Catching on the Rebound: Economic Modelling of Energy Services and... Rebound Effects resulting from Energy Efficiency Improvements

advertisement

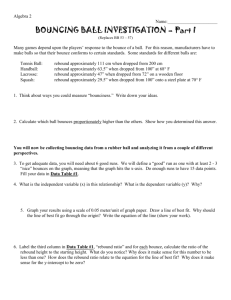

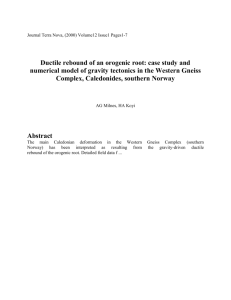

Catching on the Rebound: Economic Modelling of Energy Services and Determining Rebound Effects resulting from Energy Efficiency Improvements* Lester C Hunt† and David L Ryan‡ Abstract By deriving consumer demands for energy sources from a consumer utility maximization model that is defined over energy services, the relationship between these energy source demands and demands for various energy services is recognized and modelled explicitly. This modelling approach facilitates identification of appropriate strategies for empirically determining the so-called rebound effect where, due to the behavioural response by consumers to the resulting fall in the implicit price of energy services, energy efficiency improvements result in energy savings that are often less than those suggested by engineering calculations. The analysis is illustrated using UK time-series energy expenditure and price data. _________________________________________ † Surrey Energy Economics Centre (SEEC), School of Economics, University of Surrey, UK. (e-mail: L.Hunt@surrey.ac.uk) ‡ Department of Economics, University of Alberta, Edmonton AB Canada T6G 2H4 (e-mail: David.Ryan@ualberta.ca) * The ideas for this research originated during Ryan’s visit to the University of Surrey during his sabbatical in 2010. We are also grateful to Natural Resources Canada for funding support provided through the Canadian Building Energy End-Use Data and Analysis Centre (CBEEDAC). 1. Introduction It is often discussed how households desire energy not for its own sake, but because of the services that it produces, such as heating, lighting, cooking, etc. Nevertheless, especially in empirical work, this feature appears to be frequently overlooked, as researchers tend to focus on modelling demand for aggregate energy, or for particular energy sources, such as natural gas, electricity, and oil products (see, for example, Hunt et al, 2003; Huntington, 2010). Although, as we demonstrate in this paper, there are potentially important, and in many cases useful, implications that arise from explicit consideration of energy as a derived demand, this aspect of energy demand appears to have generally been viewed as unimportant, and is frequently not even mentioned or discussed. Largely, the approach that has been adopted is likely to be data driven, since information is often available on aggregate or even individual consumption of particular energy sources, but it is rarely available at either of these two levels on consumption of particular energy services such as heating or lighting. Another determining factor may be that interest predominately centres on price and income responsiveness of total energy demand, or of demand for particular energy sources. Since neither the price nor the quantity consumed of heating services is generally observed, there would naturally be less interest in, for example, the own-price elasticity of demand for heating than in the own-price elasticity of natural gas demand. This effect is possibly reinforced by interest in examining the likely effects of various strategies that might be used to reduce dependence on fossil fuels, because mechanisms like carbon taxes or various cap and trade schemes can typically be translated into an effect on the prices of these fuels. Consequently, the expected effectiveness of such mechanisms can be examined through price elasticities of demand for these fuels or energy sources. 1 A particular reason for paying more attention to the distinction between the demand for energy sources and the demands for the services that these energy sources provide, and the relationship between them, has arisen recently with increased interest in what in the energy literature is referred to as the rebound effect. This concept refers to the fact that with increased energy efficiency for various products, the savings in energy consumption that products embodying this higher level of energy efficiency are expected to elicit is typically, or at least frequently, not observed. The amount of these expected savings is usually based on engineering calculations that assume that with increased efficiency, the demand for the service that is being produced – such as space heating – will not change. Hence, if a certain lower amount of energy is now needed to produce this same amount of heat, then there should be a corresponding decrease in consumption of that energy source. However, any relative price change (including prices of energy services) will result in a substitution effect that will increase consumption of the good or service whose relative price has decreased, while in many if not most cases the income effect will enhance this effect. If, for example, furnaces or boilers used to produce space heating become more efficient, thereby lowering the relative price of heating, demand for heating will likely increase and this will possibly increase demand for the energy source(s) used to provide this heating. As a result, consumption of the energy source may not decrease as much as the engineering calculations originally suggested (thereby producing a direct rebound effect), or in an extreme case consumption of the energy source may actually increase, an effect referred to as “backfire”. Despite some serious limitations concerning its use, which we consider later, the negative of the estimated own-price elasticity of energy demand is often used to empirically evaluate direct rebound effects. 2 In this paper we demonstrate that a better understanding of rebound effects, including identification of an appropriate mechanism for empirically evaluating them, is provided by returning to the idea that energy is demanded for the services it provides rather than for any intrinsic reasons. Specifically, we develop a model of consumer behaviour where utility is derived from consumption of these services rather than from the energy sources that are used to produce them. A particular advantage of this framework is its demonstration of the direct role for energy efficiency in determining energy demands, even if energy efficiency may be predetermined at the time that current-period energy demand decisions are made. This proves to be more conducive environment for analysis of many aspects of energy demand, including – but not limited to – the determination of rebound effects. A drawback of this formulation is that information is required on energy efficiency, and this is typically not directly observed. Consideration of possible approaches to deal with this problem suggests a number of avenues for examining a variety of aspects of energy demands. As an empirical illustration, the demands for energy sources that are derived from our energy services model are jointly estimated in a systems framework using the linearized version of the Almost Ideal Demand System (AIDS) specification with time series data on energy expenditures and prices for the UK. Furthermore, the implications of these results for rebound effects are investigated and explored. Section 2 discusses the background to the rebound effect in more detail, while Section 3 introduces the theoretical model of utility maximization conditional on energy services, which is generalized in Section 4. Section 5 addresses issues of empirical implementation of the energy services model, while different approaches to modelling unobserved energy efficiency are considered in Section 6. Section 7 provides an empirical illustration, with a brief summary and conclusion presented in Section 8. 3 2. Rebound Effects In the consumer context, when the price of a good or service is changed, there are two resulting effects. The first is the substitution effect, which refers to the response to the change in relative prices, holding utility constant, and which acts in the opposite direction of the price change, such as decreasing the quantity consumed of the good or service whose price has increased. The second is the income effect, which reflects the fact that a change in relative prices generally means that a different utility level will be attainable, and the change to this utility level will involve a rearrangement of the quantities that are consumed of various goods. A key implication then is that if the price of a good is decreased, consumption of that good would be expected to change – and most likely increase, and consumption of other goods are also likely to change, and possibly increase. These effects are no different in the context of changes in the prices of energy sources, such as electricity or natural gas, than they are anywhere else. However, in the field of energy economics, rather than focusing on consumer responses to changes in the prices of these energy sources, attention has increasingly been concentrated on the effect of efficiency changes – that is, of changes that improve the efficiency with which energy services are delivered. Of course, such efficiency changes are tantamount to changes in the price of the energy services that are delivered, and therefore also result in income and substitution effects. However, in