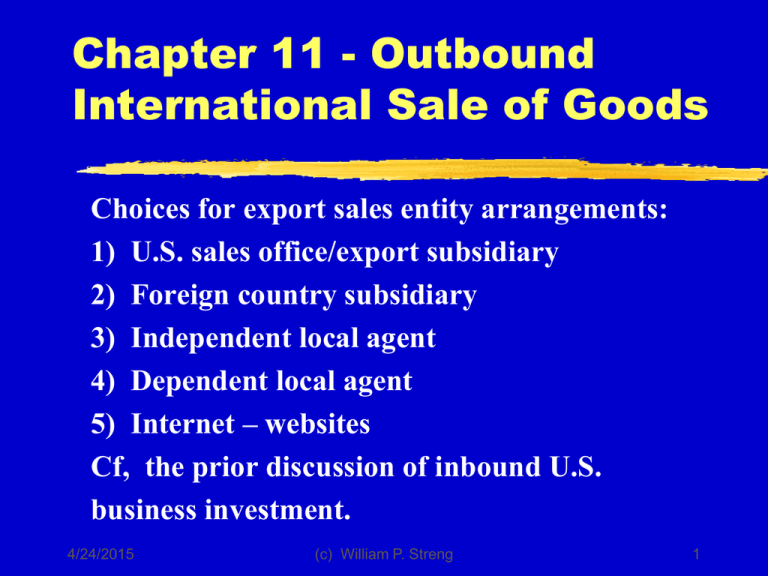

Chapter 11 - Outbound International Sale of Goods

advertisement

Chapter 11 - Outbound International Sale of Goods Choices for export sales entity arrangements: 1) U.S. sales office/export subsidiary 2) Foreign country subsidiary 3) Independent local agent 4) Dependent local agent 5) Internet – websites Cf, the prior discussion of inbound U.S. business investment. 4/24/2015 (c) William P. Streng 1 Tax Exposure in the Foreign Jurisdiction p.883 1) No foreign country tax exposure if no representative office in the jurisdiction – but, dependent upon local country tax law. 2) Tax liability if a local agent exists, unless that agent is “independent” of the U.S. principal. 3) Foreign country tax liability arises for a local country subsidiary (but a possible exception exists if the corporate “place of mind and management” is elsewhere). 4/24/2015 (c) William P. Streng 2 U.S. Foreign Tax Credit Planning p.883 Assuming foreign country income tax jurisdiction does exist – the U.S. tax planning objective is to limit foreign income taxes to assure that no excess foreign tax credits arise. Consider: the §904(d)(1)(B) general limitation basket & the §904(d)(3) look-through rules. U.S. income tax multiple objectives to generate income as: (i) foreign source, (ii) low taxed in the foreign country, & (iii) in the FTC “general limitation” category. 4/24/2015 (c) William P. Streng 3 Possible Impact of an Income Tax Treaty p.884 For the U.S. taxpayer the foreign country income tax result may be moderated by a bilateral income tax treaty between (1) the foreign destination country and (2) the U.S. (or, perhaps, between an intermediary third jurisdiction and the destination country). Query: Does a P.E. exist? However, a foreign country may impose less extensive tax jurisdiction than under the tax treaty (e.g., using a “participation exemption” system). 4/24/2015 (c) William P. Streng 4 Application of a Bilateral U.S. Income Tax Treaty 1) Business profits allocation – Art. 7(1) determination of the amount of business profits subject to foreign country income tax. 2) Amount of income subject to tax - choices are: (a) only that income attributable to the P.E., or (b) a “limited force of attraction” rule, similar to U.S. rules (or unlimited force of attraction). 3) Income tax deduction available for expenses? 4/24/2015 (c) William P. Streng 5 Tax Treaty Concept of “Permanent Establishment” P. 887. A “permanent establishment” is a fixed place of business for engaging in industrial or commercial activity. See U.S. Model Treaty, Article 5(1). How distinguish between a “dependent” and an “independent” agent? Art. 5(5) & (6). Remember the Taisei Fire case (U.S. Tax Court) in the inbound reinsurance context where the agent had multiple principals. 4/24/2015 (c) William P. Streng 6 Income Tax Treaty Interpretation Tools p.895 1) OECD Commentary (p. 895) - under continual revision by OECD 2) U.S. Treasury Dept. (unilateral?) “Technical Explanation” of a particular bilateral U.S. income tax treaty (& the 2006 U.S. Model Tax Treaty). 3) Court decisions in the U.S. and other jurisdictions (e.g., Taisei, concerning definition of an “independent agent”). 4/24/2015 (c) William P. Streng 7 Problem 1 p.898 Independent Distributor Cosmos, U.S. corporation, makes export sales to independent distributor in S. Korea that buys from Cosmos and resells for its own account. Cosmos has no sales office in S. Korea. Minimal contacts in S. Korea. Cosmos P.E in S. Korea? No. Article 9 (p.890). Is income realized by Cosmos on these sales subject to S. Korea income tax? No, since no P.E. Independent distributor is not a P.E. of Cosmos. 4/24/2015 (c) William P. Streng 8 Problem 2 p.898 Orders Accepted in Country Cosmos employees had (and exercised) authority to accept orders when visiting the distributor in South Korea. P.E. would exist in S. Korea because Cosmos employees are deemed to be persons acting on behalf of Cosmos – they have and habitually exercise authority to conclude sales contracts in the name of Cosmos. Article 9(4)(a). P. 891. 