Federal Income Taxation Chapter 1 Overview Professors Wells Presentation:

advertisement

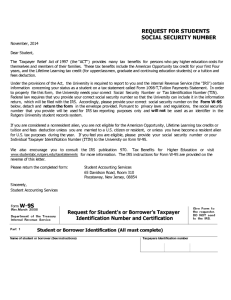

Presentation: Federal Income Taxation Chapter 1 Overview Professors Wells August 24, 2015 Introduction to Federal Taxation p.1 Federal Income Tax is a law school subject, but it is much more, it is about the social compact. Other quotes on taxes: “Taxes are what we pay for civilized society.” Justice Oliver Wendell Holmes, Compania General de Tabacos de Filipinas v. Collector of Internal Revenue, 275 U.S. 87, 100 (1927) (dissenting). “Basic tax, as everyone knows, is the only genuinely funny subject in law school.” --Martin D. Ginsburg “[T]axation, in reality, is life. If you know the position a person takes on taxes, you can tell their whole philosophy. The tax code, once you get to know it, embodies all the essence of life: greed, politics, power, goodness, charity.” --Sheldon S. Cohen “America's tax laws are similar to the writings of Karl Marx and the writings of Sigmund Freud in that many of the people who loudly proclaim opinions about these documents have never read a word of them.”--Jeffery L. Yablon “One of the problems with trying to have a rational discussion about taxes is that so many people want to believe what's convenient rather than what's accurate. Believing, after all, requires so much less effort than thinking.” --Allan Sloan “Tax issues are fun. Getting to love them may take a bit of effort, but the same is true for Beethoven's string quartets, and think of how much pleasure they give if one does make the effort.”--Peter L. Faber “People want just taxes more than they want lower taxes.” --Will Rogers 2 Congress “plans” much more tax revenue p.3 Congress “plans” no discretionary spending growth 57% Increase 67% Increase *CBO: Budget and Economic Outlook: Fiscal Years 2015 to 2025 (January 2015) 3 Tax Policy Concerns p. 3 1. Financing Government Expenditures 2. Promoting Economic Stability and Growth 3. Equity (Fairness) 4. Redistributing Income or Wealth 5. Neutrality 6. Create Special Incentives or Disincentives for Certain Activities 4 Tax Subsidies p. 3 Tax subsidies involve using the tax system to redistribute money. - Tax transfers (e.g., refundable credits, energy credits, first time homebuyer credits) - Social spending, e.g., charitable deduction What are “upside-down” subsidies? 5 Sources of Federal Revenue GDP CBO (February 2014) p.10 Distribution'of'BeforeBTax'Income'and'Taxes,'by'Income'Group,'2009'and'2010* Average'Income'(2010'Dollars) Lowest+Quintile Second+Quintile Middle+Quintile Fourth+Quintile Highest+Quintile 2009 ++++++++23,800 ++++++++44,000 ++++++++65,200 ++++++++95,100 +++++227,100 2010 ++++++++24,100 ++++++++44,200 ++++++++65,400 ++++++++95,500 +++++239,100 All+Quintiles ++++++++89,800 ++++++++92,200 Share'of'Income'(Percent) Change+ All+Federal+ (Percent) Taxes * 0.4 L0.2 3.8 L0.4 9.1 L0.7 17.6 1.1 68.8 Share'of'Federal'Taxes'(2010) Individual+ Social+ Corporate+ Income+ Insurance+ Income+ Taxes Taxes Taxes L6.2 5.6 1.7 L2.9 9.8 3.1 2.9 15.4 5.5 13.3 23.9 9.5 92.9 45.1 78.8 Change+ (Percent) 1.2 0.5 0.3 0.4 5.3 2009 5.1 9.8 14.6 21.1 50.8 2010 5.1 9.6 14.2 20.4 51.9 Excise+ Taxes 13.4 15.4 18.7 20.6 31.5 2.7 100.0 100.0 n.a. 100.0 100.0 100.0 100.0 100.0 0.5 1.8 3.5 16 14.9 10.1 12.5 13.3 14.6 9.9 12.5 14.9 L0.3 L0.2 * 1.6 15.5 11.9 17.2 24.2 15.4 13.8 24.6 39.0 17.8 11.5 11.5 4.2 8.4 7.1 13.7 49.5 12.0 7.1 7.5 4.9 + + 81st+to+90th+Percentiles 91st+to+95th+Percentiles 96th+to+99th+Percentiles Top+1+Percent +++++134,000 +++++178,400 +++++276,700 ++1,237,300 +++++134,600 +++++181,600 +++++286,400 ++1,434,900 *Chart+Taken+From+CBO+Report+on+Distribution+of+Household+Income+and+Federal+Taxes+2009+and+2010+(February+2014) Is the tax burden “fair?” Is society happier with higher or lower taxes? See Johnston, “Taxes, Happiness & Heliocentrism” “People want just taxes more than they want lower taxes.” -Will Rogers. Is Will Rogers right? 