Hindawi Publishing Corporation Journal of Applied Mathematics Volume 2007, Article ID 97540, pages

advertisement

Hindawi Publishing Corporation

Journal of Applied Mathematics

Volume 2007, Article ID 97540, 15 pages

doi:10.1155/2007/97540

Research Article

Visitor and Firm Taxes Versus Environmental Options in

a Dynamical Context

Angelo Antoci, Marcello Galeotti, and Lucio Geronazzo

Received 17 February 2007; Revised 10 May 2007; Accepted 8 June 2007

Recommended by Ibrahim Sadek

The main objective of the paper is to analyze the effects on economic agents’ behavior

deriving from the introduction of financial activities aimed to environmental protection.

The environmental protection mechanism we study should permit exchange of financial

activities among citizens, firms, and Public Administration. Such a particular “financial

market” is regulated by the Public Administration, but mainly fuelled by the interest of

two classes of involved agents: firms and dwelling citizens. We assume that the adoption

process of financial decisions is described by a two-population evolutionary game and we

study the basic features of the resulting dynamics.

Copyright © 2007 Angelo Antoci et al. This is an open access article distributed under

the Creative Commons Attribution License, which permits unrestricted use, distribution,

and reproduction in any medium, provided the original work is properly cited.

1. Introduction

The main objective of the paper is to analyze the effects on the behavior of economic

agents, deriving from the introduction of an environmental protection mechanism that

allows the exchange of financial activities among visitors of a region R, firms operating in

the region R, and the Public Administration (PA). This financial market is regulated by

the PA, but mainly fuelled by the interest of visitors and firms.

The context we analyze has the following features.

The PA offers to an individual who desires to spend a period of time in the region R

the choice between

(1) purchasing a call environmental option sold by the PA at a given price, which

implies a cost in the case of a high-environmental quality, measured according to

a properly defined quality index Q, but offers a reimbursement in the case of a low

value of Q, consequently, buying the financial option represents a self-assurance

device against environmental degradation;

2

Journal of Applied Mathematics

(2) paying a fixed amount (entrance ticket) to the PA as a visitor’s tax.

Analogously, the PA offers to a potentially polluting firm operating in the region R the choice between

(3) issuing a put environmental option bought by the PA: this financial activity implies a monetary aid for the firm only if the quality index Q results higher than a

properly defined threshold level;

(4) paying a fixed amount as an environmental fine to carry on its activity in the

region R.

Hence, in the case of a high value of Q, visitors bear a cost but find satisfaction in a

high-environmental quality, while the firms choosing (3) receive financial support for investments aimed at environmental protection (hence such investments do not diminish

their competitiveness). Furthermore, the PA attains the goal of improving the environmental quality at a low cost (if prices of financial activities are determined in such a way

that the costs born by visitors compensate, at least partially, for the aid to firms). In the

case of a low value of Q, instead, the visitors choosing (1) receive a partial reimbursement for the environmental damage and the firms choosing (3) do not receive financial

aid.

The PA has to determine the prices of these financial activities taking into account,

among other things, the number of visitors and firms wanting, respectively, to buy and

sell the options, the costs of nonpolluting technologies, the transaction costs, and

so on.

As a consequence of the mechanism described, we can expect a strong interdependency between firm and visitor payoffs. Our goal is to study the dynamics of such a financial market, arising from the interaction of economic agents and the PA. To this end, we

represent the process of adopting choices through a two-population evolutionary game,

where one population of firms strategically interacts with one population of visitors. The

evolution of visitors and firms’ behavior is modelled by the socalled replicator dynamics, according to which the choices whose expected payoff is greater than the average one

spread within the populations at the expense of the other choices.

This way we are led to describe the phase portraits and bifurcations of a family of

five-degree polynomial systems, which represent the possible market evolutions.

The paper is structured as follows. In Section 2, possible environmental financial instruments are introduced and our choice of environmental options is motivated. In

Section 3 we describe the model. Sections 4 and 5 are devoted to the mathematical analysis of the evolutionary dynamics. Section 6 concludes the paper.

2. Environment policies and financial instruments.

Environmental problems arising from economic activity are going to become a wellestablished research area both in micro and macro economics. Among many suggestions

found in economic literature, aimed at rationalizing pollution reduction or other environment protection activities, the most innovative ones regard the introduction of specific

financial assets to sustain or integrate the traditional policy making of the public sector,

as well as to inject market incentives in environmental objectives. The idea underlying the

proposals of using bonds or other financial instruments to achieve environmental targets

Angelo Antoci et al. 3

is that the market dynamics guarantees resource allocations that, in general, are more

efficient than the allocations resulting from public sector enterprise. Such an approach

can be considered a branch of the mainstream theory that sees privatization as a way to

overcome obstacles to an efficient achievement of social goals.

