Quantifying the Trade Effects of

advertisement

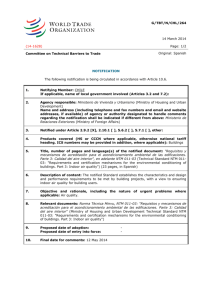

Quantifying the Trade Effects of Technical Barriers to Trade: Evidence from China Xiaohua Bao School of International Business Administration Shanghai University of Finance and Economics Email: xiaohuabao77@163.com Larry D. Qiu School of Economics and Finance University of Hong Kong Email: larryqiu@hku.hk May 7, 2009 Very Preliminary, Comments Welcome Abstract Technical barriers to trade(TBT)are now widespread and have increasing impacts on international trade. Different from any other trade measures, TBT have both trade promotion and trade restriction effects. Due to their theoretical complexity and data scarcity, TBT have been considered as “one of the most difficult NTBs imaginable to quantify”. In this paper, we construct a TBT database from 1998 to 2006 to examine how TBT imposed by China influence the country’s bilateral trade. The empirical study is based on the gravity model. First, we calculate a series of frequency ratio at 4-digit-level of the Harmonized System and aggregate them into import coverage ratio at HS2. We show that TBT in China mainly appear in agriculture, agri-products and processing food sectors. Second, we find that those TBT-rocked industries have negative trade impacts while the results for the other industries are ambiguous. Third, we show that TBT are complementary to tariff now in China, whereas they are expected to become a substitute to tariff in the later period. Fourth, by comparing to other studies, we find that the TBT effects on trade are different between developed and developing countries. Finally, we draw policy implications based on the empirical findings. This paper makes important contributions to the literature on trade policy and has a number of features. First, in contrast to the existing empirical studies which exclusively focus on developed countries TBT, this paper focuses on a developing country, China. Second, this paper uses disaggregated data so that it can identify the sectors/products with predominant negative impacts on trade. Third, tariff data and quotas are included as additional explanatory variables which allow us to compare the impacts of traditional barriers and those of TBT. Key Words: technical barriers to trade (TBT), frequency ratio, import coverage ratio, China’s import Trade 1 1. Introduction Technical barriers to trade(TBT)are now widespread and have increasing impacts on international trade. The spread of TBT may have some special reasons. First, it’s legitimate. The WTO members are authorized by WTO TBT/SPS Agreement to take such measures in order to protect human health, as well as animal and plant health, provided that the enforced measures are not disguised protectionism. Second, as Baldwin (1970) emphasized, “The lowering of tariffs has, in effect, been like draining a swamp. The lower water level has revealed all the snags and stumps of non-tariff barriers that still have to be cleared away”. Wallner (1998) considered this phenomenon as a “law of constant protection”, referring to perfect substitutability between tariff and none-tariff barriers in maintaining a degree of desired domestic protection. Third, with the trade liberalization process, the remaining barriers, like TBT have a more important but not a less important impact due to the “globalization magnification effect”, seemingly minor differences in technical norms can have an outsized effect on production and trade (Baldwin 2000). Fourth, the increasing income of importing country and consumer preference may result in a higher demand for product quality, safety and environment protection. Since the proliferation of TBT and its increasing trade-restrictive impacts, OECD (2001) drew attention to TBT and suggested more empirical research on it, because the quantitative analysis is an important step in the regulatory reform process and can help inform governments to define more efficient regulations. However, due to the theoretical complexity and data scarcity, TBT have been considered as “one of the most difficult NTBs imaginable to quantify” (Deardorff and Stern 1997)So far, there is not a preferred quantification strategy and claims abound on both sides about “whether such restrictions tend to reduce trade by virtue of raising compliance costs or expand trade by increasing consumer confidence in the safety and quality of imported goods” (Maskus and Wilson 2001). Maskus and Wilson (2001), Maskus, Otsuki, and Wilson (2001), Beghin and Bureau (2001), Ferrantino (2006) and Korinek, Melatos and Rau (2008) etc provide comprehensive overviews of key economic issues relating to TBT modeling and measurement. Based on these literatures, quantification techniques can be broadly grouped into two categories. Ex-post approaches such as gravity-based econometric models tend to estimate the observed trade impact of standards. On the other hand, ex ante methods such as simulations involving the calculation of tariff equivalents are usually employed to predict the unobserved welfare impact. No approach is or can be definitive. Each methodology offers its own pluses and minuses, depending on a number of factors, including the nature of the technical measure, the availability of data, and the goal of measurement. (Popper et al 2004) Concerning the trade effect1, different from any other trade measures, TBT have both trade promotion and trade restriction effects. Although a unified methodology does not exist, the gravity model is most often used for the evaluation. The gravity 1 Since our paper is focused on the trade effect by incorporating TBT frequency and coverage ratio, here we only briefly review those literatures with most close relationship with our paper, which use inventory approach to quantify TBT and estimate trade effects with a gravity model. 2 model employs a number of different approaches to measure the TBT. The policy indices obtained by survey can be used as proxy for the severity of TBT, and direct measures based on inventory approach are incorporated too. Beghin and Bureau (2001)summarized three sources of information that can be used to assess the importance of domestic regulations as trade barriers: (i) data on regulations, such as the number of regulations, which can be used to construct various statistical indicators, or proxy variables, such as the number of pages of national regulations; (ii) data on frequency of detentions, including the number of restrictions; frequency ratios and the import coverage ratio (iii) data on complaints from the industry against discriminatory regulatory practices and notifications to international bodies about such practices. Besides the above mentioned approach, some studies try to use explicit standards requirements such as maximum residue levels too. There are a considerable number of study combined the variable for the stringency of TBT with gravity model to estimate the direction of the trade impact. Swann, Temple, and Shurmer (1996) used counts of voluntary national and international standards recognized by the UK and Germany as indicators of standard over the period 1985–1991, their findings suggest that share standards positively impact exports, but had a little impact on imports; unilateral standards positively influence imports but negatively influence exports. Moenius (2004, 2006) examines the trade effect of country