stochastic additive models (SAM, Chen and Tsay 1993) and

the additive coefficient models (ACM, Xue and Yang 2006 a & b). Here SAM models are

similar to the additive models (Stone 1985, Hastie and Tibshirani 1990), the difference

is that SAM assumes both responses and predictors are from a stationary stochastic

process. We use SAM to analyze weakly dependent time series data, and ACM to analyze

independent, randomly sampled data. For both models, in addition to numerical studies,

we establish the asymptotic oracle properties in theory.

For stochastic additive models (SAM), its estimation method has been studied by

a large amount of literature. For example, Chen and Tsay (1993) considered two backfit­

ting techniques: alternating conditional expectation algorithm of Breiman and Friedman

(1985) and the BRUTO algorithm of Hastie and Tibshirani (1990). Huang and Yang

(2004) estimated the additive components in SAM using an efficient regression splines

procedure. Wang and Yang (2007, 2009) proposed a spline-backfitted kernel estimator,

which was shown to be both computationally expedient and theoretically reliable. How­

ever, the important issue of variable/lag selection in the SAM is not well studied in general.

Our PPS method estimates and performs variable selection in the same process. Conse­

quently, the consistent properties in both estimation and model selection are theoretically

developed and proved under a more general assumption of weakly dependent data, rather

than the commonly used assumption of independent data.

For the second model we considered, the additive coefficient model (ACM) proposed

6

by Xue and Yang (2006a), we extend the varying coefficient model to be more flexible.

This models the dynamic changes of regression coefficients by allowing the coefficient

functions to vary with multiple variables in an additive functional form. It is particularly

useful in modeling temporal and spatial data. As discussed in Xue and Yang (2006a), the

additive coefficient model includes the aforementioned additive model, varying coefficient

model, partially linear model, and linear regression model as special cases. The estimation

of the additive coefficient model was studied in Xue and Yang (2006 a & b), using local

polynomial and polynomial spline methods respectively. The model selection problem on

ACM has not be studied prior to this research.

In our theoretical results, we prove a set of strong global oracle properties for ACM.

Recent literature including Xue (2009) and Xue, Qu and Zhou (2010) consider SCAD

penalty, that only guarantees there exists a sequence of local minimum that is consistent

in recovering a sparse model and consistent in estimating the non-zero function compo­

nents. However, when the objective function is non-convex (which is our case), the local

minimum is not necessarily the global minimum. Therefore, there is a discrepancy between

the theory and the fact that the PPS estimator is the global solution by the definition.

Previous literature have done some work to address this. For example, Xue and Qu (2012)

proved the oracle properties of the global minimum under the varying coefficient models, a

special case of additive coefficient models for the truncated L1 penalty. Kim, Choi and Oh

(2008) discussed the oracle properties of the global minimum for the SCAD penalty, but

only in linear regression models. However, our research in the thesis has initially studied

the global minimum under the general ACM models with the SCAD penalty.

The remainder of the thesis contains two parts. Section 2 discusses lag selection in

stochastic additive models. Subsection 2.1 defines stochastic additive models using neces­

sary notations. In Subsection 2.2, we describe an estimation procedure for the stochastic

additive model and established asymptotic properties of the proposed estimator. We then

7

introduce a penalized polynomial spline method for simultaneous estimation and variable

selection in the stochastic additive model. We develop the model selection consistency

and the oracle properties of the proposed method. In Subsection 2.3, we describe an al­

gorithm based on the local linear approximation of the nonconcave penalty function. We

also discuss to select tuning parameters via the Bayesian information criterion. Subsection

2.4 illustrates the numerical performance of the proposed methods by simulation studies

and Subsection 2.5 analyzes the US employment time series. Technical proofs, relative

definitions and assumptions are contained in Subsection 2.6.

Section 3 focuses on model selection in additive coefficient models. In Subsection 3.1,

we introduce the additive coefficient model. In Subsection 3.2, we propose the penalized

polynomial spline method for simultaneous model selection and estimation in the additive

coefficient model. The asymptotic property of the proposed method is established in

subsection 3.3. We describe an algorithm based on the local linear approximation to solve

the non-convex minimization problem and discuss a tuning parameter selection by the

Bayesain Information Criteria (BIC) in Subsection 3.4. Subsection 3.5 and 3.6 contain

simulation studies and an analysis of the Tucson housing price data. Technical proofs are

relegated to Subsection 3.8.

8

2

2.1

LAG SELECTION IN STOCHASTIC ADDITIVE MODELS

Model and Introduction

Linear models such as ARMA, ARIMA and SARIMA models (Brockwell and Davis

1991), VAR, VARMA and PAR models (Lütkepohl 1993) have been a popular method

for modeling time series data. These simple linear structures allow for easy estimation

and inference in the data generating process. However, for many important time series,

there is little a priori justification for assuming such linearity. Tong (1990, 1995) and

Tjøstheim (1994) gave interesting examples of data with asymmetric cycles and nonlinear

relationship between lagged variables. To model such nonlinear time series, non- and

semi-parametric models are useful alternatives. In this paper, we consider a stochastic

∞

T

additive model. Let (Xt , Yt )+

t=−∞ with Xt = (Xt1 , . . . , Xtd ) be a stationary stochastic

process satisfying

Yt = µ0 + µ1 (Xt1 ) + µ2 (Xt2 ) + · · · + µd (Xtd ) + εt ,

(2.1)

where µ0 is an unknown constant and {µl (·)}dl=1 are unknown nonparametric functions

and {εt } is white noise conditional on Xt . The covariates Xt can contain both variables

from an exogenous time series and lagged values of Yt . When it contains only lagged

values of Yt , it reduces to the nonlinear additive autoregressive model considered in Chen

and Tsay (1993).

2.2

Polynomial spline estimation

Let (Xt , Yt )nt=1 be a sample of size n generated from the stochastic additive model

(2.1). The additive functions in model (2.1) are not identified up to a constant. One

practical solution is to impose an identification condition that E [µl (Xtl )] = 0 for each

9

l = 1, . . . , d. Furthermore, since nonparametric functions are often estimated only on a

compact set, we assume without loss of generality that each Xtl has a compact support

on [0, 1]. Note that the identification condition entails that µ0 = E (Y ) . Therefore µ0 can

be consistently estimated by the sample average Y at the root-n rate, which is faster than

any rate of convergence for nonparametric function estimation. Therefore, for notation

simplicity, we assume µ0 = 0 and the response variable Y is centered with Y = 0. Now

�

let µ(Xt ) = dl=1 µl (Xtl ) be the additive function in (2.1) with E [µl (Xtl )] = 0 for each

l = 1, . . . , d. The main objectives of this paper are (a) to establish the rate of convergence

of polynomial spline estimation of the nonparametric functions in the stochastic addi­

tive model (2.1) for weakly dependent data, and (b) to propose a penalized polynomial

spline method for simultaneous lag selection and nonparametric function estimation for

the model (2.1).

l

=

Let H[0,1]

{

f : E [f (Xl )] = 0, E [f (Xl )]2 < ∞

}

be the space of all square inte­

grable functions that are centered with respect to the probability measure of Xl . Here

l

for l = 1, · · · , d.

