The University of Georgia The Feasibility of a Barnesville Expo Center

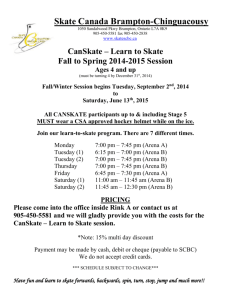

advertisement