specific standards and bilaterally shared standards over the period 1985-1995. Both papers used the counts of binding standards in a given industry as a measure of stringency of standards. Moenius (2004) focus on 12 OECD countries and found that at aggregate level, bilaterally shared standards and country-specific standards implemented by the importing or exporting country are both trade-promoting on average. At the industry level, the only variation is that importer-specific standards have the expected negative trade effect in nonmanufacturing sectors such as agriculture. In manufacturing industries, importer-specific standards are trade promoting too. Moenius (2006) confirm the result of Moenius (2004) in that bilateral standard in EU has very strong trade promoting effect as to the trade between EU and non-EU members, but harmonization decrease the internal trade of EU. Moenius (2006) distinguish 8 EU members and 6 non-EU developed countries. So he also found that importer specific standard in EU promote trade between EU members, but depress trade between EU members and non-EU members; Exporter specific standard inside EU has little trade promoting effect ,but export specific standard of non-EU members expand their trade with EU. The paper using frequency or coverage ratio within a gravity model framework include Fontagné, Mimouni and Pasteels (2005) and Disdier, Fontagné, and Mimouni (2007). Both of them use the frequency ratio based on notification directly extracted from the TRAINS database. Fontagné, Mimouni and Pasteels (2005) collect data on 61 product groups, including agri-food products in 2001. Their paper generalized the findings of Moenius (2004): NTMs, including standards, have a negative impact on agri-food trade but an insignificant or even positive impact on the majority of manufactured products. Moreover, they distinguish trade effects among “suspicious products”, “sensitive products” as well as “remaining products” according to the 3 number of notifications and distinguish different country group. Based on data covering 61 exporting countries and 114 importing countries, they find that over the entire product range, LDCs, DCs and OECD countries seem to be equally affected. However, OECD agrifood exporters tend to benefit from NTMs, at the expense of exporters from DCs and LDCs. The authors account for tariff and other NTM in the model , so they also find that tariffs matter more than NTMs, particularly for agri-food products on which comparatively high tariffs are levied. Disdier, Fontagné, and Mimouni (2008) estimate the trade effect of standards and other NTMs on 690 agri-food products (HS 6-digit level). Their data covers bilateral trade between importing OECD countries and 114 exporting countries (OECD and others) in 2004. As well as a frequency index, they use a dummy variable that records whether the importing country has notified at least one NTM and ad-valorem tariff equivalent measures of NTMs as two alternative approaches to measure NTMs. They find that these measures have on the whole a negative impact on OECD imports and affect trade more than other trade policy measures such as tariffs. The tariff equivalent shows the smallest effect. When they consider different groups of exporting countries, they show that OECD exporters are not significantly affected by SPS and TBTs in their exports to other OECD countries while developing and least developed countries’ exports are negatively and significantly affected. For the subsample of EU imports, NTMs no longer influence OECD exports positively, but exports from LDCs and DCs seem to be more negatively influenced by tariffs and SPS & TBTs than that of OECD. Finally, their sectoral analysis suggests an equal distribution of negative and positive impacts of NTBs on agricultural trade. Many studies are supportive of using maximum residue levels to directly measure the severity of food safety standards within a gravity model. These studies include Otsuki, Wilson and Sewadeh (2001a, b), Wilson and Otsuki (2004b,c) Wilson, Otsuki and Majumdsar (2003), Lacovone (2003) and Metha and Nambiar(2005). These studies tend to focus on specific cases of standards for particular products and countries. Otsuki, Wilson and Sewadeh (2001a,b) and Wilson and Otsuki (2004b) examine the trade effect of aflatoxin standards in groundnuts and other agricultural products (vegetables,fruits and cereals). The first two papers covered African export data to EU members and the third paper covered 31 exporting countries (21 developing countries) and 15 importing countries(4 developing countries). All three studies show that imports are greater when the importing country imposes less stringent aflatoxin standards on foreign products. Lacovone (2003) also used MRL of aflatoxin and found that there were substantial export losses to Latin-America from the tightening of the aflatoxin standards set by Europe. Similarly, Wilson, Otsuki and Majumdsar (2003) analyze the effect of standards for tetracycline residues on beef trade and find that regardless of the exporter standards, the standards of tetracycline imposed by the importing countries have the same negative trade impact. Wilson and Otsuki (2004c) analyze MRL relating to chlorpyrifos and Metha and Nambiar(2005) analyze the impact of MRL on India’s export of four processing agri-products to 7 developed countries and yield the similar result. Since our paper focus on the trade effect of technical barrier, we will use the 4 most suitable ex post quantification methods. Moreover, while frequency and coverage ratio can give some guidance as to the potential trade impact of a technical measure, econometric model is used to estimate its magnitude. Our paper make contributions to the current literature in the following ways: First, in contrast to the existing empirical studies which exclusively focus on developed countries TBT, this paper focuses on a developing country, China. Second, this paper has a self-constructed trade measure database based on disaggregated data covered all HS2 products, including agricultural and processing food products (HS01-24) and manufacturing products (HS25-97) so that it can identify the sectors/products with predominant negative impacts on trade. Third, tariff data, import licenses and quotas are included as additional explanatory variables, allowing the distinction between the impact of traditional trade barriers and TBT on trade. Fourth,, our data covers 43 exporting countries (including 25 developing countries), it helps to distinguish the trade effect of different country groups. Fifth, in contrast to most literature relied on cross-section data1, our paper covers 9 years time series data on TBT, so we can both capture variation across products and variation within products over time, in particular the changing effects before and after China’s entry into the WTO. The rest of the paper is organized as follows. In section 2, we construct a TBT database from 1998 to 2006 and use inventory approach (frequency index and coverage ratio) to quantify the stringency of technical measures in China. In section 3, we present our regression model, discuss all the variables and describe the data. In section 4, we discuss our findings. We make some concluding remarks in section 5. 