4/24/2015 (c) William P. Streng 9 Problem 3 Greece treaty p.898 p.888 Distributor in Greece and Cosmos export division employees had no authority to negotiate a sale but only to solicit and accept orders on the standard terms and conditions of sale as required by the Cosmos. Greece treaty, Article II(1), requires that an agent (including an employee?) must have authority to negotiate and conclude contracts for foreign enterprise before being a P.E. 4/24/2015 (c) William P. Streng 10 Problem 4 Agents as P.E.? p.898 Mfg. Reps. What is the possible authority (without P.E. status) if an agent is in Belgium or South Korea? Agent as independent only if legally and economically independent of the principal. What is the degree of control by the principal in these situations? Limited control? Agents here seem to be independent (do they have their own risk of loss?) And, they are not subject to comprehensive control or detailed instructions. 4/24/2015 (c) William P. Streng 11 Problem 5 p.898 Market Research - Purchasing Market research and purchasing offices established in South Korea and Greece: 1) S. Korea treaty - (a) Article 9(3)(d) & (e) market research/advertising and purchasing office does not create a P.E. 2) Greece treaty - No counterpart of Article 9(3). See Article II(1) re possible income taxation for advertising (but not purchases – Article II(1)(i))? 4/24/2015 (c) William P. Streng 12 Problem 6 Local manufacture p.899 Locally manufactured components are resold by the Cosmos offices to Belgian or Greek manufacturers. 1) S. Korea - See Article 9(5)(b) (p. 891) indicating that the Article 5(3)(d) exemption does not apply if all or part of the goods purchased in S. Korea are sold by Cosmos for use, consumption or disposition in S. Korea. 2) Greece - same result. See Article II(1). 4/24/2015 (c) William P. Streng 13 Problem 7 p.899 Engineers in S.Korea &Greece Offices with staffs of engineers to (a) provide advice to potential customers and (b) provide after-sales warranty services. 1) S. Korea treaty - no explicit exemption from P.E. characterization & these services are not of a preparatory or auxiliary character. 2) No exemption under the Greece treaty. P.E.s in both situations? Probably. 4/24/2015 (c) William P. Streng 14 Problem 8 p.899 Warehouses in All Countries Are warehouses exempt from a P.E. classification and deliveries are made to distributors? 1) Belgium treaty - Article 5(4)(a), yes (p.892) 2) S. Korea treaty - Article 9(3)(a), yes (p.890) 3) Greece treaty - Article II(1)(i) – a warehouse is not excluded from P.E. classification (note: an agent with a “stock of goods”). P.888. 4/24/2015 (c) William P. Streng 15 Problem 9 Local processing p.899 Products shipped for local processing before delivery to local distributors who purchase under export orders accepted in U.S. Exclusion from P.E. definition for a stock of goods belonging to the enterprise for processing by another enterprise? Belgium treaty Article 5(4)(c). Cf., S. Korea treaty, Art. 9(5), a P.E. exists if items sold for consumption in S. Korea. 4/24/2015 (c) William P. Streng 16 Problem 10 p.899 Out-of-country Delivery Products shipped for local processing before being delivered to out-of-country distributors. Belgium (Art. 5(4)(a)) & S. Korea (Art. 9(3)(a)) treaties - no P.E. exists. Greece treaty – a P.E. exists without regard to where the products are sold (Article II(1)). 4/24/2015 (c) William P. Streng 17 Problem 11 p.899 Subsidiaries of U.S. Parent Co. Subsidiaries as permanent establishments of Cosmos? These subsidiaries act as “independent distributors.” Subsidiary is not regarded as a P.E. of Cosmos under any of the three treaties: Belgian Treaty, Article 5(7) S. Korea Treaty, Article 9(7) Greece Treaty, Article II(1) OECD Commentary, see p. 896. 4/24/2015 (c) William P. Streng 18 Problem 12 Subsidiaries as Agents p.899 Subsidiaries function as agents of Cosmos and employees of subsidiaries regularly negotiate export sale contracts and enter into contracts on behalf of Cosmos for commissions paid to subsidiaries. Sales are made directly by Cosmos to local customers. If subsidiaries function as Cosmos agents and exercise authority specified, P.E. status for Cosmos. Belgian Treaty, Article 5(5); S. Korea Treaty, Article 9(4)(a), Greece Treaty, Article II(1). 4/24/2015 (c) William P. Streng 19 Problem 13 p.899 “Force of Attraction” Rule Cosmos has three divisions: radios, refrigerators, and toys. Toy division has sales offices in Belgium, S. Korea and Greece. Other two divisions handle sales by solicitation in country but home office acceptance of orders. Each toy division's sales offices constitute a P.E. Impact on other income? Greece, Art. III(1) - “force of attraction” rule applies; Others - attributable income only is taxed; Belgium Treaty, Art. 7(1); S. Korea, Art. 8(1). 