the field of energy economics these effects are viewed with some consternation – since they tend to act in the opposite direction of the effect (reduced energy use) that was intended – so much so that they are jointly referred to as rebound effects. Although precise definitions of what rebound effects actually are differ, and there are several different types of rebound effects, as described below, in general a rebound effect is said to exist whenever the result of increased energy efficiency is an increase in consumption of the 4 energy services that are now provided more efficiently. Thus, for example, if there is an increase in the efficiency of natural gas heating, so that the same amount of heat can be provided using less natural gas, then if consumption of heat changes (increases) as a result, there is said to be a rebound effect. Of course, depending on the extent of the efficiency increase, even with this increased consumption of heating there may still be a decrease in natural gas consumption compared to the level prior to the efficiency increase, or in an extreme case, natural gas consumption may actually increase, an effect known as “backfire”. In any event, the key issue is that natural gas consumption does not decrease as much as “expected”, where what is “expected” in such cases is based on engineering calculations that assume that there will be no change in consumption of the energy services that are provided, in this case heating. Typically, three types of rebound effects are delineated.1 The first is the direct rebound effect, as described above, where improved efficiency for a particular energy service results in increased consumption of that service. The second is the indirect rebound effect, which refers to increased demand for other goods and services that also require energy for their provision. The third category is economy-wide rebound effects, which occur when a decrease in the real price of energy services leads to adjustments in the economy that result in expansion of the energyintensive sectors relative to those that are less energy-intensive.2 As summarized in Greening et al. (2000), and Sorrell and Dimitropoulos (2008), there have been a number of attempts to provide empirical estimates of rebound effects, particularly 1 See, for example, Sorrell and Dimitropoulos (2008). 2 As Sorrell (2009) notes, with indirect rebound effects distinctions are also sometimes made between embodied energy (such as the energy required to produce the energy efficiency improvement) and secondary effects that result from the energy efficiency improvement. 5 for transportation. However, probably because energy efficiency is not directly observed or measurable in most cases, there is no standard approach for obtaining these estimates. Indeed, Sorrell and Dimitropoulos (2008) provide eight different definitions of direct rebound effects, most of which have been used to provide empirical estimates, and discuss the limitations and assumptions that each embodies. For our purposes, the one that is of most interest, in part because of its widespread and increasing use, is the own-price elasticity of demand for the energy source that produces the relevant energy service. With this approach (Definition 4 of Sorrell and Dimitropoulos (2008)), virtually any energy demand equation that is estimated provides empirical estimates of these price elasticities, and hence of direct rebound effects. The justification for this approach is provided below, but it useful at the outset to note that for a number of reasons, Sorrell and Dimitropoulos (2008) conclude that “studies that use the own-price elasticity of demand as a proxy for the direct rebound effect appear to be particularly flawed” (p. 646). In particular, they argue that these studies are likely to overestimate the magnitude of rebound effects due to such reasons as asymmetric responses to price changes, possible positive correlation between energy efficiency and capital costs, priceinduced efficiency improvements, energy efficiency being endogenous, and perhaps a negative correlation between energy efficiency and time efficiency. It is argued below that while past use of the own-price elasticity of energy demand for the relevant energy service as a measure of the direct rebound effect may be misguided, in fact the problem is that the model on which such measures are usually based is inappropriate for this purpose. It is interesting that in much of the literature on the rebound effect, very little attention is paid to the consumer decision model from which rebound effects are likely to arise. In fact, even the alternative definitions of direct rebound effects provided by Sorrell and Dimitropoulos 6 (2008) are based predominately on definitional relationships between energy services, energy efficiency and energy inputs, and between the cost per unit of energy services and the price of energy, and various derivatives of these relationships. This is somewhat analogous to basing demand analysis on the budget constraint and various derivatives of it, but ignoring the utility or other function that is being optimized.3 As might be expected, what is required to examine rebound effects without using various contrivances that are unlikely to be correct is a model that takes account of consumer demand being for energy services rather than for energy sources, and therefore in which energy efficiency appears explicitly. Within such a model, the usefulness of using own-price elasticities of various energy demands to measure direct rebound effects, and even of using various cross-price elasticities to measure (some) indirect rebound effects, becomes apparent, suggesting that to use such price elasticities as measures of rebound effects, it is necessary to estimate them using a different model specification. Prior to developing a model of energy services in the next section, the use of the ownprice elasticity of demand as a measure of the direct rebound effect is considered. Based on Sorrell and Dimitropoulos (2008), this requires the following two definitional relationships: (1) and (2) In (1), efficiency ( ) is defined as the units of the energy service produced (S) per unit of the energy source (E), in other words, the number of units of energy services provided by one unit of 3 That said, the appendix to Sorrell and Dimitropoulos (2005) does introduce some fundamentals in terms of illustrative indifference curve analysis. 7 the energy source.4 Thus, if more energy services can be produced using the same amount of energy, then efficiency has increased. In (2), the cost per unit of energy services, referred to as the per-unit price of such services, is defined as the cost of energy required to produce one unit of those services, that is, the price per unit of the energy source divided by energy efficiency. Jointly, (1) and (2) imply: (3) , that is, that expenditure on energy services is equal to expenditure on the energy source(s) used to provide these services. According to Sorrell (2009), the generally accepted measure of the direct rebound effect is given by the elasticity of the demand for energy services with respect to energy efficiency, , defined as: (4) , Differentiating (1) with respect to energy efficiency, , yields: 1 (5) where 1, is the elasticity of the demand for energy with respect to energy efficiency, or the efficiency elasticity of the demand for energy. Thus, if rebound effect; if 0 1 1 1 0 1 there is no 0 then there will be a rebound effect; and if 0 then there will be backfire. 4 Note that this definition of efficiency abstracts from how efficient any particular equipment that is used to convert energy to energy services may be relative to other equipment that might be used to perform the same task. 8 To relate the rebound effect, (2) and the assumptions that , to the own-price elasticity of demand, use is made of and that the price of energy, , does not depend on the efficiency with which energy services are delivered, . Specifically,5 (6) , so that 1 (7) 1, where is the elasticity of the demand for energy services with respect to the price of those services. Since, from (1) and (2), simplifies to: , and , then if is treated as constant, , that is, the own-price elasticity of demand for energy. Hence, from (4), (5) and (7), 1 (8) . Thus, under these (restrictive) conditions, the rebound effect is just equal to the negative of the own price elasticity of energy demand. For example, if the own-price elasticity was –0.5, this would mean that a 1% decrease in price would result in a 0.5% increase in energy demand. Hence (from (8)), a 1% increase in energy efficiency would result in a 0.5% increase in demand for energy services, in which case there would be a 50% “take-back” of the energy savings resulting from energy efficiency improvements due to the direct rebound effect. Although this equivalence in (8) has been used by a number of authors,6 there are a number of caveats to its 5 See Sorrell and Dimitropoulos (2008). 6 See, for example, the studies identified Sorrell and Dimitropoulos (2008, Section 4). 