Sabotage in a Fishery Ngo Van Long and Stephanie F. McWhinnie

advertisement

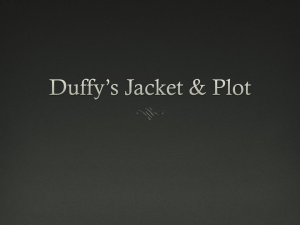

Sabotage in a Fishery Ngo Van Long Department of Economics, McGill University, Montreal H3A 2T7, Canada and Stephanie F. McWhinnie School of Economics, University of Adelaide, SA 5005, Australia Preliminary and Incomplete - Comments Welcome 1 SABOTAGE IN A FISHERY Abstract: This paper presents a simple model of a common access fishery where fishermen engage in sabotage activities in addition to productive fishing activity. We model sabotage as reducing the catchability coefficient of rival fishermen. We show that the steady-state fish stock is higher, the greater is the effectiveness of the sabotage technology: it seems that sabotage can mitigate the over-exploitation associated with the tragedy of the commons. We also consider the effect of sabotage on steady-state profit and find some interesting results: in the presence of sabotage, industry profit at first increases as the number of fishermen increases but later decreases, this non-monotonicity cannot happen in the standard model. Increasing the effectiveness of sabotage reduces sabotage effort but has a non-monotonic effect on levels of fishing effort. 2 1 Introduction Sabotage is a fact of life. Reports of sabotage have been made in a variety of fisheries including gear tampering, stealing and intimidation. A fisherman may want to sabotage the fishing effort of his rivals for various reasons. One possible motive for sabotage in an oligopolistic market is to raise rivals’ costs, thus reducing their outputs. Alternatively, in a perfectly competitive market (where the fishermen are price-takers), there is an incentive for a fisherman to sabotage if he shares the fishing ground with a fixed number of rivals, because his sabotage would reduce their catches, thus increasing next period’s stock (relative to what it would be without his sabotage) and hence increases his future catch at any given effort level. A third motive for sabotage is envy: an individual may care about his relative income, in addition to the usual concern for absolute income. In this paper we investigate whether sabotage may be helpful to a fishery: by reducing catches it may mitigate the tragedy of the commons. We present a simple model of a common access fishery where, in addition to productive fishing activity, price-taking fishermen also engage in sabotage. We investigate how the steady-state fish stock is dependent on the effectiveness of the sabotage technology. In particular, we ask if sabotage can result in a higher steady-state stock than the socially optimal stock and evaluate whether other model parameters such as the price/cost ratio lead to higher or lower steady-state levels of sabotage. In addition, we consider the effect of sabotage on steady-state profits relative to the non-sabotage profit level. In our model, agents act in their own best interests when harvesting from a common-pool resource. What differs from the standard Clark-Munro model is that, instead of simply choosing effort to maximise profits, they can also choose to engage in sabotage activities to reduce the ‘catchability coefficient’ in the production function of their rivals. We show that the greater the effectiveness of the sabotage technology, the higher the steady-state fish stock: it seems that sabotage can mitigate the over-exploitation associated with the tragedy of the commons. We also show that lower sabotage effort does not necessarily imply higher catchability if the sabotage 3 technology has improved and that any change in the price/cost ratio that results in a higher steady-state stock will result in a lower steady-state level of sabotage effort. Our numerical analysis on the effect of sabotage on profits gives some interesting