4/24/2015 (c) William P. Streng 20 Problem 14 p.900 Treaty Income Definition Tax treaty impact – controls the amount of: 1) Includible gross income; and, 2) Expenses (including non-local country expenses G&A, etc. expenses). Belgium: Art. 7(2) S. Korea: Art. 8(2) Greece: Art. III(2), “profits” means deductions? 4/24/2015 (c) William P. Streng 21 Problem 15 Construction Project p.900 U.S. architectural firm designed Belgian, S. Korea and Greece motels - design activities occurred in its U.S. offices. Temporary offices at building sites with employees of U.S. firm responsible for supervision. Project completed within one year. Income tax exposure in foreign country? (1) 12 months rule in the treaty? Belgium, Art. 5(3)(a); (2) S. Korea, Art. 9(2)(h)& 3(f) – 6 months rule; (3) no provision in the Greece treaty. 4/24/2015 (c) William P. Streng 22 Electronic Commerce & P.E. Status p.900 Computer equipment as a P.E. where located in a foreign country. Fixed situs? Where goods are shown or returns are received? What if no tangible connection with a country? Distinction between (1) computer equipment and (2) software for purposes of establishing P.E.? Distinction between website & server. P.902. Independent service provider (ISP) as not an agent for the U.S. seller? 4/24/2015 (c) William P. Streng 23 Problem 1 Independent ISP p.904 Website on a server maintained by an unrelated ISP in Brazil. Orders are transmitted to U.S. from the website. Orders will be filled from U.S. No fixed business place in Brazil for Cosmos. If the ISP is an “agent,” then the status of the agent’s activities would be as “preparatory and auxiliary” (since not concluding contracts binding on Cosmos). 4/24/2015 (c) William P. Streng 24 Problem 2 p.904 Website Acceptance in Brazil Website accepts orders and the customer tenders payment (credit card info) to the website. Website then issues electronic delivery instructions to the U.S. warehouse. Website is not an “agent.” Need for a “human agent” under OECD rules? Computer program oK to establish tax status? Correct result if the website is established and controlled by Cosmos and orders are completed there? Should this be P.E. status? 4/24/2015 (c) William P. Streng 25 Problem 3 p.904 Manufacturer Owns the Server Cosmos owns the server in Brazil. The server will be treated as a “fixed place of business” in Brazil. The activities include accepting orders, beyond preparatory and auxiliary activities. Therefore, the server will constitute a P.E. in Brazil. [Remember that a “P.E.” is a tax treaty term and Brazil actually has no tax treaty with the U.S.] 4/24/2015 (c) William P. Streng 26 Problem 4 Bermuda based server p.904 Cosmos owns, maintains and operates the server located in Bermuda (where no income tax applies). Therefore, the server cannot be a fixed place of business in Brazil. Therefore, no P.E. in Brazil. But, should the server’s physical location be the controlling factor (or be irrelevant) in this context? 4/24/2015 (c) William P. Streng 27 Problem 5 p.904 Physical Status Controlling? Should a website and server located outside the destination country be treated as precluding P.E. status for purposes of tax jurisdiction in the destination country? Too much emphasis on traditional jurisdictional concepts? What is the comparable situation in the U.S. concerning state sales taxation? 4/24/2015 (c) William P. Streng 28 Use of Export Corporation U.S. Tax Planning p.905 Choices: 1) U.S. corporation, including a special purpose U.S. subsidiary. 2) Foreign corporation - including a third country corporation. Categorized as a CFC for Subpart F purposes. 3) Previously, (a) FSC (or, earlier, DISC; note, however, the “interest-charge DISC” is still available); or, (b) gross income (ETI) exclusion (i.e., prior Code §114), determined to be illegal. 4/24/2015 (c) William P. Streng 29 Use of Foreign Export Corporation p.907 Foreign organized corporation is not subject to U.S. income tax, except for its U.S. source income. Assume foreign source income is received for: 1) Services performed at a location outside the United States. 2) Sale of inventory if the title passes outside the United States. Locate in low-tax third country? 