6 Top Marginal Tax Rates, 1909-2012 p. 10 7 Distributional Effects: Ability to Pay p.11 Should the rich pay more proportionately? Utility Lost Utility Taxes Lost Utility Taxes Income 8 Tax Incidence Theory Tax Incidence: Describes the person that bears the ultimate burden of a tax. Hypothetical: Are retail sales taxes borne economically by the customer or by the retailer? Depends on whether prices can be increased. Hypothetical: Exemption for state and local interest. Municipal bond rates are lower to reflect in part the tax preference given to the investor. So, the investor tax savings is “shared” with states and municipalities via lower interest rates. Assumption: Income taxes (particularly on wages, salaries, and service income is typically not shifted but stays with the individual. 9 Capital Gain and Dividend p.29 1) A tax rate preference for much of our history has existed for certain “capital gains.” See §1(h). 2) Thus, we need to categorize whether income is from a sale or exchange of a capital asset or if it is “ordinary income.” We will cover this character question in Chapters 19-21. 10 Average versus Marginal Rates p.31-32 1. Average Tax Rates. This is the percentage tax rate the taxpayer pays on their entire income 2. Marginal tax rates. This is the incremental tax rate the taxpayer pays on the next incremental amount of income. Marginal rates are what influence tax planning and investment decisions. 3. Types of Income Taxes. A. Progressive Income Tax: Tax rates increase as income increases. B. Regressive Income Tax: Tax rates decrease as income increases. C. Proportional Income Tax: Tax rates remain constant. 11 WHAT IS INCOME? P.554 How is the concept of “income” defined? Consider the Haig-Simons definition: Y = C + ΔW “Accession to wealth” consisting of 1) Consumption (during the measurement period), plus 2) Change in net worth (during the measurement period). 12 Tax Terminology 1) Taxable Income: This is the “base” on which we calculate the tax due. How we get there: Step One: Start with Gross Income defined in §61 Step Two: Deductions (set forth in §62) are subtracted from Gross Income to arrive at Adjusted Gross Income. Step Three: Deductions (personal exemptions plus either standard deduction or itemized deductions) are subtracted to arrive at Step Four: Taxable Income as defined in §63. Taxes are computed on Taxable Income per §1 to derive tentative tax due. Credits (see §21 through §54) and minimum tax computations to derive final Tax Payable. 13 Timing Issues 1) 2) 3) Tax Accounting Methods A. Cash Method. Exception: Capital Expenditures B. Accrual Method C. Regardless of method, the tax period is typically an annual accounting period. Issue: transactional consistency versus annual reporting. Timing of Income Recognition: governed by when income is realized and when it must be recognized. A realized gain is generally recognized for tax purposes. When is a gain realized? When is a realized gain not recognized? Timing of Deductions (Cost recovery, depreciation, basis). 14 Whose Income Is It? (Chapter 17 & 18) 1) Assignment of Income Issues. To preserve a progressive tax system, we must have the right taxpayer report their income and not have it deflected to others at lower rates. 2) Deflecting income to business entities (corporations/ partnerships), trusts, or to family members to be reported as the income of others is a Chapter 7 issue. 15 Survey Over Areas Things Lawyers Do Implicate Tax Issues. 1) What is income? Chapters 1-8. u Contexts: Payments in settlement of cases, compensationtype arrangements, transactional issues, dealing in encumbered real estate, debt discharge issues, family wealth planning, marital settlements. In other words, things that lawyers document. 2) What is deductible for tax purposes? Chapters 9-16. u Payments in a variety of contexts (personal, business, investment). 3) Whose income is it anyway? Chapters 17-18. Deflecting income to business others. Who is taxed in what situations? 