results: the response to an increase in sabotage effectivess is non-monotone: industry profit at first increases as the number of fishermen increases but then it reaches a peak and afterward further increases in the number of fishermen lead to lower industry profit, this non-monotonicity cannot happen in the standard model without sabotage. There is a large literature on sabotage in the contexts of rent-seeking and tournament, see, for example, Gonzalez (2007), Konrad (2000, 2009), Amegashie and Runkel (2007). In contrast, to our knowledge, there has been no formal analysis of sabotage in a fishery. By considering sabotage we aim to highlight the effect of non-profit-maximising behaviour on fisheries and, renewable resources more generally. In addition, by extending the analysis to allow for cooperative production and the ability to engage in protection (as is currently in progress) we hope to shed light on the effect of cooperative behaviour amongst fishermen. 2 The Model The basis for our model is Clark and Munro’s (1975) dynamic, single species model. That is, we consider a fish stock exploited by n cymmetric fishermen who live in the same community. They do not coordinate their harvesting decision. We assume that their outputs are sold in a large market, so that aggregate quantity of fish they catch does not influence the market price, which we assume to be a constant p. Let xt denote the stock size and Lit the effort level of fisherman i at time t. Following Schaefer (1957) we assume that the amount harvested by each agent is hit = qit xt Lit , where qit is the catchability coefficient specific to agent i, and let the stock grow at a natural rate minus the total harvest. The cost per unit of effort is c > 0. We now diverge from the standard model and suppose that, in addition to productive fishing activity, fishermen may undertake sabotage activities against their 4 rivals. We model sabotage by rivals as affecting the catchability coefficient of each agent. Let sijt denote the sabotage effort of agent j directed against agent i with cost per unit of sabitage effort c > 0 (the same as the cost of fishing effort). Let Sti be the sum of sabotage efforts (by all other fishermen) directed against i: X Sti = sijt j6=i Then catchability, qit , depends on sabotage efforts by all rivals directed at i: qit = qb ≡ qi (Sti ) where 0 < σ ≤ 1 1 + (θ/σ)(Sti )σ (1) where qb is a positive constant, and θ > 0 is the effectiveness of the sabotage technology. The restriction 0 < σ ≤ 1 ensures that qi0 (S i ) < 0 and qi00 (S i ) > 0. Incorporating sabotage in this way means that each agent’s harvest is directly affected by the sabotage efforts of his rivals, and this affects both individual profits and the growth function of the stock. In addition, each unit of effort that i puts into sabotage reduces his own profits. That is, agent i’s profit, net of his fishing effort cost and the cost of his own sabotage effort directed against his rivals, is: X j sit πit = (pqit (Sti )xt − c)Lit − c (2) j6=i and the net rate of growth of the stock is n xt X ẋt = rxt 1 − − qit (Sti )xt Lit K i=1 where r > 0 is the intrinsic growth rate and K > 0 is the carrying capacity. We assume that in the absence of sabotage, the industry is potentially profitable. More precisely, we make the following assumption: Assumption 1: There exists a stock level xt < K such that pb q xt > c for xt > xt . That is, pb q xt > c iff xt > xt , where xt < K. We restrict the sum of agent i’s fishing effort and sabotage effort directed against other agents to not exceed Lit : Lit + X sjit ≤ Lit j6=i 5 (3) In what follows, we will focus on the symmetric equilibrium where each agent acts identically and sabotages all rivals equally. Then we can define: sit ≡ sjit for all j 6= i and agent i thus faces n − 1 identical agents, each