4/24/2015 (c) William P. Streng 30 Commission Approach p. 908 Pay a commission for the sales activities rendered in the foreign jurisdiction. If related: Issue concerning an appropriate §482 allocation for the services rendered. Avoid having any activities of the foreign corporation conducted in the United States. But, possible Subpart F exposure for these sales activities (FBCo sales income). 4/24/2015 (c) William P. Streng 31 Purchase and Sale Approach p.908 Purchase at arm's length price and then sell outside the United States, i.e., “buy-sell.” §862(a)(6) re sourcing rule outside U.S. Title passage test under Reg. §1.861-7(c). (i.e., where does title pass to the buyer?). Passage of title at the port of destination? How assure complying with “terms of the deal”? Might have FBC sales income for Subpart F. 4/24/2015 (c) William P. Streng 32 Impact of CFC Rules §954(d) p.910 Defining foreign base company sales income status §954(d). Possible issue concerns whether the “manufacture” of the product by the foreign subsidiary (CFC) has occurred to enable an escape from the “FBC sales income” definition. Note: Dave Fischbein Mfg. Co. case., p.911. Significant major assembly by the Belgian sub. is treated as manufacturing in Belgium and, therefore, as not causing FBC sales income (even though not 20% of value contributed). 4/24/2015 (c) William P. Streng 33 Sales & Manufacturing Branch Rules p.916 §954(d)(2), i.e., the “branch rule”. What objective of establishing a sales branch outside the country where the manufacturing occurs? (or, a manufacturing branch?) Effect of branch rule treatment is to cause the “deemed subsidiary” to be treated (for Subpart F) as (1) a wholly owned subsidiary of U.S. corporation, (2) a CFC, and (3) a party to the sales transaction, with FBC sales income generated. Apply a “tax rate disparity test.” 4/24/2015 (c) William P. Streng 34 Rev. Rul. 75-7 (p.917) revoked by Rev. Rul. 97-48 CFC incorporated in country M. CFC purchased metal ore in U.S. and Canada from related persons. Conversion of ore by CFC under contract with an unrelated foreign corp. in Country O. Only contractual relationships between CFC and the unrelated foreign corporation. Here foreign (contract manufacturer) corp. treated by IRS as a branch – for purposes of “branch rule.” But, a higher income tax rate in the sales co. country makes the branch rule not applicable! 4/24/2015 (c) William P. Streng 35 Ashland Oil, Inc. p.920 Contract Manufacturing Issues concerning foreign branch rule: 1) Does the §954(d)(2) branch rule apply to a “contract manufacturing” arrangement between a CFC and an unrelated corporation? Not in this situation - no “branch.” 2) Is the “manufacturing branch” rule in the regulations invalid? Not determined in this case, since determining that no branch existed. 4/24/2015 (c) William P. Streng 36 Rev. Rul. 97-48 p.929 Revoking Rev. Rul. 75-7 and holding that activities of a contract manufacturer can not be attributed to a CFC for purposes of the branch rule for determining FBCSI status. Also, holding that the manufacturing activity can not be treated as undertaken by the CFC if contract manufacturing for the FBCSI rule of §954(d)(2). Correct position by IRS? Was Ashland a “facts & circumstances” determination? 4/24/2015 (c) William P. Streng 37 “Substantial Contribution” Test p.930 Revised regulations provide for a “substantial contribution” test to determine whether the participation of taxpayer (through its employees) with the contract manufacturer should cause the branch rule to be invoked for those activities. Test: Appropriate to treat contract manufacturing as done by a CFC? See Reg. §1.954-3(a)(4)(iv), p. 932. 4/24/2015 (c) William P. Streng 38 2009 FBCSI Regulations Contract Manufacturing T.D. 9438 (2-2-2009); See Reg. §1.954-3(a)(4)(iv)(b). Re: Contract manufacturing arrangements. CFC substantial contributions made by the CFC to the manufacture process can include: (1) Oversight, (2) Material selection, (3) Management of manufacturing costs, (4) Control of manufacturing logistics, (5) Quality control, (6) Product design. 