Nathan B. Smith Agricultural and Applied Economics

advertisement

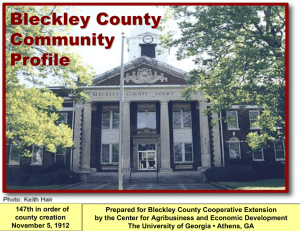

Nathan B. Smith Agricultural and Applied Economics Agribusiness Economy Georgia’s Largest Sector 65 products with significant farm value production$12.0B farm value, $68.9B direct and indirect value 380,000 jobs Ag Forecast 2012 Authors – Humphreys, Escalante, Fonsah, Shumaker, Smith, Smith, Shurley, Stegelin, McKissick, Lacy, Morgan, Shepherd, Wolfe, Kane, Gaskins, Molpus Catoosa Towns Fannin 2009 Total Farm Gate Value GA = $11.3 B Rabun Union Murray Whitfield Walker Gilmer m ha White rs be Lumpkin Ha Gordon Chattooga Stephens Pickens Dawson Cherokee Bartow Franklin Banks Hall Floyd Jackson Polk Paulding Barrow Gwinnett Cobb Madison Oglethorpe Ro c kd ale Fulton Lincoln Wilkes Walton DeKalb Douglas Elbert Clarke Oconee Haralson Hart Forsyth Clayton Carroll Morgan Newton Taliaferro Columbia McDuffie Warren Coweta Heard Pike Hancock Lamar Meriwether Richmond Putnam Jasper Butts Spalding Troup Greene Henry Fayette Glascock Baldwin Burke Jefferson Jones Monroe Washington Upson Bibb Harris Wilkinson Jenkins Crawford Talbot ch ee Muscogee Emanuel Peach Taylor oo Candler Treutlen Bulloch Effingham Macon Ch att ah Laurens Bleckley Houston Marion Screven Johnson Twiggs Pulaski Schley Dodge Dooly Wheeler Stewart Webster Sumter Montgom ery Dade Evans Toombs Bryan Tattnall Chatham Wilcox Telfair Crisp Quitman Liberty Randolph Terrell Lee Jeff Davis Ben Hill Long Appling Turner Irwin Clay Dougherty Calhoun Worth Coffee Wayne Bacon McIntosh Tift Early Pierce Baker Berrien Mitchell Miller Atkinson Brantley Colquitt Cook Glynn Ware Lanier Seminole Decatur Grady Clinch Thomas Brooks Camden Charlton Lowndes Echols $652,321 - $20,000,000 $20,000,000 - $45,000,000 $45,000,000 - $80,000,000 $80,000,000 - $200,000,000 $200,000,000 - $475,048,630 2010 – Up significantly to $12.1 B 2011 – Likely higher yet! Catoosa Towns Fannin Rabun Union Murray Whitfield Walker Gilmer What About 2012? m ha White rs be Lumpkin Ha Gordon Chattooga Stephens Pickens Dawson Cherokee Bartow Franklin Banks Hall Floyd Jackson Polk Barrow Gwinnett Cobb Paulding Madison Lincoln Wilkes Ro c kd ale Fulton • Slow Rate of Growth for US and GA. Oglethorpe Walton DeKalb Douglas Elbert Clarke Oconee Haralson Hart Forsyth Clayton Carroll Morgan Newton Taliaferro Columbia McDuffie Henry Fayette Warren Coweta Heard Pike Hancock Lamar Meriwether Richmond Glascock Baldwin Burke Jefferson Jones Monroe • Commodity Prices Peaked in 2011, Remain Relatively High/Variable. Putnam Jasper Butts Spalding Troup Greene Washington Upson Bibb Harris Wilkinson Jenkins Crawford Talbot Emanuel Peach Taylor ch ee Muscogee oo Candler Treutlen Bulloch Effingham Macon Ch att ah Laurens Bleckley Houston Marion Screven Johnson Twiggs Pulaski Schley Dodge Dooly Wheeler Stewart Webster Sumter Montgom ery Dade Evans Toombs Bryan Tattnall Chatham Wilcox Telfair Crisp Quitman Liberty Randolph Terrell Lee Jeff Davis Ben Hill Long Appling Turner Irwin Clay Dougherty Calhoun Worth Coffee Wayne Bacon McIntosh Tift Early Pierce Baker Berrien Mitchell Miller Atkinson Brantley Colquitt Cook • Input Prices/Cost Continue to Rise. Glynn Ware Lanier • Weak Dollar Helps GA and Ag Exports, But Growth Limited. Europe Crisis is Strong Headwind to Growth. Seminole Decatur Grady Clinch Thomas Brooks Camden Charlton Lowndes Echols $652,321 - $20,000,000 $20,000,000 - $45,000,000 $45,000,000 - $80,000,000 $80,000,000 - $200,000,000 $200,000,000 - $475,048,630 • More Policy Uncertainties, Election Year Politics vs. Needed Fiscal Policy • Another Dry Spring? Greater Potential to Impact Production. KEY MACRO FACTORS • • • • • Economic growth Energy cost Employment Interest rates Housing market Economic Growth Gross Domestic Product Household Business Government 16,000 14,000 2,674 2,878 2,295 2,097 9,806 10,105 8,819 9,323 2005 2006 2007 2008 2,518 2,233 2,113 10,000 1,731 Billion 3,045 1,828 1,855 10,001 10,349 10,500 2009 2010 2011 2,370 12,000 8,000 3,000 2,915 1,772 1,846 2,327 1,983 1,589 2,172 1,969 1,662 1,647 1,730 6,000 4,000 6,830 7,149 7,439 2000 2001 2002 7,804 8,285 2003 2004 2,000 0 Quarterly Gross Domestic Product 1.9 -- 2010 -- -- 2011 2012 Energy Cost Data through Dec 31, 2011 Employment Labor Statistics Population Labor Force Unemployed Not in LF 250 241 240 237 236 234 232 229 226 223 221 218 215 213 Employed Millions 200 150 136 137 137 154 153 151 149 147 147 145 144 143 154 138 139 142 144 146 145 75 76 77 77 79 80 100 70 71 73 50 9 8 7 7 9 7 8 8 6 2000 2001 2002 2003 2004 2005 2006 2007 2008 154 153 154 140 139 139 141 82 83 86 87 14 15 15 13 2011 11-Dec 0 2009 2010 Interest Rates Figure 2. Quarterly National and Regional Loan-Deposit Ratios (LDR) and Average Lending Rates (INT) of Agricultural Banks, 2005-2011 90% 14.00% 85% 12.00% 80% 10.00% 75% 8.00% 70% 6.00% 65% 4.00% 60% 55% 2.00% 50% 0.00% Year-Quarter LDR-US LDR-Southeast INT-US INT-Southeast Average Interest Rate (%) Loan-Deposit Ratio (%) Source: Agricultural Finance Databook, Federal Reserve Board Housing Market Agricultural Outlook Figure 1. U.S. and Georgia Farmland Values, By Farm Type, 2003-2011 Source: USDA - National Agricultural Statistics Service 350 8,000 7,000 300 250 5,000 200 4,000 150 3,000 100 2,000 50 1,000 0 0 2003 2004 2005 2006 2007 Year 2008 2009 2010 GA - Cropland Value US Cropland Value GA Pasture Value US Pasture Value GA-Cropland Rent US-Cropland Rent GA-Pasture Rent US-Pasture Rent 2011 Cash Rent $ per Acre Farmland Value $ per Acre 6,000 Ag Inputs and Production Expenditures Variable costs of producing crops will climb another 15-20% in 2012, with volatile fertilizer and seed prices being primary drivers of increases. Fertilizer price follows the oil price; increasing use of complex genetic traits have increased seed prices. Pesticide prices will vary by product. Farm equipment prices anticipated to rise nearly 10% as well, as manufacturers realize high commodity prices at harvest mean more money in farmers’ pockets who may still have pent up demand for new or nearly new farm equipment and machinery. Land prices and rents also expected to increase with low interest rates and farmers with cash. Georgia Animal Industry Outlook Broilers/Eggs Beef/Dairy/Pork/Equine Towns Fannin Dade Rabun Gilmer m ha White Stephens H Gordon $1.3B 2010 Dawson Hall Forsyth Jackson Polk Madison Elbert Clarke Oglethorpe Oconee ck da le Fulton Lincoln Wilkes Walton DeKalb Clayton Morgan Newton Greene Taliaferro Columbia Warren Coweta Heard Floyd Cherokee Bartow Hancock Polk Lamar Clayton Baldwin Pike Lamar Meriwether Troup Jenkins Baldwin Burke Jefferson Jones Monroe Bibb Harris Emanuel Bulloch Effingham Crawford Talbot Emanuel ch ee Wheeler oo Evans Toombs Bryan Tattnall Pulaski Crisp Jeff Davis Ben Hill Wheeler Stewart Liberty Lee Dodge Dooly Wilcox Quitman Webster Sumter Bulloch Toombs Bryan Tattnall Chatham Telfair Crisp Quitman Irwin Worth Coffee Liberty Randolph Wayne Bacon Effingham Evans Wilcox Long Appling Turner