2. Quantification of TBT 2.1 Measurement of NTM: Inventory approach The inventory approach allows estimates of the extent of trade covered by NTMs or their frequency of application in specific sectors or against individual countries or groups of countries. Bora etc (2002) reviews various approaches to quantify NTMs and give a detailed instruction on how to construct frequency index and coverage ratio as follows. The percentage of trade subject to NTMs for an exporting country j at a desired level of product aggregation is given by the trade coverage ratio: ⎡ ∑ (Dit ⋅ ViT ) ⎤ C jt = ⎢ ⎥ ⋅ 100 ⎣⎢ ∑ ViT ⎦⎥ (1) where, if an NTM is applied to the tariff line item i, the dummy variable Di takes the value of one and zero if there is no NTM; Vi is the value of imports in item i; t is the year of measurement of the NTM; and T is the year of the import weights. A problem for interpretation of this measure arises from the endogeneity of the import value 1 Moenius (2004, 2006) tries to determine the impact of standard using a ten-year panel which includes frequency data on standards. Metha and Nambiar (2005) account for changing maximum residue levels over only four years. Cao and Johnson (2006) examine the effect of HACCP (denoted by a dummy variable) implemented in New Zealand for 9 years. 5 weights. At the extreme, if an NTM is so restrictive that it precludes all imports of item i from country j, the weight V will be zero and, in consequence, the trade coverage ratio will be downward biased. Similarly, the coverage ratios will not indicate the extent to which NTMs have reduced the value of the affected import items, and so they will reduce the weight of restricted items in the total value of a country’s imports. It would be a refinement to use import weights from the world as a whole, as a proxy for free trade weights. Another procedure, which avoids the problem of endogeneity of the weights, is the frequency index. This approach accounts only for the presence or absence of an NTM, without indicating the value of imports covered. Thus, it is not affected by the restraining effect of NTMs (as long as they do not completely preclude imports from an exporting country). The frequency index shows the percentage of import transactions covered by a selected group of NTMs for an exporting country. It is calculated as: ⎡ ∑ (Dit ⋅ M iT )⎤ C jt = ⎢ ⎥ ⋅ 100 ⎣⎢ ∑ M iT ⎦⎥ (2) where Di once again reflects the presence of an NTM on the tariff line item, Mi indicates whether there are imports from the exporting country j of good i (also a dummy variable) and t is the year of measurement of the NTM. Unlike the coverage index, however, the frequency index does not reflect the relative value of the affected products and thus cannot give any indication of the importance of the NTMs to an exporter overall, or, relatively, among export items. To make it simple, frequency index measures the number of product categories subject to an NTB as a percentage of the total number of product category in the classification and the import coverage ratio is constructed as the value of imports of each commodity subject to an NTB, as a percentage of imports in the corresponding product category. In the former case, the occurrence of TBT is not weighted by the import, but in the latter case, the frequency is weighted by the import value. 2.2 China’s NTM database: data description and methodology Followed the method described above, we will construct a Chinese NTMs database from 1998 to 2006 by using inventory approach. The data covered 96 HS2 digit level agricultural and manufacturing industries. First, we calculate a series of frequency index at 4-digit-level of the Harmonized System and then aggregate them into import coverage ratio at HS2. In this database, data are collected by tariff item on the application of a range of tariff and NTMs (TBT, license and import quota) against Chinese imports. The main source of the information on the trade control measures in the database is from Chinese government publications. “Administrative Measures Regarding Import & Export Trade of the People's Republic of China” published by the Ministry of Commerce and Custom General Administration of China provide detailed information at HS 8-digit-level on tariff and non-tariff measures. The code list of supporting documents subject to customs control provide detailed name of licenses or instruments of ratification, which helps to identify 6 whether a tariff line product subject to a specific non-tariff barrier. Concerning the technical measures, it includes those government administrative measures for environmental protection, safety, national security and consumer interests. The code subject to TBT control remains almost the same during the 1998-2001. Specificly, the code subject to TBT in 1998 is IRFM, denoting for Import commodity inspection (I), Quarantine control release for animal, plant and thereof product (R), Import food inspection certificate (F) and Medicine inspection certificate (M). The code concerning TBT in 1999-2001 is AMPR, denoting for Import inspection and quarantine (A), Import commodity inspection (M), Import animal, plant and thereof product inspection (P) and Import food hygiene supervision inspection (R). Since 2002, the government revised the code list into details. Although there is some tiny difference between years, the new code list remains quite stable during 2002-2006 (See the code list in Annex1). The code subject to TBT is ACFIPQSWX during 2002-2005 and AFIPQSWX in 2006, each code stands for Certificate of inspection for goods inward (A), Certificate of inspection for goods inward: Civil commodity import inspection (C), Import licencing certificate for endangered species (F), Import or export permit for psychotropic drugs (I), Import permit for waste and scraps (P), Report of inspection of soundness on import medicines (Q), Import or export registration certificate for pesticides (S), Import or export permit for narcolic drugs (W), Environment control release notice for poisonous chemicals (X). Note that our data on trade control measures do not have a bilateral dimension. TBT measures, import license and import quotas are enforced unilaterally by Chinese government and applicable to all exporting countries. When we calculate coverage ratio and frequency ratio, Vi is the total value of imports in product i from the whole world and Mi indicates whether there are imports from the whole world of good i. Hence, in a specific year, NTM variables vary among different sectors but remain the same among different countries. Although we miss the bilateral dimension associated with such measures, still the exporters are differently affected by TBT measures depending on the structure of their exports in terms of products and markets. To be precise, the frequency ratio of TBT (FR-TBT) measures the proportion of product items covered by TBT measures within a product category, which varies between 0% (no coverage) and 100% (all products covered). We first count the number of HS items (defined at the 8 digit level of the HS) covered by the TBT measures and divide it by the maximum number of product items belonging to the product category (defined here at the 4-digit level of the HS). So we get the results of frequency ratio of TBT at HS4 digit level. For example, regarding HS2402 (Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes), there are 3 product items with codes 24021000 (Cigars, cheroots and cigarillos, containing tobacco), 24022000 (Cigarettes containing tobacco), 24029000(other). Only one of them (HS24022000) is covered by TBT measures, so the corresponding TBT frequency index equals 33.33% (1 / 3). Then we do the same at HS2 digit level. The import coverage ratio(IC-TBT) measures the proportion of affected import of the total import within a product category. Take HS17 (Sugars and sugar confectionery) as an example, there are 4 product items with code HS1701, 1702, 7 1703 and 1704 respectively. Only three of them (except HS1703) are covered by TBT measures (it means the frequency index for HS1703 equals 0, while the other three are between 0 and 100%), the import value of the TBT affected products sum up to 111.216 million US$, the import valued of HS17 is 182.244 million US$, so the corresponding TBT import coverage ratio equals 66.46% (111.216/182.244). 