4) Type of Income or Deduction (Capital Gains & Losses versus or 16 Ordinary Income & Expenses) New BigLaw Associates to Spend First Month in B-School WSJ Law Blog, Trendy New Perk (or Punishment?) for Law Firm Junior Lawyers Debevoise & Plimpton’s presiding partner Michael Blair announced internally that the 675lawyer firm has arranged for a group of 23 incoming associates to participate in a program developed by Fullbridge, a year-old company co-founded by two Harvard MBA graduates. The associates from its New York and London offices arriving at the firm September 12 will participate in the program full-time over their first four weeks at the firm, Mr. Blair said in an email to the firm. The program will be a pilot this year, he noted. The Fullbridge program, which combines an online format with individualized coaching and group projects, aims to teach the junior lawyers financial and accounting concepts, including how to read balance sheets and analyze financial statements, as well as how to spot and resolve business problems in case studies. They’ll also learn practical skills which many law schools don’t teach, such as creating powerpoint presentations and computer spreadsheets. Those skills can come in handy when junior lawyers are calculating damages or compiling facts for investigations or litigation, Debevoise says. Skadden, Arps, Slate, Meagher & Flom in January rolled out a training program for its associates though Fullbridge, according to Carol Sprague, the law firm’s director of associate and alumni relations and attorney recruiting. Fullbridge will run a second program for all 100 or so of Skadden’s fall associates in its U.S. offices, she said. The fall Fullbridge program will take place over the course of four weeks. 17 TIME VALUE OF MONEY Pay Tax Today or Tomorrow? p.254 What is the importance of the “time value of money” concept? Dollars that are invested will give a return over time. It follows then that a dollar received early is worth more than a dollar received later. The earlier dollar will grow to be worth more than a dollar received later. It follows also that dollars received at different times do not have the same real meaning (even if there were no inflation). They are like apples and oranges. Dollars received or paid at different times cannot be compared or netted as if they were the same. How is this done? 18 TIME VALUE OF MONEY Pay Tax Today or Tomorrow? p.255 Dollars received or paid at different times can not be compared or netted as if they were the same. • One must first “translate” the earlier dollar into what it would be worth later. • Alternatively, one must translate the later dollar into its equivalent at the earlier time. Dollars payable at different times are translated into either a “future value” or a “present value” before they are compared. Financial analysis only insists on translation to a single time. Dollars received earlier than the point of comparison must be translated forward by taking into account the compound growth that is available; dollars received later than the point of comparison must be translated back by “discounting.” 19 TIME VALUE OF MONEY Future Value Concepts p.256 Example: $100 dollars at Year Zero with a 10% interest market rate has the following equivalent values depending on the date (assuming no taxes for the moment) $110 Year 1 $121 $133 Year 2 Year 3 $100 Year 0 Conclusion: If I can defer paying a $100 tax until Year 3, I will pay the $100 and have an extra $32 to keep. In real terms, I have used the government’s money to earn $32 to apply against my tax bill. 20 TIME VALUE OF MONEY Future Value Concepts $110 Year 1 $121 $133 Year 2 Year 3 p.256 $100 Year 0 Although the above picture shows the principle graphically, we can also express this concept mathmatically as follows: P * (1+r) n where r is the interest rate and n is the periods 100 * (1+10%) 100 * (1.1) 3 3 100 * (1.331) = 133.1 21 TIME VALUE OF MONEY Present Value Concepts p.256 “Discounting” or present value calculations are just the inverse of compound growth calculations. • The present value of a future value is the amount that will grow to equal this future value amount at given compound growth rates. The present value answers the question of how much must I put into an account if I need