2.1. Environmental bonds. The so-called Social Policy Bonds, or Environmental Bonds

(EBs), introduced in [1, 2] and others, constitute the most relevant example of a financial

asset that can be issued in accordance with environmental purposes. EBs are, as usual,

auctioned by central or local government on the open market, but, unlike ordinary bonds,

can be redeemed at the face value only when a specified environmental objective has

been achieved. In the case that a maturity is inserted in the contract, the bond expires

unredeemed if at maturity the objective has been missed.

Technically speaking EBs are zero coupon bonds, in the sense that they do not bear any

interest, and the yield investors can gain from the investment depends on the difference

between the auctioned price and the face value in the case of redemption. Due to the intrinsic uncertainty concerning either the redemption or the time of redemption (if any),

EBs are typical assets with uncertain yield, like stocks or options.

If the auction price is low enough, private investors are attracted by the gain embedded

in the difference between redemption value and price, this way ensuring the required level

of demand for the assets. What is more relevant, however, is that industries involved in

the environment objective (either polluters or not), once in possession of the bonds, have

a strong interest to operate in such a way that the objective itself is quickly achieved, so

to cash in the expected gains as soon as possible. Consequently, active investors can start

financing initiatives aimed at the specified environmental target, either using their own

capital or borrowing money on the market.

On the side of the issuer, the government, the difference between the total amount

necessary for reimbursement and the net amount cashed in at the auction (keeping into

account collateral costs) represents the net cost that the achievement of the environmental

goal requires.

In conclusion, by issuing EBs, the government obtains the same result as by contracting out the achievement of environmental goals to the private sector, remaining, though,

the ultimate source of funding and the only authority setting the objectives.

Once the EBs have been auctioned, they can be traded on the marketplace as any other

financial instrument. Without entering into detail, we remark that the market price of

EBs will fluctuate according to the available information about the approaching of the

target and the elapsing of time.

For many pollution containment (or reduction) purposes, other instruments, for example, Tradable Permits to Pollute (TPPs), are actively traded on proper markets. TPPs

are especially useful in allocating unpriced resources, such as the assimilative capacity of

atmosphere, and they work most efficiently with large-scale processes, which are more

easily monitored. Nevertheless, such instruments exhibit informational disadvantage in

any context characterized by a large number of polluters. Furthermore, they do not bear

any actual incentive toward virtuous behavior, and show no capability of adapting to

goals other than the attainment of established levels of pollution.

4

Journal of Applied Mathematics

On the other hand, EBs can work better than TPPs in any context. Moreover, once

proper indicators are well specified at the time of issue and are correctly monitored during

the life of the bonds, informational disadvantages are totally absent even in the case when

many sources of pollution are operating together.

Another advantage that would make EBs a suitable instrument is the focus on outcomes rather than activities, which bears a great relevance in situations where a multiplicity of solutions is required. Finally, under an EBs regime, different activities would be

rewarded in proportion to their actual success.

Due to the above-mentioned advantages, the adoption of EBs in a real environmental

context is strongly recommended in most specialistic literature.

2.2. Environmental options. In our paper, however, although we firmly share the idea

that the introduction of financial instruments in environmental economics models is a

step towards a better understanding of environmental policy dynamics, we suggest assets

different from EBs. There are several reasons for our choice. The first and most relevant

is a direct consequence of the sector we choose to deal with, that is, tourism. In fact, the

tourism game has to take into account the tourist himself, who deserves an active role in

the matter. Convinced of this as we are, instead of letting the tourist be a mere payer of

some taxes for potential environmental damage, we suggest an instrument that, on one

hand, is like an insurance contract over the quality of the environmental conditions, and

on the other can incentivate industries operating in the area to a virtuous behavior as far

as limitation of air or water pollution or other environmental goals are concerned. Government, or another public institution, stays in the background, setting the nature of the

instrument, acting as intermediary between the parts, and participating in the operation

as a promoter.