Xl is the l−th component in X = (X1 , . . . , Xd )T . Assume µl ∈ H[0,1]

{

}

�d

l

Then H = h : h(X) = l=1 hl (Xl ), hl ∈ H[0,1]

for l = 1, · · · , d is a space of all square

integrable additive functions on [0, 1]d with µ ∈ H. For any functions f, g ∈ H, de­

fine the theoretical and empirical inner products as (f, g) = E [f (X)g(X)] and (f, g)n =

2

1 �n

t=1 f (Xt )g(Xt ) respectively. The induced theoretical and empirical norms are lgl =

n

(g, g) and lgl2n = (g, g)n respectively. Then, Lemma 2.6.1 in the Appendix entails that,

under some reasonable assumptions on the joint density of X, H is theoretically identifi­

able in the sense that for any h ∈ H, lhl = 0 implies hl = 0 a.s. for l = 1, · · · , d.

For each l = 1, . . . , d, we estimate the unknown function µl in (2.1) by polynomial

splines. The polynomial spline is a piece-wise polynomial that is connected smoothly

over a set of interior knots. Let {0 = xl,0 < xl,1 < · · · < xl,Nn < xl,Nn +1 = 1} be a set

of Nn interior knots. Then for any integer p > 0, let Gl be the space of polynomial

10

spline functions that are polynomials of order p (or less) on the intervals [xl,j , xl,j+1 ]

for j = 0, . . . , Nn and overall it is p − 1 times continuously differentiable on [0, 1]. The

polynomial spline has been widely used in nonparametric function estimation due to the

fact that it often provides a good approximation to smooth functions with only a small

number of knots. Since each µl in model (2.1) is theoretically centered, we consider

�n

Gnl = {g : g ∈ Gl , t=1

[g (Xtl )] /n = 0} , the space of empirically centered polynomial

splines. Let Gn = {g : g(X) = g1 (X1 ) + · · · + gd (Xd ), gl ∈ Gnl for l = 1, . . . , d}, which

provides approximation for functions in the model space H. The following lemma shows

the theoretical and empirical norms are asymptotically equivalent on Gn .

Lemma 2.2.1. Under Assumptions (A1)-(A3) in the Appendix, one has

lgl2n

sup

lgl2

g∈Gn

−1

= oP (1),

that is, for any ε > 0,

lim supP

n→∞

sup

g∈Gn

lgl2n

lgl2

−1

>ε

= 0.

(2.2)

Lemma 2.2.1 indicates that except on a set with probability goes to zero, the theoret­

ical norm can be approximated by the empirical norm. Therefore together with Lemma

2.6.1, the approximation space G is identifiable under both theoretical and empirical

norms.

Lemma 2.2.2. For any g ∈ Gn , lgln = 0 or lgl = 0 implies gl = 0 a.s. for l = 1, . . . , d

under Assumption (A2).

2.2.1

An initial estimator

Suppose that each µl in model (2.1) is smooth and can be approximated by a

polynomial spline function gl ∈ Gnl for l = 1, · · · , d. Then one has

µ (Xt ) ≈

d

L

l=1

gl (Xtl ), t = 1, · · · , n.

(2.3)

Let bnl (x) = bl (x)− n1

in which

(x)p+

(

p

b

(X

)

with

b

(x)

=

x,x2 ,· · · ,xp ,(x − xl,1 )+

,· · · ,(x − xl,N )p+

tl

l

t=1 l

�n

p

= (x+ ) . Here

bln (x)

11

)T

,

is the empirically centered truncated power basis for

Gnl . Denote µ = (µ (X1 ) , · · · , µ (Xn ))T , and Bl = (bnl (X1l ), · · · , bnl (Xnl ))T . Then an

equivalent expression of (2.3) in terms of matrix is

µ≈

d

L

Bl βl ,

(2.4)

l=1

)T

(

where the coefficients β = β1T , · · · , βdT

can be estimated by minimizing the sum of

squares

βj = arg min Y −

β

T

d

L

2

Bl βl

l=1

.

2

Here Y = (Y1 , . . . , Yn ) and l·l2 is the vector L2 -norm. Equivalently, µ

j=

j

µ

jl = bnT

l βl satisfying

µ

j = arg min Y −

gl ∈Gn

l

d

L

2

gl

l=1

,

(2.5)

�d

jl

l=1 µ

with

(2.6)

n

where with slightly abuse of notation, Y denotes a random function that interpolates the

values Y1 , . . . , Yn at data points. For identically and independently distributed data, it

has been shown in the literature (Stone 1985 and Huang 1998) that the polynomial spline

j for time series

estimator µ

j in (2.6) is L2 -consistent. However, the asymptotic property of µ

data is less well understood in general. Theorem 2.2.1 below establishes that µ

j in (2.6) is

also L2 -consistency with an optimal rate of convergence for weakly dependent data that

are geometrically α−mixing.

Theorem 2.2.1. Under Assumptions (A1)-(A3) in the Appendix, lµ̂ − µl2 = OP (Nn /n+

ρ2n ) and lµ̂ − µl2n = OP (Nn /n + ρ2n ) with ρn = 1/Nnp+1 .

The proof of Theorem 2.2.1 is given in the Appendix. Theorem 2.2.1 demonstrates

the consistency of the polynomial spline estimator. However it fails to produce a parsi­

monious model when there exists redundant variables. This result is useful for providing

12

an initial consistent estimator for late development in simultaneous lag/variable selection

and estimation of the stochastic additive model.

2.2.2

Penalized polynomial spline estimation

For variable selection in the stochastic additive model (2.1), we propose a penalized

polynomial spline method. It minimizes the sum of squared errors subject to an additive

jP L be the

penalty on the L2 norms of the spline functions. To be more specific, let µ

penalized polynomial spline estimator (PPS) defined as,

d

1

L

PL

µ

j =

argmin l(g) = argmin

Y −

gl

g∈Gn

g∈Gn

2

l=1

2

+

n

d

L

l=1

pλ (lgl ln )

.

(2.7)

Here the penalty function pλ (·) is the smoothly clipped absolute deviation (SCAD) penalty

proposed in Fan and Li (2001), whose derivative is

p′λ (|β|) = λI(|β| � λ) +

(aλ − |β|)+

I(|β| > λ)

a−1

(2.8)

with a constant a = 3.7 as in Fan and Li (2001) and a positive tuning parameter λ whose

selection is discussed in subsection 2.3.1. The SCAD penalty rather than other penalty

functions are used here because of its desirable properties such as unbiasedness, sparsity

and continuity (Fan and Li 2001).

The following two Theorems show that the proposed penalized polynomial spline es­

timator with SCAD penalty has nice asymptotic properties on both estimation consistency

and sparsity for variable selections for geometrically α−mixing time series data. Without

loss of generality, assume that only the first r components of Xt contribute in explaining Yt

�r

in model (2.1). Correspondingly, µ = l=1

µl where r = min {s : P [µs+1 (Xs+1 ) = 0] = · · ·

= P [µd (Xd ) = 0] = 1}.

