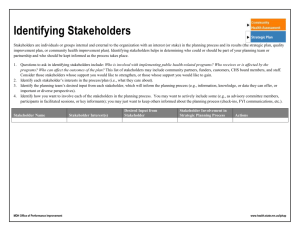

Assessing Stakeholder Salience through the View ... Enterprise Transformation ARCHNES

advertisement