The instrument we introduce is somehow similar to a weather derivative , a financial

asset whose payoff depends on the level of some atmospherical index. It works this way:

the tourist can buy the asset and keep it until the end of his stay. Depending on the level

of the index at a specified date (or on the average value during the holiday period), she/he

receives either a fixed amount of money or nothing. The contingent claim we refer to is a

digital option of the type cash or nothing, with the environmental index as the underlying

asset.

The government, or another local authority, arranges for the emission of the options,

collecting the revenues. The total net amount cashed (reduced by the emission and other

cost components) is credited to the industries operating in the area on the basis of an

index depending on some economic parameters, such as the global amount of taxes each

industry pays or the global production level. At maturity, if the pollution is higher than

the established threshold, the industries must pay a fixed amount to the asset holders (the

equivalent of a fine for contributing to the pollution); otherwise they cash in the prices

of the options, just like a subsidy for their proper behavior.

To be more precise, let us denote by Q the critical level of the pollution index (this

level is the strike, according to the options terminology) and by QT the level of the index

at maturity. Hence the payoff function of the contingent claim at T (we assume the option

can be exercised only at maturity) is expressed as

Angelo Antoci et al. 5

⎧

⎨0

Payoff = ⎩

M

if QT ≤ Q,

if QT > Q,

(2.1)

where M is the fixed amount the tourist receives as an indemnity for the bad quality of the

environment, QT plays the role of a pollution index, and the asset behaves as a European

call option. Reverting the payoff:

⎧

⎨M

Payoff = ⎩

0

if QT ≤ Q,

if QT > Q,

(2.2)

the index level is to be assumed as a good quality one and the resulting option is of put

type.

More complex assets are easily derived from this basic one by changing the payoff

function. For example, we can obtain Asian options, by replacing the value of the index at

a fixed date T with some average A[t,T] over a specified period [t,T], or barrier options, by

introducing a threshold H for the index (the option will come to life, or will extinguish,

once the index level passes through the barrier).

Of course the choice of the option type, European plain vanilla, digital, Asian, barrier,

and so forth, has relevant consequences as far as the possibility of expressing the equilibrium price via a direct closed formula is concerned.

Although financial instruments like the one we have described are currently traded

in the marketplace, at this stage of the research we assume that the options, after being

bought, are kept by the buyers until expiration. Actually this assumption is not too restrictive if the option life is intrinsically short, as is the case when the tourist buys the

asset shortly before his/her vacation starts.

3. The model

The main objective of the model is to analyze the effects on the behavior of economic

agents deriving from the introduction of the previous financial activities.

The environmental protection mechanism we analyze is centered on the introduction

of innovative financial activities issued with assistance of the Public Administration (PA),

sold by polluting firms operating in the region R and bought by visitors or residents. The

motivations underlying the introduction of such mechanism are as follows.

(1) Virtuous firms choosing a nonpolluting technology can obtain financial aid by

selling the put options.

(2) Visitors can protect themselves against environmental degradation by a selfassurance device (see, e.g., [3]).

(3) The PA can attain the goal of improving the environmental quality at a low cost,

since the costs born by visitors compensate, at least partially, for the financial aid

to firms.

6

Journal of Applied Mathematics

The basic features of the “contracts” between the PA and visitors, and between the PA and

firms, are the following.

3.1. The contract between the PA and visitors. The PA offers to an individual who desires to spend a period of time in the region R the choice between

(V1 ) purchasing an environmental option sold by the PA at a given price, that is, from

the visitor’s point of view, a call option, it gives rise to a nonrefundable cost in the case

of high-environmental quality, measured by a suitable pollution index Q, on the contrary, it gives the right, in the case of a low level of Q, to a defined positive payoff as an

indemnity;

(V2 ) paying a fixed amount (entrance ticket) to the PA as a visitor’s tax.

3.2. The contract between the PA and polluting firms. The PA offers to a firm operating

in R the choice between

(F1 ) issuing an environmental option bought by the PA, which, from the firm’s point

of view, behaves as a put option, implying the payment of a fixed amount back if the

quality index Q does not result sufficiently high (i.e., if a given environmental goal is not

reached);

(F2 ) paying a fixed amount as an environmental fine to carry on its activity in the

region R.

We assume that the choice of F2 implies the choice of a polluting technology. Furthermore, we do not consider (by assumption) the possibility of free riding (for a motivation

of such hypothesis see, [1]), that is, firms have no incentive in issuing the financial asset

if they are going to adopt a polluting technology.

3.3. Our modelling choices. As a consequence of the described mechanism, a strong

interdependence between firm and visitor decisions is achieved. According to this, the

profits of each firm strictly depend on the choices of both the other firms and the visitors.