Theorem 2.2.2. (Estimation consistency) Under Assumptions (A1)-(A5) shown in the

Appendix, for n sufficiently large, there exists a local minimizer µ

jP L of the criterion

13

function l(·) in Gn such that µ

jP L − µ

OP (Nn /n + ρ2n ) for l = 1, · · · , d.

2

= OP (Nn /n + ρ2n ). Furthermore, µ

jlP L − µl

2

=

Theorem 2.2.3. (Sparsity) Under Assumptions (A1)-(A5) shown in the Appendix, except

on a set whose probability tends to zero as n → ∞, µ

jPl L = 0 a.s., for l = r + 1, · · · , d.

Theorem 2.2.3 shows that unlike the initial polynomial spline estimator, the pe­

nalized polynomial spline estimator correctly shrinks the nonparametric components of

redundant variables to zero and provides a parsimonious fitted model with probability

approaching to one. Theorem 2.2.2 further indicates that µ

jP L converges to µ at the same

optimal rate as the initial polynomial spline estimator. Therefore, adding the SCAD

penalty term does not change the accuracy of estimation. These two facts ensure the

advantages of penalized polynomial spline estimator with the SCAD penalty.

2.3

Algorithm

Note that the Newton-Raphson algorithm can not be directly used to minimize the

penalized polynomial spline in (2.7) since the SCAD penalty function does not have a

continuous second order derivative. Instead, we extend the local linear approximation

(LLA) algorithm of Zou and Li (2008) to solve the penalized polynomial spline problem.

In the LLA algorithm, we substitute the SCAD penalty in the criteria function l(g) by

its local linear approximation. Then we calculate the corresponding minimizer of the

adjusted criteria function using the coordinate-wise descent algorithm (CWD, Yuan and

Lin 2006).

Motivated from Zou and Li (2008), we first approximate the SCAD penalty function

(0)

by a local linear function. To be more specific, for a given initial estimator gl

(0)

can write pλ (lgl ln ) ≈ pλ ( gl

(0)

n

) + pλ′ ( gl

(0)

n

)(lgl ln − gl

n

=µ

jl , one

) for l = 1, · · · , d. As a

14

result, the objective function in (2.7) can be approximated by

2

d

S(g g

(0)

L

1

) =

Y −

gl

2

+

l=1

n

d

L

(0)

p′λ ( gl

n

l=1

) lgl ln ,

(2.9)

up to a constant. Therefore the minimizer of S(g g (0) ) is an approximated solution

to the original minimization problem (2.7). Equivalently, in terms of the spline basis

representation, (2.9) can be written as

d

S(β β

(0)

L

1

)=

Y −

Bl βl

2n

l=1

where lβl lKl =

J

βlT Kl βl with Kl =

BT

l Bl

n ,

2

+

d

L

l=1

2

qλ,l lβl lKl

(0)

and qλ,l = p′λ ( βl

Kl

(2.10)

) is a constant only

(0)

depending on the initial value βl . This reduces to a group lasso with component-specific

tuning parameter qλ,l . It can be solved by applying the coordinate-wise descent (CWD)

algorithm as in Yuan and Lin (2006). Notice that by letting βl∗ = Dl βl and Bl∗ = Bl D−1

l

( T )1/2

, the objective function in (2.10) becomes

with Dl = Bl Bl

2

d

∗

nS(β β

(0)

L

1

)=

Y−

B∗l βl∗

2

+

l=1

d

L

√

nqλ,l lβl∗ l2 .

(2.11)

l=1

2

Proposition 1 of Yuan and Lin (2006) shows that the solution to (2.11) can be found

iteratively by

∗(k)

βl

= 1 −

√

nqλ,l

S∗l,k

2

(

S∗l,k ,

+

)T

βj1∗T , . . . , βjd∗T

be the value of β ∗ at con­

(

)T

j∗

vergence. Then the minimizer of (2.10) βj = βj1T , . . . , βjdT

is found by β̂l = D−1

l βl for

where S∗l,k = Y −

�

∗ ∗(k) .

ji=l Bj βj

Let βj∗ =

l = 1, · · · , d. Our experience shows that the CWD algorithm converges in just a few

iterations.

2.3.1

Tuning Parameter and Knots Selection

In this section we discuss how to choose the smoothing and tuning parameters. For

the polynomial spline estimation, the polynomial spline spaces {Gl }dl=1 depend on the

15

knot sequence {xl,1 , · · · , xl,N } with N interior knots. We have used an equal spaced knot

sequence with the knot number N selected by the Bayesian information criterion (BIC),

which is defined as BIC = n ln( RSS

n ) + kn ln(n). Here RSS is the residual sum of squares

and kn is the number of free parameters to be estimated in (2.6) and n is the sample size.

This strategy was also used in Xue (2009) and Huang et al. (2004). Generally the number

of interior knots for each spline space Gl can be different. However we here use the same

knot number N for all d spline spaces for computational simplicity.

For lag selection, we have used the same optimal number of interior knots N selected

by the BIC in the polynomial spline approach. In addition, the definition of the SCAD

penalty function in equation (2.9) involves two tuning parameters a and λn . Following

Fan and Li (2001), we take a = 3.7. The parameter λn plays an important role in the lag

selection results. A larger value of λn leads to a simpler model with fewer variables. We

}

{

(0)

select the optimal λn by the BIC and we consider λn in the interval from min βl

/a

and up to some value which shrinks all components of µ

jP L to zero.

2.4

Simulation studies

In this section we use simulation to study the finite sample performance of the

proposed penalized polynomial spline method. Denote S0 as the set of relevant variables

in the true model (2.1). Following Huang and Yang (2004), we say that the variable set

of the fitted model, denoted as S, is an overfit of S0 if S is a proper superset of S0 ; S is a

correct fit if S is exactly S0 . For other cases, we say S is an underfit of S0 . Furthermore,

we use the median integrated squared error (MISE) to evaluate the estimation accuracy

of a fitted model, which is defined as,

MISE =

d

L

l=1

Median

1≤i≤nrep

1

ngrid

ngrid (

L

i=1

)

( )

(r) ( G ) 2

x

µ l xG

µ

−

j

i,l

i,l

l

.

16

(r)

Here µ

jl

is the l-th component of the given fitted function estimated from the r-th repli­

(r)

G

, i = 1, · · · , n

cation, and xi,l

jl

grid are the grid points at which µ

is evaluated .

We simulate 500 random samples of size n=100, 200 or 500 from each of the additive

autoregressive models given in Table 2.1. The same models were also used in Huang and

Yang (2004). The models in Table 2.1 contain only one or two relevant lags with either

linear or non-linear function forms. In addition, the error term εt in (2.1) are independent

and identically distributed as N (0, 0.1) random variables. We consider the selection of

relevant lags from a set of ten possible lags. That is, we consider Xt = (Xt1 , · · · , Xtd )T in

model (2.1) to be the lag variables of Yt as Xtl = Yt−l for l = 1, · · · , 10. We also compare

the estimation accuracy of our method with polynomial spline estimations of the oracle

and the full models respectively. The full model is an additive autoregressive model (2.1)

containing all 10 possible lags, while the oracle model contains only the relevant ones in

model (2.1).