9 use. One of the most problematic would seem to be the requirement in the last step (following (7)), of treating energy efficiency, , as constant, which seems at odds with determining the efficiency elasticity of the demand for energy services, which is defined as the percentage change in demand for energy services resulting from a percentage change in energy efficiency.7 Second, in view of its derivation, the definition is only appropriate when energy demand refers to a single energy service. Third, while – subject to these caveats – the negative of the own-price elasticity may provide a measure of the direct rebound effect, the derivation provides no information about how corresponding measures of indirect rebound effects might be determined. The models developed in the following sections of this paper attempt to overcome some of these caveats pertaining to the use of the negative of the own-price elasticity as a measure of the rebound effect, and indicate how some indirect rebound effects can be analogously obtained. In addition, estimates of rebound effects obtained from these new model specifications overcome many of the arguments, mentioned earlier, concerning why estimates of rebound effects that are based on own-price elasticity estimates are likely to overstate the magnitudes of the rebound effects. For later use we briefly summarize two of these key arguments here. Asymmetric price responses to energy price changes First, there is evidence from many empirical studies (see, for example, Gately and Huntington, 2002) that price elasticities are higher when energy prices are rising than when they are falling. Essentially, the main rationalizations for this finding are: (i) when energy prices are rising there are technical improvements made in energy efficiency that are not reversed when 7 Of course, it could be argued that energy efficiency is fixed at the time energy consumption decisions are made, but even in this case in order to examine the rebound effect there must be the possibility that changes in energy efficiency cause changes in consumption of energy services. 10 energy prices subsequently fall; (ii) investments in measures such as insulation that are made when prices are rising are unlikely to be reversed when prices subsequently fall; (iii) higher energy efficiency requirements that may be imposed through regulation when energy prices rise are unlikely to be repealed if these prices subsequently fall. In terms of the implications of this for using price elasticities as estimates of rebound effects, the argument that has been made is that increases in efficiency are ‘equivalent’ to decreasing energy prices, so that the relevant price elasticities for estimating rebound effects would be those obtained when energy prices are falling (Sorrell and Dimitropulos, 2008:641). However, even if demand responses to energy price changes are asymmetric, the argument that the elasticity estimates that should be used to measure rebound effects are those from a period when energy prices are falling seems counter-intuitive. If energy prices are rising, households have incentives to improve energy efficiency and reduce their energy use, whereas no such incentives exist when energy prices are falling. In any event, the key point is that the arguments for the existence of asymmetry pertain to increasing energy efficiency when energy prices are rising compared to when they are falling. This suggests that if a model of energy demand could capture these efficiency effects separately from the price effects, then the price elasticity may be a more appropriate measure of the rebound effect, regardless of the direction in which prices have been moving. This is one of the features of the model developed in Section 3. Price-induced energy efficiency A second reason that has been suggested for why estimates of rebound effects that are based on own-price elasticity estimates are likely to overstate the magnitudes of these effects pertains to energy efficiency being endogenous and/or induced by energy prices. As summarized by Sorrell and Dimitropoulos (2008), there appear to be two main components to this argument. 11 First, energy efficiency may be expected to be a function of current and historical energy prices. Ignoring this effect is likely to result in price elasticities that overstate the magnitude of the rebound effect. Second, consumers with a higher demand for energy services may be more likely to choose appliances with higher energy efficiency in order to minimize their energy costs. These, as well as other, aspects of efficiency are also taken into account in the model developed in the following section. By explicitly including energy efficiency in the model of consumer behaviour and modelling its determinants, the roles of past values of energy prices are recognized. It is not clear whether current energy prices should play a role in determination of current efficiency since, at least in the household context, there is typically a lag between choice and installation of the equipment that embodies a particular level of energy efficiency, and the energy services that are demanded from this equipment. Nevertheless, a variety of different specifications of the determinants of energy efficiency – including the use of current prices as a determinant – are consistent with the model that we develop. In addition, the general specification of the determinants of efficiency that is used in the model would allow such efficiency to depend on past usage levels, and thereby capture the potential effect of increased energy usage inducing increased efficiency. More generally, the specification would also allow the effects of exogenous changes – such as those imposed through legislation or minimum efficiency performance standards – to be taken into account.8 8 By utilizing different specifications of the determinants of the energy efficiency terms, the model that we develop can readily deal with other issues that in a standard model have been thought to result in price elasticities yielding over-estimates of rebound effects. These include the possible positive correlation between energy efficiency and the capital costs of the equipment that embodies such efficiency, and the idea that as time becomes more valuable, consumers will substitute energy services for time. 12 3. A Simple Model of the Demand for Energy Services The preceding analysis and discussion indicates that although the negative of estimated own (and cross) price elasticities of energy demand have frequently been used as estimates of the rebound effect, the basis for this is very weak. In particular, it is based upon an ad hoc approach that does not explicitly consider the demand for energy services, and hence the efficiency variables that drive the rebound effects, and relies on overly restrictive assumptions. To address these drawbacks, we develop a consumer utility maximization model that is defined over energy services. We begin with a simple model in which each energy source produces only a single energy service, and where each energy service is provided by only a single energy source. For generality, other goods apart from energy services are included in the utility function, but the analysis could be restricted just to energy services. Within such a model, the relationship between rebound effects and price elasticities for energy sources is shown to be relatively straightforward. In a subsequent section, we generalize this framework to allow for the more realistic possibility that several energy sources produce the same type of energy service (e.g., heat), and each energy source may produce more than one energy service. 3.1 Utility Maximization Model It is assumed that utility is derived from energy services rather than energy itself, as well as other non-energy goods. The conceptual approach in which utility is derived from energy services rather than energy(or energy sources) itself appears to have a long history in energy economics, as many authors refer to derived demands for energy (see for example, Howarth, 1997; Hunt et al., 2003; Haas et al., 2008; Fouquet and Pearson, 2012). However, as far as is 13 known, there have been no previous attempts to model this explicitly, or to use such a framework to analyze rebound effects. While we consider a more general specification in the next section, to simplify the analysis and notation here it is assumed that utility is derived from the consumption of two types of energy services – space heating ( ), and lighting ( ) – as well as consumption of other goods. For ease of notation, and to facilitate development of the more general model that we consider subsequently, it is convenient to distinguish the “consumption services” provided by other goods, ( ), from the actual amount of other goods that are purchased, although this may be a one-to-one definitional relationship. Thus, given prices of heating, lighting, and other services, p , p , and p B, that is allocated among them, the consumer’s problem is to determine , and , , (9) subject to , and a budget, to: . To provide a concrete example, suppose that space heating is provided using natural gas, , while lighting is provided using electricity, . Of course, natural gas may provide other services, such as water heating, and cooking services, and electricity provides power and possibly heating services. To begin, however, these complications are ignored, and it is assumed that each energy source only produces one type of energy service. It is similarly assumed that consumption services of other goods, oth, are produced only by other goods, o. As explained in Section 2, it is standard in this type of set up to define efficiency as the units of the service produced per unit of the energy source.9 Thus, if ε is heating efficiency, ε 9 It is not necessary to be specific about the definition of a unit of each of these energy services, since the units of measurement of the efficiency variables will adjust to accommodate alternative choices of units of services. 