Extreme Return-Volume Dependence in East-Asian Stock Markets: A Copula Approach Cathy Ning

Extreme Return-Volume Dependence in East-Asian

Stock Markets: A Copula Approach

Cathy Ning

a

and Tony S. Wirjanto

b a

Department of Economics, Ryerson University, 350 Victoria Street, Toronto, ON Canada, M5B 2K3.

b

Department of Economics, University of Waterloo, Waterloo, Ontario, N2L 3G1.

July 2008

Abstract

A copula approach is adopted to examine the extreme return-volume relationship in six emerging East-Asian equity markets. The empirical results indicate that the return-volume dependence is signi…cant and asymmetric at extremes for all six East-

Asian markets. In particular extremely high returns (large gains) tend to be associated with extremely large trading volumes, but extremely small returns (big losses) tend not to be related to either large or small volumes.

Keywords: Return-volume dependence; Extreme returns, Copulas; Tail dependence

Corresponding author. Tel.: 1-416-979-5000 ext. 6181; Fax: 1-416- 598-5916; E-mail address: qning@ryerson.ca.

1

JEL classi…cation: C14, C51, G12

1 Introduction

The return-volume relationship has long been recognized as an important research topic in

…nancial economics. Yet research to this date has tended to focus only on the return-volume relationship during "normal" market situations and for developed markets, such as the U.S.

stock market - see, for example, Gallant et. al. (1992) and Gervais et al. (2001). There is even fewer research, with a notable exception of Marsh and Wagner (2004), which focusses on their relationship under extreme market conditions (such as market stress or market crash). Moreover, to the best of our knowledge, there is no empirical work on the extreme return-volume relationship for the emerging East-Asian markets. However the 1997 Asian

…nancial crises can uniquely serve as an ideal setting in which to study the return-volume relationship at extremes. The scanty volume of the literature on the extreme return-volume relationship may be due to the lack of a proper model or methodology to address the issue.

This paper is trying to …ll this gap by applying the copula approach to study the extreme return-volume dependence in six East-Asian stock markets. We contribute to the literature by using copulas to capture the return-volume dependence structure, and providing further evidence on the return-volume relationship in the emerging Asian markets.

Gallant et al. (1992) and Baldazzi et al. (1996) suggest that the return-volume relationship at the tails may be di¤erent from that of the mean of the distribution. In addition prior studies have found a positive correlation between absolute stock price changes (that is,

2

absolute returns) and the transaction volume under "normal" market conditions. However

Baldazzi et al. (1996) …nd that extremely small returns have a very weak correlation with transaction volume during the market crash. In this paper, we investigate the return-volume correlation at both the upper (maximal) and lower tails (minimal) of their distribution for the emerging East-Asian markets. In particular, we use the copula approach that allows us to directly examine the return-volume relationship under both market extremes (market booms and crashes).

Our major …ndings can be summarized as follows. The extremely high returns tend to be accompanied by extremely high volumes, but extremely low returns tend not to be associated with trading volumes. The …rst …nding is consistent with the information ‡ow explanation of the return-volume relationship; that is, the transaction volume carries new information to the market. This implies that a larger trading volume provides more opportunities for prices to rise. The second …nding is consistent with the implication of the studies by Gennotte and

Leland (1990) and Donaldson and Uhlig (1991); that is, during a crash, the same trading volume may lead to very di¤erent price changes. This may explain why, in the emerging

East-Asian markets, the trading volume appears to carry information of market booming but not of market crash.

The paper is organized as follows. Section 2 describes the methodology used in the investigation. Section 3 presents the data and Section 4 discusses the empirical results.

Lastly section 4 concludes the paper.

3

2 The Methodology

Copulas are functions that join multivariate marginal distribution functions to their joint distribution function. The suitability of copulas in modeling extreme dependences is attributed to the Sklar’s theorem and the tail dependence de…ned by copulas.

Consider two variates, namely the return, X t

, and the volume, Y t

. Let u = F ( x t

) and v = G ( y t

) be the marginal distribution functions of the return and the volume respectively.

