To: Ann McColl From: Jason Weber

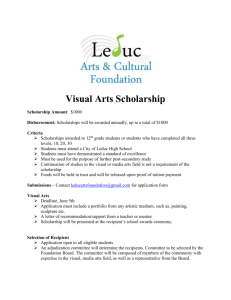

advertisement

To: From: Re: Date: Ann McColl Jason Weber HB 1104 “Equal Opportunity Scholarship Tax Credit” 6/1/2012 HB 1104 Overview and Analysis Similar Legislation in Other States: From the National Conference of State Legislatures (available at http://www.ncsl.org/issues-research/educ/school-choice-scholarship-taxcredits.aspx) Arizona o Allows both individuals (A.R.S. 43-1089) and corporations (A.R.S. 43-1183) to claim a tax credit on income for donations made to "school tuition organizations" (STOs). o The value of the credit is 100 percent of the donation made up to a maximum of $500 for individuals and $1,000 for couples filing jointly. There is no maximum credit for corporations, meaning if they donate an amount equal to their entire corporate income tax liability they will not owe any income tax. o Scholarship funds from individual donations can go to any student of the STOs choosing including those already attending private school (no income-based eligibility requirements) o Scholarship funds received from corporate donations must go to low-income students who are either starting kindergarten or attended a public school the previous year. o Can only be used for private school expenses. In other words, students who receive scholarships must attend a private school approved by the STO. o Private schools participating in the corporate scholarship program must annually administer a qualified standardized test, and make the results available to the public. There is no testing requirement for schools participating in the individual scholarship program. Florida o Allows corporations to apply for a tax credit for donations to an "eligible nonprofit scholarship-funding organization" (F.S. 220.1875). The value of the credit is 100 percent of the donation made o A corporation can apply for a credit worth up to 75 percent of its total income tax liability o As a whole, the state awards a maximum of $140 million (FY 2011) in scholarship tax credits. However, Florida’s statewide limit is flexible, meaning if the amount of corporate donations made exceeds 90 percent of the tax credit limit ($140 million) it automatically increases by 25 percent o Scholarships must be awarded to students who qualify for the free or reduced-price lunch program and are either entering kindergarten or first grade, or attended a public school the previous school year o Eligible nonprofit scholarship-funding organizations can spend only 3 percent of collected donations on administrative expenses 1 o Qualified private schools must administer or make arrangements to allow scholarship recipients between grades 3 and 10 to take an approved standardized test o Scholarships can also be awarded to low-income students that attend a public school outside of their own district. This scholarship is intended to cover travel expenses and any other related educational expenses (F.S. 1002.395) Georgia o Allows individuals and corporations to claim a tax credit for donations made to "student scholarship organizations" valued at 100 percent of the donation made o Corporations are limited to a credit worth 75 percent of the its total income tax liability o Individuals are limited to a credit worth up to $1,000 for an individual and $2,500 for a married couple o The state is allowed to award a total of $50 million in credits each year (O.C.G.A. § 48-7-29.16) o All students enrolled in a Georgia public school or entering kindergarten are eligible to receive a scholarship to a qualified private school o Student scholarship organizations must spend at least 90 percent of their revenue in the form of scholarships o There is no requirement that students receiving scholarships take a standardized test (O.C.G.A. § 20-2A) Indiana o Offers individuals and corporations a tax credit for donations to "scholarship granting organizations" o Taxpayers receive a credit worth 50 percent of the donation made with no maximum credit o Sate caps the statewide total credits awarded at $2.5 million (I.C. 6-3.1-30.5). o Eligible students must have a household income at 200 percent of the required level for the free or reduced-price lunch program, and either be starting kindergarten or have been previously enrolled in a public school o Scholarship granting organizations must spend at least 90 percent of their total donations on student scholarships o Participating private schools must administer standardized tests to all students in the school (I.C. 20-51) Iowa o Offers individuals (but not corporations) a tax credit for donations made to "school tuition organizations" o The credit is equal to 65 percent of an individual’s total contribution o While there is no limit on the size of a credit an individual can claim, there is a statewide tax credit cap of $7.5 million o To receive a scholarship, a student’s family income must be no more than 300 