WHAT EVERY EXECUTOR OUGHT TO KNOW D & W

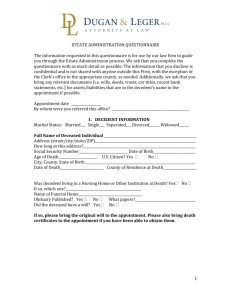

advertisement