SENATE BILL 184 REPORT Senate Bill 184 Report

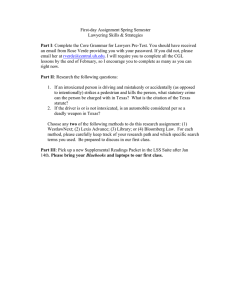

advertisement