percent of the federal poverty guideline as defined by the U.S. Department of Health and Human Services o Students already enrolled in private school are also eligible for scholarships. Qualified schools must be private and receive accreditation by the Iowa Department of Education 2 o School tuition organizations must allocate 90 percent of their annual revenue in the form of scholarships (I.C. 422.11S) Oklahoma o Allows individuals and corporations to claim a tax credit for contributions made to a scholarship-granting organization o The credit is equal to 50 percent of the contribution made with a maximum credit of $1,000/$2,000 for single/married individuals and $100,000 for any business entity o The state can award a maximum of $1.7 million in credits each year for individuals and $1.7 million for businesses. o To qualify for a scholarship a student must be lawfully present in the U.S. and must have a household income that is no more than 300% of the standard to qualify for a free or reduced price lunch. Students who attended a school in the previous year identified as 'failing', private school students living within the resident boundaries of a school marked as failing, or those identified as students with special needs also qualify for private school scholarships o The scholarships can be used at any accredited school the student gains acceptance to o Scholarship-granting organizations must spend 90% of their revenue on student scholarships. Pennsylvania o Allows businesses to claim a tax credit for contributions made to "scholarship organizations" o The credit is equal to 75 percent of a one-year contribution and 90 percent of a twoyear contribution made by a business. Each contributing business can receive a maximum credit of $300,000 per year o Statewide, the credits awarded cannot exceed $44.7 million o Students with family incomes of $60,000 or less ($12,000 allowance for each additional dependent) are eligible to receive a scholarship. This includes students already enrolled in private school o A scholarship organization must spend at least 80 percent of its revenue on scholarships. Scholarship recipients can attend a public or private school approved by the scholarship organization. o There is no requirement for participating private schools to administer standardized tests Rhode Island o Offers businesses a tax credit for contributions to "scholarship organizations." The value of the credit is equal to 75 percent of the contribution, or 90 percent if the contribution is matched for two consecutive years. Each business can claim a maximum credit of $100,000. The state will award a total maximum of $1 million in tax credits o Students with a household income less than 250 percent of the federal poverty guideline as defined by the U.S. Department of Health and Human Services are eligible to receive scholarships. Students already enrolled in private school are also eligible. Recipients must attend a private school approved by their scholarship organization. o Scholarship organizations must spend 90 percent of their revenue on student scholarships. 3 o There is no requirement for private schools to administer standardized tests (G.L. § 44-62). Issues From Similar Programs in other States General Criticisms: o Funds used to attract star athletes from public to private schools o NPO’s administering scholarships receiving large amounts of money as administrative/operations fees o Lack of oversight of the “scholarship granting organizations” to ensure proper use of scholarship funds, reporting procedures o Lack of research showing private school education improves academic performance of students switching from public to private o Separation of church/state – many private schools are religious. Indirectly funds religious education Counter-argument: Private dollars going directly to private NPOs. Not really government funding because scholarship money does not go into public accounts SC upheld Arizona’s program, rejecting challenges that it violated the Establishment Clause Arizona Christian School Tuition Organization v. Winn Opinion: http://www.supremecourt.gov/opinions/10pdf/09-987.pdf Basically, didn’t reach the Establishment Clause issue because the plaintiff taxpayers did not have standing to sue. This is an indirect expenditure of funds. No money actually flows out of the public fisc. State Specific Criticisms: o GA: Families can donate and receive credit, not just corporations. Concern is that family donates, gets tax credit, then applies for a scholarship for their own children State collects virtually no data on scholarship organizations, does not regulate them, etc. No income-based limits for eligible students. Funds are not being used for disadvantaged youth. Instead being used by families who already send their children to private school o AZ: Permits donors to recommend students who already attend private schools for scholarships, regardless