Procurement Card Guidelines

advertisement

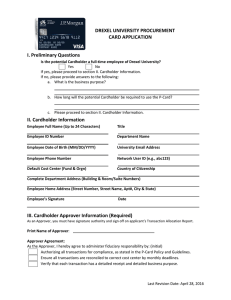

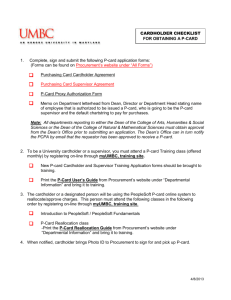

Procurement Card Guidelines Overview of Procurement Card Guidelines The Drexel University Procurement Card (P-Card) program is designed as an efficient means for members of the Drexel community to make certain business purchases, including those related to travel. The use of a P-Card is a privilege accorded to the employee to ease their administrative burdens and is not available to all employees. Accepting a P-Card brings with it certain obligations and responsibilities. Strictly adhering to these responsibilities reduces the inherent risks associated with a P-Card program. The privilege of having a P-Card may be revoked at any time for non-compliant usage. Guidelines will be modified from time to time as necessary to provide additional clarification or react to modifications in the Purchasing Policy or P-Card Policy. Procurement Services will make its best efforts to communicate changes and additions to the guidelines, but it is ultimately the responsibility of the PCardholder and the Approver to review and understand all current guidelines. Lack of knowledge of these guidelines and the P-Card Policy are not justifications for avoiding consequences associated with non-compliance. The P-Card is: • A Visa card issued by JP Morgan Chase. • Intended for business purpose only, and may not be used for personal purchases. • To be used by the P-Cardholder only. If there is a unique circumstance indicating need for multiple individuals to a single P-Card, please contact the P-Card Office directly at pcard@drexel.edu. • If the P-Card is issued in the name of a Department, the authorized user(s) are to be listed on the P-Card application, along with the defined designated administrator, who is responsible for submitting approved monthly Transaction Allocation Reports. • All P-Card transactions are automatically loaded into the accounting system, thus reducing the need for purchase requisitions, check requests, petty cash and purchase orders. Requirements and process for obtaining a P-Card • Eligibility: o Members of the Drexel community such as full-time, part-time and graduate students. o Non-members of the Drexel community can also obtain a P-Card with the proper approvals from the requesting department. • Submit completed and approved Procurement Card Application form (http://drexel.edu/procurement/makingPurchases/pcard/apply/). • Form must be approved by the appropriate Approvers listed on the P-Card application form and submitted to the P-Card Administrator at pcard@drexel.edu. • Once the application is approved and processed the P-Card office will send a confirmation with a registration link to schedule training within 2-3 business days. • P-Card training is mandatory; use of the P-Card is not permitted until the training and competency quiz are completed. Refresher trainings will be expected of the P-Cardholders. The P-Card office will reach out to the P-Cardholders about these trainings. P-Card Spend Limits The P-Cards are set up with monthly and single purchase limits. Maximum standard P-Cardholder Limits: • $4,999 Single Transaction Limit • $10,000 Monthly Transaction Limit • 12 Transactions per day Limit Adjustments • Adjustments may be made to limits: Any limits requested that are below the maximum limits may be submitted directly to P-Card office. • Limits pertaining to temporary or permanent increases that exceeds the small dollar authority requires approval from Strategic Sourcing prior to any limits being increased. Procurement Services cannot increase any limits without prior authorization from Strategic Sourcing. o Temporary Adjustments for Emergencies Only: A request must be sent to pcard@drexel.edu indicating amount of increase and cost center; the Approver must be notified before the request is submitted and copied on the communications; and copies of quote/invoices/agreement must be included in the communication. o Permanent Adjustments: Submit a P-Card Change Form (http://drexel.edu/procurement/makingPurchases/pcard/apply/) to pcard@drexel.edu. Budget Owner Reconciliation Statements On the 19th – 21st of each month, P-Cardholders will receive an e-mail from the P-Card Office with the current cycle due date. Statement must be submitted online 15 business days after the notification. Please refer to the Consequences Section for more details on reconciliation. Reimbursements If they make a purchase on a personal credit card that could have been made with the P-Card (e.g. travel related purchases), P-Cardholders are entitled to reimbursement. There may be a delay for reimbursements of up to 90 days after the expense report is processed in Procurement Services. Audits Tier One Audit The Compliance Analyst will conduct a Tier One audit on the following items for compliance: • At the end of each monthly cycle, the Compliance Analyst will check for on-time reconciliation. Please see the Consequences Section. • Each transaction listed on the reconciliation should have business notes. • For each monthly cycle, appropriate signatures from both the Cardholder and Approver. Tier Two Audit To