allocating Ljt units of effort to fishing, and sjt units of effort to sabotaging each rival. The effort constraint (3) therefore reduces to: Lit + (n − 1)sit ≤ Lit We assume that each agent’s goal is to maximize the integral of discounted utility of net profit, where utility is: uit (πit ) = πit1−α 1−α where α ≥ 0.1 Player i takes the natural growth rate of the fish stock (xt ) and others’ fishing and sabotage effort levels (Ljt and sjt , j 6= i) as given. His problem is to choose his own fishing and sabotage effort levels (Lit and sit ) to maximise the discounted stream of utility: ˆ∞ e−δt 1−α 1 (pqit (Sti )xt − c)Lit − (n − 1)csit dt 1−α 0 Taking into account the non-negativity and time constraints on fishing and sabotage effort and denoting agent i’s shadow price of the fish stock at time t as ψt we get the Hamiltonian for agent i as: H = 1−α e−δt (pqit (Sti )xt − c)Lit − (n − 1)csit 1−α h i xt +e−δt ψt rxt 1 − − (n − 1)qjt (Stj )xt Ljt − qit (Sti )xt Lit K +e−δt ηt Lit + e−δt µt sit + e−δt νt (L¯it − Lit − (n − 1)sit ) 1 (4) In the steady-state, the parameter α plays no role but we retain this formulation to aid future consideration of the motives for sabotage, that is, purely profit driven or behavioural motives such as envy. 6 Assuming an interior solution, the first order conditions with respect to Lit , sit , xt and ψt are:2 πit−α (pqit (Sti )xt − c) − ψt qit (Sti )xt = 0 −πit−α (n − 1)c − ψt (n − πit−α pqit (Sti )Lit ∂qjt ∂Stj 1)xt Ljt j ∂St ∂sit (5) =0 (6) 2xt j i − ψt (n − 1)qjt (St )Ljt − ψt qit (St )Lit = − ψ̇t − δψt + ψt r 1 − K (7) xt rxt 1 − − (n − 1)qjt (Stj )xt Ljt − qit (Sti )xt Lit = 0 (8) K Condition (5) says that at the agent’s optimum, today’s marginal utility obtained by exercising fishing effort is equated to the imputed cost of having a lower stock tomorrow. Provided that n − 1 6= 0, condition (6) says that today’s marginal cost of sabotage effort against n − 1 rivals is equated to the benefit of reducing their catches (in terms of inducing a higher stock tomorrow). If n − 1 = 0 then of course there will be no sabotage; in what follows, we assume n − 1 > 0. At the symmetric steady state, Lit = Ljt = L∗ , sjt = sit = s∗ , and qit = qjt = q(S ∗ ) where S ∗ = (n − 1)s∗ . This means (5) and (6) can be rewritten as: ψ∗ = π ∗−α (pq(S ∗ )x∗ − c) q(S ∗ )x∗ (9) and ψ∗ = − π ∗−α c ∂q ∂S x∗ L∗ ∂S ∂s 2 (10) We have ignored corner solutions for simplicity. To take into account corner solutions, we note that (i) fishing effort would be zero whenever the stock level is so low that the value marginal product of fishing effort is lower than the marginal effort cost c, and that (ii) sabotage effort si would be zero if the marginal benefit of sabotage (evaluated at s = 0) is lower than the marginal effort cost, c. Clearly, if 0 < σ < 1 then sabotage is always positive when fishing effort is positive. If σ = 1 then for sabotage to be positive, θ must be sufficiently large. In what follows, we focus on the interior solution, and assume that θ is sufficiently large. 7 Equating (9) and (10) and finding ∂q ∂S ∂S ∂s from (1) gives: 2 c 1 + σθ S ∗σ pq(S ∗ )x∗ − c = q(S ∗ ) L∗ q̂θS ∗σ−1 and substituting in for q̂ from (1) gives: θ ∗σ S c 1 + σ pq(S ∗ )x∗ − c = (11) L∗ θS ∗σ−1 which is the arbitrage condition that the marginal value from an extra unit of effort used for fishing must equal the marginal value of effort used for sabotage. Substituting (9) into (7) and setting ψ̇ = 0 gives the steady-state relationship: q(S ∗ )x∗ 2x∗ ∗ ∗ + pq(S )L − nq(S ∗ )L∗ δ =r 1− K pq(S ∗ )x∗ − c (12) Further, (8) in steady-state can be rearranged to give: r L = nq(S∗) ∗ x∗ 1− K (13) which can be substituted into (12) to give: 2x∗ r x∗ pq(S ∗ )x∗ δ =r 1− − 1− n− K n K pq(S ∗ )x∗ − c (14) Equation (14) is the usual fisheries modified golden rule except that the catchability coefficient is a function of sabotage.3 However, as there are two endogenous variables in (14), the equilibrium requires an additional equation. The other steadystate relationship we can use is the the intratemporal arbitrage condition (11) with (13) substituted in, that is: c 1 + σθ S ∗σ nq(S ∗ ) pq(S )x − c = ∗ θS ∗σ−1 r 1 − xK ∗ ∗ 3 (15) The intuition of (14) is as usual: at the margin, the return from harvesting another fish today must equal the return from leaving it in the ocean to grow for tomorrow, net of the change that a rival will take it first. 