of family income level State legislators can be on scholarship organization board, can be paid by organization Scholarship organizations can decide which private schools they will award scholarships for (essentially allows the organization to restrict their scholarships to students who want to attend a particular private religious school). Primarily used by families whose children already attend private school o PA: 4 permits children of donors to receive scholarships and allows scholarship organizations to retain up to 20% in administrative fees NC Legislation (HB 1104) Basics o § 105-129.101(a): Only allows corporations to apply for tax credit o § 129.101(b) Value of credit is 100% of donation made (dollar for dollar) o § 129.102: Places cap on total amount of tax credits available during calendar year 2012 – $2 million 2013 – $40 million o § 129.103: Contains substantiation process to verify corporation made qualifying donation to qualifying entity o § 115C-562.1 In order to receive a scholarship, students must meet eligibility requirements: Enrollment status is one of the following: o A full time student at a public school during previous semester o Received a scholarship from a scholarship-funding organization in the previous school year o Entering kindergarten or first grade Belongs to household with an income level not in excess of 225% of the federal poverty level o §562.2 Scholarship-funding organizations must be certified by the Division of Nonpublic Education in the Department of Administration Criteria o 501(c)(3) o Use 100% of donations to fund scholarships for first two years following certification. Must use at least 91% of donations to fund scholarships once certified for more than two years Essentially allows these orgs to keep up to 9% for administrative fees after its been certified for over two years o Cannot award scholarships to students within five degrees of kinship for family of paid staff or board members o Cannot allow donors to direct their donation/scholarship for the direct benefit of a particular school or student o Cannot be affiliated with a private school being attended by a scholarship recipient o Cannot discriminate for race, color, ethnicity, national origin o Scholarship amt limited to 4,000 5 o Allows scholarship recipients to attend private school of their choosing o Only gives scholarships to students meeting eligibility guidelines o Can take scholarship $ with them if transferring to another private school o §562.3 Checks on Scholarship-funding organizations: Must submit annual financial and compliance audit from independent CPA Must submit annual report regarding donation scholarship info including: o #, grade level, race, sex of eligible students awarded scholarships o Total amount of scholarship funding awarded o % of first time scholarship recipients o LEA or charter school in which students were enrolled in prior semester o Private school at which students are enrolled Must have separate accounts for donation/scholarship funds and operating funds Shall carry forward no more than 20% of donations to following fiscal year. Any donations remaining in excess of 20% must be returned to State Treasurer and deposited into General Fund Can have certification revoked if failing to comply with requirements Must report to Dept. of Rev each donor’s donation amt + certification of amount o §562.4 Requirements for Private Schools receiving scholarship funds Must provide scholarship funding org with tuition, fee info Staff must have passed criminal background check Must provide progress reports to scholarship receiving students Must report test scores each year for scholarship receiving students Must report graduation rates If the school has more than 25 students receiving scholarships, must report aggregate test data Checks on Private Schools If fails to comply with requirements, will be ineligible to receive future scholarship funds o §562.6 All of this (scholarship orgs certification, reporting requirements, private school requirements and reporting, etc) is overseen by the Division of Nonpublic Education of the Dept. of Admn. This Division must report to DPI at least twice a year with the following: o # of students who have received scholarships 6 Purpose: for DPI to adjust LEA allotments Division must report annually to the Joint Legislative Oversight Committee with: o # and name of scholarship orgs o #, race, etc of students receiving scholarships o Amt of scholarship $ awarded o Private school in which students are enrolled o # of donors and amt of donations received by each scholarship org Division must report annually to DPI and Joint Leg Committee with learning gains of students receiving donation scholarships o Must be conducted by independent research org o Must compare learning gains of participating students on statewide basis to the statewide gains of public school students with similar socioeconomic