2.3 TBT rocked sectors in China By calculating frequency index and import coverage ratio of TBT, we can examine which products are the most affected. According to the definition by UNCTAD (1997), those with a frequency ratio and coverage ratio both above 50% are TBT rocked product. In our sample, 34 products(HS01-24; HS30,31,33; HS 41;HS 44-47; HS51 and HS72)are TBT-rocked during the period from 1998-2002. In 2003, two product items (HS 42-43) become TBT-rocked. In 2004, two more products (HS 50 and HS80) added into the category. During 2005-2006, HS78 are included as TBT-rocked products but HS50 is excluded. See Annex2 for the detailed product information of TBT rocked products. There are a significant number of products, particularly agricultural products and processing food widely affected by technical measures (HS01-24). However, enforcement of TBT is not limited to those products, but is spreading to manufacturing products also. The TBT rocked manufacturing products include Pharmaceutical products(HS30, Essential oils, perfumes, cosmetics, toileteries (HS33), Raw hides and skins, leather, furskins and articles thereof (HS41-43), Wood and articles of wood(HS44-46), Base metals and articles thereof, like iron and steel, aluminium and tin.( HS72, 76 and 80) etc. They are either labor intensive products or final goods concerning consumer safety, like medicaments in particular. Although TBT rocked sectors cover about 1/3 of total number of products at HS2 digit level, the proportion of affected trade is limited: about 10-16% of total import. However technical barriers are the most frequent type of NTM, the import subject to TBT account for above 90% of Chinese total import except for the rare case in 2001 (77.29%). (see Table 1). 3. Model, methodology and data 3.1 Model specification We use gravity model to examine how TBT imposed by China influence the country’s bilateral trade. To capture the size effect, population of both countries is used as proxy for exporting country’s supply capacities and importing country’s demand capacity. Per capita income of the two countries is included because higher income countries trade more in general. Transport costs are measured using the bilateral distance between both partners. Bilateral trade can also be fostered by countries’ cultural proximity. We therefore control for this proximity by introducing a common language dummy variable. Based on the typical gravity model, we introduce our key variables—tariff and non-tariff trade barriers. Our basic regression model takes the following forms: 8 log X ijt = α 0 + α1 log GDPPCit + α 2 log GDPPC jt + α 3 log POPit + α 4 log POPjt + α 5 log DISTij + α 6Contig ij + α 7Comlang ij + α 8 Smctryij + α 9 Contig ij + α10 log Tariffit + α11TBTit + α12 Lit + α13Qit + ε (3) X: China’s import value of product k from country j in year t GDPPC: real GDP per capita of country j or country i (China) in year t POP: population of country j or country i in year t DIST: the geographical distance between the two countries Contig: dummy variables indicating whether the two countries are contiguous Comlang: dummy variables indicating whether the two countries share a common language Smctry: dummy variables indicating whether the two countries belong to the same country Tariff: China’s average preferential tariff applied to product k in year t TBT: frequency ratio or import coverage ratio of China’s TBT applied to product k in year t L: frequency ratio or import coverage ratio of China’s import license applied to product k in year t Q: frequency ratio or import coverage ratio of China’s import quota applied to product k in year t Alternative specifications include Developing and WTO. Developing is a dummy variable indicating whether country j is a developing country and WTO is a dummy variable which equals 1 since 2002. 3.2 Data source and description The data utilized in this model are collected for 9 years, 1998-2006, on single importing country-China mainland and 43 exporting markets include Burma (Myanmar), Hong Kong, India, Indonesia, Iran, Japan, Macau, Malaysia, Pakistan, Philippines, Kazakstan, Saudi Arabia, Singapore, Korea, Thailand, Turkey, Viet Nam, United Arab Emirates, Taiwan, South Africa, Belgium, Denmark, United Kingdom, Germany, France, Italy, Netherland, Spain, Austria, Finland, Romania, Sweden, Switzerland, Russian Federation, Ukraine, Argentina, Brazil, Chile, Canada, United States, Australia, New Zealand and EU. Data for bilateral trade, in particular, the value of China’s imports of all kinds of products originated from the above mentioned 43 countries in thousand US dollar under the HS2 digit level and HS4 digit level are collected from China Custom Statistic Year Book. Each country’s per capita GDP (GDPPC: in constant 2005 US dollars) are collected from USDA ERS International Macroeconomic Data Set. Each country’s population (POP) is collected from Census Bureau of the U.S. Department of Commerce available at http://www.census.gov/ipc/www/world.html and the population for Taiwan is obtained from China Statistic Year Book. Data for geographical distances are collected on the basis of the average distance between the capitals of the two countries and these distances as well as the data for Comlang and Contig are all extracted from the CEPII database. 9 Concerning the trade control measures, we use the self constructed database mentioned in Section 2. Tariff is the simple average of MFN tariff within the product category. The method to calculate the frequency index and import coverage ratio of licenses and import quotas are the same as that of TBT. All the original data are extracted from the “Administrative Measures Regarding Import & Export Trade of China”. 