to have the future value by the end of n periods. • If, for instance, I need $133 in 3 years and get 10% tax exempt in my best investment, I can calculate that I must put $100 aside now: $100 will grow to equal $133 by the end of three years. So $133 in three years is like $100 now. 22 TIME VALUE OF MONEY Present Value Concepts p.256 I can demonstrate that $100 is the present value equivalent of $133 from Year 3 pictorially as follows: $110 Year 1 $121 $133 Year 2 Year 3 $100 Year 0 Or, I can express the same idea mathmatically for a future value of A as follows: PV= A since 133 = 133 = n 3 3 (1+r) (1+10%) (1.1) 133 = 1.331 100 23 TIME VALUE OF MONEY p.256 How Financial Concepts Turn the World Around Why does any of this matter? Prove to me that it makes any real difference? Okay, stay with me on this and let’s look at a simple example. 24 TIME VALUE OF MONEY p.256 How Financial Concepts Turn the World Around An investor is given a choice of the following three investments expressed in red numbers that provide cash flow in black numbers. Year 0 Year 1 Year 2 Year 3 A ($100) $0 $20 $0 B ($100) $40 $40 $40 C ($30) $55 $20 $20 Year 4 Year 5 $110 ($70) Which investment has the highest accounting profit? 25 TIME VALUE OF MONEY p.256 How Financial Concepts Turn the World Around An investor is given a choice of the following three investments. Year 0 Year 1 Year 2 Year 3 A ($100) $0 $20 $0 B ($100) $40 $40 $40 C ($30) $55 $20 $20 Year 4 Year 5 $110 ($70) Which investment has the highest accounting profit? Answer: A= $30 profits B= $20 profits C=($5) loss 26 TIME VALUE OF MONEY p.256 How Financial Concepts Turn the World Around An investor is given a choice of the following three investments. Year 0 Year 1 Year 2 Year 3 A ($100) $0 $20 $0 B ($100) $40 $40 $40 C ($30) $55 $20 $20 Year 4 Year 5 $110 ($70) What choice has the highest net present value assuming a 5% discount rate? 27 TIME VALUE OF MONEY p.256 How Financial Concepts Turn the World Around An investor is given a choice of the following three investments. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 A ($100) $0 $20 $0 $110 B ($100) $40 $40 $40 C ($30) $55 $20 $20 ($70) What is the net present value of each investment assuming a 5% hurdle rate? Answer: NPV @ 5% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 A $4.33 ($100) $0 $20 $0 B $8.93 ($100) $40 $40 $40 C $0.21 $55 $20 $20 ($30) $110 ($70) 28 TIME VALUE OF MONEY p.256 How Financial Concepts Turn the World Around An investor is given a choice of the following three investments. Year 0 Year 1 Year 2 Year 3 A ($100) $0 $20 $0 B ($100) $40 $40 $40 C ($30) $55 $20 $20 Year 4 Year 5 $110 ($70) What is the result assuming a 10% hurdle rate 29 TIME VALUE OF MONEY p.256 How Financial Concepts Turn the World Around An investor is given a choice of the following three investments. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 A ($100) $0 $20 $0 $110 B ($100) $40 $40 $40 C ($30) $55 $20 $20 ($70) What is the result assuming a 10% hurdle rate? Answer: NPV @ 10% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 A ($15.17) ($100) $0 $20 $0 $110 B ($0.53) ($100) $40 $40 $40 C $3.75 ($30) $55 $20 $20 ($70) 30 Relevancy of Time Value of Money Tax Law p.257 Implication: Timing matters greatly to the issue of the effective tax rate. Effective tax rates measure the difference between the aftertax rate of return on and rate of return if there were no income tax. The benefit of deferring a tax or accelerating a deduction can greatly impact a businesses “effective tax rate.” We are not striving to make you financial planners in this class. We will leave that to the business school, but lawyers need to understand what makes deferral a financial benefit. Tax lawyers must be sensitive to time value of money issues to understand whether a case is being decided correctly or wrongly. Without knowing these concepts and without a grasp of the HaigSimon ideal, you are at sea without a compass. Tax laws that can achieve tax deferral for clients provide an enormous value to their clients. 