The same argument applies for visitor monetary payoffs.

A dynamical model arising as a natural choice from the above assumptions is a twopopulation evolutionary game, where the population of firms strategically interacts with

the population of visitors.

With the aim of keeping the presentation at an understandable level, we study the

interaction of firms and visitors in a simplified strategic context, preserving, nevertheless,

the main features of the real dynamics. Namely, at each instant of time, two pairs of

randomly chosen firms and visitors are assumed to match in order to play a one-shot

game. On occasion of each match-up,

(1) each firm has to choose (ex ante) between the two strategies: F1 (selling the option described above) and F2 (paying a fixed amount as an environmental fine);

(2) each visitor has to choose (ex ante) between the two strategies: V1 (buying the

option described above) and V2 (paying a fixed amount as an entrance ticket).

The analysis of such a context allows us to take into account all types of interdependence

between economic agents (between two firms, between two visitors, between firms and

visitors), working in a very simplified analytical setting.

Angelo Antoci et al. 7

Table 3.1

V1

V2

V1 , F1 , F1

− p2

−p

V1 , F1 , F2

− p2 + α21

−p

V1 , F2 , F2

− p2 + α22

−p

V2 , F1 ,F1

− p1

−p

V2 , F1 ,F2

− p1 + α11

−p

V2 , F2 , F2

− p1 + α12

−p

F2 , V1 , V1

−cNP

−cP − q

F2 , V1 , V2

−cNP

−cP − q

F2 , V2 , V2

−cNP

−cP − q

Table 3.2

F1

F2

F1 , V1 , V1

−cNP + β2

−cP − q

F1 , V1 , V2

−cNP + β1

−cP − q

F1 , V2 , V2

−cNP + β0

−cP − q

3.4. Visitor payoff matrix. To avoid trivial cases, we assume that, in each match-up,

the quality index Q results high enough (i.e., the predetermined environmental goal is

reached) only if both firms choose F1 (i.e., choose a nonpolluting technology).

We consider the visitor payoff matrix shown in Table 3.1 matrix (where p2 = p + p2

and p1 = p + p1 ).

The entry a11 gives the payoff of a visitor choosing V1 , matched with another visitor

and two firms choosing, respectively, V1 and F1 , and so on.

The parameter p ≥ 0 represents the fixed amount paid as an entrance ticket when

adopting the strategy V2 . The parameters (p + p1 ) and (p + p2 ), with 0 < p1 < p2 , are

the prices (fixed by PA) of the financial activity described above in the case where, respectively, only one or both visitors choose V1 . So the price of the option is positively

correlated to the number of visitors willing to buy it.

The parameters αi j (the index i = 1,2 indicating the number of visitors buying the

self-assurance device and the index j = 1,2 indicating the number of polluting firms,

that is, firms choosing F2 ), fixed by the PA, are the reimbursements, which depend on

the strategies adopted by firms and visitors according to the following rule: α1 j > α2 j ,

αi2 ≥ αi1 , i, j = 1,2.

Therefore, if the value of Q is low, the resimbursement is (coeteris paribus) inversely

correlated to the number of visitors choosing V1 . For the sake of generality, we do not

impose any restriction about the correlation between the reimbursement and the number

of firms selling the option, that is, adopting F1 .

Moreover, we assume that the option provides actual insurance coverage, that is α12 ,

α22 > p2 (and consequently α11 , α21 > p1 ).

3.5. Firm payoff matrix. We suppose the payoff matrix holds for firms as shown in

Table 3.2, where cNP and cP , 0 < cP < cNP , represent the costs of the nonpolluting and

polluting technology, respectively. We assume that β0 < β1 < β2 , that is, the financial aid

given to firms choosing F1 increases with the number of visitors subscribing to the options offered by the PA. Furthermore, we assume the condition cNP − cP < β0 , stating that

the financial aid is higher than the cost difference.

3.6. Expected payoffs and dynamics. Let the variable x(t) denote the proportion of visitors adopting strategy V1 at the instant of time t, 0 ≤ x(t) ≤ 1.

8

Journal of Applied Mathematics

Analogously, let y(t) denote the proportion of firms choosing strategy F1 at the instant

of time t, 0 ≤ y(t) ≤ 1.

Let us indicate by

(i) EVi (x, y) the expected payoff of strategy Vi , i = 1,2.