backgrounds Analysis of HB 1104 Addresses almost all criticisms of similar legislation in other states. Florida’s law, the one on which NC based 1104, also addressed those issues. Positives: o Individuals are not eligible for the tax credit. Only corporations o Scholarships only available to defined class of children from low-income families (225% of federal poverty level) o Oversight of scholarship funding orgs, cannot donate to children of org board members, cannot direct scholarships to specific private schools, donors cannot choose which schools receive their scholarship $, etc o Annual reporting requirements for scholarship orgs, annual study of the program’s effectiveness in increasing student achievement/test scores o Contains method to revoke scholarship org’s certification o Only allows up to 9% of donations to scholarship orgs to be used for administrative fees (better than most states. PA allows up to 20%) Criticisms o Florida had tighter control/oversight over the scholarship organizations because they only allowed one NPO to administer the scholarships/to be certified as a scholarship granting org. Florida also limited their scholarship org to keeping 3% of donations as fees Florida also allowed scholarships for low-income students that attend a public school outside of their own district. This scholarship is intended to cover travel expenses and any other related educational expenses Each of these changes would strengthen our own legislation. Particularly allowing students to apply and receive scholarships to attend other public schools outside of their district. Would at least keep them in the public schools and keep the $ in public schools 7 o Might want tighter controls over private schools that can receive scholarship funds. Maybe add clause that would ensure the school’s curriculum meets a defined standard/is in line with or better than NC’s state standards, health and safety standards, etc. o Directs participating private schools to use approved, nationally standardized tests. Perhaps limit this to certain, defined tests o Because the majority of private schools are religious schools, this legislation still indirectly funds religious education. However, the Supreme’s have ruled on this in the AZ case discussed on pg 1 above. o Also not absolutely clear that corporations are only taxpayers allowed to qualify for tax credit. Corporation is used in the bill’s name, but the rest of the bill uses the term “taxpayer.” I’m not sure if this is really an issue, but could have a definition of taxpayer that limits it to corporations. Would prevent the numerous problems that arose in other states from allowing individuals to receive credits. o Could try and strengthen controls over scholarship granting orgs, but I’m not clear on what else to do. 1104 has addressed all the criticisms I could find regarding similar legislation o Could include reporting requirement regarding $ supposedly saved through this legislation/program. 1104’s backers claim it will save NC $53,000 in year 1, $16 million in year 2, and $12 million in year 3. If this isn’t happening, should have method to revoke program o Cost? How much will this cost in lost tax revenue? o Greater limits on how much corporations can donate or receive in tax credits? Current bill only states limited to amount of tax bill (in other words, cannot receive more $ in credit than you would have paid in taxes). FL only allows tax credit up to 75% of its income tax bill. Overall criticisms/sound bites: o Diverts $ and attention from strengthening our public schools o Diverts needed tax $ during time of severe budget cuts, shortfalls, etc. o Indirect funding of religious education o Lack of proven educational benefits. We need to focus efforts on proven reform strategies o Private schools are not accountable to taxpayers Resources: http://www.ncpolicywatch.com/2012/05/23/bad-timing-for-bad-idea/ o Highlights lobbyist involvement http://www.ncpolicywatch.com/2012/05/25/a-voucher-plan-dressed-up-like-a-tax-credit/ o Audio overview of legislation, highlights criticisms of similar legislation in other states http://www.nytimes.com/2012/05/22/education/scholarship-funds-meant-for-needybenefit-private-schools.html?_r=2 o Criticizes similar legislation in other states. Focuses on AZ, GA, PA. (Uses a lot of anecdotal evidence) http://www.nea.org/assets/docs/HE/mf_PB15_TaxCredits.pdf 8 o Outlines lack of proven benefits, lack of proven tax savings, brief analysis of tax policy effects http://www.indyweek.com/indyweek/gop-plan-would-send-public-funds-to-privateschools/Content?oid=3077399 o Overview of 1104, similar legislation. Offers brief analysis of how this furthers conservative goals for privatizing, Koch brother’s involvement in supporting this legislation http://www.pfaw.org/media-center/publications/dereliction-of-duty/the-rush-toprivitization-vouchers-and-tuition-tax-cre o Criticisms of FL program. 9