WHAT EVERY EXECUTOR OUGHT TO KNOW D & W

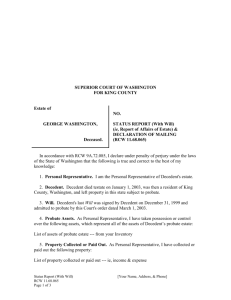

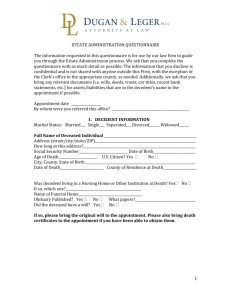

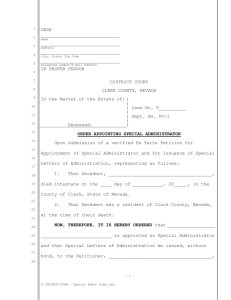

advertisement