(ii) EF j (x, y) the expected payoff of strategy F j , j = 1,2.

The process of adopting strategies is modeled by the so-called replicator dynamics [see,

e.g., [4]], according to which the strategies whose expected payoffs are greater than the

average payoff spread within the populations at the expense of the others:

ẋ = x EV1 − EV ,

(3.1)

ẏ = y EF1 − EF ,

where

EV = x · EV1 + (1 − x) · EV2 ,

(3.2)

EF = y · EF1 + (1 − y) · EF2

are average payoffs of the populations of visitors and firms, respectively.

As to the expected payoffs of the single strategies, they are calculated multiplying entries of the above payoff matrices by conditional probabilities. For example,

EV1 = Σi, j,k PV1 Vi ,F j ,Fk · prob Vi ,F j ,Fk /V1 ,

(3.3)

where PV1 (Vi ,F j ,Fk ) denotes the payoff of a visitor playing V1 matched with agents playing, respectively, Vi , F j , Fk , i, j,k = 1,2.

In fact we will assume independence in the strategy choices of agents (i.e., matching is

really random) and identify the probability of meeting an agent adopting a given strategy

with the proportion of agents playing it in the respective population (e.g., prob (V1 ,F1 ,

F2 /V1 ) = xy(1 − y)). Therefore, by straightforward computations, we can write (3.1) as a

polynomial system defined in the square [0,1]2 :

ẋ = x(1 − x)F(x, y),

(3.4)

ẏ = y(1 − y)G(x, y),

where (posing γ1 = α11 − α21 , γ2 = α12 − α22 , δ = p2 − p1 )

F(x, y) = −x δ y 2 + γ1 + δ y(1 − y) + γ2 + δ (1 − y)2

+α11 y(1 − y) + α12 (1 − y)2 − p1 y 2 − y + 1 G(x, y)

2

= y β2 x + β1 x(1 − x) + β0 (1 − x)

2

− cNP − cP

2

x −x+1

(3.5)

4. Mathematical results

4.1. Fixed points. Notice that the vertices (x, y) = (0,0), (0,1), (1,0), (1,1) of the

square [0,1]2 are always fixed points of the system (3.4). The other fixed points are the

Angelo Antoci et al. 9

intersections

(i) between the locus F(x, y) = 0 and the horizontal edges y = 0 and y = 1 of the

square;

(ii) between the locus G(x, y) = 0 and the vertical edges x = 0 and x = 1;

(iii) between F(x, y) = 0 and G(x, y) = 0 in the interior, (0,1)2 , of the square.

Let us investigate, in particular, the fixed points of type (iii).

Note that the expressions in square brackets of F(x, y) and G(x, y) are positive for any

y and any x in [0,1], respectively, and that (cNP − cP )(x2 − x + 1) > 0 for all x.

In the open square (0,1)2 , the isocline ẋ = 0 is represented by the intersection between

(0,1)2 and the graph of a function

x = x(y) =

P2 (y)

.

Q2 (y)

(4.1)

Similarly, the isocline ẏ = 0 is represented by the intersection between (0,1)2 and the

graph of a function

y = y(x) =

S2 (x)

,

T2 (x)

(4.2)

where P2 , Q2 , S2 , and T2 are degree two polynomials, with Q2 (y) > 0 for y ∈ [0,1] and

S2 (x) > 0, T2 (x) > 0 for x ∈ [0,1]. Clearly, (4.1) and (4.2) have horizontal asymptotes,

respectively, as y → ±∞ and as x → ±∞. Furthermore, the two functions exhibit at most

one maximum and one minimum.

First of all, let us consider (4.1). Under our assumptions, we check that x(1) < 0 and

x(0) > 1. Consequently, the graph of x(y) in [0,1]2 cannot present both increasing and

decreasing tracts, since in that case some vertical line would have three intersections with

it. Thus, in [0,1]2 , x(y) is decreasing.

With regard to the isocline ẏ = 0, it is easily checked that function (4.2) has one maximum for x = x1 < 0 and one minimum for x = x2 > 1. Since y(0) = (cNP − cP )/β0 < 1

(by assumption), the intersection between [0,1]2 and the graph of (4.2) is again that of a

decreasing function.

Finally, we observe that the graphs of (4.1) and (4.2) can have at most five intersections (eventually outside [0,1]2 ), in that the number of intersections corresponds to the

number of roots of a five-degree polynomial.