14 is lighting efficiency, and ε denotes the efficiency of providing services from other goods (which would generally be equal to 1),10 then by definition, ; ; (10) As a result, the cost per unit of heating services, which is equated to the (unobserved) price, p , is a function of heating efficiency, since if the heating efficiency is twice as great, this means that it would take half as much natural gas to produce the same amount of heat, and the (variable) cost (that is, the cost of the natural gas) would be half as much. Of course there would also be a capital cost associated with obtaining increased heating efficiency (e.g., a new furnace or boiler, or increased insulation), but it is assumed that this capital decision has been made in advance of the utilization decision. Hence, the budget, B, available to be spent on the three goods would be net of the annualized capital costs.11 Thus, the relationship between the price of heating and the price of natural gas, p , between the price of lighting and the price of electricity, p , and between the price of the services provided by other goods and the price of other goods, p , is given by: ; (11) ; . As a result of (10) – (11), expenditure on heating, p p , equals expenditure on natural gas, , expenditure on lighting, p , equals expenditure on electricity, p , and expenditure on 10 Note that if the analysis is just restricted to energy expenditures, with B defined as expenditure on energy sources, then rather than ‘other goods’, ‘o’ could refer to oil products, for example, in which case would refer to the efficiency with which oil products produce energy services, and therefore need not equal one. 11 The model could be generalized to include capital equipment purchasing decisions, but we do not consider this extension here. 15 services provided by other goods, p , equals expenditure on other goods, p . Thus, the budget constraint in (9) can be alternatively written as: . (12) Since this is the same budget constraint that would be used if utility was defined over consumption of natural gas, electricity, and other goods, it may appear that considering utility as a function of the services provided by the various energy sources rather than as a function of the energy sources themselves has no real effect. However, this is not the case. Specifically, from (9), the demand equations for , , and , (13) , , would be given by: , ; , , , ; Using (10) – (11) to substitute for p , p , and p , , in terms of p , p , and p , and for h, l, and oth in terms of g, e, and o, we obtain: (14a) , (14b) , (14c) , , , , , , , , , , , , , , and , , , , . Thus, compared to commonly-used specifications, demands for all of the goods, including the various energy sources, depend on the prices of the energy sources, the price of other goods, the budget, and heating, lighting, and ‘other’ efficiency. For subsequent use, it is convenient to write the demand equations in (14a), (14b) and (14c) as expenditure share equations: , (15a) (15b) (15c) s , , , , , , , , , , , , . , , . , , , , 16 where s , s , and s are the expenditure shares for natural gas, electricity, and other goods, where, for example, s / , etc. As can be seen from these expressions, the fundamental difference from the typical specification that is estimated is that the price terms are all expressed in efficiency units, that is, the price of natural gas is divided by heating efficiency, the price of electricity is divided by lighting efficiency, etc. Obviously, if all these efficiency terms equal one, that is, there is a one-to-one relationship between consumption of the energy source and consumption of energy services – this will simplify to the usual specification where efficiency variables do not appear. Note, however, that estimation of equations such as (15a), (15b) and (15c) require data over time or over individuals, with an additional “t” subscript added to all variables. Thus, to simplify to the usual specification it would be necessary that all the efficiency terms equalled one for all observations, which seems unlikely.12 3.2 Rebound Effects A particularly interesting aspect of this specification concerns its implications for determining rebound effects. For a function ′ and using ′ , … , where p and ε only appear in ratio form, ′ to denote the partial derivative of f(.) with respect to , then /ε , while p /ε , so that the elasticity of f(.) with respect to ε , denoted η , is given by η ′ , while the elasticity of f(.) with respect to p , denoted η , is given by η 12 Since there is no set definition of a unit of heating or of lighting, the scaling of the may be preferable to view the model as reducing to the usual specification if the is arbitrary, so it are the same for each service, for all observations, which seems equally unlikely. 17 ′ . Thus, η η , yielding the type of relationship between the price elasticities and the efficiency elasticities described in (8) in Section 2. In the context of the share equation in (15a) for example, since p p , then s is both the expenditure share for natural gas and the expenditure share for heating, so that g B s , while h B h B h s s . Thus, (16) . . . . . . , while: . (17) . . . where ′ . . , . is the functional expression on the right-hand side of (15a), and derivative with respect to ( ⁄ ). Hence, ′ . is its , so that the direct rebound effect for increased efficiency in heating, that is, the elasticity of demand for heating with respect to a change in the energy efficiency of heating, is equal to the negative of the own-price elasticity of demand for natural gas. Similarly, the direct rebound effect for increased efficiency in lighting is equal to the negative of the own-price elasticity of demand for electricity. Further, if, for example, o represented oil products rather than other goods, the direct rebound effect for the energy service provided by oil products would be equal to the negative of the own-price elasticity of demand for oil products. In addition to direct rebound effects, the model developed above also provides information about indirect rebound effects. As described earlier, these refer to changes in 18 demand for goods or for other energy services that result from an increase in the efficiency of a particular energy service. To continue with the above example, this could be the change in the demand for lighting because of increased heating efficiency. This could arise, for example, because the increased heating efficiency might increase the heated area in a house, making more space usable and thus requiring increased lighting. In this case, the indirect rebound effect would be defined as , that is, the elasticity of demand for lighting with respect to a change in the energy efficiency of heating. From (15b), and noting that share for electricity and for lighting, then , while . (18) , so that is the expenditure . Thus, . . , while (19) . . . , where s . is the functional expression on the right-hand side of (15b), and s ′ . is its derivative with respect to (p ⁄εh ). Hence, η h l η e , so that the indirect rebound effect for lighting due to increased efficiency in heating, that is, the elasticity of demand for lighting with respect to a change in the energy efficiency of heating, is equal to the negative of the crossprice elasticity of demand for electricity with respect to the price of natural gas. Similarly, the indirect rebound effect for heating due to increased efficiency in lighting is equal to the negative of the cross-price elasticity of demand for natural gas with respect to the price of electricity. Similar results hold for the other good, o, which if it represented other goods in the economy, would mean that the cross-price elasticities of o with respect to the prices of particular energy sources would provide measures of the economy-wide rebound effects described in Section 2. 19 While this analysis, especially concerning direct rebound effects, appears to provide a rationalization for the common practice of using own-price elasticities as measures of these direct rebound effects, there are two very important caveats. First, it is necessary that in the models that are estimated, the efficiency of providing each energy service must be explicitly included; in our formulation, the prices of each energy source appear relative to the efficiency of the energy service that they provide, but other specifications could be used. In previous empirical studies that have used the price elasticity in determining the rebound effect, this is typically not the case.13 Second, the results derived here only hold where each energy source provides a single energy service, and each energy service is provided by only a single energy source. However, this one to one correspondence between energy services and energy sources is unlikely to hold in practice. For example, heating can be produced using natural gas (as in the simple model) or electricity (or possibly other energy sources). Natural gas can produce space heating, cooking, and water heating (which may or may not be separate from space heating), and electricity can be used to produce lighting (as in the simple model), heating, refrigeration, power for small appliances, etc. In the next section, we consider a generalization of the simple model of the demand for energy services to allow for these possibilities, and investigate the implications of this for empirical analysis, including the determination of rebound effects. 