We applied the penalized spline regression with both linear (p = 1) and cubic (p = 3)

jn . For one

splines. The BIC criteria was used to select the optimal tuning parameter λ

run with sample size n = 500, Figure 2.1 plots the empirical norms of the estimated

additive component µ

jPl L (λn ) from the penalized cubic spline (p = 3) against λn for a

linear AR3 model and a nonlinear NLAR1 model. One can see that most component

norms turn to zero for λn large enough. Therefore, larger values of λn leads to a simpler

model with fewer selected variables. The dotted line in Figure 2.1 marks the location of

jn . It clearly indicates that the BIC works reasonably well for this run since

the optimal λ

jn that provide the correct fit. The lag selection results of each autoregressive

it chooses λ

model are presented in Table 2.2, in terms of underfitting, correct-fitting and over-fitting

percentages. One can see that, for all additive autoregressive models, the percentage of

correct fitting increases quickly to 100% or close to 100% as the sample size increases to

500. Therefore, it numerically verifies Theorem 2.2.3 that penalized polynomial spline

17

method is consistent for variable selection.

Besides the lag selection results, we also compared the estimation accuracy of the

penalized polynomial spline estimator with the polynomial spline estimations of the oracle

and full models. Table 2.3 summarizes MISEs of the three estimators for all autoregressive

models in Table 2.1. In almost all cases, the full estimator has largest MISEs while the

oracle estimator has the smallest MISEs. It is not surprising since the oracle estimator

uses the information on the data generating process, which is not available for real data

analysis. The MISEs of the penalized spline estimator is much smaller than that from

the full estimator and is very close to that of the oracle estimator. Furthermore, for

one run with sample size n = 500, Figure 2.2 plots the estimated component curves from

three approaches for model NLAR1 with p = 1 and model NLAR2 with p = 3 respectively.

Figure 2.2 graphically confirms the results in Table 2.3 and clearly shows that the proposed

methods estimate the unknown functions reasonably well. Both Figure 2.2 and Table 2.3

numerically support Theorem 2.2.2 that the penalized polynomial spline can estimate the

model as accurately as the oracle when the sample size is large enough. The performances

of the cubic regression and the linear regression are comparable except that the cubic

regression gives smoother fitted component curves, which can be seen from Figure 2.2.

2.5

Real data analysis

We applied our proposed method to analyze the quarterly US unemployment rate

data from the first quarter of year 1948 to the last quarter of year 1978. Denote this time

series by {Rt }120

t=1 . The data covers unemployed people in the labor force who are at least

16 years old of all ethnic origins, races and sexes, without distinction between industries

and occupations. We then deseasonalized this series by taking the fourth difference of the

data. Denoting the resulting new series {Yt }116

t=1 , as Yt = Rt+4 − Rt for t = 1, · · · , 116. In

18

our analysis, the last 16 observations of Yt were left out for prediction. The rest were used

for model fitting.

As in simulation study, we considered the last 10 lags of Yt as possible predictor

variables. Then we applied the penalized polynomial spline method for lag selection, as

well as the unpenalized spline estimation of the full model consisting all 10 lags. We

considered cubic spline functions (p = 3) for both approaches. For each model fitting, the

coefficient of determination R2 , the mean squared estimation error (MSEE) and the mean

squared prediction error (MSPE) were calculated. Denote Ŷt the estimated or predicted

1 �100

value for Yt , and Y = 90

t=11 Yt , we write

�100 (

)2

jt

Y

−

Y

t

t=11

R2 = 1 − �100 (

)2 ,

t=11 Yt − Y

MSEE =

100

116

)2

)2

1 L (

1 L(

Yt − Yjt .

Yt − Yjt , MSPE =

90

16

t=11

t=101

We also compute the mean absolute estimation error (MAEE) and the mean absolute

prediction error (MAPE)

100

116

1 L

1 L

j

MAEE =

Yt − Yt , MAPE =

Yt − Yjt .

90 t=11

16 t=101

The R2 , MSEE and MAEE measure how well the models fit the data, while MSPE and

MAPE compare the prediction performance of various models. The results are reported

in Table 2.4. It shows that the full model with all ten lags gives smaller estimation errors

(MSEE and MAEE) compared with the penalized one, due to the fact that the full model

has a larger model size. However, the penalized method not only gave a parsimonious

model which is much easier to interpret, but also had better prediction performance with

smaller prediction errors (MSPE and MAPE). Finally, we also consider a linear autore­

gressive model with two selected lags Yt−1 and Yt−2 by the penalized polynomial spline

method. That is, we consider Yt = β0 + β1 Yt−1 + β2 Yt−2 + ǫt . It gives much larger estima­

19

tion and prediction errors, suggesting that the nonlinear additive model better describes

the underlying data generating structure for the quarterly US unemployment data.

2.6

Assumptions and Proofs

2.6.1

Notation and Definitions

∞

First, suppose we have two sequences {an }∞

n=1 and {bn }n=1 .

Define an � bn if

lim an

n→∞

bn

= 0, an ≍ bn if an � bn and bn � an . For Gnl , the spline space of polynomial

functions on [0, 1] with order p (or less), we denote its dimension as Jn . Clearly Jn =

Nn + p + 1. On the approximation space Gn , we define two important constants, An =

{

}

1g1∞

1/2

sup

and ρn = infn

lg − µl∞ . Note that according to Huang(1998), An ≍ Jn ≍

1g1

g∈Gn

1/2

Nn ,

g∈G

1

≍ p+1

for polynomial spline space under Assumption (A3).

Nn

�

Recall that µ̂ = dl=1 µ

jl (Xl ) is the least squared estimator of µ in Gn based on the

�

sample. Furthermore, we denote µ̃ = dl=1 µ

Jl (Xl ) to be the best approximation of µ in

and ρn ≍

1

Jnp+1

Gn with respect to the empirical norm. Let Q be the projection operator onto Gn with

respect to the empirical inner product. We can write µ̃ = Qµ and µ̂ = QY . Consequently,

the error can be decomposed as µ̂ − µ = (µ̂ − µ̃) + (µ̃ − µ). By Triangular Inequality, one

has lµ̂ − µl � lµ̂ − µ̃l + lµ̃ − µl.

As mentioned in Section 2.2.2, when there are redundant variables, without loss

�

of generality, we can write the true regression function as µ(X) = rl=1 µl (Xl ) for some

r � d. Correspondingly denote G(0) = {g : g(X) = g1 (X1 ) + · · · + gr (Xr ),where gl ∈ Gnl

for l = 1, . . . , r}. Then G(0) is an approximation space of µ other than Gn . Similar to

Q, one can also define a projection operator Q(0) on to G(0) with respect to the empirical

inner product. Let µ̂(0) = Q(0) Y , which is the least square estimation of µ in the space

G(0) instead.