Notice that the above analysis implies that there are no fixed points in the interior of

the edges y = 0 and y = 1 of [0,1]2 , while one fixed point always exists in the interior of

each vertical edge, that is, x = 0 and x = 1.

4.2. Stability and limit cycles. Straightforward calculations show that the vertices (x, y)

= (0,1), (1,0) are always sinks and the vertices (x, y) = (0,0), (1,1) are saddles. The fixed

points in the interior of the edges x = 0 and x = 1 always have a positive eigenvalue in

direction of the edge, so they cannot be sinks.

Now we want to examine the stability of the fixed points in the interior of [0,1]2 .

Let (x, y) ∈ (0,1)2 be a fixed point of the system (3.4) and let J = J(x, y) be the Jacobian

10

Journal of Applied Mathematics

matrix evaluated at such a point. It holds that

∂F ∂G ∂F ∂G

sign Det J = sign

−

,

∂x ∂y ∂y ∂x

(4.3)

Therefore (see (4.1) and (4.2)):

Det J(x, y) > 0 ⇐⇒ y (x) · x (y) > 1,

(4.4)

Det J(x, y) < 0 ⇐⇒ y (x) · x (y) < 1.

(4.5)

In case (4.4), the fixed point is a sink or a source, in case (4.5) the fixed point is a

saddle.

Theorem 4.1. There are at most three fixed points in (0,1)2 and at most one of them is not

a saddle.

Proof. We bound ourselves to a sketch of the proof, since the required computations are

rather lengthy. According to what we have seen, the intersections of F(x, y) = 0 and

G(x, y) = 0 with [0,1]2 can be viewed as the graphs of two decreasing functions, say, respectively, y = f (x) and y = g(x). We can consider, in fact without restriction, the generic

case.

A sink or a source corresponds to an intersection (x, y) of the two graphs with f (x) <

g (x). If more than one such point existed, there should be x1 , x2 , x3 , 0 ≤ x1 < x2 < x3 ≤ 1,

such that f (x1 ) < g (x1 ), f (x2 ) > g (x2 ), f (x3 ) < g (x3 ). So in (x1 ,x3 ) the two derivatives

f (x) and g (x) should intersect at least twice. But in fact it can be shown that, given

f (x1 ) < g (x1 ), f (x) and g (x) can intersect at most once in (x1 ,1).

Theorem 4.2. If there is only one fixed point in (0,1)2 and it is a sink, then there exists a

repelling limit cycle.

Proof. In this case, it is easily checked that the fixed points on the vertical edges of [0,1]2 ,

that is, A = (0,(cNP − cP )/β0 ) and B = (0,(cNP − cP )/β2 ) , are saddles. As ẋ < 0 at A and ẋ >

0 at B, it follows that the unstable manifolds of the two saddles lie on the respective edges,

while the α-limit sets of their stable manifolds must stay in (0,1)2 . Since the only fixed

point in (0,1)2 is assumed to be a sink, then, by the Poincaré Bendixson Theorem [see,

e.g., [5]], the α-limit set, the same for the two stable manifolds, can only be (generically)

a repelling limit cycle surrounding the internal equilibrium.

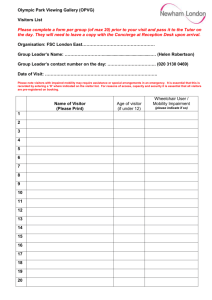

Figure 4.1 illustrates the previous theorem through a numerical example: the unique

interior fixed point is a sink surrounded by a repelling limit cycle. In this figure, as in the

following ones, the strip {0.375 ≤ y ≤ 0.6}, where the relevant topological features of the

phase portrait occur, is zoomed with respect to the rest of the square [0,1]2 .

Angelo Antoci et al.

11

Y

1

X

0

1

Figure 4.1. One interior attractor surrounded by a repelling limit cycle.

5. Dynamics and bifurcations: some numerical examples

We rename the coefficients of F(x, y) and G(x, y) as follows:

p2 − p1 = a,

α12 = e,

p1 = f ,

α11 − α21 = b,

β2 = g,

α12 − α22 = c,

β1 = h,

β0 = i,

α11 = d,

cNP − cP = l.

(5.1)

In the examples below, bifurcations in the phase portrait of system (3.4) take place as a

suitable parameter ε > 0 varies.

Example 5.1. Two equilibria, a sink and a saddle, are in (0,1)2 .

Set

l = 1,

i = 1.4,

a = 2.4 − 2,

d = e = 5.4,

h = 2.2,

g = 2.4

f = 2.4 + (5.2)

b = c = o().