13 See, for example, Berkhout et al (2000), who seem to suggest that any estimates of price elasticities can be used. Sorrell and Dimitropoulos (2008:640) also appear to support this view, if the price elasticitybased definition of the rebound effect is used. 20 4. Generalized Model Here we consider the case where there are of which may produce more than one of energy sources, indexed , energy services, indexed , 1, … , 1, … , , each . For notational convenience, energy services are defined separately according to the energy source that is used to produce them. Thus, rather than considering heating as an energy service that can be produced using electricity or natural gas, or some other energy source or combination of energy sources, heating produced by electricity is considered to be a different energy service to heating produced by natural gas.14 4.1 Utility Maximization Model Using x to denote the quantity of the ith energy source or good, and y to denote the quantity of the mth energy service, the efficiency of energy source i used to produce energy service m is given by ε , where: , (20) where is the quantity of energy source i that is used to produce energy service m, so that (21) ∑ where ∑ . refers to the sum over all energy services (m) that are provided by energy source , i. As in the simple model, relationships analogous to (11) provide the links between the (unobserved) prices of the energy services ( ), each of which is provided uniquely by a single energy source, and the prices of the energy sources ( ). Specifically, 14 Although in both cases the end result is heating, it is often the case that efficiency improvements are for a particular energy service–energy source combination. 21 (22) 1, … , ; , 1, … , ; . Thus, total expenditure on energy source i is the sum of expenditure on all the services produced by that energy source, so that: (23) ∑ ∑ 1, … , ; , 1, … , ; . Hence, the budget constraint for the case where the household derives utility from consumption of energy services and other goods becomes ∑ determine y , m (24) p y B and the consumer’s problem is to 1, … , n ,to: , subject to ∑ ,…, , which yields derived demand equations for the services/goods given by: (25) , ,… , , ,…, , , and hence expenditures on each energy service given by: ,…, (26) , , Although expenditure on energy service m, p y , is equal to expenditure on the amount of energy source (i) used to produce that energy service, p x , this latter expenditure is generally unobserved unless energy source i is used to produce only a single energy service. However, summing over all energy services produced by energy source i yields total expenditure on energy source i, p x , which is observed. Specifically, using (23) where both sides are divided by total expenditure, B, in conjunction with (26) yields expenditure share equations: (27) ∑ ∑ ,…, , , ,…, , 1, … , . Thus, compared to the simple model in Section 3, the only difference is that the price of each energy source appears (potentially) more than once in each expenditure share function, in each 22 case divided by the respective efficiency term. This has important implications for the identification of rebound effects using price elasticities, as is considered further below. 4.2 Price Elasticities and Rebound Effects In contrast to the simple model, when multiple energy sources can provide the same service (such as space or water heating), and multiple services can be provided by the same energy source (such as natural gas providing space heating and cooking), the relationship between the rebound effects and the price elasticities is necessarily more complex. In particular, it will not generally be possible to identify specific direct rebound effects directly from the own price elasticities. For example, in a model that has three energy sources but five energy services, there are three own-price elasticities but five direct rebound effects, so it is clearly not possible to uniquely identify each direct rebound effect from each estimated own-price elasticity. Rather, each price elasticity will involve a weighted sum of certain rebound effects, as shown below. Given that the expenditure share of the ith energy source is defined as s x p x /B, so that Bs /p , it follows that the own- and cross-price elasticities can be written as: , , (28) where δ 1 if i j, and 1, … , , 0 otherwise. Since the direct and indirect rebound effects are given by: (29) , m, q = 1, …, , and, as can be seen from (22), ε only appears in the denominator of p , where 1, then using the chain rule the rebound effects can be written as: (30) , , 1, … , . 23 Defining the expenditure share of the mth energy service as s B y B , so that B , the direct and indirect rebound effects can be written as: (31) , m, q = 1, …, 1 if where , and , 0 otherwise. To determine the relationship between the price elasticities in (28) and the rebound ∑ effects in (31), we first divide both sides of (23) by B to yield s s , where m i refers to all energy services (m) that are provided by energy source i. Thus, ∑ (32) ∑ ∑ , , 1, … , ; , 1, … , , since the jth energy source may be used to produce a number of energy services, so that its price, 1, for , may be related to several prices of energy services, via (22). Since, from (22), , then substituting (32) in (28) yields: ∑ (33) Substituting for , , 1, … , ; , 1, … , . from (31) now yields: (34) ∑ To simplify, we note that if i j, then δ δ ∑ 0. Conversely, if i ∑ ,, 0, and since m i and q j, then m 1, and ∑ j, then δ 1, … , ; δ , 1, … , . q, so that 1, so that since ∑ 1, it follows that: (35) ∑ ∑ , , 1, … , ; , 1, … , . 24 This result indicates that the own- and cross-price elasticities are linear combinations of various direct and indirect rebound effects, where the weights are (the negative of) the ratios of the expenditure shares of an energy source used to provide a particular energy service to the total expenditure share (across all uses) of that energy source. For example, suppose that one of the energy sources is natural gas (g), and that this produces heating h s and cooking c . Then if denotes the (usually unobserved) expenditure share of gas used for heating, and s denotes the (usually unobserved) expenditure share of gas used for cooking, while s is the (observed) expenditure share of gas used for all purposes (=s s ), then from (35), (36) where = elasticity of gas, (heating with gas) with respect to efficiency of heating with = elasticity of with respect to efficiency of cooking with gas, elasticity of (cooking with gas) with respect to efficiency of heating with gas, and elasticity of with respect to efficiency of cooking with gas. = = It is possible (but not necessary) that the two indirect rebound effects are zero, η h η c rebound elasticities, 0, but even in this case it is still not possible to identify the two direct and , from the own-price gas elasticity, η . Of course, if gas only produced a single energy service, say heating, as in the simple model, then s and s 0, so that η η s , h , and the rebound effect would be the negative of the own-price elasticity. However, in general, if an energy source produces multiple energy services, it is not possible to identify specific rebound effects from price elasticities. However, in this case the price elasticities will still provide information about combined rebound effects, as in (35) or 25 (36), and if this can be supplemented with information about the shares of an energy source that are used for different purposes, it may be possible to provide conditional information about specific rebound effects. 