At last, we introduce the α-mixing coefficient α(s) of a stationary stochastic process

20

∞

(Yt , Xt )+

t=−∞ , which measures the strength of dependence for any two data points that

are at least s time units apart. To be more specific,

{

}

α(s) = sup |P (A)P (B) − P (A ∩ B)| :A∈σ({Xt′ , Yt′ , t′ � t}), B∈σ({Xt′ , Yt′ , t′ ; t + s}) .

(2.12)

Here for any index set Γ, σ({Xt , Yt , t ∈ Γ}) is the σ-field generated by {Xt , Yt , t ∈ Γ}.

Note that in stationary stochastic process, α(s) does not vary with t in Equation (2.12).

2.6.2

Assumptions

To establish the asymptotic theory, we need the following assumptions.

(A1) The stochastic process (Xt , Yt ) is stationary and α−mixing with its α-mixing coeffi­

cient α(s) � C1 e−C2 s for some constants C1 and C2 .

(A2) The joint density of Xt , denoted as fXt , is bounded away from 0 and ∞ on the

compact support [0, 1]d .

(A3) For each spline space Gnl , l = 1, · · · , d, the number of interior nodes Nn satisfies

Nn ≍ nθ with 0 < θ < 13 . And the choice of these nodes tl,1 , · · · , tl,Nn satisfies

max |tl,j+1 −tl,j |

1JjJNn

< η for a positive constant η.

min |tl,j+1 −tl,j |

1JjJN

n

(A4) The tuning parameter λn in the SCAD penalty function satisfies limn λn = 0.

(A5) The tuning parameter λn in the SCAD penalty function satisfies

lim

n→∞

√

2

Nn /n+ρn

λn

=

0.

2.6.3

Proof of Preliminary Lemmas

Proof of Lemma 2.2.1. Let GnU B = {g ∈ Gn : lgl � 1} ⊆ Gn be a subset of all

functions in Gn that are in the unit ball under the theoretical norm l·l defined before.

Note that, to prove Lemma 2.2.1, it is sufficient to prove Equation (2.2) for all g ∈ GnU B .

21

For ∀ε1 , ε2 > 0, let f1 , f2 , g1 , g2 ∈ GnU B with lf1 − f2 l � ε1 , lg1 − g2 l � ε2 . One has

lf1 g1 − f2 g2 l∞ � l(f1 − f2 ) g1 l∞ + lf2 (g1 − g2 )l∞

� lf1 − f2 l∞ lg1 l∞ + lf2 l∞ lg1 − g2 l∞

� A2n [lf1 − f2 l lg1 l + lf2 l lg1 − g2 l]

� A2n [ε1 + ε2 ]

(2.13)

and

V ar (f1 g1 − f2 g2 ) � 2V ar [(f1 − f2 ) g1 ] + 2V ar [f2 (g1 − g2 )]

� 2 lf1 − f2 l2 lg1 l2∞ + 2 lf2 l2∞ lg1 − g2 l2

[

r

� 2A2n ε21 + ε22 .

Let h = f1 g1 − f2 g2 . Then for any integer r ≥ 3, one has

{

}

{

}

E |h − E(h)|r = E |h − E(h)|2 |h − E(h)|r−2 � E |h − E(h)|2 2r−2 lhlr−2

∞

rr−2

[

� 2r−2 A2n (ε1 + ε2 )

E |h − E(h)|2

[

rr−2

� r! A2n (ε1 + ε2 )

E |h − E(h)|2

= r!cr−2 E |h − E(h)|2 ,

where c = A2n (ε1 +ε2 ). By letting m22 = max

one observes that

m22

�

2A2n (ε12 + ε22 )

1�t�n

and mrr

}

{

E |h − E(h)|2 , mrr = max {E |h − E(h)|r },

1�t�n

�

cr−2 r!m22 .

1

Consequently 25m22 + 5cε ≍ A2n .

Recall that An ≍ Nn2 . Assumption (A3) indicates A−2

n = OP (1). Therefore, for any inte­

ger q between 1 and

n

2,

Theorem 1.4 of Bosq (1998) gives

22

P ((En − E)(h) > ε)

)

(

)

(

] 2r

[

r

qε2

5mr 2r+1

n

ε2

2r+1

−C2 n

q

� 2

+1+

exp −

+ 11n(1 +

)

C1 e

2

2

ε

q

25m2 + 5cε

25m2 + 5cε

)

(

)

(

n

qε2

� 2

+ 2 exp −

q

50An2 (ε21 + ε22 ) + 5A2n ε(ε1 + ε2 )

r

(

] 2r

] 1 ) 2r+1

[

5[

−C n 2r+1

2(r−1)

r−2 2

2 r

+11n 1 +

r!An

C1 e 2 q

(ε1 + ε2 ) (ε1 + ε2 )

ε

)

(

4n

qε2

�

exp −

q

50A2n (ε21 + ε22 ) + 5A2n ε(ε1 + ε2 )

( ) r [

] 1 [

] 2r

5 2r+1

2r+1

−C2 n

r−2 2

2 2r+1

q

+22n

(ε

+

ε

)

(ε

+

ε

)

C

e

r!A2(r−1)

1

2

1

n

1

2

ε

1

for n large enough. Furthermore, through the convexity of function e− x , one has

)

(

)

(

n

qε2

qε2

P ((En − E)(h) > ε) � 2

exp −

+ exp −

10A2n ε(ε1 + ε2 )

q

100A2n (ε21 + ε22)

( ) r [

] 1 [

] 2r

5 2r+1

2r+1

−C2 n

r−2 2

2 2r+1

q

+22n

(ε

+

ε

)

(ε

+

ε

)

.

(2.14)

r!A2(r−1)

e

C

1

2

1

n

1

2

ε

For any g ∈ Gn

U B , consider a sequence of subsets {g ≡ 0} = ℑ0 ⊂ ℑ1 ⊂ · · · ℑk ⊂ ℑk+1 ⊂

· · · satisfying min

lg − g∗ l � δk , where δk = 31k . Note that the cardinality of ℑk satisfies

g ∗ ∈ℑk

)dJn

(

k /2

� 3(k+1)dJn . Furthermore, for any arbitrary given t > 0, choose K

#(ℑk ) � 1+δ

δk /2

( )K

to be the maximum nonnegative integer such that 23

� 4At 2 . Then for each g ∈ GnU B ,

n

one can find

∗

gK

∈ℑK such that lg −

∗ l

gK

�

1

.

3K

So for each fixed positive integer k � K

∗

and the corresponding gk ∈ ℑk , we can choose gk−1

∈ ℑk−1 to satisfy

δk−1 =

1

.

3k−1

∗

gk − gk−1

�

K

For any f ∈ GnU B , define {fk∗ }k=0

in a similar way. From the definitions of

∗ and g ∗ , and (2.13), one has

fK

K

∗ ∗

∗ ∗

gK )| < 2 lf g − fK

gK l∞ �

|(En − E)(f g − fK

4A2n

t

� K.