Let J ( x t

; y t

) be the joint distribution function. Then by Sklar’s (1959) theorem, there exists a copula C ( : ) , such that for all x t and y t in R,

J ( x t

; y t

) = C ( F ( x t

) ; G ( y t

)) : (1)

In other words, a copula is a joint distribution function of marginal distributions, which are uniform on the interval [0,1].

Next taking derivatives of both sides of equation (1), we obtain:

@ 2 J ( x t

; y t

)

@x t

@y t

=

@ 2 C ( F ( x t

) ; G ( y t

))

@F @G f ( x t

) g ( y t

)) : (2)

That is, a joint density is expressed as the product of the copula density and its univariate marginal densities. The former carries all information about the dependence structure between the variables X t and Y t

. Furthermore, equation (2) allows us to conveniently model the marginal distributions and the dependence structure between variables separately via copulas.

Copulas possess a number of very useful properties for the purpose of studying dependences. First, copulas can capture nonlinear dependences. Second, copulas allow for any

4

types of distribution of marginal variables (that includes a skewed and fat-tailed distribution, which is often found to characterize stock returns). Third, copulas are invariant to a strictly increasing transformation. For further properties of copulas, see Joe (1997) and

Nelson (1999).

Using copulas, we can measure the dependence at the extremes by the extent of the tail dependence. A tail dependence measures the probability that both variables are in their lower or upper joint tails. Intuitively, an upper (lower) tail dependence refers to the relative amount of mass in the upper (lower) quantile of their joint distribution. The lower (left) and upper (right) tail dependence coe¢ cients, l and r

, are de…ned as: l

= lim u !

0

P r [ G

Y

( y ) u j F

X

( x ) u ] = lim u !

0

C ( u; u )

; u r

= lim u !

1

P r [ G

Y

( y ) u j F

X

( x ) u ] = lim u !

1

1 2 u + C ( u; u )

;

1 u

(3)

(4) respectively, where l and r

2 [0 ; 1] . If l or r is positive, X and Y are said to be left

(lower) or right (upper) tail dependent. Because tail dependence measures are derived from the copula functions, they possess all of the desirable properties of the copulas mentioned above.

To capture the return-volume dependence, we need to use a copula that is ‡exible enough, so that it can capture the left tail, right tail, and no tail dependence. We started with a mixture of the Clayton (which captures the left tail dependence only), the survival Clayton

(which has the right tail dependence only), and the Frank copula (which describes the tail independence) as follows:

C = w

1

C

C

(

C

) + w

2

C

SC

(

SC

) + (1 w

1 w

2

) C

F

(

F

)

5

(5)

If estimates of w

1 and

C

, w

2 and

SC are found to be signi…cant, then there is evidence of both the left and right tail dependence in the distribution. In our empirical applications, the estimation results for all markets indicate a zero weight on the Clayton copula and a zero on the Clayton and Frank copula parameters. Thus, in the subsequent analysis, we focus on the copulas with only the upper tail dependence. These are the Gumbel copula and the survival Clayton copula. The tail dependence expressions for the mixture, survival Clayton and Gumbel copula are as follows:

Mixture copula:

Survival Clayton copula :

Gumbel copula:

M C l

= w

1

2

1

C

;

M C r

= w

2

2

1

SC

SC l

= 0;

SC r

= 2

1

SC

GC l

= 0;

GC r

= 2 2

1

G

(6)

(7)

(8)

Since our focus is on the return-volume dependence, we use a nonparametric method for the marginal distributions of the return and the trading volume. Then we use a twostep semi-parametric method for the estimation; that is, we …rst estimate the cumulative distribution function (CDF) for the marginals via the empirical CDF. We then plug the estimated CDF into the copula model and use the maximum likelihood for the estimation of the copula model.

3 The Data and Volume Adjustment

The data consist of daily closing indices, p t

, and turnover data (trading volume), v t

, for six

East-Asian markets: Taiwan, Singapore, Malaysia, Thailand, Indonesia, and Korea. These

6

markets experienced 1997 Asian …nancial crises. As such, they provide an ideal setting in which to examine dependence at the extremes. The data set is collected from Datastream.

The equity indices are chosen in our study based on the following two criteria: (i) they represent the majority of securities traded on the respective markets and (ii) the corresponding trading volume data are also available. The sample period starts from the date when data are …rst available in Datastream for each market and ends on December 31, 2007. Thus the starting date is di¤erent for each market as listed in Table 1. All holidays are deleted from the data. Daily returns are computed as 100 ( lnp t ln p t 1

) .

