ECONOMIC REPORT of the HUDSON VALLEY

advertisement

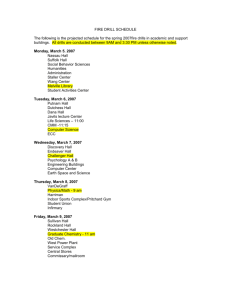

ECONOMIC REPORT of the HUDSON VALLEY First Quarter 2011 MARIST COLLEGE Dr. Christy Huebner Caridi Bureau of Economic Research School of Management Poughkeepsie, New York 12601 Edited by Leslie Bates June 2011 This report is available on the Bureau of Economic Research homepage at http://www.marist.edu/management/bureau The support of research assistant Haley Hart and Heather Iori is acknowledged and appreciated. While every effort has been made to ensure that the information in this report is accurate, Marist College cannot be held responsible for any remaining errors. Hudson Valley Two years into the national recovery, the economy is weak and becoming weaker with each passing day. Real GDP growth is below trend – annualized rate of 1.8 percent, the unemployment rate remains above the “natural” rate, private-sector job creation is barely keeping pace with the reduction in public-sector jobs and the housing market continues to negatively impact consumer sentiment. Further, weak income growth in concert with increased fuel costs has negatively impacted retail sales growth; retail sales began to decelerate in the 1st quarter. The direct consequence of this nascent trend is a slowdown in the trade, transportation and utilities sector, an important albeit low-wage employer. The secondary consequence – in a consumerdriven economy – is a further decline in economic growth. Whether the above factors have moved the economy into a double-dip recession or are simply a harbinger of sustained substandard growth cannot be determined at this time. One of the more important factors is the labor market. The longer the economy remains on a slowgrowth track, the stronger the possibility that the labor market may never fully recover. The result will be a permanent increase in the level of joblessness. This pool of the ‘structurally unemployed’ will place an increasing burden on social assistance at the exact time the government sector is attempting to rein in public welfare programs. The long-term result will be a permanent decline in economic growth and the creation of a permanent underclass. Pieces of this puzzle have already begun to fall into place. Since the 1991 recession, jobless recoveries have become the norm, long-term joblessness is on the rise and an increasing number of persons have left the labor force. Region-wide, employment and labor-force participation reached a near-term peak in the 3rd quarter of 2008. Since that time, labor-force participation and employment have fallen 7.06 percent (84,100) and 8.68 percent (98,100), respectively. Year-over-year, labor-force participation in the Hudson Valley fell 1.16 percent from 1,126,059 in the 1st quarter of 2010 to 1,112,984 in the 1st quarter of 2011. Over the same one-year period, employment declined .53 percent from 1,033,239 to 1,027,802.Because the number of persons in the labor force fell (13,075) by more than the reduction in employment (5,437), the unemployment rate declined .59 percentage points from 8.24 percent to 7.65 percent. The decline in the labor force is an important event that is national in scope. Between July of 2008 and April of the current year, the national labor market participation rate declined from 66.00 percent to 64.20 percent. Factors that have contributed to this trend include but are not limited to: early retirement from public- and private-sector employment, retraining, the pursuit of higher education, discouraged workers and disability. Job creation within the Hudson Valley remains mixed. The year-over-year decline in public-sector employment at 4,700 all but eliminated the positive impact from private-sector job creation (4,900). Over the 12-month period ending in March of 2011, the region-wide job-count advanced in the professional and business services sector (2,800), the education and health sector (2,300), the leisure and hospitality sector (1,700), and the trade, transportation and utilities sector. Of the above-named sectors, only two have posted positive post-recession employment growth: the education and health services sector and the professional and business services sector at 8,100 and 1,900, respectively. Employment continues to fall in manufacturing (1,200), financial activities (700) and information (500). Within the region, year-over-year employment advanced (1,000) in the Rockland-Westchester-Putnam, NY, MSA; declined (1,000) in the Poughkeepsie-Newburgh-Middletown, NY, M.S.A. (Dutchess and Orange counties), advanced (200) in the Kingston, NY, MSA (Ulster County) and was unchanged in Sullivan County. The Average Weekly Wage (AWW) paid in the nonfarm sector advanced between the 4th quarter of 2009 and the 4th quarter of 2010 (latest numbers). The largest percentage increase in nonfarm wages occurred in Rockland County at 5.07 percent. Putnam County posted the smallest increase at 1.42 percent. The AWW in the public sector advanced region-wide. Rockland County posted the highest increase at 8.72 percent, followed by Orange and Sullivan counties at 6.41 percent and 3.21 percent, respectively. The smallest increase in public-sector wages occurred in Ulster County at 1.59 percent. The AWW paid in the traditionally high-wage, goods-producing sector (manufacturing, construction and mining) was a mixed picture. The wage increased in Rockland (7.50 percent), Westchester (4.77 percent), Orange (2.97 percent), Dutchess (2.70 percent) and Ulster (0.33 percent), and decreased in Putnam (1.88 percent), and Sullivan (2.43 percent). The highest AWW in the goods-producing industries occurred in Westchester and Dutchess counties at $1,736 and $1,676, respectively. Across the region and on average, for every one dollar paid in the goods-producing industries, $.60 is paid in the serviceproviding industries. An important exception is Westchester County. Westchester’s service sector is heavily weighted in top-tier service-sector jobs and as a direct consequence the wage premium paid in the goods-producing sector is approximately one half ($.30) of the average regional wage premium. The household budget continues to be negatively impacted by the rising price of necessities, slow job growth and long-term unemployment and underemployment. The consequence has been an increase in the number of households dependent on food stamps, temporary assistance and home-heating assistance. As of the 1st quarter of 2011, 204,667 residents of the Hudson Valley were receiving monthly food-stamp benefits compared to 198,312 persons in the 4th quarter of 2010. This translates to one out of every 11 persons in the region. Year-over-year, the number of monthly food-stamp recipients increased 15.47 percent. The number of persons who received monthly Temporary Assistance (TA) benefits – which includes Family Assistance (FA) and Safety Net Assistance (SNA) – increased from 32,980 persons in the 4th quarter of 2010 to 33,167 persons in the 1st quarter of 2011. Year-over-year, the number of monthly TA recipients advanced 5.20 percent. Over the same one-year period, the monthly expenditure for TA increased $0.80 million, from $13.40 million per month in the 1st quarter of 2010 to $14.20 million per month in the 1st quarter of 2011. During the 1st quarter of 2011, the average monthly per-person SNA and FA benefits were $493.00 and $369.16, respectively. Safety Net Assistance is the more costly of the two programs at 54.13 percent of total TA expenditures; FA serves the largest number of persons. Foreclosures, tougher credit standards and the weakness of the current economic recovery continue to impact the market for new and existing homes. Another important factor is the uncertainty surrounding the existing and potential inventory of bank-owned properties – whether the properties be adequately maintained, and when they will be brought to market. The overall number of foreclosures is down relative to