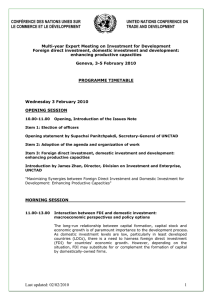

Investment and development

advertisement