5. Empirical Implementation of the Generalized Energy Services Model Next we consider empirical implementation of the general model of energy services developed above using typically available data that pertain to consumption of energy sources. Since it is used in the illustrative empirical analysis in Section 7, the energy services model is considered in the context of the equations of the Almost Ideal Demand System (AIDS). In this case, the expenditure share equations are derived from a cost function rather than a utility function, but the outcome in terms of the preceding analysis is unchanged. Following Deaton and Muellbauer (1980), the equations for the expenditure shares for each energy service, s B B , have the form: ∑ (37) , m, q = 1, …, , where ln P is the logarithm of a price index, which is considered further below. Since, from (22), ln p ln p ⁄ε ln p ln ε , 1, … , n; 1, … , n ; q j , (37) can be re-written as: (38) m, q = 1, …, ∑ ∑ ln ∑ ∑ ln , where ∑ ∑ ∑ ln ln ∑ , ln . In the general case, different energy services are provided by the same energy source, and thus face the same price for that energy source (but possibly have different efficiencies), while 26 unobserved budget shares for different energy services provided by a specific energy source sum to the observed budget share for that energy source. Thus, (38) can be aggregated by summing across all the different energy services provided by each of the n energy sources ∑ s to yield the following system of budget share equations, one for each energy source (or good): ∑ (39) 1 , i, j = 1, …, , where ∑ (40) and ∑ ∑ ; ∑ ; ∑ ∑ ; , , 1, … , , . refers to the sum over all energy services (m) that are provided by energy source (i), where i, j =1, …, n index the n energy sources and/or goods, ln P is the logarithm of the usual homogeneous of degree 1 (HD1) price index that appears in the AIDS model, as discussed below, and TERM1 is also defined below. Note that the usual adding-up conditions (since the sum of the budget shares is 1), along with homogeneity and symmetry, which apply to (37) or (38), have implications for the parameters in (39). In particular, adding-up requires: (41) 1; ∑ ∑ 0 for all ; ∑ 0; m, q = 1, …, , while homogeneity and symmetry require: (42) ∑ 0 for all ; and , As can be seen from the definitions in (40), γ i, j = 1, …, n, while ∑ α ∑ γ 0 ∑γ 1 ∑γ ∑α m, q = 1, …, γ 1; ∑ β . , m, q = 1, …, n , implies that γ 0 ∑β γ , 0; and ∑ γ 0. Thus, the same conditions that apply to (37) or (38) apply to the re-parameterized specification in (39). Of course, for (39) to satisfy adding up it is also necessary that ∑ TERM1 0, which can be shown to hold given the restrictions in (41). 27 Thus, in the absence of TERM1 in (39), and even though energy services might be provided by multiple energy sources, and any particular energy source may provide several different types of energy services, the system of equations that would be estimated when the model is specified in terms of energy services would be the same as the system that would typically be estimated when utility is defined simply over energy sources (and possibly goods), and the usual parameter restrictions would be appropriate. Thus, the key difference that arises from the consideration of energy services is this extra expression, TERM1 . Unless this expression is equal to zero, estimation by standard methods will result in omitted variables bias, and this has implications for price elasticities and rebound effects that would be determined from such a system. The possibility of this expression equalling zero, and therefore of avoiding bias issues when it is omitted, is discussed below in the context of specific AIDS model formulations. 5.1 The Nonlinear AIDS Model in (37) is defined by: For the nonlinear energy services AIDS model, (43) ∑ ∑ ∑ ⁄ ln Since, from (22), ln , , = 1, …, , , 1, … , ; 1, … , ; , (43) can be re-written as: (44) ∑ ∑ / ∑ ∑ / ∑ ∑ / , , = 1, …, , which, using (40), can be simplified to: (45) 2 where ln P is the usual price index defined in the nonlinear AIDS model as: (46) ∑ ∑ ∑ , j, k = 1, …, n. 28 and where: (47) 2 ∑ ∑ ∑ ∑ ∑ ∑ , , = 1, …, ; Hence, for the nonlinear AIDS model in (39) the expression (48) 1 ∑ ∑ – 2 ∑ 1, … , , 1 is given by: 2 ∑ . Thus, in terms of empirical implementation, the only change that occurs with the nonlinear AIDS model when consumers determine demands for energy services rather than for energy sources, is the addition to the estimating equations for the expenditure shares of TERM1 . In particular, expenditure shares are still defined in terms of energy sources, and the price terms in the estimating equations, (39) and (46), refer to these energy sources. Thus, focusing on demands for energy sources (as is typically done) rather than demands for energy services is tantamount to omitting TERM1 from the estimating equations. This term involves (in natural logarithms) the efficiency measures, the cross products of the efficiency measures with the prices of the energy sources, and the cross products of the efficiency measures. Under certain, though unlikely conditions, this omission will be unimportant. These include when efficiency is equal to 1 for all energy services and for all observations (ln ε all energy services and observations (ln ε 0), or when efficiency is the same for θ), where θ is a constant, in which case TERM1 will disappear with the homogeneity conditions (42) or be absorbed into the intercept otherwise. Even if efficiency differs for different energy services but is constant over time (ln ε TERM1 will be absorbed into the intercept and the coefficients on θ ), . However, in any other circumstances, such as when there are differences in efficiency and variation over time, as would 29 be expected, then estimation of (39) (incorporating (46)) without including the efficiency terms (TERM1 ) will result in omitted variables bias.15 5.2. The Linearized Form of the AIDS Model (LAIDS) In the linearized form of the AIDS model, the price index, ln P in (37) is replaced by a predetermined price index, such as the Stone Price Index: (49) ∑ ln ∑ where s ∑ ln ln ∑ ∑ ln , s , so that ln P simplifies to the usual Stone Price Index defined over energy ∑ sources, ln P ∑ s ln p . Hence, based on summing (38) over , for LAIDS the expression TERM1 in (39) is given by: (50) ∑ 1 where ∑ ∑ , . refers to the sum over all energy services m that are provided by energy source i.16 Thus, in view of (50), the only difference between (39) and the usual share equations for the LAIDS model that would typically be estimated when the model is defined in terms of energy 15 If efficiency is the same for all energy services but differs over time (ln ε θ ), with the homogeneity conditions, TERM1 will simplify to a stochastic trend. 16 Note that if the efficiency terms were also to be introduced in the Stone Price Index in (49), by defining ∑ ln ∑ ∑ ln ln ∑ ∑ ln ln , 1 in (39) would become . Typically, since the Stone Price Index is used as an approximation to linearize the share equations, and since introducing unobserved efficiency terms into (49) would mean that (49) could not be determined prior to estimation and would therefore result in all current period shares appearing as explanatory variables in each share equation, (49) would not be defined in this way. 30 sources rather than energy services is the inclusion of additional terms, ln ε , to reflect the energy efficiency of the various energy sources when used to produce particular energy services. With the LAIDS version of (39), since the efficiency terms do not appear in the Stone Price Index in (49), p and ε do not only appear in ratio form. Therefore, there will not be the usual correspondence between the (combined) rebound effect and the negative of the price elasticity that was derived earlier. The price elasticities for the various energy sources for the LAIDS model can be calculated from the estimated parameters using the relationship:17 (51) , , The rebound effects for the LAIDS version of (38), using ln 1, … , . as defined in (49), are calculated using (29) as: (52) , Thus, rather than (35), the relationship between ∑ (53) ∑ m, q = 1, …, and , , . is given by: 1, … , ; m, q = 1 …, . It is perhaps useful to note that the lack of a direct (negative) relationship between the combined rebound effects and the price elasticities with the LAIDS model is of no practical importance, since estimates can still be readily obtained of both the combined rebound effects (using the left hand side of (53)) and the price elasticities (using (51)). Indeed, the relationship 17 See Buse (1994) for an evaluation of the various possible elasticity expressions that can be used with the LAIDS model. This expression is the most widely used and, according to Buse’s results, is marginally the best. 31 between these two measures is only of importance in typical energy demand models where efficiency is not taken into account, and where therefore there is no other obvious way to determine rebound effects. However, as has been shown earlier, even in this case the combined rebound effect can only be effectively estimated using the negative of the price elasticities if energy efficiency is explicitly incorporated in the model. As discussed in the following section, these energy efficiency variables are typically not observed; the approach we use involves specifying them as functions of variables and parameters. In the LAIDS model, the functional expression for the rebound elasticities does not depend explicitly on the ε , but only on the parameters that appear directly in (51). In particular, these rebound elasticities will not depend explicitly on the particular variables included in these efficiency functions, and their corresponding estimated coefficients, although these aspects of the specifications will of course potentially affect the values of all the other estimated parameters in the model and the estimated shares, and therefore will affect the numerical values of the rebound elasticities.18 18 However, as can be inferred from (47), which involves products of the prices of the energy sources and the efficiency terms, in the elasticity formula for the nonlinear AIDS model the ε do appear explicitly, so that with that specification, the particular variables included in the efficiency functions, and their corresponding estimated coefficients, will affect the elasticities directly. 