8 This means that the steady-state equilibrium of this model is defined by both the intertemporal arbitrage equation (14) and the intratemporal arbitrage equation (15). In subsequent sections we use these conditions to evaluate the effect of sabotage on equilibrium stock levels and the effect of sabotage on steady-state profits. Lemma 1: Equilibrium steady state profit per fisherman is: 1 c ∗ ∗ −1 π = + cS θS ∗σ−1 σ (16) where S ∗ is the Nash equilibrium level of sabotage.4 Proof: In a symmetric equilibrium, we can see from (2) and (11) that: π ∗ = (pq(S ∗ )x∗ − c)L∗ − cS ∗ and c 1 + σθ S ∗σ (pq(S )x − c)L = θS σ−1 Substituting (18) into (17) gives (16). ∗ 3 ∗ (17) ∗ (18) The case where 0 < σ < 1 In the case where 0 < σ < 1, we have a system of two equations in two unknowns, x∗ and S ∗ , equations (14) and (15) which can be rewritten as: r x∗ c 2x∗ − 1− (n − 1) − δ =r 1− K n K pq(S ∗ )x∗ − c r x∗ θS ∗σ−1 c = 1− ∗ n K qb pq(S )x∗ − c (19) (20) It turns out that these two equations can be solved in two steps. In the first step, S ∗ can be expressed as an explicit function of x∗ and of other parameter values, S ∗ = φ(x∗ ; qb, θ, σ, δ, n). In the second step, this function is substituted into eq (19) to obtain an equation in x∗ . We state these results as Lemma 2 and Lemma 3. In the special case where σ = 1, we get π ∗ = c/θ, which is rather surprising: it depends only on c and θ. 4 9 Lemma 2: Given that n − 1 > 0, the steady-state stock x∗ uniquely determines the steady-state sabotage effort by the following equation: 1 1−σ θ ∗ S = q̂ 1 ! 1−σ ∗ 2 r2 1 − xK ∗ n nδ − r + (n + 1) rx K (21) Proof: Equation (19) can be re-written as: ∗ δ − r 1 − 2x c K + (n − 1) = x∗ r ∗ pq(S )x∗ − c 1− K n (22) which gives the same right-hand-side as (20). Therefore, equating (22) and (20) gives: ∗ δ − r 1 − 2x K r x∗ 1 − n K r + (n − 1) = n x∗ θS ∗σ−1 1− K qb and rearranging: S ∗σ−1 " # ∗ q̂ δ − r 1 − 2x n − 1 K = ∗ 2 + r r x∗ θ 1 − xK 1 − n n K q̂ rx∗ = (n + 1) nδ − r + ∗ K nθ nr 1 − xK 2 (23) From (23) we can see that S ∗σ−1 will be positive if and only if r − nδ x∗ > K (n + 1)r (24) We have already assumed that profits are positive which tells us that the right-handside of (22) must be positive. This implies the left-hand-side must also be positive, that is: ∗ δ − r 1 − 2x K n−1+ r x∗ 1 − n K 10 >0 which can be rearranged to show that x∗ r − nδ > K (n + 1)r Therefore, as profits are positive, S ∗σ−1 must be positive so we can denote S ∗ = φ(x∗ ) such that:5 1 1−σ θ ∗ S = q̂ 1 ! 1−σ ∗ 2 r2 1 − xK = φ(x∗ ; δ, r, K, n, θ, qb) ∗ n nδ − r + (n + 1) rx K (25) It can be seen from equation (21) that the derivative of S ∗ with respect to x∗ is negative for all x ≤ K, provided that condition (24) holds. Thus we obtain the following proposition: Proposition: Given that 0 < σ < 1, any change in a parameter (other than n) that results in a higher steady-state stock x∗ will result in a lower steady-state sabotage effort, S ∗ . Note, however, that a lower steady-state sabotage effort does not necessarily imply a higher steady-state catchability coefficient. For example, increasing the sabotage effectiveness parameter θ may lead to less sabotage effort being necessary to achieve the same or a lower catchability coefficient for rivals and hence higher stocks. Lemma 3: Assume that n − 1 > 0. Then there exists a steady-state stock of fish x∗ < K. It is a solution of the following equation: 6 #σ/(1−σ) σ/(1−σ) " ∗ 2 r2 1 − xK θ = (θ/σ) ∗ qb n nδ − r + (n + 1)r xK (nδ − r + (n + 1)r(x∗ /K)) (p/c)b q x∗ K(r − nδ) − 1, where < x∗ < K ∗ nδ + nr(x /K) r(n + 1) 5 (26) Note that (25) does not contain the parameter p/c, we will need another equation to determine the effect of changing this ratio later. 