ensure compliance with the P-Card Policy and Guidelines, the P-Card Office will conduct monthly random in-house audits of between 50-100 Cardholder Statements. • Each transaction must have clear and complete business notes. • Check to see if all of the purchases were made within the P-Card Guidelines. Audit Findings Report will be sent to the P-Cardholder, Approver and Budget Owner if there are any findings. A spreadsheet will be created to monitor and track the audits. Tier Three Audit To ensure compliance with the P-Card Policy and Guidelines, the P-Card Office will conduct monthly random on-site audits of 12 Cardholders’ Statements. An email is sent to the Cardholder informing them that they have been selected for a random audit. The email indicates the statement cycle(s), date and time of audit. Audits include documenting the departmental internal controls related to the Cardholder approval process, authorized P-Card purchases of goods, services and travel, use of preferred vendors, sales tax payments, and proper storage of statements and receipts. A monthly report is generated and an email is sent to the P-Card Director, Manager and the University Internal Audit Department. The Audit Report includes Cardholder name, department, Approver, the month of the audit, audit findings and recommendations. The department is required to provide a response to any audit findings including corrective action that will be taken to assure future compliance. A follow-up audit will be conducted as needed to ensure corrective actions have been performed. Please refer to the Consequences Section. Fraudulent Charges If a fraudulent charge is discovered, please contact the P-Card Office immediately. To report a fraudulent charge, please immediately contact JP Morgan Security Center, 1.800.935.9935, the P-Card Approver and the P-Card Office at pcard@drexel.edu. Intentional fraudulent charges discovered will result in an immediate cancellation of the P-Card. Fraudulent charges made by a P-Cardholder are covered by Visa’s Liability Waiver if and only if the individual committing the fraud is terminated from employment. The waiver covers up to $100,000.00 per instance. For more information, please contact P-Card Office. Record Retention All documentation for Transactions (e.g. detailed receipts, paid invoices, missing receipts form, etc.) paid through any non-grant related funds must be retained with the Cardholder’s statement at the department level in accordance to the Record Retention Policy (drexel.edu/generalcounsel/policies/OGC-4/), which is seven years. Documentation for transactions paid through a grant must be maintained permanently. Consequences The P-Card Program supports an accountability process for non-compliance as follows: Non-Compliant Purchases If a purchase of an item that is non-compliant with the P-Card Policy is made, the following will occur (please see the Prohibited Purchases section of the P-Card Policy for the list): • First Incidence – Upon the first time a non-compliant item is purchased with the P-Card, there will be an immediate suspension. After the P-Cardholder is in compliance, there will be an additional suspension for 30 days. The Approver and Budget Owner will be notified. • Second Incidence – If there is a second violation within 12 months of the first violation the individual’s card will be suspended for a period lasting at least 60 days following any requirements to rectify the violation. In addition to the suspension the Cardholder’s department will be charged a $25.00 reactivation fee if the card is reinstated. The Budget Owner will be notified and a corrective action plan will need to be submitted indicating corrective steps will be • taken to assure future compliance. The offending Cardholder must also take P-Card Training to reinstate the P-Card. Third Incidence – A third violation that occurs within 12 months of the second violation will result in the immediate and permanent cancellation of the P-Card. The Budget Owner will be notified. If the P-Cardholder wishes to dispute this action, they are entitled an appeal process. Please see the Appeal section for more information. Personal Use of the P-Card Unintentional uses of the P-Card for personal use are forgivable only if the P-Cardholder notifies the PCard Office, Approver and Budget Owner. Reimbursement of the charge must be made immediately by delivering payment by the P-Cardholder to the Cashier’s office. A receipt of payment must be attached to the Transaction Allocation Report for the cycle that transaction occurred. Appropriate and sufficient documentation must be provided on the statement to indicate the circumstances of the personal charge. (Unintentional use is defined as a transaction where it would reasonable to understand how the mistake could be made. It would also be something that would rarely occur and have no pattern to it.) • • • First Incidence – Any intentional use of the P-Card for non-business related purchases. PCardholders are expected to deliver their reimbursement to the Cashier’s office and attach a receipt of payment to the Transaction Allocation Report for the cycle that transaction occurred. If this violation is not