Candler Treutlen Macon Schley Chatham Telfair Laurens Bleckley Houston Marion ah Dodge Dooly Sumter att Pulaski Schley Screven Johnson Peach Taylor Muscogee Ch Ch att Jenkins Twiggs Candler Treutlen Stewart Dougherty Wilkinson Laurens Bleckley Houston ery ah oo ch ee Richmond Glascock Upson Screven Macon Calhoun Hancock Johnson Twiggs Clay Columbia McDuffie Warren Putnam Jasper Butts Burke Wilkinson Peach Taylor Terrell Taliaferro Washington Marion Randolph Greene Henry Fayette Washington Bibb Webster Lincoln Wilkes Coweta Heard Jefferson Crawford Talbot Muscogee Oglethorpe Morgan Newton Upson Harris Elbert Clarke Oconee Richmond Jones Monroe Madison Walton DeKalb Fulton Spalding Pike Meriwether Troup Barrow Gwinnett Cobb Paulding Haralson Hart Forsyth Jackson Carroll Glascock Franklin Banks Hall Putnam Jasper Butts Spalding $5.4B 2010 Dawson McDuffie Henry Fayette Stephens Pickens Douglas Ro Douglas Carroll sh Ha Gordon Chattooga ery Paulding Barrow Gwinnett Cobb Haralson Hart Montgom Cherokee Bartow Franklin Banks r be Lumpkin Pickens Floyd am White rs e ab Lumpkin Rabun Union Murray Whitfield Walker Gilmer Chattooga Towns Fannin Union Murray Whitfield Walker Catoosa Ro ck da le Catoosa Montgom Dade Terrell Lee Jeff Davis Ben Hill Long Appling Turner McIntosh Tift Early Berrien Mitchell Miller Cook Dougherty Calhoun Atkinson Brantley Colquitt Irwin Clay Pierce Baker Glynn Early Ware Berrien Clinch Thomas Brooks Camden Wayne Bacon McIntosh Pierce Baker Mitchell Seminole Grady Coffee Tift Lanier Decatur Worth Miller Atkinson Brantley Colquitt Cook Glynn Ware Charlton Lanier Lowndes Seminole Echols Decatur Grady Clinch Thomas Brooks Camden Charlton Lowndes Echols $0 - $3,000,000 $3,000,000 - $5,000,000 $5,000,000 - $10,000,000 $10,000,000 - $15,000,000 $15,000,000 - $60,478,017 $0 - $1,000,000 $1,000,000 - $10,000,000 $10,000,000 - $40,000,000 $40,000,000 - $100,000,000 $100,000,000 - $363,791,473 Meat supplies were slightly larger in 2011 but will be lower in 2012 2011 Projected 2010 Commodity 2012 Forecast BILLION POUNDS 11 vs 10 12 vs 11 PERCENT CHANGE Beef 26.41 26.30 25.08 -0.42% -4.86% Pork 22.46 22.78 23.21 1.40% 1.85% Total Red Meat* 49.18 49.37 48.58 0.38% -1.63% Broilers 36.52 36.84 36.11 0.87% -2.02% Total Poultry** 42.59 43.09 42.39 1.16% -1.65% Total RedMeat & Poultry 91.77 92.46 90.97 0.75% -1.64% Source: USDA-WASDE, January 2012 Report Record Cattle Prices in 2011 MED. & LRG. #1 & 2 STEER CALF PRICES 500-600 Pounds, Georgia, Weekly $ Per Cwt. 150 Avg. 2005-09 140 130 2010 120 110 100 2011 T O C L JU R AP JA N 90 Continuing drought will keep hay prices high and limit expansion in the beef sector Projected Prices 2012 and Beyond Source: USDA, LMIC and UGA Crop Agriculture – Can Increased Revenues be Repeated? Catoosa Towns Fannin Rabun Union Murray Whitfield Walker Gilmer rs be Lumpkin Ha Gordon Chattooga Row & Forage Crops m ha White Stephens Pickens Dawson Hall Floyd Cherokee Bartow Franklin Banks Forsyth Jackson Polk Barrow Gwinnett Cobb Paulding Madison Lincoln Wilkes Ro ck da le Fulton $2.4 B 2010 Oglethorpe Walton DeKalb Douglas Elbert Clarke Oconee Haralson Hart Clayton Carroll Morgan Newton Taliaferro Columbia McDuffie Henry Fayette Warren Coweta Heard Pike Hancock Lamar Meriwether Richmond Putnam Jasper Butts Spalding Troup Greene Glascock Baldwin Burke Jefferson Jones Monroe Washington Upson Bibb Harris Wilkinson Jenkins Crawford Talbot Emanuel ee ch Bulloch Effingham Ch ery oo Candler Treutlen Macon att ah Laurens Bleckley Houston