K

3

2

(2.15)

Using (2.14) and (2.15), let’s now prove Lemma 2.2.1. Firstly, Triangular Inequality gives

sup |(En − E)(f g)| �

f,g∈Gn

+

∗

sup |(En − E)(f g − fK ∗ gK

)|

f,g∈Gn

K

L

sup

k=1 fk ,gk ∈ℑk

∗

) .

(En − E)(fk∗ gk∗ − fk∗−1gk−1

23

Therefore, by (2.15), one has

P

+

sup

{|(En − E)(f g)|} > t

P

sup

f,g∈Gn

U B

K

L

�

# (ℑk )

k=1

sup

f,g∈Gn

UB

∗ ∗

|(En − E)(f g − fK

gK )| > t

∗

∗

gk−1

) >t

(En − E)(fk gk − fk−1

fk ,gk ∈ℑk

k=1

∞

L

�P

sup P

fk ,gk ∈ℑk

(

1

2k

,

∗

∗

(En − E)(fk gk − fk−1

gk−1

) >t

for n sufficiently large. By plugging (2.14) with ε =

t

,ε

2k 1

1

2K

1

2k

)

= ε2 =

,

1

3k−1

(2.16)

into the last term

above, one has

P

sup

f,g∈Gn

UB

{|(En − E)(f g)|} > t

}

}

{

qt2 /22k

qt/2k

3

�

+ exp −

2 /32(k−1)

q

20An2 /3k−1

200A

n

k=1

( ) r (k−1)

2(r−1)

n 2r

2 2r+1

+ C3 nAn2r+1 e−C2 q 2r+1

3(k+1)dJn ,

3

[ 2 ]

1

[ ( 4 )r 2r r 2r+1

1/2

where C3 = 22 12 5t

C1 r!

. Now, let q = n 3 . Recall that An ≍ Nn , Jn ≍ Nn .

∞

L

2n

(k+1)dJn

Assumption (A3) gives

P

A2n Jn

q

{

exp −

1

≍ n2(θ− 3 ) → 0 as n → ∞. Thus

sup

f,g∈Gn

UB

{|(En − E)(f g)|} > t

}

{

}

{

∞

L

n

qt/2k

n

qt2 /22k

�

4 exp −

+ 4 exp −

q

20An2 /3k−1

q

200An2 /32(k−1)

k=1

( ) r (k−1)

2(r−1)

2r

2 2r+1

−C2 n

2r+1

q 2r+1

+C3 nAn

3(k+1)dJn .

e

3

Then by e−x � x1 e−1 , one gets

P

+

sup

f,g∈Gn

UB

∞

L

k=1

{|(En − E)(f g)|} > t

2(r−1)

2r+1

C3 nAn

n

2r

e−C2 q 2r+1

�

∞

L

k=1

7200

nA2n

q 2 t2

( ) r

(k−1)

2 2r+1

3(k+1)dJn ,

3

( )2k

( )

nA2 2 k

2

+ 240 2 n

3

q t 3

24

in which the first two terms converge to 0

as n → ∞.

Let r =

3. Since

Jn q

n

1

≍ n(θ− 3 ) → 0

as n → ∞, so for n large enough,

( )

3 (k−1)

2 7

−C 6n

C3 nAn

e

2 7q 3(k+1)dJn

3

k=1

{

( )}

∞

L

4

6n

3(k − 1)

2

7

=

C3 nAn exp −C2

+ d(k + 1) (log 3) Jn +

log

7q

7

3

k=1

{

( )}

∞

L

4

6n

3(k − 1)

2

�

C3 nAn7 exp − C2 +

log

7q

7

3

∞

L

4

7

k=1

{

}L

∞ ( ) 3(k−1)

7

6n

2

,

=

C3 nAn exp − C2

7q

3

4

7

k=1

which also goes to 0 as n → ∞. Therefore, lim supP

n→∞

sup

f,g∈Gn

UB

{|lf gln − lf gl|} > t

Lemma 2.6.1. Under Assumption (A2), for any function h =

�

�d

a constant C ≤ 1, such that C dl=1 lhl l � lhl ≤ l=1

lhl l .

�d

l=1 hl

= 0.

∈ H, there exists

Proof. Under Assumption (A2), one can assume that there exist constants 0 < b ≤

B such that the density function b ≤ fXt ≤ B on [0, 1]d . Let Wl = (X1 , · · · , Xl ) and

Sl = h1 + · · · + hl for l = 1, · · · , d. We show by induction that, for each l = 1, · · · , d,

where δ =

J

(

1−

b

B.

1 − δ

2

) l−1

2

(lh1 l + · · · + lhl l) � lSl l ,

(2.17)

For l = 1, (2.17) is a trivial case. Suppose (2.17) is true for l < d, we

show that (2.17) holds for l + 1. When lhl+1 l = 0 or lSl l = 0, since H is theoretically

identifiable, it is a trivial case. Therefore one may assume that lhl+1 l > 0 and lSl l > 0.

Denote ρ =corr(Sl , hl+1 (Xl+1 )). Then the part of variance of hl+1 (Xl+1 ), which cannot

25

be explained linearly by Sl (Wl ), can be written as

{

}

(1 − ρ2 ) lhl+1 l2 = minE [hl+1 (Xl+1 ) − γSl (Wl )]2

γ

j 1 j

= min

[hl+1 (xl+1 ) − γSl (wl )]2 fWl ,Xl+1 (wl , xl+1 )dwl dxl+1

γ

;

0

b

min

B γ

Wl ∈[0,1]l

j

Wl ∈[0,1]l

=

b

min

B γ

j

Wl ∈[0,1]l

=

Therefore 1 − ρ2 ;

b

B.

j

1

0

(hl+1 (xl+1 ) − γSl (wl ))2 fXl+1 (xl+1 )dxl+1 dwl

[ ( 2

)

r

E hl+1 (Xl+1 ) + γ 2 Sl2 (wl ) dwl

b

lhl+1 l2 .

B

Hence −δ � ρ � δ. Consequently,

lSl+1 l2 = lSl l2 + 2ρ lSl l lhl+1 l + lhl+1 l2

1 + ρ

(lSl l + lhl+1 l)2

2

(

) l−1

1−δ

1−δ 2

;

(lh1 l + · · · + lhl l) + lhl+1 l

2

2

(

)

1−δ l

;

(lh1 l + · · · + lhl+1 l)2 .

2

;

Proof of Lemma 2.2.2. Given h =

�d

l=1 hl

2

∈ H, lhl = 0, from the definition of

theoretical inner product one knows that h = 0 a.s. Besides, Lemma 2.6.1 gives 0 �

�

C dl=1 lhl l � lhl = 0. So lhl l = 0 for l = 1, · · · , d.

Given g ∈ Gn , lgln = 0. Lemma 2.2.1 entails that, except on a set whose probability

tends to zero as n → ∞,

1

lgl2 � lgl2n � 2 lgl2 , g ∈ Gn .