4. Empirical results 4.1 The whole sample results Table 2-1 shows the summary statistics of our key variables. Table 2-2 reports the Pearson coefficients of the trade control measure variables. For the frequency index, import license and tariff appear to be negatively correlated. For the coverage ratio, besides import license, TBT seems to be slightly negative correlated with the tariff. Except for the above rare cases, the import control policies are positively correlated to each other. In general, different kinds of import control measures in China seem to be complementary to each other. Among them, import license and import quota have the highest positive coefficient, this accords with the fact that these two measures are sometimes combined together. Normally a country will distribute quota by issuing import license. We use OLS to estimate the gravity model. Regressions are run on pooled data for 9 years (see Table 3 and 4) and on data for each year separately (see Table 5 and 6). Table 3 and 5 report the result using frequency index, while Table 4 and 6 report the result using coverage ratio, both at HS 2-digit-level. For the whole sample regression results in Table 3 and 4, column 1 shows the result of the basic gravity model, column 2 introduces tariff and non-tariff barriers, column 3 tries to identify the difference between developing and developed countries and column 4 adds WTO as an additional control variable. Year-country-product fixed effect is used for all the specifications. The results for standard gravity explanatory variables are consistent with prior expectations except for Contig as a rare case. The effect of GDPPC, POP and dist is positive and highly significant for all regressions. It implies that a 1 percent increase in the population of exporting country yields a 1.39-1.47 percent increase in the bilateral trade, and a 1 percent increase in the per capita GDP of exporting country yields a 0.91-1.40 percent increase in the bilateral trade. A 1 percent increase in geographic distance between the two trade partners will result a 1.42-1.45 percent decrease in bilateral trade. The effect of POPchina and GDPPCchina is positive and significant in two regressions. If Chinese population or per capita GDP increase 1 percent, Chinese import will increase 10.8-14.1 percent or 2.0-2.8 percent respectively. The coefficient for Comlang is positively significant in all specifications, which implies that if the exporting country share a same language with China, Chinese import will be stimulated by 2.6-3.3 percent. If the exporting market belongs to China, it will increase Chinese import by 0.3 percent. The coefficient for Contig is significantly negative, which implies that if the exporting country and China are contiguous, Chinese import will decrease 0.76-0.99 percent. This result is not 10 consistent to the prior expectation. But the intuition is easily understood because the most important importing markets such as the US, Japan, EU members are not contiguous with China mainland. We then discuss the key explanatory variable, Tariff have a significant negative effect on Chinese import. A 1 percent increase in the MFN tariff will decrease import value by 0.64-0.66 percent. The results of the frequency index of NTM are all significant. A 1 unit increase in FRTBT will decrease import value by 1.1%, a 1 unit increase in FRQ will decrease import value by 1.7%, a 1 unit increase in FRL will increase import value by 4.1%. The results of the coverage ration of NTM are different in some extent with that of frequency index. A 1 unit increase in ICTBT will increase import value by 0.2%, a 1 unit increase in ICL will increase the import value by 2.7%, and the coefficient for ICQ is negative but not statistically significant. Table 5 and 6 give us a clear picture about how the effect of trade control measures change yearly. Tariff remains negatively significant for all 9 years. Moreover, the elasticity for Tariff dramatically increased since 2003. The trade depressing effect of Tariff nearly doubled after China’s entry into the WTO. FRTBT is negatively significant in all year specifications, and the coefficient remains stable through the sample period. FRL is positively significant while FRQ is negatively significant except for three years. In 1998, 1999 and 2001, FRL is insignificant while FRQ is positively significant due to the multicollinearity1. The result of ICTBT is changeable during the sample period. The coefficient of ICTBT is positively significant during 1998-2002, negatively significant in 2003 and insignificant during the remaining years. ICL remains positively significant during all 9 years, plus the elasticity for ICL slightly increased since 2002. ICQ is significant during 1998-2002, but the sign of the coefficient is changeable, and ICQ becomes insignificant since 2003. So ICQ doesn’t affect bilateral trade value in a systematic way. From the yearly result, we observe that some of the trade control measure change trade patterns in a different way. Does the trade effect change significantly before and after China entry into the WTO? Whether there is any systematic difference in the trade effect between developing and developed countries? To solve these two problems, we add two interactions. Column 5 introduces the interaction between Developing and each of frequency indices of trade measures. Column 6 adds the interaction between WTO and each of coverage ratios of trade measure. As we can see, tariff (Tariff) and import quota (FRQ and ICQ) seem to have no difference between difference country groups. The change of FRTBT will affect Chinese import from developing countries less than that from developed countries. The change of ICTBT will affect Chinese import from developing countries more than that from developed countries. The change in FRL or ICL will have less impact on Chinese import from developing countries than from developed countries. On average, tariff, license have an increasing effect but quota has a decreasing effect after China’s entry into the WTO. The effect of TBT does not change significantly. 1 The Pearson coefficient for FRL and FRQ is .089,0.89,0.73,0.86 in the first four years respectively and change to -0.05~-0.07 in the remaining years. 11 4.2 The sub-sample results Next the products are divided into two groups at the HS2 digit level: agri-food products (HS01-24) and manufacturing products (HS 25-97). Note that the products in the first product group are all TBT rocked products. The estimating results for the two sub-samples are provided in Table 7 and 8 respectively. The estimation for the typical control variables in the basic gravity model do not change except that Smctry has a significant negative effect in Table 7. It proves that Hongkong and Macau are not the main sources of Chinese imports of agri-food products. We first examine the trade effect in agri-food products in Table 7. If we use frequency index to measure NTM, in model (1), Tariff and frtbt are both significantly negative as we expected. Frl is significantly positive and Frq is not significant. In model (2), Frq becomes significantly positive, while tariff and frtbt become insignificant. It indicates that the depressing trade effect of TBT is strengthened over time. If we use coverage ratio to measure NTM, in model (1), Tariff and ictbt are both insignificant. Icl and Icq are both significantly positive. In model (2), Icl and Icq remained the same to that in model (1) and Ictbt becomes significantly positive. It indicates that the promoting trade effect of TBT becomes weaker over time. Whatever alternative measurement of NTM we use, we still have some similar conclusions: The two country groups do not have significant distinction in their export to China; China’s import trade is expanding after its entry into the WTO. The effect of tariff on developing countries is larger and there is no significant different trade impact on the two country groups concerning the three type of NTM. The effect of quota becomes smaller. And the effect of tariff and license do not change systematically after China’s entering the WTO. Then we examine the trade effect in manufacturing products in Table 8. If we use