self-reported by the Cardholder and corrective action immediately taken it will result in the card being suspended for a minimum of 30 days following the steps required to bring the card into compliance. If this first violation is self-reported and corrective action taken there will be no suspension for the first offense. Second Incidence – If personal charges are made within 12 months of the first offense the Cardholders P-Card will be immediately suspended and will remain suspended for a minimum of 60 days following actions that will result in the Cardholder being in full compliance. PCardholders are expected to deliver their reimbursement to the Cashier’s office and attach a receipt of payment to the Transaction Allocation Report for the cycle that transaction occurred. In addition the department will be charged a $25.00 reactivation fee to reinstate the card. Third Incidence – If another violation occurs within 12 months of the second violation the PCard will be permanently closed and the Approver, Approver and Budget Owner will be notified. P-Cardholders are expected to deliver their reimbursement to the Cashier’s office and attach a receipt of payment to the Transaction Allocation Report for the cycle that transaction occurred. If the P-Cardholder wishes to dispute this action, they are entitled to an appeal process. Please see the Appeal section for more information. Statements • First Incidence – Statements that are five days late, incomplete without detailed transaction notes or missing signature will receive immediate suspension of the P-Card until statement is completely compliant. The Approver and Budget Owner will be notified. • Second Incidence – If a P-Cardholder submits late statements consecutively for two months or without detailed notes or signatures, their P-Card will be suspended. After the P-Cardholder is in compliance, there will be an additional suspension for 60 days and the department will be charged a $25.00 reactivation fee. The Budget Owner will be notified, an action plan from the PCardholder and Approver is required and both the P-Cardholder and Approver must take P-Card Training to reinstate the P-Card. • Third Incidence – If a P-Cardholder submits statements that are late or without detailed notes, or missing signatures a third time within 12 months, the P-Card will be cancelled and the Budget Owner will be notified. If the P-Cardholder wishes to dispute this action, they are entitled to one appeal process. Please see the Appeal section for more information. Stringing/Splitting The splitting of purchases with the University P-Card is prohibited. Splitting a transaction is the practice of placing multiple orders to circumvent the transaction limit. There are two ways to split transactions: 1. Acceptable Split Transaction: During reconciliation, utilizing the Add Lines function in PaymentNet to allocate a posted charge to multiple cost centers. 2. Against Policy: Permitting the vendor to break up the payments for a single invoice across multiple transactions or multiple P-Cards. • First Incidence – Immediate Suspension. After the P-Cardholder is in compliance, there will be an additional suspension for 30 days. Approver and Budget Owner will be notified. • Second Incidence – A second occurrence will result in another suspension of the PCard. After the P-Cardholder is in compliance, there will be an additional suspension for 60 days and the department will be charged a $25.00 reactivation fee. The Dean/Vice President will be notified, an action plan from the P-Cardholder and Approver is required and both the P-Cardholder and Approver must take P-Card Training to reinstate the P-Card. • Third Incidence – Third occurrence the P-Card will be cancelled. The Dean/Vice President will be notified. If the P-Cardholder wishes to dispute this action, they are entitled to an appeal process. Please see the Appeal section for more information. Repeated Offending P-Cardholders in a Department The Approver of a department is responsible for the compliance of their P-Cardholders. If there becomes a pattern of violations occurring under one Approver’s line, then the Approver will be required to submit a plan for bringing their Cardholders into compliance. Continued failure of an Approver to assure compliance of Cardholders may result in a requirement to identify another Approver or have all cards in that line cancelled. Missing Transaction Allocation Reports for Transfers or Terminated P-Cardholders It is the Approver’s responsibility to submit the P-Cardholder’s final Transaction Allocation Report within 10 business days of their transfer or termination. For every month after the allotted time to submit the P-Cardholder’s final Transaction Allocation Report, the department will be charged $25.00. Appeal Process An appeal for a cancellation of a card is permitted. The appeal will be made in writing to the Vice President for Finance, CFO and Associate Treasurer. If it is determined that a card will be reinstated, the Cardholder will be required to be in compliance moving forward. Any additional violations will result in permanent cancellation of all P-Card rights and appropriate personnel action will be taken.