32 6. Approaches to Modelling Unobserved Energy Efficiency As noted above, a difficulty with the energy services model specification is that in general it is unlikely that data will be available on the various efficiency variables. For notational convenience we include a time of observation subscript on these variables, so the issue to be considered is how to specify ln ε (q = 1,..., , t=1, …, T) in the equations that are to be estimated. The approach adopted here is to approximate these terms using functions of observed variables: (54) , , , , where the subscript ‘r’ on the function indicates that the function may differ for different energy services. An illustrative selection of possible choices for the explanatory variables that determine (the natural logarithm of) energy efficiency for the rth energy service is considered below. 6.1 Energy Efficiency Dependent on Time One possibility is that energy efficiency simply follows a time trend, reflecting the effects of technological progress. The use of time trends in systems of demand equations to represent technical progress has a long history (see Hunt et al., 2003 for a summary of the debate in the literature about the use of a linear trend), and such an approach here would therefore be consistent with many previous studies. Allowing for possible nonlinearities, this suggests:19 (55) A drawback of this approach, however, is the assumption that improvements in energy efficiency are ‘exogenous’, and not driven by prices. 19 Alternatively, a stochastic trend (as discussed in Hunt et al., 2003) could be considered, although this is difficult to apply in a systems framework. 33 6.2 Energy Efficiency Dependent on Past Energy Prices If the prices of energy sources are increasing, there is presumably more motivation for technical change to improve efficiency of the delivery of household energy services, such as heating using natural gas. Such technical change could be embodied in the furnace or boiler that is used for the space heating, or it could be reflected in additional insulation that is installed in the house. Either of these factors would be expected to increase the amount of service (heat) produced per unit of the energy source, that is, to increase energy efficiency of natural gas heating. This suggests that energy efficiency will be a function of past prices of various energy sources, not necessarily just the one that is used to provide the energy services being considered, since substitution is possible. Alternative choices here for the lagged energy source price terms include relative prices, real prices, or growth rates; in our illustrative empirical application we use three- and five-year growth rates, which we supplement with time trends as in (55). With such an approach, the essential difference compared to demand systems that are typically estimated for different energy sources, and possibly including other goods, is the inclusion of lagged price (or price growth) terms in the expenditure share equations. 6.3 Energy Efficiency Dependent on Past Energy Price Components A number of authors have estimated energy demand models that allow for asymmetric responses to price changes. A rationalization for the existence of such asymmetric responses is that when energy prices rise, households make irreversible energy efficiency investments that reduce their responsiveness to energy demand, even if energy prices were subsequently to decrease. In the energy services model developed here, these energy efficiency investments are explicitly recognized rather than being the implicit cause of an effect captured through allowing different coefficients on different components of energy prices. Of course, the types of terms 34 used to allow for asymmetric effects, as considered by Gately and Huntington (2002) (among others), could be used to summarize past behaviour of energy prices that affects energy efficiency. Specifically, what matters in determining energy efficiency might not just be past prices of energy sources, but the actual sequence of these prices. In other words, energy efficiency might only be expected to increase if there is a sustained period of energy price increases. Thus, rather than use lagged prices, the past maximum price (provided it is not too far in the past), along with cumulative price recoveries and cumulative price decreases, might be an appropriate way to summarize the effects of price on energy efficiency. 7. Illustrative Empirical Example To illustrate the approach developed here, we estimate various specifications using UK residential energy demand data. We compare results for a ‘base’ benchmark model – the LAIDS model without the extra terms that result from explicitly incorporating energy services in the consumer utility maximizing framework – with three augmented models that capture the effect of efficiency using the various approaches discussed in the previous section.20 The Base Model is given by: (56) ∑ ln ln , , = 1, …, , =1,…, , where: , = 1, …, represents the n (=3) energy sources ( , =1 for electricity, =2 for natural gas, =3 for other (oil and solids); is the expenditure share on the is total per-capita expenditure on the three energy sources, energy source in period , is the price of the energy 20 These specifications are just meant to be illustrative; the energy services model is sufficiently rich to allow many other possibilities, and some others may be preferable. 35 source, =1,…, , ∑ is the Stone Price Index, where , is a weather- related variable (typically included in residential energy demand equations) – here, average January temperature (degrees Celsius), and is a random error term. Lagged shares are included to deal with possible autocorrelation. Adding up, homogeneity, and symmetry conditions are imposed, so that we jointly estimate two of the three expenditure share equations (‘other’ is omitted, and the parameters of this equation are retrieved via the adding up conditions). The Augmented Models are the same as the base model specification except that a set of , is added.21 We consider three specifications of the variables, terms, ∑ that are used to capture energy efficiency: A1: 1, , A2: 1, , , 3, A3: 1, , , ; , 5, , 1, ; 1,2,3 ; , 1, , 1; 1,2,3 ; is the once-lagged three year growth rate for the real price of the jth energy source where 3 , (j=1,2,3), where 3 , , and is a general price deflator, 5 , is the once-lagged five-year growth rate for the real price of the jth energy source, defined analogously, and , , , , and , (j=1,2,3) are the components of the Gately and Huntington (2002) real (logarithmic) price decomposition, lagged one period. 21 Note that the theoretical model places no restrictions on the coefficients of these variables, other than the usual adding-up conditions, whereby ∑ 0, for all r. 36 UK annual data for the residential (domestic) sector for the period 1964 to 2009, from the UK Office for National Statistics (ONS) online database,22 are used for electricity, gas and ‘other’ (oil and solids) expenditure, with the implied deflators used for the price indices. Table 1 displays the log-likelihood value (LL) and the Schwarz Bayesian information criterion (BIC) for the base specification and the three alternative specifications. Likelihood Ratio (LR) tests show that all of the augmented specifications are preferred to the base specification, showing the importance of modelling energy services and attempting to capture the energy efficiency impacts. LR tests also indicate that models with various forms of lagged prices (A2 and A3) are preferred to specification A1 that only includes t and t . Augmented specification A2 that encapsulates asymmetric price responses gives the highest LL and lowest BIC. Table 1: Results of Estimated Specifications Specification Base A1 A2 A3 1 253.547 263.161 289.922 315.097 -231.637 -232.487 -232.955 -249.367 N/A Reject Reject Reject N/A N/A Reject Reject Estimated own-price elasticities, obtained from (53) with i=j, denoted combined rebound effects, obtained from (55), denoted , and associated , for the Base Specification as well as Augmented Specifications A2 and A3, are shown for all years in Figures 1 and 2. Average values are presented in Table 2. 