frequency index to measure NTM, in model (1), Tariff is significantly negative as we expected. Frl is significantly positive, Frtbt is not significant and Frq is significantly negative. In model (2), The significance and sign of tariff and frtbt remained the same as that in model (1), Frq becomes significantly positive, while Frl become insignificant. If we use coverage ratio to measure NTM, in model (1), in contrast to the result by using frequency index, Tariff is significantly negative, ictbt is significantly positive. And Icq is significantly negative and ICL is significantly positive. In model (2), Tariff becomes insignificant and the sign and significance of the three NTM variables remain unchanged. Whatever alternative measurement of NTM we use, we still have some similar conclusions: China import more manufacturing goods from developed trade partners than from developing countries. There is an increase in the import of manufacturing goods since China’s accession into the WTO. The difference is that if we use frequency index, tariff has no significant difference concerning its effect on the two trade groups. The exports of manufacturing goods on average are not affected significantly but exports from developing countries are positively affected by TBT. Both country groups are positively affected by license and quota, but the developing countries are affected less by the license whereas the quota does not make any 12 difference. Tariff, TBT and license have an increasing effect but quota has a decreasing effect after China’s entry into the WTO. If we use coverage ratio, the manufacturing exports from developing countries are affected more by tariff and TBT. The exports from developing countries are affected less by license and import quota. Tariff and license both have an increasing effect but TBT has a decreasing effect on import, the effect of quota doesn’t change significantly after China’s entry into the WTO. 5. Conclusion The results of current literature suggest that TBT in importing country has restrictive trade effect and exports of poor countries are affected more. The paper explores whether technical measures imposed by China have restrictive effects for the imports from main exporters all over the world. Our research confirms some of the results reported elsewhere in the literature while differences remain in some aspects. First, in general trade control measures do have import restrictive effect in China. Second, tariff plays an important role even after China entry into the WTO. So far it’s still the most efficient policy tool. Third, TBT is the most frequently used NTM in China and cover almost all the imports. TBT do have some trade depressing effect but the effect is relatively small compared to the effect of tariff. Fourth, in contrast to the general belief that TBT works as a substitute to tariff and traditional NTM in developed countries(Thonsbury1998, Abbott 1997 etc), there is no obvious substitution effect between tariff and TBT in China, moreover, the TBT is complementary to tariff in some extent. Reference: Abbott, Frederick L.(1997) “The Intersection of Law and Trade in the WTO System: Economics and the Transition to a Hard Law System.” in David Orden and Donna Roberts, eds., Understanding Technical Barriers to Agricultural Trade. St. Paul, Minnesota. Baldwin, Richard (2000) “Regulatory Protectionism, Developing Nations and a Two-Tier World Trade System”. CEPR Discussion Paper No.2574. Beghin, John C. and Jean-Christophe Bureau.(2001) “Quantification of Sanitary, Phytosanitary, and Technical Barriers to Trade for Trade Policy Analysis.” Center for Agricultural and Rural Development, Working Paper 01-WP 291. Bora, Bijit Aki Kuwahara and Sam Laird (2002) “Quantification of Non-tariff Barriers”, United Nations Conference of Trade and Development, Policy Issues in International Trade and Commodities, Study Series No.18. Cao, K. and R. Johnson (2006), “Impacts of mandatory meat hygiene regulations on the New Zealand meat trade”, Australasian Agribusiness Review, Vol.14, paper 3. Cipollina, M. and L. Salvatici (2006) Measuring protection : mission impossible ? TradeAG, Working Paper # 06/07. Deardorff, Alan V. and Robert Stern.1998 “The Measurement of Non-Tariff Barriers”, OECD Economics Department Working Papers No. 179, 1998. 13 Disdier, Anne-Celia., Lionel Fontagne, Mondher Mimouni(2008)The Impact of Regulations on Agricultural Trade: Evidence from the SPS and TBT Agreements, Ferrantino, Michael.(2006) “Quantifying the Trade and Economic Effects of Non-Tariff Measures,” OECD Trade Policy Working Papers, No. 28, Paris: OECD. Jayasuriya, S., D. MacLaren, and R. Metha. 2006 “Meeting Food Safety Standards in Export Markets: Issues and Challenges facing Firms Exporting from DevelopingCountries”. Paper presented at the IATRC Summer Symposium, Food Regulation and Trade: Institutional Framework, Concepts of Analysis and Empirical Evidence, Bonn, Germany, 28-30 May 2006. Korinek, Jane, Mark Melatos and Marie-Luise Rau (2008) A Review of Methods for Quantifying the Trade Effects of Standards in The Agri-food Sector, OECD Trade Policy Working Paper No. 79. Lacovone, L.(2003)“Analysis and Impact of Sanitary and Phytosanitary Measures”, Available at http://www.cid.harvard.edu/cidtrade/Papers/iacovone.pdf. Maskus, K.E. and John S. Wilson. “Quantifying the Impact of Technical Barriers to Trade: A Review of Past Attempts and the New Policy Context.” Paper prepared for the World Bank Workshop on “Quantifying the Trade Effects of Standard and Technical Barriers: Is it Possible?” World Bank, 2000. Metha, R. and R.G. Nambiar (2005) International food safety standards and processed food exports: India, report within project International food safety standards and processed food exports from developing countries: a comparative study of India and Thailand, The Australian National University, unpublished. Moenius, J. (2004) Information versus product adaptation: The role of standards in trade, Kellogg School of Management Working Paper, Northwestern University. Moenius, J. (2006) “The Good, the Bad and the Ambiguous: Standards and Trade in Agricultural Products,” IATRC Summer Symposium, May 28-30, Bonn, Germany. OECD (2001) Measurement of sanitary, phytosanitary and technical barriers to trade. Otsuki, T., Wilson, J.S. and M. Sewadeh (2001a) “Saving two in a billion: Quantifying the trade effects of European food safety standards on African exports,” Food Policy, 26(5), pp. 495-514. Otsuki, T., Wilson, J.S. and M. Sewadeh (2001b) “What price precaution? European harmonisation of aflatoxin regulations and African groundnuts,” European Review of Agricultural Economics, 28(3), pp. 263-283. Thornsbury, Suzanne. “Technical Regulations As Barriers to Agriculture Trade”. Phd Dissertation of Virginia Polytechnic Institute and State University, 1998. UNCTAD (1997) Indicators of Tariff and Non-tariff Barriers on CD-ROM. Wallner, Klaus. Mutual Recognition and the Strategic Use of International Standard, SSE/EFI Working Paper No.254, Stockholm School of Economics, 1998. Wilson, J.S. and T. Otsuki (2004a) Standards and Technical Regulations and Firms in Developing Countries: New Evidence from a World Bank Technical Barrier to Trade Survey, World Bank, Washington DC. Wilson, J.S. and T. Otsuki (2004b) “Global trade and food safety: winner and losers in a non-harmonized world,” Journal of Economic Integration, 18(2), pp. 14 266-287. Wilson, J.S. and T. Otsuki (2004c) “To spray or not to spray: pesticides, banana exports and food safety,” Food Policy, 29, pp.131-145. Wilson, J.S., Otsuki, T. and B. Majumdsar (2003) “Balancing food safety and risk: do drug residue limits affect international trade?” Journal of International Trade and Development, 12(4), pp-377-402. 