Document 10901140

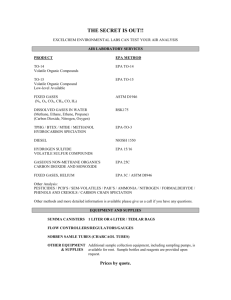

advertisement