Document 10836596

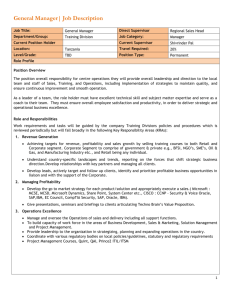

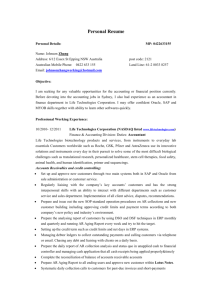

advertisement