6 Equation (26) determines the steady-state stock x∗ in the feasible interval (0, K). It does not seem possible to prove uniqueness analytically; it is conceivable that there are several solutions, i.e. multiple steady states). 11 Proof of Lemma 3: Substitute into the rearranged modified golden rule equation (22) the equation for q(S ∗ ) (1) and subsequently substitute S ∗ = φ(x∗ ; ...) ∗ δ − r 1 − 2x c K + (n − 1) = p ∗ x∗ r q b x c 1− K −c n 1+ θ S ∗σ σ 1 = p qbx∗ c θ 1+ σ [φ(x∗ ;...)]σ −1 which can be rearranged to: 1+ p qbx∗ c θ [φ(x∗ ; ...)]σ σ ⇒ 1+ −1= p qbx∗ c θ [φ(x∗ ; ...)]σ σ δ−r 1− r n 2x∗ K ∗ 1 − xK + (n − 1) nr 1 − x∗ K ∗ r 1 − xK =1+ ∗ > 1 nδ − r + (n + 1) rx K (27) The right-hand-side of (27) must be greater than one when x∗ < K and profits are positive, that is, from condition (24). Further rearranging gives: 1+ Thus p qbx∗ c θ [φ(x∗ ; ...)]σ σ ∗ nδ + n rx K = ∗ nδ − r + (n + 1) rx K " # rx∗ nδ − r + (n + 1) θ p K [φ(x∗ ; ...)]σ = qbx∗ −1 ∗ σ c nδ + n rx K (28) Substituting (21) for φ(x∗ ; ...) in (28) gives us a condition for x∗ : σ !# 1−σ # " σ " ∗ 2 ∗ r2 1 − xK θ θ 1−σ p ∗ nδ − r + (n + 1) rx K −1 = qbx rx∗ rx∗ σ qb c nδ + n K n nδ − r + (n + 1) K (29) where from (24) K(r−nδ) r(n+1) < x∗ < K. The graph of the left-hand side of eq (29) against x in the interval K(r−nδ) r(n+1) < x∗ < K is a continuous curve, which approaches infinity when x is arbitrarily close 12 to K(r−nδ) , r(n+1) and which approach zero as x tends to K. The graph of the right- hand side of eq (29) against x in the interval K(r−nδ) r(n+1) < x∗ < K is a continuous curve, which approaches −1 when x∗ is arbitrarily close to K(r−nδ) , r(n+1) and approaches ∗ (p/c)b q K − 1 > 0 as x tends to K. Therefore the two curves must intersect at least once. This completes the proof of Lemma 3.7 Remark: In the special case where σ = 1 , 2 we obtain from (29) the following cubic equation: 2 x∗ x∗ θ2 2 δ+r = 2 r 1− q̂ K K x∗ pq̂x∗ x∗ x∗ nδ − r + (n + 1)r nδ − r + (n + 1)r −n δ+r K c K K Defining z = x∗ , K (30) this cubic equation is: 2θ2 r2 pq̂K 2 (1−z) (δ+rz)−(nδ − r + (n + 1)rz) (nδ − r + (n + 1)rz) z − n(δ + rz) = 0 qb c (31) Numerical analysis for the case of σ = 21 . 4 In this section we explore the effect of changing various parameters on the level of sabotage, the fish stock, and individual and industry profit under the assumption that σ = 0.5. For our base parameters we use: r = 1, δ = 0.05, n = 10, σ = 0.5, qb = 1, K = 1, p = 222.2, c = 1, θ = 100 Substituting these initial parameter values into (31) gives a unique positive root: z = 0.5. Thus the steady-state stock is x∗ = 0.5, which is at the maximum sustainable yield level. We can now use equations (21), (1), (13) and (16) to calculate the equilibrium sabotage (S ∗ = 0.25), catchability coefficient (q(S ∗ ) = 0.0099), fishing effort (L∗ = 5.05), and individual (π ∗ = 0.255) and industry profit (nπ ∗ = 2.55). Equation (29) determines the steady-state stock x∗ in the feasible interval (0, K). It does not seem possible to prove uniqueness analytically. It is conceivable that there are multiple steady states. 7 13 4.1 Changes in theta x* π* S* 0.58 0.56 0.28 0.28 0.26 0.26 0.24 0.24 0.22 0.22 0.2 0.2 0.54 0.52 0.5 100 110 120 130 0.18 100 θ nπ* 110 −3 x 10 2.6 120 130 0.18 100 110 θ θ q* L* 120 130 120 130 5.1 10 5.09 2.4 9.5 5.08 2.2 5.07 9 2 1.8 100 5.06 110 120 130 8.5 100 110 θ 120 θ 130 5.05 100 110 θ If we raise the effectiveness of sabotage, we can see that the steady-state stock rises while effort devoted to sabotage falls. Both individual and industry profits fall. Interestingly, effort devoted to fishing has a non-monotonic response. 