We follow Marsh and Wagner (2004) in adjusting the volume data. In particular, lnv t is

…rst de-trended using a Hodrick and Prescott (1997) …lter. Then an ARMA(1,1) process and weekday dummies are used to remove serial correlation and seasonal e¤ect from the data.

A graphical illustration of the data for the Korean stock index is given in Figure 1 (Figures for the other …ve stock markets are available on request from the author). From the …gures, both the return and adjusted volume appear to be stationary.

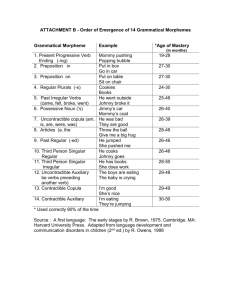

The summary statistics of the return and adjusted volume are presented in Table 1. In particular, both the return and the volume show positive excess kurtosis, providing evidence of fatter tails in the distributions of the returns. The copula approach has been shown to work well in handling the dependence of variables with such leptokurtic distributions.

7

4 The Empirical Results

We start with the mixture of the Clayton, survival Clayton and Frank copulas. The results are presented in Table 2. The two-step semi-parametric estimation converges at the lower bound (zero) of w

1

, the weight for the Clayton copula, and

F

, the Frank copula parameter

(except for the Korean index with an insigni…cant estimate of

F

) for all of the six returnvolume pairs. The insigni…cancies of the estimates of the Clayton copula parameters, the zero Clayton copula weight and the Frank copula parameters, together, indicate that there is neither a lower tail dependence nor a tail independence for the return-volume pair. This implies that an extremely low return tends not to be associated with an extremely small volume; and the return and volume tend not to be independent at the extremes. The signi…cance of the estimate of the survival Clayton copula parameter and its weight implies a right tail dependence. For this reason, we focus our subsequent analysis on the survival

Clayton and Gumbel copula that can capture the upper tail dependence. From Table 3, we observe a signi…cant estimate of the parameter of the upper tail dependence of the returnvolume pairs in all of the six markets. These results suggest that extremely high volumes tend to be accompanied by extremely high returns, providing evidence that a market booming is accompanied by a large amount of trading volume. This is consistent with the information based return-volume relationship in the sense that a high trading volume contains important information about the stock returns.

In summary, for the six East-Asian countries, an extremely high volume is found to be related to an extremely high return, but an extremely low volume is found not to be

8

related to an extremely low return. If an extremely high trading volume is associated with an extremely low return, then we should observe that the negative return has an upper tail dependence with the volume. To see whether this is the case, we apply the copula models to the negative of the return and the volume. Our results indicate no tail dependence and an extremely small likelihood for all of the markets considered in the study. In other words, market stress, such as a crisis, is not shown to be accompanied by a large trading volume.

The result of no correlation between the minimal return and the trading volume obtained in this paper is consistent with that of Baldazzi et al. (1996) reported for the U.S. market.

Overall, the volume is found to be positively dependent on the return only at the upper tail, not at the lower tail, of the distribution. This implies that volume helps to explain market booming but not market crash.

5 Conclusion

This paper uses a copula approach to examine the return-volume relationship at the extremes of the distribution for the six East-Asian stock indices. It is found that there exists asymmetric return-volume dependence at the extremes; that is, extremely high returns tend to be accompanied by extremely large volumes, but extremely low returns tend not to be associated with extremely low or high trading volumes.

9

References

[1] Balduzzi, P., Kallal, H.,Longin, F. 1996, Minimal Returns and the Breakdown of the

Price-Volume Relation, Economic Letters 50: 265-269.

[2] Donaldson, G.R. and Uhlig, H., 1991, Portfolio insurance and asset prices. Journal of

Finance 48: 1943–1955.

[3] Gallant, A, Ronald, Peter E. Rossi, and George E. Tauchen, 1992, Stock Prices and

Volume, Review of Financial Studies 5: 199-242.

[4] Gennotte, G., Leland, H. E. 1990, Market Liquidity, Hedging, and Crashes, American

Economic Review 80: 999-1021.