the early months of the housing crisis but remain at historical highs. During the 1st quarter of 2011, lenders filed 1,031 preforeclosure notices, 91 homes were auctioned and bank-owned property (REO) increased by 139. Home sales posted a year-over-year increase of 1.75 percent; the median selling price remained well below peak evaluations. The average postcrisis decline: 25 percent. Housing experts anticipate further weakness. The market for new single-family homes posted a year-over-year decline from 206 in the st 1 quarter of 2010 to 165 in the 1st quarter of 2011; the demand for multifamily units increased from 21 to 33. As of the 1st quarter, the largest multifamily construction project in the region is a $13.50 million, 1-building/92-unit complex in Yorktown in Westchester County. Revised data for 2010 revealed a 12.30 percent year-over-year increase in the demand for single-family housing permits from 1,358 permits in 2009 to 1,525 permits in 2010. Over the same one-year period, the demand for multifamily construction permits increased from a total of 60 building (528 housing units) to 100 building (1,100 housing units). Orange County experienced the largest increase in the number of single-family permits at 112, followed by Putnam County (37), Dutchess County (24) and Rockland County (23). Single-family permits declined in Ulster (17), Sullivan (10) and Westchester County (2). The most active places within the region were Wallkill Town in Orange County at 153 single-family permits, followed by the Town of Fishkill in Dutchess County at 110. The three most important multiunit projects were a $15.5 million, 30-building/384-unit complex in Newburgh Town in Orange County, a $9.0 million, 2-building/71-unit complex in Spring Valley Village in Rockland County and a $9.0 million, 2-building/74-unit complex in Somers Town in Westchester County. * Hudson Valley Labor Force Reduction in labor-force participation drives the unemployment rate lower Labor Force Employment Year-over-year, labor-force participation in the Hudson Valley fell 1.16 percent from 1,126,059 in the 1st quarter of 2010 to 1,112,984 in the 1st quarter of 2011. Over the same one-year period, 1,200,000 1,140,000 Employment and labor force employment participation peaked in July of 2008 declined .53 1,180,000 1,120,000 percent from 1,033,239 to 1,160,000 1,100,000 1,027,802. Because the number of 1,140,000 1,080,000 persons in the labor force fell 1,120,000 1,060,000 Labor Force (13,075) by more Employment than the 1,100,000 1,040,000 reduction in employment 1,080,000 1,020,000 (5,437), the unemployment 1,060,000 1,000,000 rate declined .59 2006 2007 2008 2009 2010 2011 percentage points from 8.24 percent to 7.65 percent. Between the final quarter of 2010 and the 1st quarter of 2011, labor-force participation declined (8,906), employment fell (12,671) and the unemployment rate increased .39 percentage points. This decline in unemployment is consistent with trend and can be explained by seasonal factors. Region-wide, employment and labor-force participation peaked in July of 2008 at 1,130,800 and 1,191,800, respectively. The 1st Quarter unemployment rate was 5.12 percent. Since Peak 2011 that date, labor-force participation by Peak Labor Labor % Hudson Valley residents has fallen 7.06 Date Force Force Change percent (84,100), and employment has Dutchess Jul-06 150,876 140,545 -6.85% declined 8.68 percent (98,100). As noted Orange Jul-08 185,595 175,151 -5.63% above, the primary driver of the decline in Putnam Jul-08 57,967 53,388 -7.90% the unemployment rate has been the Rockland Jul-08 161,644 149,232 -7.68% reduction in labor-force participation. This Sullivan Oct-08 38,119 33,917 -11.02% phenomenon is national in scope. Between Jul-08 94,200 87,698 -6.90% Ulster July of 2008 and April of the current year, the Westchester Jul-08 512,028 473,053 -7.61% national labor market participation rate has declined from 66.00 percent to 64.20 percent. Factors that