COMPILATION OF STATE TAX LAW RELATING TO OIL, GAS AND MINING

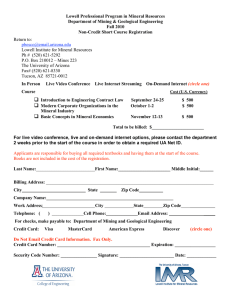

advertisement