14 4.2 Changes in the number of fishermen x* π* S* 1 0.8 0.8 0.8 0.6 0.6 0.6 0.4 0.4 0.4 0.2 0.2 0.2 0 10 20 30 0 10 n nπ* 3 0.025 2.5 0.02 20 30 10 n n q* L* 20 30 20 30 15 10 2 0.015 1.5 0.01 5 1 0.005 10 20 30 0 10 n 20 n 30 10 n As we raise the number of fishermen, we can see that, as usual, the steady-state stock and individual profits fall. The effort devoted to sabotage and to fishing falls. The non-monotonic response of industry profits that occurs here is not possible in the standard model without sabotage: usually industry profits are strictly decreasing in the number of fishermen. 15 4.3 Changes in the price π* S* x* 0.3 0.52 0.35 0.28 0.51 0.3 0.26 0.24 0.5 0.25 0.22 0.49 200 220 240 0.2 200 220 p nπ* 3 240 220 p p q* L* 0.011 2.8 0.2 200 240 5.5 0.0105 2.6 0.01 5 2.4 0.0095 2.2 2 200 220 240 0.009 200 220 p p 240 4.5 200 220 240 p As the price rises (or equivalently costs fall), the steady-state stock falls while fishing effort and individual and industry profits rise. Sabotage efforts rise. 16 5 Preliminary Conclusions This paper models the effect of sabotage on stock status and profits in a dynamic, renewable framework. In contrast to standard fisheries models, we allow fishermen to undertake sabotage activities against their rivals as well as conduct productive fishing. The effect of sabotage mitigates the usual tragedy of the commons result of overexploitation of stocks. We show that increasing the sabotage effectiveness parameter has a non-monotonic effect on fishing effort. In addition, in the presence of sabotage, industry profits are non-monotonic in the number of fishermen, which is in contrast to the model without sabotage. While sabotage protects against the tragedy of the commons, we do not propose that encouraging sabotage is an optimal policy response. Our next step is to consider the effects on stocks and profits of cooperative production with profit sharing, as in Sen (1966), and allowing fishermen to engage protection. 17 APPENDIX Consider the special case where σ = 1. Rewrite the modified golden rule (14) slightly: 2x∗ r x∗ c δ =r 1− − 1− (n − 1) − K n K pq(S ∗ )x∗ − c (32) and also rewrite the (11) with (1) and σ = 1: c θr = ∗ ∗ pq(S )x − c q̂ n x∗ 1− K (33) Substituting (33) into (32) we get a single equation that determines the steady-state stock: 2 2x∗ r x∗ r x∗ θ δ = r 1− − 1− (n − 1) + 1− K n K n K qb 2 x∗ r (n + 1)r x∗ θ r2 = − + 1 − n n K q̂ n2 K (34) If this equation has a unique solution x∗ , it will be the unique candidate interior steady-state stock. Notice that (34) does not contain terms such as p and c. We must also use eq (33), which (with (1)) can be written in the following form : S ∗ = −1 + qbpx∗ c+ (35) cnb q ∗ θr(1− xK ) and verify that S ∗ is indeed positive at the value x∗ that satisfies (34). Proof of equation (35). Let us find S ∗ as a function of θ in the case where σ = 1. From (33), with σ = 1, pq(S ∗ )x∗ − c nb q = c θr 1 − we get pq(S ∗ )x∗ nb q = c θr 1 − x∗ K ∗ nb q + θr 1 − xK + 1 = ∗ x∗ θr 1 − xK K 18 i.e. ∗ cnb q + cθr 1 − xK 1 = ∗ 1 + θS ∗ qbpx∗ θr 1 − xK (36) i.e. ∗ ∗ q − cθr 1 − qbpx∗ θr 1 − xK qbpx∗ θr 1 − xK − cnb −1= θS = ∗ x∗ cnb q + cθr 1 − K cnb q + cθr 1 − xK ∗ q px∗ − c] − (cnb q /θ) r 1 − xK [b ∗ S = x∗ (cnb q /θ) + cr 1 − K ∗ x∗ K (37) (So for S ∗ to be positive, it is necessary that qbpx∗ − c > 0.) Simplify x∗ r 1 − qbpx∗ K S ∗ = −1 + ∗ r 1 − xK c + (cnb q /θ) = −1 + qbpx∗ c+ cnb q ∗ θr(1− xK ) Then, for S ∗ to be positive, we need qbpx∗ > c + cnb q ∗ θr 1 − xK This condition is satisfied if θ is sufficiently great. We now