4/24/2015 (c) William P. Streng 39 Problem 1 Sales branch p.933 §954(d)(2) U.S. corp has manufacturing subsidiary in the Netherlands and this Dutch sub establishes its branch office in Switzerland. Swiss branch handles sales of Dutch manufactured products to non-Dutch customers. Tax rate disparity exists (e.g., less than 90 percent of higher rate – or more than a 5% rate differential). Applicability of the foreign branch rule when goods are (1) manufactured in the Netherlands and (2) sold by Swiss branch? Yes & FBC sales income. 4/24/2015 (c) William P. Streng 40 Prob. 2 - §954(d)(2) P.934 Manufacturing branch Alternative situation of: 1) Dutch manufacturing branch of a 2) Swiss organized CFC. The Swiss corporation handles the sales of products manufactured by the manufacturing branch based in the Netherlands. Reg. §1.954-3(b)(1)(ii) applies a reverse tax-rate disparity test. The manufacturing branch is treated as a separate wholly owned sub. for purposes of the Subpart F rule & Swiss corp. has FBC sales income. 4/24/2015 (c) William P. Streng 41 Prob. 3 P.934 Substantial Contribution? U.S. parent; Bermuda sub. Mexico contract manufacturer for the Bermuda sub with the Bermuda sub having significant participation in activities of the Mexican based contract manufacturer. Because of these activities by the Bermuda sub the Bermuda sub’s income on sales to U.S. parent does not produce foreign base company sales income. Bermuda sub is a “manufacturer.” 4/24/2015 (c) William P. Streng 42 Prob. 4 P.934 Substantial Contribution? a) Singapore involved in manufacturing by CM-C to make Singapore as providing a substantial contribution. b) Distinction between employee of CFC and parent corp. for purposes of the substantial contribution test. c) Independent contractor causing Singapore as to not be deemed as making a substantial contribution? 4/24/2015 (c) William P. Streng 43 Other Tax Savings Using Foreign Export Corp. p.938 1) Organize a 50-50 corporation - no CFC status. 10-50 rule for FTC and “look-through” rule. 2) Manufacture in the country of incorporation the Fischbein scenario. 3) Generate low/no taxed foreign source & correct FTC basket income, so as to moderate the impact of the foreign tax credit limitation provisions. 4) Use foreign tax haven base company to reduce the foreign tax liability. 4/24/2015 (c) William P. Streng 44 Export Tax Incentives Summarized p.941 1) Domestic International Sales Corporations (or DISC) regime – but remaining is the “interestcharge DISC.” 2) Foreign Sales Corporation (FSC) 3) Extraterritorial Income Exclusion, including favorable transition rules. All declared illegal under GATT. 2004 Act: §199 – deduction (up to nine percent) for “qualified production activities” income. 4/24/2015 (c) William P. Streng 45 Prior Tax Incentive - The Foreign Sales Corporation Prior Domestic International Sales Corporations (or DISC) Regime Code §991-994; Revenue Act of 1971 Deferral of a diminishing portion of the income derived from qualified export sales. 1984 – Remaining DISC provisions limited to small DISCs for deferral only of taxable income attributable to a maximum of $10 million of qualified export 4/24/2015 (c) William P. Streng receipts. 46 Tax Incentive System for Exports Year 2000 enactment FSC replaced with a gross income exclusion for “extraterritorial income”. Code §114. U.S. manufacturers can permanently exclude a portion of their export profit. WTO declares illegal export subsidy. Repeal transition rules also illegal. 4/24/2015 (c) William P. Streng 47 Prior Tax Treatment of FSCs Code §§921-927 and Code §291(a)(4). Permanent exemption of a portion of the export income from U.S. income tax. FSC must be a foreign corporation with a substantial presence abroad. FSC operates as a wholly owned sub of the U.S. parent and sells U.S. goods produced by the U.S. parent or an affiliate. 4/24/2015 (c) William P. Streng 48 Formal FSC Qualification Requirements 1) Foreign corporation - in qualified foreign country or a U.S. possession Exchange of information agreement with the foreign country or adequate exchange of information provision in the applicable income tax treaty. U.S.V.I. or Barbados 2) Number of shareholders - not more than 25. Usually one. 4/24/2015 (c) William P. Streng 49 FSC Requirements continued 3) No preferred stock, but more than one class of common is possible. 4) At least one nonresident director. What if death? May be a nonresident U.S. citizen. 5) Maintain a foreign office. Computer diskette OK to establish a foreign office? 6) U.S. location for tax records. 