2

(2.18)

Thus lgl = 0. Since g ∈ Gn ⊆ H, one has g = 0 a.s.

For the last identifiability, properties of centered spline function assures that there

exist x∗l such that gl (x∗l ) = 0, l ∈ {1, · · · , d}. Given l0 , since the joint density of X is

bounded away from 0, one has that P (Xl = xl∗ , l = l0 ) > 0. Therefore,

26

d

L

L

∗

(x

)

+

g

(X

)

=

0

;

P

gl (Xl ) = 0 = 1.

P (gl0 (Xl0 ) = 0) = P

gl l

l0

l0

li=l0

2.6.4

l=1

Proof of Theorems

Proof of Theorem 2.2.1. We divide the norms of estimation error into two parts

by Triangular Inequality. To be specific, lµ̂ − µl � lµ̂ − µ̃l + lµ̃ − µl and lµ̂ − µln �

−(p+1)

lµ̂ − µ̃ln + lµ̃ − µln . Recall that ρn ≍ Nn

. Theorem 2.2.1 can be proved by showing

(i) lµ̂ − µ̃l2n = OP ( Nnn ), lµ̂ − µ̃l2 = OP ( Nnn );

(ii) lµ̃ − µl2n = OP (ρn ), lµ̃ − µl2 = OP (ρn ).

n

n

To prove (i), denote {φj }dJ

j=1 as a set of orthonormal basis of the additive space G

�dJn

with respect to the empirical inner product. Note that µ̂ − µ̃ = QY − Qµ = j=1

(Q(Y −

�dJn

µ), φj )n φj = j=1 (Y − µ, φj )n φj . Therefore, with εt = Yt − µ(Xt ), one has

(

E lµ̂ −

µ̃l2n

)

=

dJn

L

j=1

=

E(Y −

dJn

L

E

j=1

�

dJn

L

µ, φj )n2

1

n2

n

L

=

dJn

L

j=1

2

n

1L

E

εt φj (Xt )

n t=1

ε2t φ2j (Xt ) + E

t=1

1

n2

L

εs εt φj (Xs )φj (Xt )

1�s<t�n

(Ij1 + Ij2 ) .

j=1

For the first part,

Ij1 =

n

n

r}

r

1 L [ 2 2

1 L { [ 2

φ

(X

)

=

E E φj (Xt )εt2 |Xt

E

ε

t

t j

2

2

n

n

t=1

=

1

E

n2

t=1

n

L

φ2j (Xt )σ 2 =

t=1

σ2

n

.

As in Ij2 , given each pair of (s, t), one has

E [εs εt φj (Xs )φj (Xt )]

= E {E [εs εt φj (Xs )φj (Xt )|σ {X1 , . . . , Xt }]}

= E {εs φj (Xs )φj (Xt )E [εt |σ {X1 , . . . , Xt }]} = 0

27

since E [εt |σ {X1 , . . . , Xt }] = 0. Therefore lµ̂ − µ̃l2n = OP ( Jnn )

=

OP ( Nnn ). The inequality

(2.18) further gives that lµ̂ − µ̃l2 = OP ( Nnn ).

To prove (ii), Theorem 6 on Page 149 of de Boor (2001) entails that, for ev­

ery l = 1, . . . , d, there exists a constant C ∗ and a spline function gl∗ ∈ Gnl

satisfying

�d

∗

lgl∗ − µl l � C ∗ ρn . Denote g∗ =

l=1 gl . Then through Triangular Inequality, one

gets lg∗ − µl = OP (ρn ). Inequality (2.18) entails that lg∗ − µln = OP (ρn ). As we

mentioned before, µ̃ is the best approximation of µ in Gn with respect to the empiri­

cal norm. Thus one has lµ̃ − µln � lg∗ − µln = OP (ρn ). Furthermore, lµ̃ − g∗ ln �

lµ̃ − µln +lg∗ − µln = OP (ρn ). Again inequality (2.18) gives lµ̃ − g∗ l = OP (ρn ). Therefore lµ̃ − µl � lµ̃ − g ∗ l + lg∗ − µl = OP (ρn ).

Corollary 2.6.4.1. Denote µ̂ =

Then

�d

jl ,

l=1 µ

µ̃ =

�d

Jl ,

l=1 µ

where µ

jl , µ

Jl ∈ Gnl for l = 1, . . . , d,

J

J

(i) lµ

jl − µ

Jl l = OP ( Nn /n) and lµ

jl − µ

Jl ln = OP ( Nn /n);

Jl − µl ln = OP (ρn );

(ii) lµ

Jl − µl l = OP (ρn ) and lµ

J

J

jl − µl ln = OP ( Nn /n + ρn ).

Consequently, lµ

jl − µl l = OP ( Nn /n + ρn ) and lµ

�

Proof. Lemma 2.6.1 and conclusion (i) in Theorem 2.2.1 gives dl=1 lµ

jl − µ

Jl l =

J

�d

�d

OP ( Nn /n) and l=1 lJ

µl − µl l = OP (ρn ). Inequality (2.18) further proves l=1 lµ

jl − µ

Jl ln =

J

OP ( Nn /n). Since µ̃ is the best approximation of µ in G with respect to the empirical

norm, Lemma 2.2.2 entails that µ

Jl is the best approximation of µl in G with respect to

the empirical norm for l = 1, · · · , d as well. Recall gl∗ in proof of Theorem 2.2.1 (ii) such

�

�d

that lgl∗ − µl l = OP (ρn ), then by (2.18) one has dl=1 lµ

Jl − µl ln � l=1

lgl∗ − µl ln �

�

2 dl=1 lgl∗ − µl l = OP (ρn ).

28

Corollary 2.6.4.2. For µ = µ1 + · · · + µr , replace the approximation space Gn with G(0) ,

(0)

(0)

one has that the least squared estimator µ

j(0) = Q(0) Y = g1 + · · · + gr

µ̂(0) − µ

2

= OP (Nn /n + ρ2n ) and µ̂(0) − µ

2

n

= OP (Nn /n + ρ2n ).