15 Table 1: Restrictiveness of NTM by type of measure(Frequency index at HS2) Type of measure Tariff TBT Licence Quota Affected imports (thousand US$) (2) Restrictiveness =(2)/ Total imports (thousand US$) Number of affected Products (1) Restrictiveness =(1) / Total Number of Products 1998 96 100.00% 136,698,089 100.00% 1999 95 98.96% 164,039,379 99.00% 2000 95 98.96% 208,724,085 98.73% 2001 95 98.96% 276,491,273 99.02% 2002 95 98.96% 279,654,465 98.97% 2003 95 98.96% 407,605,638 99.05% 2004 95 98.96% 554,406,001 99.05% 2005 95 98.96% 651,765,484 99.06% 2006 95 98.96% 782,291,262 99.10% 1998 70 72.92% 125,641,672 91.91% 1999 65 67.71% 152,705,419 92.16% 2000 74 77.08% 200,023,143 94.62% 2001 73 76.04% 215,806,053 77.29% 2002 76 79.17% 267,412,019 94.64% 2003 81 84.38% 399,786,552 97.15% 2004 82 85.42% 547,067,690 97.74% 2005 83 86.46% 642,031,520 97.58% 2006 83 86.46% 768,634,084 97.37% 1998 21 21.88% 89,549,798 65.51% 1999 22 22.92% 114,601,204 69.16% 2000 22 22.92% 149,079,530 70.52% 2001 25 26.04% 175,663,852 62.91% 2002 30 31.25% 234,498,993 82.99% 2003 37 38.54% 371,968,600 90.39% 2004 36 37.50% 503,444,064 89.95% 2005 35 36.46% 570,994,948 86.78% 2006 35 36.46% 719,767,331 91.18% 1998 15 15.63% 83,212,840 60.97% 1999 16 16.67% 106,109,004 64.04% 2000 12 12.50% 126,286,133 59.74% 2001 16 16.67% 149,452,821 53.52% 2002 7 7.29% 9,015,966 3.19% 2003 7 7.29% 11,816,213 2.87% 2004 8 8.33% 18,645,068 3.33% 2005 7 7.29% 17,617,835 2.68% 2006 6 6.25% 15,419,738 1.95% Year 16 Table 2-1: Summary statistics for the key variable Variable | Obs Mean Std. Dev. Min Max -------------+-------------------------------------------------------im | 37152 5.871933 4.208045 0 19.94 pop | 37152 10.36992 1.46442 6.05 13.93 gdppc | 37152 9.148269 1.452322 6.05 10.82 popchina | 37152 14.06111 .0179164 14.03 14.09 gdppcchina | 37152 7.218889 .2161533 6.91 7.58 contig | 37152 .1860465 .3891494 0 1 comlang | 37152 .1162791 .3205636 0 1 smctry | 37152 .0697674 .2547581 0 1 dist | 37152 8.67907 .6658877 6.86 9.87 -------------+-------------------------------------------------------tariff | 37152 2.583032 .6303838 0 4.1 frtbt | 37152 42.84427 39.66484 0 100 frl | 37152 7.844965 18.40589 0 100 frq | 37152 2.294722 9.835737 0 90 ictbt | 37152 54.13314 42.29381 0 100 icl | 37152 15.43926 29.80252 0 100 icq | 37152 4.350706 16.20075 0 100 Table 2-2: Pearson coefficient between the key variables | tariff frtbt frl frq -------------+-----------------------------------tariff | 1.0000 frtbt | 0.1323 1.0000 frl | -0.0282 0.0134 1.0000 frq | 0.1331 0.1316 0.3088 1.0000 | tariff ictbt icl icq -------------+-----------------------------------tariff | 1.0000 ictbt | -0.0043 1.0000 icl | -0.0676 0.1538 1.0000 icq | 0.1283 0.1559 0.2293 17 1.0000 Table 3: Result of pooled regression for all the products (using frequency index at HS2) pop gdppc dist popchina gdppcchina contig comlang smctry (1) im 1.469 (94.50)*** 1.401 (77.47)*** -1.415 (33.22)*** -7.662 (1.25) -0.591 (0.48) -0.761 (12.33)*** 2.610 (27.86)*** 0.103 (0.85) (2) im 1.469 (97.45)*** 1.401 (79.90)*** -1.415 (34.25)*** 10.840 (1.82)* 2.444 (2.05)** -0.760 (12.71)*** 2.610 (28.73)*** 0.103 (0.88) -0.644 (21.67)*** -0.011 (17.66)*** 0.041 (39.43)*** -0.017 (8.70)*** (3) im 1.388 (90.26)*** 0.908 (32.78)*** -1.451 (35.34)*** 11.123 (1.88)* 2.765 (2.33)** -0.991 (16.46)*** 3.321 (34.81)*** 0.351 (3.00)*** -0.644 (21.81)*** -0.011 (17.78)*** 0.041 (39.70)*** -0.017 (8.76)*** -1.601 (22.91)*** (4) im 1.388 (90.27)*** 0.907 (32.76)*** -1.451 (35.35)*** -12.653 (1.55) -0.486 (0.34) -0.992 (16.47)*** 3.322 (34.83)*** 0.352 (3.01)*** -0.648 (21.94)*** -0.011 (17.80)*** 0.041 (39.90)*** -0.017 (8.95)*** -1.602 (22.93)*** -0.432 (4.24)*** (5) im 1.388 (90.33)*** 0.907 (32.77)*** -1.451 (35.37)*** -12.653 (1.56) -0.486 (0.34) -0.992 (16.49)*** 3.322 (34.85)*** 0.352 (3.01)*** -0.642 (14.41)*** -0.015 (17.94)*** 0.045 (28.48)*** -0.016 (5.54)*** -1.790 (10.87)*** -0.432 (4.25)*** -0.009 (0.16) 0.006 (6.73)*** -0.006 (3.03)*** -0.001 (0.36) Yes Yes Yes 37152 0.30 Yes Yes Yes 37152 0.34 Yes Yes Yes 37152 0.35 Yes Yes Yes 37152 0.35 Yes Yes Yes 37152 0.35 tariff frtbt frl frq developing wto tariff_dping frtbt_dping frl_dping frq_dping tariff_wto frtbt_wto frl_wto frq_wto Time FE Country FE Product FE Observations R-squared (6) im 1.388 (90.47)*** 0.907 (32.83)*** -1.451 (35.43)*** -10.591 (1.30) -1.011 (0.72) -0.992 (16.51)*** 3.322 (34.91)*** 0.352 (3.01)*** -0.354 (6.52)*** -0.015 (15.45)*** 0.011 (2.82)*** 0.017 (3.59)*** -1.790 (10.89)*** 0.733 (3.87)*** -0.009 (0.16) 0.006 (6.74)*** -0.006 (3.04)*** -0.001 (0.36) -0.469 (7.77)*** 0.000 (0.34) 0.035 (8.90)*** -0.036 (6.69)*** Yes Yes Yes 37152 0.36 Absolute value of t statistics in parentheses, *,** and *** denote significant at 10%, 5% and 1% respectively 18 Table 4: Result of pooled regression for all the products (using coverage ratio at HS2) pop gdppc dist popchina gdppcchina contig comlang smctry (1) im 1.469 (94.50)*** 1.401 (77.47)*** -1.415 (33.22)*** -7.662 (1.25) -0.591 (0.48) -0.761 (12.33)*** 2.610 (27.86)*** 0.103 (0.85) (2) im 1.469 (97.77)*** 1.401 (80.16)*** -1.415 (34.36)*** 13.769 (2.32)** 1.982 (1.66) -0.760 (12.75)*** 2.610 (28.82)*** 0.103 (0.88) -0.660 (22.29)*** 0.002 (3.53)*** 0.027 (42.68)*** -0.001 (0.54) (3) im 1.389 (90.56)*** 0.908 (32.89)*** -1.451 (35.45)*** 14.052 (2.39)** 2.303 (1.95)* -0.991 (16.51)*** 3.321 (34.92)*** 0.351 (3.01)*** -0.660 (22.44)*** 0.002 (3.56)*** 0.027 (42.98)*** -0.001 (0.54) -1.600 (22.98)*** (4) im 1.388 (90.56)*** 0.907 (32.88)*** -1.451 (35.46)*** -5.768 (0.71) -0.407 (0.29) -0.992 (16.52)*** 3.321 (34.93)*** 0.352 (3.01)*** -0.663 (22.54)*** 0.002 (3.50)*** 0.027 (43.11)*** -0.001 (0.74) -1.602 (23.00)*** -0.360 (3.55)*** (5) im 1.388 (90.67)*** 0.907 (32.90)*** -1.451 (35.50)*** -5.768 (0.71) -0.407 (0.29) -0.992 (16.55)*** 3.322 (34.98)*** 0.352 (3.02)*** -0.673 (15.20)*** -0.003 (3.56)*** 0.030 (31.69)*** -0.003 (1.65)* -1.995 (11.74)*** -0.360 (3.55)*** 0.017 (0.30) 0.008 (9.04)*** -0.006 (4.46)*** 0.004 (1.53) Yes Yes Yes 37152 0.30 Yes Yes Yes 37152 0.35 Yes Yes Yes 37152 0.36 Yes Yes Yes 37152 0.36 Yes Yes Yes 37152 0.36 tariff ictbt icl icq developing wto tariff_dping ictbt_dping icl_dping icq_dping tariff_wto ictbt_wto icl_wto icq_wto Time FE Country FE Product FE Observations R-squared (6) im 1.388 (90.76)*** 0.907 (32.93)*** -1.451 (35.54)*** -4.496 (0.55) -0.775 (0.55) -0.992 (16.57)*** 3.322 (35.02)*** 0.352 (3.02)*** -0.458 (8.62)*** -0.001 (1.38) 0.020 (10.24)*** 0.008 (2.97)*** -1.995 (11.76)*** 0.748 (3.93)*** 0.017 (0.30) 0.008 (9.05)*** -0.006 (4.46)*** 0.004 (1.54) -0.385 (6.54)*** -0.003 (3.51)*** 0.012 (6.01)*** -0.011 (3.84)*** Yes Yes Yes 37152 0.36 Absolute value of t statistics in parentheses, *,** and *** denote significant at 10%, 5% and 1% respectively 19 Table 5: Yearly result of cross section for all the products (using frequency index at HS2) pop gdppc dist contig (1) (2) (3) (4) (5) (6) (7) (8) (9) 1998 1999 2000 2001 2002 2003 2004 2005 2006 1.345 1.366 1.378 1.380 1.376 1.401 