Marion Screven Johnson Twiggs Peach Taylor Muscogee Pulaski Schley Dodge Dooly Wheeler Stewart Webster Sumter Montgom Dade Evans Toombs Bryan Tattnall Chatham Wilcox Telfair Crisp Quitman Liberty Randolph Terrell Lee Jeff Davis Ben Hill Long Appling Turner Irwin Clay Dougherty Calhoun Worth Coffee Wayne Bacon McIntosh Tift Early Pierce Baker Berrien Mitchell Miller Atkinson Brantley Colquitt Cook Glynn Ware Lanier Seminole Decatur Grady Clinch Thomas Brooks Camden Charlton Lowndes Echols $30,000,000 - $100,616,482 $15,000,000 - $30,000,000 $5,000,000 - $15,000,000 $1,000,000 - $5,000,000 $0 - $1,000,000 • Prices Good in Almost all Georgia Row Crops on Tight Supply. • High Prices Have Cut Into Demand. • Will Feed Prices Improve for Animal Agriculture! Selected Georgia Row Crop Acreage, 2006-2011 3,000 - 10 + 80 - 100 2,700 Thousand Acres 2,400 + 70 2,100 - 85 1,800 1,500 1,200 900 + 270 600 300 0 2006 Cotton Peanuts 2007 Corn 2008 Soybeans 2009 Wheat 2010 2011 Grain Sorghum Profit Scoreboard Assumes Land Rent of $65/acre Commodity Corn – Dryland Cotton – Dryland Peanut – Dryland Soybean – Dryland Avg Yield Avg Price Out of Pocket & Total Costs 85 bu $6.00 $381 $129 75% $471 $40 58% $493 $119 73% $652 -$39 43% $711 $304 80% $905 $111 62% $304 $26 59% $376 -$46 34% 700 lb 2900 lb 30 bu $0.88 $700 $11.00 Potential Returns Chance of Positive Returns Profit Scoreboard Assumes Land Rent of $175/acre Commodity Avg Yield Avg Price Corn – Irrigated 200 bu $6.00 Cotton – Irrigated Peanut – Irrigated Soybean – Irrigated 1200 lb 4200 lb 60 bu $.875 $700 $11.00 Out of Pocket & Potential Total Returns Costs Chance of Positive Returns $836 VC $364 90% $984 TC $216 78% $766 VC $284 87% $937 TC $113 67% $844 VC $535 84% $1150 TC $320 72% $378 VC $282 98% $575 TC $85 72% Peanut Disappearance by Use 3000 2500 1,000 Tons 2122 2000 1825 1500 1000 500 0 Food Use Exports Crush Seed, Shrink, Resid Production Carryover Source: Oil Crops Outlook, ERS, USDA 2012 Peanut Preliminary Projections USDA 2010/11 Beginning Stocks 915 Production 2,079 Total Supply 3,025 Total Use 2,268 Ending Stocks 758 Expected Yield Planted Acres Harvested Acres 2011/12 2012/13 758 525 1,818 2,112 2,616 2,677 2,091 2,138 525 539 3350 lb/ac 1,300 mil 1,261 mil 3500 lb 3200 lb 1.37 mil 5% Higher 5% Lower 20% More HA up 20% Yield Yield Harv Acres Yld up 5% 1,000 Tons 525 525 525 525 2,218 2,007 2,225 2,336 2,782 2,571 2,789 2,900 2,138 2,138 2,138 2,138 645 434 652 763 2.3% increase 13.3% increase 13.2% increase US Cotton Acres Planted and Harvested 18 16 Million Acres 14 12 10 8 6 4 2 0 2000 2001 2001 2003 2004 2005 2006 2007 2008 2009 2010 2011 Planted Harvested World Cotton Use (Demand) Ending Stocks and Stocks-to-Use Ratio 55.5% 53.0% 50.3% 49.2% 55.0% 48.4% 49.0% 53.0% 37.1% 39.5% U.S. Corn Supply and Demand Mil bu 50% 14,000 12,000 40% 10,000 30% 8,000 6,000 19.8% 17.5% 4,000 13.9% 13.1% 11.6% 12.8% 20% 8.6% 2,000 6.8% 10% 0% 0 Ending Stocks Production Domestic Use and Exports Stocks:Use Corn Utilization Million bushels 14,000 12,000 1,410 1,600 10,000 8,000 5,000 6,000 4,000 4,700 2,000 Feed and Residual Ethanol Exports Food Seed and Other Industrial 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 96/97 0 U.S. Soybean Supply and Demand Mil bu 4,000 3,500 3,000 2,500 2,000 15.6% 1,500 1,000 18.7% 8.6% 500 6.7% 4.5% 0 Ending Stocks Production Source: USDA WASDE Reports, Nov 9, 2011 50% 3,361 3,280 45% 3,02140% 3,056 35% 30% 25% 20% 15% 8.8% 6.6% 10% 4.5% 5% 0% Total Use Stocks:Use U.S WHEAT SITUATION