Proof of Theorem 2.2.2. It is sufficient to prove µ

jP L − µ

µ

jPl L − µl

also satisfies

2

= OP (Nn /n + ρ2n ) and

2

= OP (Nn /n + ρn2 ) for l = 1, · · · , d. For µ = µ1 + · · · + µr , we have two

�

(0)

least-square estimators µ

j ∈ Gn and µ

j(0) = rl=1 µ

jl ∈ G(0) . Again from Theorem 6 on

�

Page 149 of de Boor (2001), for arbitrary positive C4 and any g ∗ = dl=1 gl∗ ∈ Gn such

J

that lg ∗ − µl = C4 Nn /n + ρ2n . Since pλn (·) ; 0, pλn (0) = 0, one has

∗

(0)

j

l(g ) − l(µ

) ;

=

1

2

1

2

(

(

lY −

g ∗ l2n

− Y −µ

j

j−µ

j(0)

lµ

j − g ∗ l2n − µ

= I + II

Denote ǫn = sup

g∈G

{

n sufficiently large,

2I

1g12n

1g12

2

(0)

n

2

n

)

)

+

+

r [

L

l=1

r [

L

l=1

(0)

pλn (lgl∗ ln ) − pλn ( µ

jl

n

(0)

jl

pλn (lgl∗ ln ) − pλn ( µ

n

]

)

]

)

}

− 1 . Lemma 2.2.1 tells that ǫn → 0 as n → ∞. Therefore, for

2

; lj

µ − g ∗ l2 (1 − ǫn ) − µ

j−µ

j

(0) (1 + ǫn )

(

)

2

2

(0)

∗ 2

(0)

∗ 2

= lj

µ−g l − µ

j−µ

j

− ǫn lj

j−µ

j

µ−g l + µ

(

)

2

1

(0)

∗ 2

;

lj

µ−g l − µ

j−µ

j

2

(

)

2

1

2

∗

(0)

∗

(0)

;

lg − µl − 2 lµ

j − µl lg − µl −

µ

j − µ + 2 lµ

j − µl µ

j −µ

2

J

2

(

)

1

=

C42 Nn /n + ρ2n − 2C4 Nn /n + ρ2n lµ

j − µl − µ

j(0) − µ

2

]

(0)

−2 lµ

j − µl µ

j −µ .

The last three terms are all of OP (Nn /n + ρ2n ) by Theorem 2.2.1 and Corollary 2.6.4.2.

Therefore by choosing C4 large enough, one can assure that the first positive term dom­

inates the rest three, indicating that I ; 0 as for n large enough. For II, consider

29

any l ∈ {1, · · · , r}.

One has that

(0)

(0)

µ

jl

(0)

; lµl l − µ

jl

− µl .

Lemma 2.6.1 im­

plies that µ

jl − µl � C −1 µ

j(0) − µ , and Corollary 2.6.4.2 gives that µ

j(0) − µ =

J

J

(0)

−(p+1)

jl

; lµl l − OP ( Nn /n + ρn2 ). Again with ρn ≍ Nn

OP ( Nn /n + ρ2n ). Thus µ

,

J

θ−1

(0)

Nn

2

2 ) = OP (1). So

µ

jl

; 21 lµl l ; aλn

Assumption (A3) indicates

n + ρn = oP (n

(0)

since λn → 0. Consequently, pλn ( µ

jl

n

)=

a+1 2

2 λn

for n large enough. Similarly, since

lgl∗ l ; lµl l − lgl∗ − µl l ; lµl l − C ∗ ρn , one gets pλn (lgl∗ ln ) =

a+1

2

2 λn

for n large enough.

Therefore, II → 0 as n → ∞. In all, l(g∗ ) − l(µ

j(0) ) ; I + II > 0. Since for any g∗

J

J

that lg∗ − µl = C4 Nn /n + ρ2n , one has l(g ∗ ) > l(µ

j(0) ) with µ

j(0) < C4 Nn /n + ρn2 for

some sufficiently large C4 , one can conclude that there exists a local minimizer µ

jP L of the

{

}

J

criterion function l(g) in the subset of G, g : lg − µl � C4 Nn /n + ρ2n . This further

assures that µ

jP L − µ

2

= OP (Nn /n + ρ2n ).

Proof of Theorem 2.2.3. As in the proof of Theorem 2.2.2, given l ∈ {r + 1, · · · , d},

J

for arbitrary gl ∈ Gnl such that lgl l = OP ( Nn /n + ρ2n ) and arbitrary g(0) ∈ G(0) such

J

that g(0) − µ = OP ( Nn /n + ρ2n ), one can see that,

l(g

(0)

) − l(g

(0)

+ gl ) =

=

(

1

Y − g (0)

2

(

1

µ

j − g (0)

2

2

n

2

n

− Y −g

(0)

2

− gl

− µ

j − g (0) − gl

n

2

n

)

)

− pλn (lgl ln )

− pλn (lgl ln ).

30

By Lemma 2.2.1, the empirical norm can be switched to the theoretical norm, which is

l(g

(0)

) − l(g

(0)

+ gl ) �

(

(0)

2

2

(0)

)

µ

j−g

− µ

j − g − gl

− pλn (lgl l)

)

(

� lgl l µ

j − g(0) + µ

j − g (0) − gl − pλn (lgl l)

(

) p (lg l)

1

λ

l

lgl l µ

j − g (0) + µ

j− g(0) − gl − n

= λn

λn

λn

= λn lgl l

p′ (ω)

j − g(0) + µ

j − g(0) − gl

µ

− λn

λn

λn

2 µ

j− g (0) + lgl l p′λn (ω)

� λn lgl l

−

λn

λn

(

)

2 lµ

j − µl + µ − g (0) + lgl l pλ′ n (ω)

� λn lgl l

−

λn

λn

� λn lgl l

Rn p′λn (ω)

−

,

λn

λn

where 0 � ω � lgl l. The last term is derived from Taylor Expansion.

(√

)

Nn /n+ρ2n

n

=

O

= OP (1).

Theorem 2.2.1 and restrictions on g (0) and gl give R

P

λn

λn

′ (ω)

pλ

n

λn , since

p′ (ω)

Therefore λλnn

For

any g(0) ∈ G(0)

ω � lgl l → 0 as n → ∞, one has that

Rn

λn ,

l(g (0) ) � l(g(0) + gl ) −

J

with g (0) − µ = OP ( Nn /n + ρ2n ),

dominates

′ (ω)

pλ

n

λn

λn 1gl 1

2

= 1 for n large enough.

< l(g(0) + gl ). That is, for

min√

gl ∈Gl ,1gl 1=OP (

�d

jlP L , whose

l=1 µ

l(g (0) + gl ) =

Nn /n+ρ2n )

l(g(0) ). Therefore, for the local minimizer µ

jP L =

existence is assured by

[ PL

r

Theorem 2.2.2, one has that limn→∞ P µ

jl = 0 = 1 for l = r + 1, · · · , d.

31

TABLE 2.1: Autoregressive models in the simulation study

Model

Function

AR1

Yt =0.5Yt−1 + 0.4Yt−2 + 0.1εt

AR2

Yt =−0.5Yt−1 + 0.4Yt−2 + 0.1εt

AR3

Yt =−0.5Yt−6 + 0.5Yt−10 + 0.1εt

NLAR1

NLAR2

NLAR3

NLAR1U1

NLAR1U2

} {

}

{

3 / 1 + (Y

4

2 )/(1 + Y 2 ) + 0.6 3 − (Y

Yt =−0.4(3 − Yt−1

t−2 − 0.5)

t−2 − 0.5)

t−1

+0.1εt

{

}

{

}

2 ) Y

2

Yt = 0.4 − 2 exp(−50Yt−6

t−6 + 0.5 − 0.5 exp(−50Yt−10 ) Yt−10 + 0.1εt

{

}

2 ) Y