22 Available from www.statistics.gov.uk 37 Table 2 Average Estimated Price and Rebound Elasticities Specification -0.80 -1.11 -0.82 Base -0.44 0.63 -0.99 0.79 -0.42 0.61 A2 -0.43 0.69 -1.03 0.76 -0.42 0.57 A3 The results in Table 2, along with the information in Figure 1, show that the estimated own-price elasticities for the augmented models differ from those for the base model. This illustrates that the explicit modelling of energy services impacts on the estimated own-price elasticities, indicating that results obtained from estimation of standard ‘energy demand’ relationships that do not consider energy service demand are likely to be biased. Moreover, the ‘bias’ can vary. For electricity, the estimated average own price elasticity (E ) from the base model is about –0.8, which is almost double the –0.4 obtained from specifications A2 and A3 (and this finding is consistent throughout the estimation period). For natural gas, the estimated average own price elasticity ( ) from the base model is about –1.1, which is just above the approximate –1.0 estimates obtained from A2 and A3. However, as Figure 1 shows, the difference is greater in 1970 and reduces over the estimation period. For ‘other’, the estimated average own price elasticity ( ) from the base model is about –0.8, which is almost double the –0.4 value obtained from A2 and A3. However, the difference is smaller in 1970 and increases over the estimation period as elasticity estimates from A2 and A3 decrease (in absolute terms) in line with ‘other’ falling as a share of consumer expenditure on energy as a whole.23 The estimated combined rebound elasticities differ somewhat from the (negative) of the own price elasticities of demand from the base model as well as from the negative of the own 23 Estimated elasticities for ‘other’ are positive towards the end of the period, but these values are insignificant and can effectively be regarded as zero. 38 price elasticities of demand from the augmented models. This clearly highlights problems in previous research that has used the negative of the own price elasticity of energy demand as an estimate of the (direct) rebound elasticity. Moreover the ‘bias’ can vary. For electricity, the estimated average rebound elasticity ( ) is about 0.6 to 0.7, which is greater than the negative of the estimated own-price elasticity ( ) of about 0.4 from A2 and A3, but less than that from the base model of about 0.8 (and the differences are consistent over the estimation period). For natural gas, the estimated average rebound elasticity ( negative of the estimated own-price elasticity ( ) is about 0.8 which is less than the ) of about 1.0 from A2 and A3, but in this case also less than that from the base model of about 1.1. However, as Figure 2 shows, the difference between these rebound elasticities and for the base model diminishes over the estimation period, although the difference at the end of the period is still noteworthy. For ‘other’, the estimated average rebound elasticity ( estimated own-price elasticity ( ) is about 0.6 which is greater than negative of the ) of about 0.4 from A2 and A3, but somewhat less than the base model value of about 0.8. However, Figure 2 shows that for ‘other’ there is no notable difference between the estimated rebound elasticity ( elasticity ( ) and the estimated (negative) own price ) from A2 and A3, although the difference between all of these and the negative of the estimated own-price elasticity from the base model increases over the estimation period. Again, this highlights potential problems with viewing the negative of the estimated energy demand price elasticity from a model that does not explicitly take account of energy service demand as a measure of the rebound effect. 39 8. Summary and Conclusions Although energy is typically demanded for the services it provides rather than for its own sake, this feature is rarely considered explicitly in empirical analysis. Consequently, the model of energy service demand that we develop here has the potential for re-examining, and providing insights into, a number of issues in energy economics that have previously been approached in a somewhat unsatisfactory, and in some cases potentially misleading, ad hoc fashion. The particular issue we focus on in this paper concerns the empirical measurement of rebound effects in energy economics, but other issues such as the debate over asymmetric energy demand responses to price increases and decreases might also be usefully considered in this framework. While consumption of various energy services might not be directly observed, particularly if there is not a one-to-one correspondence between energy services and energy sources, our energy services model can be readily estimated using aggregate data on consumption of energy sources. However, this requires the inclusion of energy efficiency terms, or terms that can be used to represent energy efficiency, in otherwise relatively standard energy demand model specifications. In these enhanced models, use of the negative of the own-price elasticity of demand as a measure of the direct rebound effect may be appropriate, although this is dependent on the particular functional specification that is used. For example, with the linearized AIDS model, a particular function of this price elasticity is more suitable for this purpose. Thus, routine interpretation of the negative of the own-price elasticity of energy demand as a direct rebound effect (as has been done in numerous previous studies, using various functional forms, that in any event do not include energy efficiency terms) could be very misleading. This finding is supported empirically by results for the UK that show that the 40 rebound effect could be significantly higher or lower than the negative of the standard own-price elasticity, both from standard and enhanced energy demand models. Finally, based on our generalized model, we show that when it is recognized that a particular energy service can be produced by any one (or a combination) of a number of energy sources, and that each energy source can produce several energy services, empirical estimates of direct (and indirect) rebound effects for particular energy services cannot be individually obtained using price elasticities for energy sources – regardless of the model that is estimated. Rather, these price elasticities yield only a weighted sum of a number of rebound effects. Since this situation is most likely to apply in practice, it would appear to be unwise to persist with interpreting price elasticities as meaningful representations of specific rebound effects. 41 References Berkhout, P.H.G., J.C. Muskens, and J.W. Velthuijsen (2000). “Defining the Rebound Effect”, Energy Policy, 28: 425-432. Buse, A. (1994). “Evaluating the Linearized Almost Ideal Demand System”, American Journal of Agricultural Economics, 76(4): 781–793. Deaton, A., and J. Muellbauer (1980). “The Almost Ideal Demand System”, American Economic Review, 70(3): 312-326. Fouquet, R., and P.J.G. Pearson (2012), “The Long Run Demand for Lighting: Elasticities and Rebound Effects in Different Phases of Economic Development”, Economics of Energy & Environmental Policy, 1(1): 83-100. Gately, D., and H.G. Huntington (2002). “The Asymmetric Effects of Changes in Price and Income on Energy and Oil Demand”, The Energy Journal, 23(1): 19–55. Greening, L.A., D.L Greene, and C.Difiglio (2000). “Energy Efficiency and Consumption – The Rebound Effect: A Survey”, Energy Policy, 28(6-7): 389–401. Haas, R., N. Nakicenovic, and A. Ajanovic (2008), “Towards Sustainability of Energy Systems: A Primer on How to Apply the Concept of Energy Services to Identify Necessary Trends and Policies”, Energy Policy, 36(11): 4012-4021. Howarth, R.B. (1997). “Energy Efficiency and Economic Growth”, Contemporary Economic Policy, 15: 1-9. Hunt, L.C., G. Judge, and Y. Ninomiya (2003). “Modelling Underlying Energy Demand Trends”, Chapter 9 in L.C. Hunt (ed) Energy in Competitive Markets: Essays in Honour of Colin Robinson, Edward Elgar, UK: 140–174. 42 Huntington, H.G. (2010). “Short- and Long-Run Adjustments in U.S. Petroleum Consumption”, Energy Economics, 32: 63-72. Sorrell, S. (2009). “The Rebound Effect: Definition and Estimation”, Chapter 9 in J. Evans and L.C. Hunt (eds.), International Handbook on the Economics of Energy, Edward Elgar, UK: 199–233. Sorrell, S., and J. Dimitropoulos (2005). “UKERC Review of Evidence for the Rebound Effect: Supplementary Note: Graphical Illustrations of Rebound Effects”, Working Paper, October 2007: REF UKERC/WP/TPA/2007/014 Sorrell, S., and J. Dimitropoulos (2008). “The Rebound Effect: Microeconomic Definitions, Limitations and Extensions”, Ecological Economics, 65(3): 636-649. 43 Figure 1: Estimated Own-Price Elasticities ( Estimated Electricity Own Price Elasticities (E11) ) Estimated Gas Own Price Elasticities (E22) ‐0.30 ‐0.85 ‐0.40 ‐0.90 E22 Base Specification E22 Specification A2 ‐0.50 ‐0.95 ‐0.60 E22 Specification A3 ‐1.00 E11 Base Specification E11 Specification A2 E11 Specification A3 ‐0.70 ‐1.05 ‐0.80 ‐1.10 ‐0.90 ‐1.15 Estimated 'Other'Own Price Elasticities (E33) 0.40 E33 Base Specification Note: For E33, dotted lines indicated estimates that are not significantly different from zero. E33 Specification A2 0.20 E33 Specification A3 0.00 ‐0.20 ‐0.40 ‐0.60 ‐0.80 ‐1.00 44 Figure 2: Estimated Rebound Elasticities ( Electricity Negative Own‐Price Elasticities (‐E11) and Direct Rebound Effects (R11) 1.20 0.80 1.10 0.70 1.00 0.60 0.90 0.50 0.80 0.40 0.70 0.30 0.60 ‐E11 Specification A2 R11 Specification A3 ‐E11 Specification A3 'Other' Negative Own‐Price Elasticities (‐E33) and Direct Rebound Effects (R33) 1.00 ) Gas Negative Own‐Price Elasticities (‐E22) and Direct Rebound Effects (R22) 0.90 ‐E11 Base Specification R11 Specification A2 & ‐E22 Base Specification R22 Specification A2 ‐E22 Specification A2 R22 Specification A3 ‐E22 Specification A3 Note: For ‐E33 andR33, dotted lines indicated estimates that are not significantly different from zero. 0.80 0.60 0.40 0.20 0.00 ‐0.20 ‐0.40 ‐E33 Base Specification ‐E33 Specification A2 R33 Specification A2 R33 Specification A3 ‐E33 Specification A3 45