At = 0 there is a tangency in (1/2,1/2), generating a saddle-node bifurcation [see,

e.g., [6]]. For > 0 small enough (e.g., = 0.1), posing o() = 0, there exist a sink at

(1/2,1/2) and a saddle (x, y), with 1/2 < x < 1. The basin of the sink is bounded by the

stable manifold of the saddle. When = 0.2, the basin of the sink is bounded by a repelling cycle. Between those two values of a saddle-connection [6] occurs: at the bifurcation value there appears a polycycle (for a definition see, e.g., [7]) constituted by a loop

through the saddle (intersection of its unstable and stable manifold).

12

Journal of Applied Mathematics

Y

1

X

1

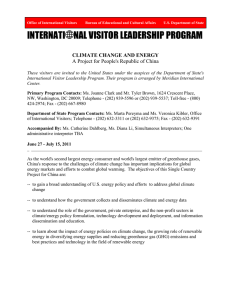

Figure 5.1. Two interior saddles and one interior attractor, whose basin is bounded by the union of

the saddles stable manifolds.

0

Example 5.2. There are three equilibria in (0,1)2 : a sink and two saddles. For small values

of the basin of the sink is bounded by the stable manifold of one saddle.

Set

l = 3,

i = 5 − o(),

h = 5 + o(),

a = 6.8 − 2,

f = 6.8 + ,

d = e = 15.3,

b = c = o().

g = 8,

(5.3)

At = 0 there is a tangency in (1/2,1/2) (saddle-node bifurcation). For > 0 small

enough (e.g., = 0.1), posing o() = 0, there exist a sink at (1/2,1/2) and two saddles,

(x1 , y1 ) and (x2 , y2 ), with x1 < 1/2 < x2 < 1. The basin of the sink is bounded by the stable manifold of the saddle (x2 , y2 ). When = 0.3, the basin of the sink is bounded by

a repelling cycle. Between those two values of , a saddle-connection occurs: at the bifurcation value there appears a polycycle constituted by trajectories connecting the two

saddles.

Example 5.3. There are three equilibria in (0,1)2 : a sink and two saddles. For small values

of the basin of the sink is bounded by the union of the stable manifolds of the saddles.

Set

l = 1,

i = 1.5 − o(),

h = 1.5 + o(),

a = 3 − 2 ,

f = 1.5 + ,

d = e = 4.5,

b = c = o().

g = 3,

(5.4)

Angelo Antoci et al.

13

Y

1

0

X

1

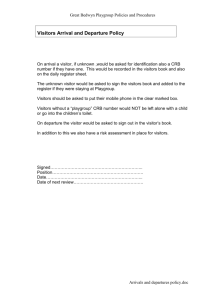

Figure 5.2. Two interior saddles and one interior attractor surrounded by a repelling limit cycle.

At = 0 there is a triple intersection of the isoclines in (1/2,1/2), giving place to an improper saddle [see, again, [6]]. For > 0 small enough (e.g., = 0.1, Figure 5.1), posing o() = 0, there exist a sink at (1/2,1/2) and two saddles. The basin of the sink is

bounded by the union of the stable manifolds of the saddles. When ε = 0.3 (Figure 5.2),

the basin of the sink is bounded by a repelling cycle. Between those two values of , a

saddle-connection occurs: at the bifurcation value there appears a polycycle constituted

by trajectories connecting the two saddles.

Remark 5.4. The previous examples suggest that the pattern of a repelling cycle, bounding

the basin of a sink, born through a saddle-connection, could be quite general.

Furthermore, we can conjecture that in our model Hopf bifurcations in (0,1)2 are

always subcritical (see, e.g., [8]): a repelling limit cycle disappears when the fixed point

turns from attractive into repulsive.

6. Conclusions

We have seen that the fixed points (x, y) = (0,1) (where environmental quality is high,

no visitor purchases and all firms issue the environmental options, that is, all firms are

not polluting) and (x, y) = (1,0) (where environmental quality is low, all visitors purchase

and no firm sells the environmental options) are always locally attractive under replicator

equations. Therefore, the dynamics is always path dependent whatever the values of the

parameters are. The states (0,1) and (1,0) are Nash equilibria and can be interpreted as

stable social conventions, that is, as strategy distributions which are customary, expected,

14

Journal of Applied Mathematics

and self-enforcing in the sense of Lewis [9]. Note that visitor and firm expected payoffs

evaluated at (0,1) and (1,0) are given, respectively, by

EV2 (0,1) = − p,

EF1 (0,1) = −cNP + β0 ,

EV1 (1,0) = − p − p2 + α22 ,

EF2 (1,0) = −cP − q,

(6.1)

where EV2 (0,1) < EV1 (1,0) and EF2 (1,0) < EF1 (0,1).

