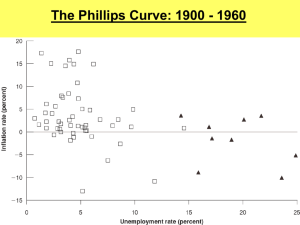

THE PHILLIPS CURVE IN AUSTRALIA

advertisement