7) Election to be treated as a FSC. 4/24/2015 (c) William P. Streng 50 Treatment of FSC Income Exemption for a portion of the FSC's "foreign trade income" Must be gross income attributable to "foreign trading gross receipts”: 1) Management of the FSC carried on outside the United States and 2) Economic processes from which the income is earned take place outside the United States. 4/24/2015 (c) William P. Streng 51 Defining Foreign Trading Gross Receipts 1) Sale of export property 2) Lease of export property 3) Services concerning export property 4) Engineering and architecture for foreign construction projects 5) Managerial services for unrelated FSC or DISC 4/24/2015 (c) William P. Streng 52 Defining Export Property Export property is property manufactured in U.S. from majority of U.S. components. Code §927(a)(1). Exclusions from export property when: 1) ultimate use in the U.S. 2) use by U.S. Government 3) U.S. subsidized transaction 4) receipts from another FSC 4/24/2015 (c) William P. Streng 53 Foreign Management Test 1) Meetings of Board of Directors and shareholders outside the U.S. 2) Principal bank account in a country where exchange of information rules are satisfied. 3) Dividends, legal and accounting fees, and officers and directors compensation paid from this account. Code §924(c). 4/24/2015 (c) William P. Streng 54 Foreign Economic Processes Test Economic processes to generate the income must be located outside the United States. 1) Participation in the solicitation (other than advertising), the negotiation or the making of the contract relating to the transaction. 2) At least 50 percent of the direct costs attributable to the transaction for five categories of sales-related activities. 4/24/2015 (c) William P. Streng 55 Foreign Direct Costs Requirement a) advertising and sales promotion. b) processing of customer orders and arranging for delivery. c) transportation to the customer. d) preparation and sending of the final invoice or the statement of account and the receipt of payment. e) assumption of the credit risk. 4/24/2015 (c) William P. Streng 56 Defining Foreign Trade Income Amount Pricing rules where the purchase of goods is by the FSC from its U.S. parent corporation: 1) Arm's length pricing - Code §482. 2) Administrative pricing rules. Statutory pricing rules. Code §925(a)(1) and (2). 4/24/2015 (c) William P. Streng 57 Taxation of the FSC Exempt foreign trade income treated as foreign source income not effectively connected with the conduct of a trade or business within the United States. Code § 921(a). Remaining income treated as effectively connected with the conduct of a trade or business in the United States. Code § 921(d). 4/24/2015 (c) William P. Streng 58 Taxation of FSC Shareholders 1) U.S. corporation is entitled to a 100 percent dividends received deduction for distributions from E&P attributable to foreign trade income, other than Code § 923(a)(2) non-exempt income. 2) Exemption from foreign base company sales income rules for the exempt foreign taxed income-Code § 951(e). 4/24/2015 (c) William P. Streng 59 Interest Charge DISC p. 951 Deferral of tax on taxable income attributable to $10 million or less of qualified export receipts for each tax year. Interest charge imposed on the shareholders of the DISC. Taxable income of the DISC attributable to qualified export receipts that exceed $10 million is deemed distributed but the DISC is not disqualified. 4/24/2015 (c) William P. Streng 60 Archer-Daniels-Midland Co. p. 957 ADM argument that 4 percent of qualified export receipts from agricultural exports is permitted in establishing the transfer price for determining DISC taxable income. ADM position that even if combined taxable income from the export transactions is zero it can still allocate four percent of the gross to the DISC. Held: no such allocation permitted. 4/24/2015 (c) William P. Streng 61 Small FSC Need not meet the (i) foreign management and (ii) foreign economic processes requirements Up to $5 million gross receipts limitation. If exceeding $5 million, can then pick the $5 million receipts to which this limitation is allocated. 4/24/2015 (c) William P. Streng 62 Financing of Exports p. 962 Export financing interest is excluded from a separate basket for passive income for FTC purposes. Included in the general limitation basket. 4/24/2015 (c) William P. Streng 63