UNCTAD Secretary-General's High-Level Multi-Stakeholder Dialogue on Commodities

advertisement

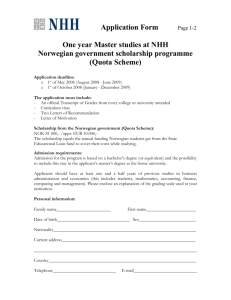

UNCTAD Secretary-General's High-Level Multi-Stakeholder Dialogue on Commodities in the context of UNCTAD XII 28-29 January 2008 Managing Petroleum Revenues – the Norwegian Case By Mr. Arent Skjæveland Deputy Director General, Economic Policy Department, Norwegian Ministry of Finance The views expressed are those of the author and do not necessarily reflect the views of UNCTAD Managing petroleum revenues – the Norwegian case Geneva 28.01.2008 Deputy Director General Arent Skjæveland Economic Policy Department 1 Norwegian Ministry of Finance The Norwegian petroleum production profile 300 250 Mill. Sm3 o.e. 200 150 100 50 0 1970 1975 1980 1985 Oil 1990 Gas 1995 2000 2005 2010 2015 2020 2025 2030 NGL (included condensate) Source: Norwegian Petroleum Directorate 2 Norwegian Ministry of Finance The importance of the petroleum sector in Norway 2006 25 % Share of GDP 3 38 % Share of state revenues 51 % Share of total exports Source: Statistics Norway, Ministry of Finance Norwegian Ministry of Finance …but labour force is our most important asset • Pension and tax system must give incentives for work • Welfare scheme reforms: More people at work fewer on benefits • Good policy fundamentals - sustainable macroeconomic policy National wealth per capita 4 % 7 % 1 % 88 % 4 P etroleum Wealth Real Capital Financial Assets Labour Force Norwegian Ministry of Finance Higher natural resource income reduces GDP growth Transmission channels • Dutch disease • Bad investments - fund invested domestically • Loss of focus on structural policy • Poor governance & weak institutions (rent-seeking ) GDP/capita 1970-89 vs. share of natural resource export in GDP in 1971 for 97 developing countries GDP per capita Natural resource intensity -> Source: Sachs and Warner (1995) 5 Norwegian Ministry of Finance Wealth management – from theory to practice: How to manage the petroleum revenues so they can give basis for a permanent wealth increase • Spending must be separated from current (volatile) oil & gas income • A petroleum fund can support fiscal management and play a separating role if: Wide political and public support Clear rules Stores genuine savings Extraction Path Consumption path after discovery Consumption path before petroleum discovery t0 6 Time Norwegian Ministry of Finance The Norwegian revenue profile Per cent of GDP for Mainland Norway 24 24 Government net cash flow 20 16 16 12 12 8 8 4 4 0 0 -4 1960 7 20 1970 1980 1990 2000 2010 2020 2030 2040 2050 -4 2060 Norwegian Ministry of Finance From a fluctuating net cash flow to stable spending according to the fiscal rule Per cent of GDP for Mainland Norway 24 24 Government net cash flow 20 16 12 8 16 Oil adjusted deficit Real expected return 4 0 -4 1960 12 8 4 8 20 0 Structural, oil adjusted deficit 1970 1980 1990 2000 2010 2020 2030 2040 2050 -4 2060 Norwegian Ministry of Finance The Fund mechanism – integrated with fiscal policy Revenues Return on investments Petroleum revenues Fund Transfer to finance non-oil budget deficit State Budget Expenditures Fiscal policy guideline (over time spend real return of the fund) 9 • consumption • investment (infrastructure, human capital) Norwegian Ministry of Finance Benchmark for the Pension Fund – Global Strategic benchmark Equities 60 % America and Africa 35 % 10 Europe 50 % Asia and Oceania 15 % Fixed Income 40 % America and Africa 35 % Europe 60 % Asia and Oceania 5% Equity index: Fixed income index: FTSE All-Cap Index Approx. 7000 equities Lehman Brothers Global Aggregate/Global Real Government / Agency / Corporate / Securitized Approx. 7500 bonds Norwegian Ministry of Finance Biggest Investment Portefolio in Europe, further strong growth Norwegian State Fund „GPF-Global“ – Market value 1996–2016(e) 700 700 Billion € 600 600 500 500 expected growth 400 400 300 300 200 200 100 100 0 0 1996 11 2000 2004 2008 2012 2016 Norwegian Ministry of Finance Sovereign Wealth Funds’ growing role in international financial markets (1) The international debate – what are the issues? • SWFs’ size and prospective growth 9 9 9 • Lack of transparency 9 • may make SWFs less predictable and even increase volatility in some situations Suspicion of whether non-financial objectives are guiding investment decisions 9 12 2.5 trillion USD today and maybe 4-5 times more in 2015 6 countries holds 85% of the capital potential market movers may encourage financial protectionism, but equal treatment of shareholders is a fundamental principle Norwegian Ministry of Finance Sovereign Wealth Funds’ growing role in international financial markets (2) 1. Well functioning markets are good for everyone 2. Sensible management of oil-producing countries’ petroleum wealth is in everyone’s interest 9 9 stabilizing the oil market by producing near maximum capacity if restrictions on investments possibilities oil production may has to be reduced 3. SWF’s act as an stabilizing factor in international financial markets 9 9 9 9 9 9 long investment horizon no leverage no short term liquidity requirements strong risk bearing capacity and ability to accommodate short term volatility offsetting possible predominance short term investors enhance market liquidity by transitioning oil revenues into the market 4. Transparency is key 9 9 9 13 Build trust and confidence – domestically and internationally Has disciplinary effect on management We would like other funds to follow our example Norwegian Ministry of Finance What can be learnt from the Norwegian experience? • Successful in: • And more generally: • 14 Limiting fiscal spending Sheltering Norwegian economy Good results from the management of the Fund capital Labour supply has remained high Productivity growth has been good Transparency is high in all areas of our management model But: Still a risk that oil revenues can be a curse…