Production Use End Stocks 3,000 Million Bushels 2,500 2,000 1,500 1,000 500 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2009 Georgia Vegetable Acreage by crop: Farm Gate Value = $916 million U.S. Vegetable Industry at a Glance, 2004-2012 Item Unit 2004 2005 2006 2007 2008 2009 2010 Th. ac 6,581 7,128 7,264 6,852 6,648 6,619 6,969 5,716 6,718 Mil. cwt 1,355 1,281 1,308 1,332 1,278 1,279 1,215 1,209 1,214 Crop Value $ mil. 15,533 15,906 17,162 17,385 18,591 18,194 18,063 19,215 18,986 Per Capita Use Lbs 448 441 434 435 419 393 395 393 Area Harvested Production 2011 Source: Vegetable and Melons Outlook/VGS-327/June26, 2008, ERS, USDA 2012 390 Fruits and Nut Produced in Georgia, 2009 Vegetable Summary • Continued Local • • • • $753B 2010 Demand Growth Demand Improvement in some crops Some Farm Gate value Growth Competitive position improved Input costs and availability ? Ornamentals (Green Industry) Summary Catoosa Towns Fannin Rabun Union Murray Whitfield Walker Gilmer m ha White rs be Lumpkin Ha Gordon Chattooga Stephens Pickens Dawson Cherokee Bartow Franklin Banks Hall Floyd Jackson Polk Paulding Barrow Gwinnett Cobb Madison Oglethorpe Ro c kd ale Fulton Lincoln Wilkes Walton DeKalb Douglas Elbert Clarke Oconee Haralson Hart Forsyth Clayton Carroll Morgan Newton Taliaferro Columbia McDuffie Henry Fayette Warren Coweta Heard Pike Hancock Lamar Meriwether Richmond Putnam Jasper Butts Spalding Troup Greene Glascock Baldwin Burke Jefferson Jones Monroe Washington Upson Bibb Harris Wilkinson Jenkins Crawford Talbot he e Muscogee Emanuel Candler Treutlen Bulloch Effingham Macon ery Ch att ah oo c Laurens Bleckley Houston Marion Screven Johnson Twiggs Peach Taylor Pulaski Schley Dodge Dooly Wheeler Stewart Webster Sumter Montgom Dade Evans Toombs Bryan Tattnall Chatham Wilcox Telfair Crisp Quitman Liberty Randolph Terrell Lee Jeff Davis Ben Hill Long Appling Turner Irwin Clay Dougherty Calhoun Worth Coffee Wayne Bacon McIntosh Tift Early Pierce Baker Berrien Mitchell Miller Atkinson Brantley Colquitt Cook Glynn Ware Lanier Seminole Decatur Grady Clinch Thomas Brooks Camden Charlton Lowndes Echols $0 - $1,000,000 $1,000,000 - $3,000,000 $3,000,000 - $6,000,000 $6,000,000 - $10,000,000 $10,000,000 - $61,751,425 • Economy and Demand Key • Flexibility in Retail • New Products also Key $586M 2010 Environmental Horticulture Situation and Outlook Georgia 2012 • Key industry success factors: economies of scale, production and marketing of premium quality plants, expansion of export markets, use of appropriate growing structures and technology, wise water management. • Profit margins to suffer in 2012 as price competition puts squeeze on operating incomes albeit input and production costs continue to climb; lower pre-order quantities and numbers of orders. • Inelastic demand for environmental horticulture means a price increase is marketer’s and producer’s primary means of capturing revenue and re-growing business after the recession. What About 2012? $0 - $20,000,000 $20,000,000 - $45,000,000 $45,000,000 - $80,000,000 $80,000,000 - $200,000,000 $200,000,000 - $316,814,000 • Animal prices remain high, a little better profit potential. • Crop prices remain relatively high due to overall tight supply demand balance , decent profits again. • Vegetable and fruits production value growth • Ornamental markets stable Bottom Line – returns high enough if can make the crop or have the animal ? Deal with input and output variability! Thank you for attending! Risks for 2012