Analysis of Enterprise Architecture Alignment:

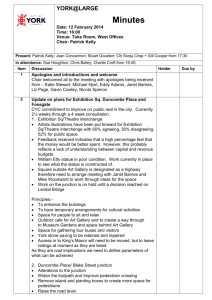

advertisement