Document 10867568

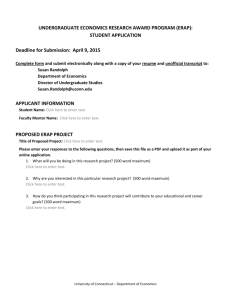

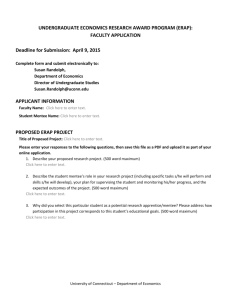

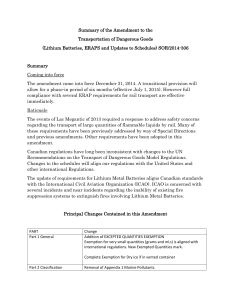

advertisement