have contributed to this trend Page 1 of 8 include but are not limited to: early retirement from public- and private-sector employment, retraining, higher education, discouraged workers and disability. Nonfarm Employment by Place of Work1 Year-over-year, the region added 200 new jobs. Contraction in the public sector continues to negatively impact regional job growth. The year-over-year decline in public-sector employment at 4,700 all but eliminated the positive impact from private-sector job creation (4,900). Over the 12-month period ending in March of 2011, the region-wide job-count advanced in the professional and business services sector (2,800), the education and health Year-over-Year Change in Employment Total Government, sector (2,300), the 4,700 leisure and hospitality Manufacturing, -1,200 sector (1,700) and the trade, transportation Financial Activities, -700 and utilities sector Information, -500 (300). Of the abovenamed sectors, only two Trade, Transportation, and Utilities, 300 have posted positive Lesiure and Hospitality, postrecession 1,700 employment growth: the Education and Health Services, 2,300 education and health Professional and services sector and the Business Services, 2,800 professional and Total Private, 4,900 business services sector at 8,100 and 1,900, respectively. Employment continues to fall in manufacturing (1,200), financial activities (700) and Private-sector job losses sustained information (500). between the 4th quarter of 2010 Within the region, year-over-year employment advanced (1,000) in the Rockland-Westchester-Putnam, and the 1st quarter of 2011 at NY, MSA; declined (1,000) in the Poughkeepsie28,700 are seasonal in nature and Newburgh-Middletown, NY, M.S.A. (Dutchess and mirror the impact of seasonal Orange counties), advanced (200) in the Kingston, NY, factors noted in previous years. As MSA (Ulster County) and was unchanged in Sullivan is expected, the preliminary jobCounty. count for the month of May points As of the 1st quarter of 2011, the education and to an uptick in job creation (1st health services sector was the largest employer in the quarter through May increase of region at 21.43 percent of total employment (26.49 percent of total private-sector employment). The second most important employer was the trade, transportation 1 Current Employment Statistics (CES): survey of sample employers excludes self-employed, agricultural, domestic workers and the military. Place of Work Series. Page 2 of 8 and utilities sector at 19.44 percent of total employment (24.03 percent of total private-sector employment). Fourth-Quarter 2010 Average Weekly Wages2 Year-over-Year Average Weekly Wages Up Year-over-year, the Average Weekly Wage (AWW) in the nonfarm sector advanced. The largest percentage increase occurred in Rockland County at 5.07 percent. Putnam County posted the smallest increase at 1.42 percent. Within the region, the strongest percentage advance in public-sector wages occurred in Rockland County at 8.72 percent, followed by Orange (6.41 percent) and Sullivan (4.32 percent). The smallest year-over-year percentage increase occurred in Ulster and Putnam counties at 1.59 percent and 2.22 percent, respectively. The AWW paid in the traditionally high-wage, goods- AWW in the public­sector posts year­over­year increase Average Weekly Wages Nonfarm GoodsProducing ServiceProviding Public Sector 2008.Q4 $910 $1,545 $733 $963 2009.Q4 $946 $1,632 $765 $1,042 2010.Q4 $973 $1,676 $790 $1,074 2008.Q4 $783 $952 $688 $1,000 2009.Q4 $804 $943 $714 $1,029 2010.Q4 $823 $971 $718 $1,095 $944 $1,137 $849 $1,113 Dutchess Orange Putnam 2008.Q4 2009.Q4 $986 $1,171 $873 $1,217 2010.Q4 $1,000 $1,149 $897 $1,244 2008.Q4 $1,004 $1,411 $909 $1,020 2009.Q4 $986 $1,387 $880 $1,066 2010.Q4 $1,036 $1,491 $917 $1,159 Rockland producing sector (manufacturing, Sullivan construction and mining) was a mixed 2008.Q4 $699 $685 $617 picture. The wage increased in Rockland 2009.Q4 $738 $700 $657 (7.50 