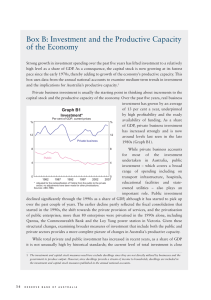

RESEARCH DISCUSSION PAPER Private Business

advertisement