state the following result: Lemma A1: Assume σ = 1. Then there exists a unique positive candidate steady-state stock x∗ < K if and only if the sabotage technology is sufficiently effective, so that the following inequality is satisfied: θr2 r >δ− 2 qbn n (38) This candidate steady-state stock is admissible iff S ∗ as given by (35) is also positive. Proof: Let us consider the graph of the left-hand side of (34) where x is measured along the horizontal axis. It is a straight line with positive slope, cutting the vertical axis at δ − (r/n) and cutting the vertical line x = K at the value δ + r. The graph 19 of the right-hand side of (34) is downward sloping curve, cutting the verical axis at θr2 /(b q n2 ) and cutting the horizontal axis at x = K. Therefore the two curves have a unique intersection at some x∗ < K if and only if the inequality (38) holds. (Note: if the inequality (38) is reversed, then there are two roots, both of which are non-admissible: one root is negative, and the other is greater than K.) Remark: having found the steady-state stock x∗ , we can find the steady-state sabotage S ∗ from c = pq(S ∗ )x∗ − c G(x∗ ) nx∗ θ qb and verify that S ∗ > 0. Proposition A1: An increase in the effectiveness of the sabotage technology will increase the steady-state fish stock. Proof: An increase in θ shifts the graph of the right-hand side of (34) upwards, and does not affect graph of the left-hand side of (34). Hence we obtain a higher x∗ From (16), in the case σ = 1, steady-state profit is c + cS ∗ π = (pq(S )x − c)L − cS = ∗ θ(S )σ−1 ∗ ∗ ∗ ∗ ∗ 1 −1 σ c θ ∗ It is rather surprising that π is independent of all other parameter values. π∗ = (39) Let us calculate the effect of an increase in θ on the steady-state stock. Define z≡ x∗ K D≡ qbn2 θr2 and Then (34) becomes z 2 + βz + γ = 0 where β ≡ −2 − n+1 rD n 20 (40) r D n The roots of the quadratic equation are real, because √ −β ± ∆ z1,2 = 2 γ ≡ 1 − δD + where 2 2 ∆ ≡ β − 4γ = r D 2 n+1 n 2 + 4D(δ + r) > 0 Assumption (38) implies that γ > 0, ie. both roots are positive, with the smaller one in the interval (0, 1). The smaller positive root is √ −β − ∆ z= 2 (It is not clear that an increase in θ will lead to an increase or a decrease in S ∗ : if x∗ is kept unchanged, then from (35) the direct effect of an increase in θ is an increase in S ∗ ; however, from Proposition 1, x∗ increases when θ increases.) Steady-state fishing effort is x∗ r x∗ r ∗ ∗ (1 + θS ) 1 − L = 1− = nq(S ∗ ) K nb q K Upon substitution, using (36), r L∗ = nb q ! ∗ qbpx∗ θr 1 − xK x∗ 1− ∗ K cnb q + cθr 1 − xK We can compare the steady-state profit under sabotage, π ∗ = c/θ, with the steady-state profit when sabotage is not present because of a low θ. In the formercase, profit is a constant: π = c/θ In the latter case, the steady-stock is given by the usual equation G(x∗∗ ) c 0 ∗∗ δ = G (x ) − (n − 1) − nx∗∗ pb q x∗∗ − c 21 and the steady-state profit is π ∗∗ = (pb q x∗∗ − c) G(x∗∗ ) ≡ (pb q x∗∗ − c) L∗∗ x∗∗ nb q 22 REFERENCES: Amegashie, A., Runkel, M., 2007. Sabotaging Potential Rivals. Social Choice and Welfare 28, 1343-1362. Clark, C.W., Munro, G.R., 1975. The economics of fishing and modern capital theory. Journal of Environmental Economics and Management 2, 92–106. Gonzalez, F.M., 2007. Effective property rights, conflict and growth. Journal of Economic Theory 137, 127-139. Konrad, K.A., 2000. Sabotage in Rent-seeking Contests. Journal of Law, Economics, and Organization 16, 155-165. Konrad, K.A., 2009. Strategy and Dynamics in Contests. Oxford University Press. Sen, A., 1966. Labor Allocation in a Cooperative Enterprise, Review of Economic Studies, 33, 361-371. Schaefer, M.B., 1957. Some Considerations of Population Dynamics and Economics in Relation to the Management of Marine Fisheries. The Fisheries Research Board of Canada 14, 669-681. 23