Water Demand Management in Kuwait LIBRARIES BARKER

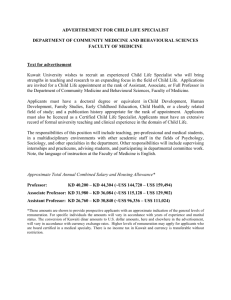

advertisement