Therefore, in (0,1) firms’ profits are higher than in (1,0) and the better performance of

firms is obtained in a context of high-environmental quality. In (1,0) visitors’ (monetary)

payoffs are higher than in (0,1); however, in (1,0) visitors’ welfare is negatively affected by

environmental degradation. So (1,0) and (0,1) cannot be ordered in the sense of Pareto

if the functional form of visitor utility is not known.

In any case, buying the financial option gives visitors a self-assurance device against

environmental deterioration, in that if firms’ choices generate low-environmental quality, subscribing the financial option allows visitors to alleviate welfare reduction due to

environmental degradation. Consequently, the Public Administration, by introducing a

market for environmental options, prevent visitors’ welfare from reaching low values,

which may inhibit individuals from visiting the region.

The fixed points (0,1) and (1,0) are pure population fixed points, in that only one strategy is chosen in each population. The above analysis has proved that there may exist fixed

points where both strategies coexist in both populations. Among these fixed points, at

most one is attractive. It is easy to check that the expected payoff of visitors (resp., of

firms), evaluated at such a fixed point, is higher than the payoff in (0,1) and lower than

that in (1,0) (resp., is higher than the payoff in (1,0) and lower than that in (0,1)). When

three attractive fixed points are present, the dynamics becomes highly path dependent.

As shown above, the existence of an attracting fixed point in the interior of [0,1]2 deeply

complicates the morphology of the attraction basins of (0,1) and (1,0), giving rise to an

indeterminacy result about dynamics.

If environmental protection is the main objective of the PA, obtained not at the expense of firms’ profits, the fixed point (0,1) is the best outcome that can be reached by

the economy, while the other attracting fixed points can be viewed as poverty traps, being

characterized by lower profits and environmental quality. In order to reach the desirable

outcome (0,1), the correct setting of the prices of options is paramount. We leave to

future research the study of dynamics in markets where prices of options (which are considered as parameters in our model) are optimally evaluated by the PA and the market.

References

[1] R. Horesh, Environmental Policy Bonds: Injecting Market Incentives into the Achievement of Society’s Environmental Goals, OECD, Paris, France, 2002.

[2] C. Perrings, “Environmental bonds and environmental research in innovative activities,” Ecological Economics, vol. 1, no. 1, pp. 95–110, 1989.

[3] N. Hanley, J. F. Shogren, and B. White, Environmental Economics in Theory and Practice, MacMillan Press, Bristol, UK, 1997.

[4] J. W. Weibull, Evolutionary Game Theory, MIT Press, Cambridge, Mass, USA, 1995.

[5] D. V. Anosov, S. Kh. Aranson, V. I. Arnold, I. U. Bronshtejn, and V. Z. Grines, Dynamical Systems

I, Springer, Berlin, Germany, 1987.

Angelo Antoci et al.

15

[6] R. Roussarie, Bifurcation of Planar Vector Fields and Hilbert’s Sixteenth Problem, vol. 164 of

Progress in Mathematics, Birkhäuser, Basel, Switzerland, 1998.

[7] M. Galeotti, “Monodromic unbounded polycycles,” Annali di Matematica Pura ed Applicata,

vol. 171, no. 1, pp. 83–105, 1996.

[8] J. Guckenheimer and P. Holmes, Nonlinear Oscillations, Dynamical Systems, and Bifurcations of

Vector Fields, vol. 42 of Applied Mathematical Sciences, Springer, New York, NY, USA, 1983.

[9] D. Lewis, Convention, Harvard University Press, Cambridge, UK, 1969.

Angelo Antoci: DEIR, University of Sassari, Via Torre Tonda 34, 07100 Sassari, Italy

Email address: angelo.antoci@virgilio.it

Marcello Galeotti: DiMaD, University of Florence, Via Lombroso 6/17, 50134 Florence, Italy

Email address: marcello.galeotti@dmd.unifi.it

Lucio Geronazzo: DiMaD, University of Florence, Via Lombroso 6/17, 50134 Florence, Italy

Email address: lucio.geronazzo@dmd.unifi.it