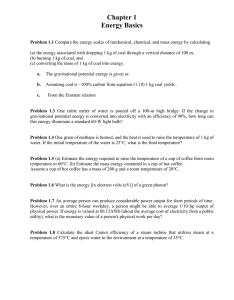

COAL ENERGY AND ELECTRIC GENERATION

advertisement