percent), Westchester (4.77 2010.Q4 $756 $683 $674 percent), Orange (2.97 percent), Ulster Dutchess (2.70 percent) and Ulster (0.33 2008.Q4 $728 $890 $607 percent), and decreased in Putnam (1.88 percent) and Sullivan (2.43 percent). As 2009.Q4 $753 $917 $628 is consistent with the geographic 2010.Q4 $773 $920 $644 proximity and strong economic crossWestchester flows with New York City, the average 2008.Q4 $1,238 $1,598 $1,184 nonfarm sector wage paid in the 2009.Q4 $1,300 $1,657 $1,248 southernmost counties of Rockland and 2010.Q4 $1,334 $1,736 $1,276 Westchester are the highest within the Hudson Valley region. The highest AWW in the goods-producing industries occurred in 2 Average weekly wage data was secured through a special request to the New York State Department of Labor. Page 3 of 8 $902 $950 $991 $965 $1,009 $1,025 $1,248 $1,339 $1,382 Westchester and Dutchess counties at $1,736 and $1,676, respectively. Across the region and on average, for every one dollar paid in the goods-producing industries, $.60 is paid in the serviceproviding industries. An important exception is Westchester County. Westchester’s service sector is heavily weighted in top-tier service-sector jobs and as a direct consequence the wage premium paid in the goods-producing sector is approximately one half ($.30) of the average regional wage premium. Monthly Income Maintenance Benefits (Social Assistance) One out of every 11.2 persons in the Hudson Valley was receiving food-stamp benefits as of the 1st quarter of 2011. The rate of increase turns positive. Logarithmic scale 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 The household budget continues to be negatively impacted by the rising price of necessities, slow job Average Quarterly Food Stamp Recipients growth, and long-term unemployment and 230,000 210,000 underemployment. The 204,667 190,000 consequence: increased 170,000 dependence on food 150,000 130,000 stamps, temporary 110,000 assistance and home90,000 heating assistance. As of 70,000 50,000 the 1st quarter of 2011, 204,667 residents of the Hudson Valley were receiving monthly foodstamp benefits compared to 198,312 persons in the 4th quarter of 2010. Year-over-year, the number of monthly food-stamp recipients has increased 15.47 percent. Statewide, 2.99 million persons received foodstamp benefits during Change in the Average Number of Quarterly Food Stamp Recipients the 1st quarter of 2011; 61 10000 percent of all foodstamp recipients were residents of NYC. 1000 The number of Hudson Valley residents who received 100 monthly Temporary Assistance (TA) – which includes Family Assistance (FA)3 and Safety Net Assistance (SNA)4 – increased from 32,980 persons in the 4th quarter of 2010 to 33,167 persons in the 1st quarter of 2011. Year-over-year, the number of monthly TA recipients advanced 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 3 As of December 1996, Family Assistance is limited to 60 months per lifetime. To be eligible for Family Assistance, the household must include (care for) a minor child. 4 Safety Net Assistance has a lifetime limit of two years. Page 4 of 8 5.20 percent. Over the same one-year period, the monthly expenditure for TA increased $0.80 million, from $13.40 million per month in the 1st quarter of 2010 to $14.20 million per-month in the 1st quarter of 2011. During the 1st quarter of 2011, the average monthly per-person SNA and FA benefits were $493.00 and $369.16, respectively. Safety Net Assistance is the more costly of the two programs at 54.13 percent of total TA expenditures; FA serves the largest number of persons. Home Sales, Prices and Building Permits Home prices show improvement. Sales volume remains weak. Year-over-year, the median selling price of an existing single family home was unchanged in Dutchess and Ulster counties, advanced 12.58 percent in Putnam County and fell 8.76 percent in Sullivan, 7.72 percent in Westchester and 4.09 percent in Orange. Over the same one-year period, the median