[5] Gervais, S., Kaniel, R., Mingelgrin, D. 2001, The High-Volume Return Premium, Journal of Finance 56: 877-919.

[6] Joe, H., 1997, Multivariate Models and Dependence Concepts, Monographs on Statistics and Applied Probability, 73. London: Chapman and Hall.

[7] Marsh,T. and N. Wagner, 2004, Return-Volume Dependence and Extremes in the International Equity Markets, Working Paper, University of California, Berkeley.

[8] Nelson, R. B., 1999, An Introduction to Copulas, Springer, New York.

[9] Sklar, A., 1959, Fonctions de répartition á n dimensions et leurs marges, Publications de l’Institut de Statistique de l’Université de Paris, 8: 229-231.

10

Table 1. Summary Statistics

Returns

Adj.

Volume

Starting date

Observations

Mean

Std dev

Skewness

Kurtosis

Mean

Std dev.

Skewness

Kurtosis

30/04/1991

4065

0.0144

1.7007

-0.0146

5.2502

0.0000

0.2889

-2.1258

64.7863

02/01/1983

6246

0.0242

1.2098

-2.0679

51.7458

-0.0000

0.3140

0.4238

4.9741

02/01/1986

5417

0.0414

1.4944

-0.1709

7.5873

-0.0000

.3072

.2840

.0899

02/04/1990

4303

0.0304

1.7102

.0410

1.0781

-0.0001

.5033

-0.4840

4.6563

02/01/1987

5155

0.0402

1.8580

.1316

.8688

-0.0000

.3902

.3971

5.4772

09/09/1987

4965

0.0327

1.9423

0.0758

6.7207

-0.0000

0.3497

-1.0972

27.4441

Markets

Taiwan

Singapore

Malaysia

Thailand

Indonesia

Korea

λ r

(Gumbel)

0.2788**

(0.0107)

0.2296**

(0.0092)

0.2548**

(0.0096)

0.2477**

(0.0098)

0.1577**

(0.0116)

.2460**

0.0103)

Table 2. Mixture Copula Results

Markets

Korea

Θ 1 Θ 2

Taiwan 0.0000 0.6684**

(93.9877 (0.2392 )

Θ 3 W1 W2 likelihood

0.0000 0.0000 0.875**

(4.6118) (0.0050) (0.1671)

Singapore 5.8227 0.6818** 0.0000 0.0000

(9.4227) (0.1895) (2.4185) (0.2573 )

Malaysia 1.4930 0.7908** 0.0000 0.0000

0.7099**

(0.1257)

0.7060**

(12.7653) (0.1495) (4.5232) (0.2622) (0.1809)

Thailand 3.0688 0.7065** 0.0000 0.0000 0.7725**

(26.3881) (0.2803) (3.6201) (0.5681) (0.2559)

(0.8849)

0.3940*

(0.2081)

0.0000

(1.0824)

0.0000

(2.2114)

0.7549*

(0.3236)

3.5119 0.2195** 5.1475 0.0000 0.6778**

(23.4768) (0.0575) (4.2713) (0.2386) (0.0914)

331.0

343.5 -677.0

371.4

362.9 -715.8

115.9 -221.8

277.4

-652.0

-732.8

-544.8

Table 3. Gumbel and Survival Clayton Copula Results

LnL

(Gumbel)

AIC

(Gumbel)

λ r

(survival Clayton)

LnL

(Survival Clayton)

AIC

(Survival Clayton)

326.9 -651.8 331.0 -660.03 0.2817**

(0.0165)

301.2 -600.4 0.1945**

(0.0145)

332.4 -662.8 0.2381**

(0.0152)

307.2 -612.4 0.2432**

(0.0154)

97.0 -192 0.2000**

(0.0000)

240.5 -479 0.1866**

(0.0165)

330.8 -659.6

355.8 -709.6

350.2 -698.4

90.8 -179.6

237.2 -472.4

Note: numbers in parentheses are the standard errors. ** indicates significance at 1% level. * indicates significant at 5% level.

11

Figure 1. Log Volume, Adjusted Volume and Log Return for the Korea Index a. Log Volume b. Adjusted Volume c. Log Returns

12