31 Relevancy of Time Value of Money Tax Law p.260 Let’s think about it another way: Suppose I told you that I could provide you the equivalent of a tax-free profit regardless of your investment. Does that sound too good to be true? 32 Cary Brown Thesis (Tax Deferral and Yield Exemption) p. 260 An immediate deduction for the cost of a capital asset, which is often called expensing, can produce the same results as exempting the income produced by the asset under certain conditions, including the assumption that tax rates remain the same. Under that assumption, the equivalence between exemption and expensing holds because the tax savings from the deduction, if reinvested in comparable assets, will fully fund future tax liabilities on income produced by the investment See E. Cary Brown, Business Income Taxation and Investment Incentives, in INCOME, EMPLOYMENT AND PUBLIC POLICY: ESSAYS IN HONOR OF ALVIN H. HANSEN 300, 309-10 (1948), reprinted in THE AMERICAN ECONOMICS ASSOCIATION, READINGS IN THE ECONOMICS OF TAXATION 525 (Richard A. Musgrave & Carl S. Shoup eds., 1959). 33 Cary Brown Thesis (Tax Deferral and Yield Exemption) p. 260 Cary Brown Thesis Proven -------------------------------------------------------------------------------------------------------(B) (A) Soft Money Capitalized Expensed or Investment Excluded -------------------------------------------------------------------------------------------------------1. Income at $100 2. Tax on row 1 at 33 percent 3. Investable amount (row 1 - row 2) 4. Investment (row 3) triples 5. Basis 6. Taxable amount 7. Tax at one-third of row 6 8. End result (row 4 - row 7) $100 -$40 $60 $180 $60 $120 Tax exempt $180 $100 $0 $100 $300 $0 $300 -$120 $180 34 Cary Brown Thesis Soft Money Investing p.260 What is the value of deferring tax on $1,000 for 5 years? Assume the tax rate is 40% and that the investment will grow 10% per year for 5 years when the tax deferral is ended. 35 Cary Brown Thesis Soft Money Investing p.260 What is the value of deferring tax on $1,000 for 5 years? Answer: The ability to earn a return on the government’s tax money will pay for the tax on profits for the taxpayer’s original investment. Year 0 Growth Year 1 Growth Year 2 Growth Year 3 Growth Year 4 Growth Year 5 (a) Post-Tax 600 1.10 660 1.10 726 1.10 799 1.10 878 1.10 967 (b) Soft Money 400 1.10 440 1.10 484 1.10 532 1.10 586 1.10 644 1000 1.10 1100 1.10 1210 1.10 1331 1.10 1464 1.10 1611 (a+b) Total Proof: 1611 x 40% = 644.4 36 Cary Brown Thesis Soft Money Investing p.260 The ability to deduct an investment immediately or to do the equivalent by the taxation on income in order to make an investment with this pre-tax amount is called "soft money investing.“ This concept is routine to tax economics but is not commonly evident in statutory or judicial decision-making. The effect of “soft money investing” is that taxpayers are given tax-free treatment on the return related to their after-tax equivalent amount. Many people would object to giving tax-free income to certain types of investment activities, but failing to recognize that tax deferral creates the equivalent of that result is a fundamental conceptual mistake that will get you into trouble. 37 Soft Money Investments: Retirement Income Plans (§401(k) Plans) p. 260 Employee gets benefit of income exclusion for (1) employer’s contribution to plan, and (2) employee’s contribution to plan Employer gets immediate deduction for contribution to the plan. Tax “whipsaw” effect? No gross income for income build-up during accumulation/ investment phase Tax Expenditure impact of Defined Contrbution & Benefit Plans, Self-Employed Plans and IRAs was is $146.4 billion (see p. 536) 38 IRS Responsibilities p.16 Administrative law is pronounced by the Internal Revenue Service (part of the U.S. Treasury Dept.) through regulations and other pronouncements. Acquiescence by IRS to Tax Court decisions IRS Revenue Rulings (Rev. Rul.) IRS Revenue Procedures (Rev. Proc.) IRS Notices IRS Private Letter Rulings (PLRs) Technical Advice Memoranda (TAM) Closing Agreements IRS Determination Letters IRS is responsible for the enforcement of tax laws, including tax reporting, collection and litigation 39 Self-Assessment System (Annual Returns) p.17 1. The income tax is a “voluntary” self-assessment regime. It is the taxpayer’s obligation to submit the information, prove the amount that is due, and to properly pay their tax. 2. The IRS is there to help the taxpayer understand their obligation and to verify that the taxpayer did comply with their obligations. 