selling price increased 4.99 percent in New York State and fell 4.71 percent nationwide. Overall sales volume advanced from 1,998 in the 1st quarter of 2010 to 2,033 in the 1st quarter of 2011. Sales volume was unchanged in Dutchess, Sullivan and Ulster counties, fell 4.64 percent in Westchester 1st Qt County and advanced Peak Peak Median Median % County Date Price Price Change 12.10 percent in Putnam County, 10.49 percent in 2006.Q3 $360,000 $255,000 -29.17% Dutchess Orange County and 10.43 percent in 2007.Q3 $330,000 $244,500 -25.91% Orange Rockland County. Over 2006.Q2 $435,777 $349,000 -19.91% Putnam the same 12-month period, existing home 2005.Q3 $529,950 $389,000 -26.60% Rockland sales increased .87 2007.Q2 $187,500 $125,000 -33.33% Sullivan percent in New York State and 14.23 percent 2007.Q3 $265,000 $215,000 -18.87% Ulster nationwide. 2007.Q3 $730,000 $552,750 -24.28% Westchester Prolonged uncertainty in the housing market –experts anticipate further declines in value in concert with tougher credit standards (better credit ratings and higher down-payments) – and slow job growth continue to place downward pressure on the demand In the 1st quarter of 2011, lenders for new housing. Year-over-year, the demand for filed 1,031 pre-foreclosure single-family construction permits fell 30.87 percent notices, 91 homes were auctioned from 206 in the 1st quarter of 2010 to 165 in the 1st and bank-owned property (REO) quarter of 2011. Over the same one-year period, the increased by 139. Activity is demand for single-family construction permits fell trending downward but remains 21.84 percent in New York State and 32.13 percent an important threat to the regional nationwide. In contrast to the decline in the number housing market in general and of single-family housing permits, total construction economic recovery in particular. cost increased 64.46 percent in the Hudson Valley, 19.71 percent in New York State and 28.62 percent Page 5 of 8 nationwide. Total construction cost is estimated at $88.07 million or $540,300 per permit. Perpermit construction costs sans Westchester County is $209,800.Within the region, Orange County issued the most single-family construction permits (56), followed by Westchester (36) and Dutchess (22). During the 1st quarter, 33 multiple-family construction permits were issued compared to 21 in the 1st quarter of 2010. Total construction cost advanced $24.60 million from $16.8 million in the 1st quarter of 2010 to 41.42 million in the 1st quarter of 2011.The average cost per unit is $112,800. As of the 1st quarter, the largest construction project in the region is a $13.50 million, 1building/92-unit complex in Yorktown in Westchester County. The average per-unit construction cost is $146,740. Annual Housing Permit Revision (2010) Year-over-year, the demand for single-family housing permits advanced 12.30 percent. The annual revised housing construction permit data for 2010 revealed that the number of single-family construction permits issued in the region recorded a year-over-year increase of 12.30 percent from 1,358 permits in 2009 to 1,525 permits in 2010. Over the same one-year period, the number of single-family 500 471 construction permits Single-Family Housing Permits 450 advanced 3.14 percent in 400 New York State and 1.40 359 336 percent in the U.S. Region350 312 wide, construction costs 300 advanced $51.0 million, from 250 2010 216 226 $398.9 million in 2009 to 177 175 200 2009 171 $449.9 million in 2010. 154 150 Orange County experienced 99 the largest increase in the 76 74 100 37 number of single-family 50 permits at 112, followed by 0 Putnam County (37), Dutchess Orange Putnam Rockland Sullivan Ulster Westchester Dutchess County (24) and Rockland County (23). Single-family permits declined in Ulster (17), Sullivan (10) and Westchester County (2). The most active places within the region were Wallkill Town in Orange County at 153 single-family permits, followed by the Town of Fishkill in Dutchess County at 110. Over the same one-year period, the demand for multifamily construction permits increased from a total of 60 building (528 housing units) to 100 building (1,100 housing units). Multifamily construction costs advanced $19.7 million from $66.3 million in 2009 to $86.0 million in 2010. Per-unit construction cost fell $47,314 from $125,525 to $78,211. The three most important multiunit projects were a $15.5 million, 30-building/384-unit complex in Newburgh Town in Orange County, a $9.0 million, 2-building/71-unit complex in Spring Valley Village in Page 6 of 8 Rockland County and a $9.0 million, 2-building/74-unit complex in Somers Town in Westchester County. Housing Permits 2009-2010 (U.S. Census Bureau) Single-Family Year Dutchess Orange Putnam Rockland Sullivan Ulster Westchester Hudson Valley NYS U.S. Blds. Units Multiple-Family Cost Blds. Units Total Cost Blds. Units Cost 2010 336 336 70,796,270 0 0 0 336 336 70,796,270 2009 312 312 67,279,161 13 3 930,000 315 325 68,209,161 Change 24 24 3,517,109 -13 -3 -930,000 21 11 2,587,109 2010 471 471 76,839,160 49 536 30,738,510 520 1,007 107,577,670 2009 359 359 59,947,700 3 7 559,000 362 366 60,506,700 Change 112 112 16,891,460 46 529 30,179,510 158 641 47,070,970 2010 74 74 26,016,574 2 7 704,167 76 81 26,720,741 2009 37 37 11,688,130 3 19 2,639,060 40 56 14,327,190 Change 37 37 14,328,444 -1 -12 -1,934,893 36 25 12,393,551 2010 99 99 28,626,130 19 195 20,811,697 118 294 49,437,827 2009 76 76 25,541,235 6 81 10,496,250 82 157 36,037,485 Change 23 23 3,084,895 13 114 10,315,447 36 137 13,400,342 2010 216 216 33,868,437 0 0 0 216 216 33,868,437 2009 226 226 35,324,341 10 20 773,026 236 246 36,097,367 Change -10 -10 -1,455,904 -10 -20 -773,026 -20 -30 -2,228,930 2010 154 154 32,364,485 14 180 10,941,740 168 334 43,306,225 2009 171 171 41,198,745 16 116 7,051,470 187 287 48,250,215 Change -17 -17 -8,834,260 -2 64 3,890,270 -19 47 -4,943,990 2010 175 175 95,343,573 16 182 22,835,999 191 357 118,179,572 2009 177 177 91,599,493 9 282 43,828,550 186 459 135,428,043 Change -2 -2 3,744,080 7 -100 -20,992,551 5 -102 -17,248,471 2010 1,525 1,525 363,854,629 100 1,100 86,032,113 1,625 2,625 449,886,742 2009 1,358 1,358 332,578,805 60 528 66,277,356 1,408 1,896 398,856,161 Change 167 167 31,275,824 40 572 19,754,757 217 729 51,030,581 2010 9,959 9,959 2,202,387 9,609 962,894 19,568 3,165,281 2009 9,656 9,656 2,132,075 8,688 930,179 18,344 3,062,254 Change 303 303 70,312 921 32,715 1,224 103,027 2010 447,311 447,311 87,124,237 157,299 14,818,824 604,610 101,943,061 2009 441,148 441,148 82,357,328 141,815 13,052,970 582,963 95,410,298 Change 6,163 6,163 4,766,909 15,484 1,765,854 21,647 6,532,763 0 0 Page 7 of 8 0 0 Sales Tax Collection Every county in the region experiences a year-over-year decline in sales tax revenue. An important indicator of retail sales activity and state and county revenue is sales tax collection. Year-over-year, total sales tax collection increased 6.10 percent from $271.5 million in the 1st quarter of 2010 to $288.1 million in the 1st quarter of 2011. The largest year-over-year dollar increase occurred in Dutchess County at $6.72 Quarterly Sales Tax Collection Dutchess Orange Putnam Rockland Sullivan Ulster Westchester Hudson Valley 2011.Q1 2010.Q1 2009.Q1 2008.Q1 2007.Q1 2006.Q1 $39,954,403 $33,237,422 $34,133,431 $34,761,227 $35,412,351 $36,216,291 $54,429,832 $51,822,130 $52,442,111 $53,429,206 $50,788,201 $54,007,070 $11,261,667 $10,639,164 $10,740,232 $12,212,491 $9,776,773 $10,097,563 $42,469,069 $39,637,960 $41,073,424 $44,647,633 $38,990,075 $37,454,110 $7,189,369 $6,934,099 $7,587,668 $7,897,302 $6,810,755 $7,227,046 $23,216,744 $22,423,983 $22,305,160 $23,751,832 $23,285,987 $23,719,612 $109,573,303 $106,834,560 $104,718,131 $118,490,760 $111,123,998 $111,933,893 $288,094,387 $271,529,318 $273,000,157 $295,190,451 $276,188,140 $280,655,585 million (21.21 percent), followed by Rockland County at $2.83 million (7.14 percent). Ω Page 8 of 8