40 Tax Controversies p.19-20 IRS has broad investigatory authority (See §§7601-7612). The IRS can prepare a taxpayer return if one was not filed (See §6020(b)) and can assert tax deficiencies (see §6201-6204). The IRS has broad authority to collect taxes that are assessed (see §6303, §6321, §6331, §6335). Resolution of disputes is first handled through the IRS administrative appeals process and then ultimately by the U.S. Courts, including the United States Tax Court (an Article 1, not Article 3, court). A. U.S. Tax Court petition after a “90 day letter” received from IRS. Must file within 90 days of the date of the “90 day letter.” B. Refund litigation: U.S. District Court U.S. Court of Federal Claims 41 Forum shopping opportunities? Statute Of Limitations p.20 Generally, the IRS has three years to assert a deficiency from the due date of a timely filed tax return, and the taxpayer has three years to file a claim for refund, but the statute of limitations is tolled upon issuance of a statutory notice of deficiency (“90 day letter”). Taxpayers cannot bring suit for a claim for refund until after six months and must do so within two years of the disallowance of the refund claim. 42 Penalties for Noncompliance p.21 Penalties Apply for Failure to File or Pay the Right Amount of Tax 1. Negligence (reckless & intentional): 20% penalty regardless of amount of underpayment. 2. Substantial Understatement: 20% penalty for underpayment that is greater than $5,000 or 10% of the proper tax amount. A. Exception #1: Reasonable Cause. Taxpayer is not subject to a penalty if they have “substantial authority” for a position. B. Exception #2: Adequate disclosure of the position on return plus a “reasonable basis.” 3. Failure to file penalty. 5% per month up to 25% of deficiency. 4. Interest for late payment. 5. Civil Fraud: 75% penalty. 6. Criminal Tax Evasion: Not more than $100,000 and 5 years in prison 43 Opinion Practice p.21 Opinion Levels 1. “Reasonable Basis” (15% to 30% chance of success) 2. “Substantial Authority” (30% to 50% chance of success) 3. “More Likely Than Not” (more than 50%) 4. “Should” Prevail (more than 70%) Tax opinions are regulated by the IRS in Circular 230 that sets forth criteria for professional quality and care in the opinion. 44 History of U.S. Taxation p.22 U.S. Constitution Art.1, Sec. 8, Cl. 1: The Congress shall have Power To lay and collect Taxes, DuBes, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all DuBes, Imposts and Excises shall be uniform throughout the United States; Art. 1, Sec. 9, Cl. 4: No CapitaBon, or other direct, Tax shall be laid, unless in ProporBon to the Census or enumeraBon herein before directed to be taken. 45 Federal Taxes – History Before the 16th Amendment p.23 Carriage tax not a “direct tax” Civil War Period: Income Tax of 1862 with 1864 Amendments 1894 - personal income tax Unconstitutionally imposed tax Pollock v. Farmers Loan & Trust - p. 23 Held: a tax on unapportioned real property rental income was unconstitutional 46 Federal Taxes –16th Amendment p.23 U.S. Constitution - 16th Amendment: Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration. 47 Federal Taxation Is A Statutory Based Set of Laws p.24 1. Primary source of law - The Internal Revenue Code (Title 26 of the United States Code) (assuming authority under U.S. Constitution). 2. Administrative Guidance (Treasury regulations, Revenue Rulings, Revenue Procedures, Private Letter Rulings). 3. Judicial Decisions. 4. Legislative History: Committee Reports (Senate Finance, House Ways & Means Committee, Conference Report, and the staff of the Joint Committee on Taxation 48