1.398 1.429 1.433 (30.70)*** (30.80)*** (30.20)*** (29.81)*** (30.43)*** (30.22)*** (29.54)*** (30.25)*** (29.96)*** 1.010 0.958 0.959 0.937 0.900 0.925 0.882 0.872 0.756 (12.82)*** (11.96)*** (11.72)*** (11.28)*** (11.01)*** (11.03)*** (10.29)*** (10.22)*** (8.78)*** -1.567 -1.472 -1.493 -1.467 -1.444 -1.449 -1.413 -1.396 -1.376 (13.37)*** (12.35)*** (12.18)*** (11.81)*** (11.95)*** (11.71)*** (11.22)*** (11.15)*** (10.92)*** -0.643 -0.891 -0.957 -0.867 -1.046 -0.983 -1.023 -1.155 -1.305 (3.68)*** (5.04)*** (5.29)*** (4.75)*** (5.90)*** (5.43)*** (5.57)*** (6.36)*** (7.17)*** 3.724 3.542 3.471 3.330 3.286 3.173 3.105 3.166 3.069 (13.66)*** (12.75)*** (12.14)*** (11.53)*** (11.71)*** (11.07)*** (10.64)*** (10.91)*** (10.50)*** 0.115 0.473 0.500 0.472 0.459 0.315 0.232 0.214 0.350 (0.34) (1.39) (1.43) (1.33) (1.33) (0.89) (0.65) (0.60) (0.98) -0.386 -0.307 -0.488 -0.284 -0.373 -0.917 -0.985 -1.061 -0.862 (4.72)*** (3.73)*** (5.50)*** (3.31)*** (4.16)*** (9.85)*** (9.90)*** (10.61)*** (8.50)*** -0.009 -0.005 -0.011 -0.011 -0.013 -0.012 -0.012 -0.011 -0.015 (5.30)*** (2.64)*** (6.29)*** (6.16)*** (7.05)*** (5.97)*** (6.15)*** (5.81)*** (7.23)*** 0.001 0.005 0.029 -0.009 0.049 0.040 0.041 0.045 0.048 (0.09) (0.54) (4.59)*** (1.20) (16.84)*** (16.85)*** (16.29)*** (17.41)*** (17.49)*** 0.028 0.024 -0.022 0.032 -0.030 -0.015 -0.014 -0.018 -0.024 (3.04)*** (2.52)* (2.74)*** (4.18)*** (3.97)*** (1.95)* (1.84)* (2.35)** (3.07)*** -1.406 -1.601 -1.619 -1.591 -1.542 -1.476 -1.569 -1.631 -1.895 (6.99)*** (7.77)*** (7.68)*** (7.46)*** (7.41)*** (7.02)*** (7.39)*** (7.78)*** (9.04)*** -2.492 -3.183 -2.073 -2.745 -1.857 -1.352 -0.758 -0.950 -0.054 (1.66) (2.07)** (1.31) (1.70)* (1.16) (0.82) (0.45) (0.57) (0.03) Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Obs 4128 4128 4128 4128 4128 4128 4128 4128 4128 R-squared 0.35 0.35 0.34 0.33 0.37 0.36 0.35 0.36 0.36 comlang smctry tariff frtbt frl frq developing Constant Country FE Product FE Absolute value of t statistics in parentheses, *,** and *** denote significant at 10%, 5% and 1% respectively 20 Table 6: Yearly result of cross section for all the products (using coverage ratio at HS2) pop gdppc dist contig (1) (2) (3) (4) (5) (6) (7) (8) (9) 1998 1999 2000 2001 2002 2003 2004 2005 2006 1.345 1.366 1.378 1.380 1.376 1.401 1.398 1.429 1.433 (30.86)*** (31.31)*** (30.36)*** (29.91)*** (30.53)*** (30.24)*** (29.59)*** (30.18)*** (29.77)*** 1.010 0.958 0.959 0.937 0.900 0.925 0.882 0.872 0.756 (12.88)*** (12.15)*** (11.78)*** (11.32)*** (11.05)*** (11.04)*** (10.30)*** (10.20)*** (8.72)*** -1.567 -1.472 -1.493 -1.467 -1.444 -1.449 -1.413 -1.396 -1.376 (13.43)*** (12.55)*** (12.24)*** (11.85)*** (11.99)*** (11.71)*** (11.24)*** (11.13)*** (10.85)*** -0.643 -0.891 -0.957 -0.867 -1.046 -0.983 -1.023 -1.155 -1.305 (3.70)*** (5.12)*** (5.32)*** (4.77)*** (5.92)*** (5.43)*** (5.58)*** (6.34)*** (7.12)*** 3.724 3.542 3.471 3.330 3.286 3.173 3.105 3.166 3.069 (13.73)*** (12.96)*** (12.20)*** (11.57)*** (11.76)*** (11.07)*** (10.66)*** (10.88)*** (10.44)*** 0.115 0.473 0.500 0.472 0.459 0.315 0.232 0.214 0.350 (0.34) (1.41) (1.43) (1.34) (1.34) (0.89) (0.65) (0.60) (0.97) -0.497 -0.327 -0.525 -0.392 -0.554 -0.931 -0.967 -1.030 -0.840 (6.15)*** (4.09)*** (6.17)*** (4.70)*** (6.36)*** (10.11)*** (9.76)*** (10.35)*** (8.25)*** 0.002 0.010 0.005 0.005 -0.005 0.000 0.000 -0.000 -0.003 (1.00) (6.71)*** (2.97)*** (2.99)*** (3.02)*** (0.20) (0.00) (0.09) (1.49) 0.012 0.020 0.029 0.012 0.033 0.028 0.028 0.028 0.028 (3.33)*** (5.30)*** (7.90)*** (3.79)*** (18.29)*** (17.28)*** (17.61)*** (17.45)*** (16.41)*** 0.016 0.008 -0.009 0.012 -0.010 0.002 0.001 0.001 -0.003 (3.78)*** (1.85)* (1.67)* (3.23)*** (2.18)** (0.49) (0.19) (0.42) (0.71) -1.406 -1.601 -1.619 -1.591 -1.542 -1.476 -1.569 -1.631 -1.895 (7.02)*** (7.90)*** (7.72)*** (7.48)*** (7.44)*** (7.02)*** (7.41)*** (7.76)*** (8.98)*** -3.340 -4.792 -3.523 -4.200 -2.348 -2.813 -2.291 -2.393 -1.537 (2.23)** (3.16)*** (2.23)** (2.60)*** (1.47) (1.72)* (1.36) (1.43) (0.90) Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Obs 4128 4128 4128 4128 4128 4128 4128 4128 4128 R-squared 0.36 0.37 0.35 0.33 0.37 0.36 0.35 0.36 0.35 comlang smctry tariff ictbt icl icq developing Constant Country FE Product FE Absolute value of t statistics in parentheses, *,** and *** denote significant at 10%, 5% and 1% respectively 21 Table7: Results for HS01-24 (using frequency index & coverage ratio) FR pop gdppc dist popchina gdppcchina contig comlang smctry tariff frtbt frl frq (1) (2) im 1.331 (46.70)*** 0.917 (27.66)*** -0.678 (8.69)*** -0.287 (0.03) -0.861 (0.38) -0.368 (3.26)*** 2.742 (15.97)*** -1.078 (4.85)*** -0.226 (2.85)*** -0.032 (4.94)*** 0.029 (12.06)*** -0.004 (1.40) im 1.229 (42.77)*** 0.296 (5.73)*** -0.723 (9.43)*** -14.184 (0.93) -1.291 (0.49) -0.659 (5.86)*** 3.635 (20.40)*** -0.765 (3.50)*** 0.162 (1.20) -0.012 (1.24) 0.011 (2.09)** 0.037 (6.05)*** -0.126 (0.10) 8.327 (5.04)*** -0.403 (2.79)*** -0.007 (0.54) -0.006 (1.21) 0.001 (0.13) 0.073 (0.44) -0.089 (5.49)*** 0.007 (1.16) -0.057 (8.94)*** Yes Yes Yes 9288 0.30 developing wto tariff_dping frtbt_dping frl_dping frq_dping tariff_wto frtbt_wto frl_wto frq_wto Time FE Country FE Product FE Observations R-squared Yes Yes Yes 9288 0.27 IC pop gdppc dist popchina gdppcchina contig comlang smctry tariff ictbt icl icq (1) (2) im 1.331 (46.35)*** 0.917 (27.45)*** -0.678 (8.62)*** -0.881 (0.08) 0.180 (0.08) -0.368 (3.23)*** 2.742 (15.85)*** -1.078 (4.82)*** -0.096 (1.29) 0.002 (0.16) 0.013 (10.81)*** 0.003 (2.14)* im 1.229 (42.32)*** 0.296 (5.67)*** -0.723 (9.33)*** -17.344 (1.12) -1.485 (0.55) -0.659 (5.80)*** 3.635 (20.19)*** -0.765 (3.46)*** 0.124 (0.99) 0.040 (1.76)* 0.012 (4.13)*** 0.015 (4.20)*** 2.329 (0.79) 113.476 (5.25)*** -0.440 (3.24)*** -0.030 (1.03) -0.003 (1.33) 0.002 (0.57) 0.213 (1.43) -1.144 (5.29)*** 0.001 (0.31) -0.022 (5.86)*** Yes Yes Yes 9288 0.29 developing wto tariff_dping ictbt_dping icl_dping icq_dping tariff_wto ictbt_wto icl_wto icq_wto Time FE Country FE Product FE Observations R-squared 22 Yes Yes Yes 9288 0.26 Table8: Results for HS25-97 (using frequency index & coverage ratio) FR pop gdppc dist popchina gdppcchina contig comlang smctry tariff frtbt frl frq (1) (2) im 1.516 (87.91)*** 1.563 (77.93)*** -1.661 (35.15)*** 20.750 (3.03)*** 3.817 (2.78)*** -0.891 (13.03)*** 2.566 (24.70)*** 0.497 (3.70)*** -0.370 (10.15)*** 0.001 (0.97) 0.043 (34.28)*** -0.038 (13.82)*** im 1.441 (82.04)*** 1.110 (35.09)*** -1.694 (36.12)*** -8.846 (0.95) -0.351 (0.22) -1.103 (16.03)*** 3.218 (29.54)*** 0.725 (5.42)*** -0.152 (2.33)** 0.001 (0.46) -0.009 (1.01) 0.016 (1.67)* -1.730 (8.39)*** 0.750 (3.32)*** 0.067 (0.95) 0.006 (3.68)*** -0.005 (2.11)** -0.001 (0.23) -0.480 (6.71)*** -0.006 (3.56)*** 0.057 (6.17)*** -0.074 (5.21)*** Yes Yes Yes 27855 0.40 developing wto tariff_dping frtbt_dping frl_dping frq_dping tariff_wto frtbt_wto frl_wto frq_wto Time FE Country FE Product FE Observations R-squared Yes Yes Yes 27855 0.38 IC pop gdppc dist popchina gdppcchina contig comlang smctry tariff ictbt icl icq (1) (2) im 1.516 (89.20)*** 1.563 (79.07)*** -1.661 (35.67)*** 19.884 (2.95)*** 2.433 (1.80) -0.892 (13.23)*** 2.566 (25.07)*** 0.497 (3.75)*** -0.243 (6.71)*** 0.009 (14.81)*** 0.029 (39.19)*** -0.014 (8.70)*** im 1.441 (83.42)*** 1.110 (35.69)*** -1.694 (36.73)*** 0.540 (0.06) 0.091 (0.06) -1.104 (16.31)*** 3.218 (30.03)*** 0.725 (5.51)*** 0.016 (0.25) 0.011 (9.94)*** 0.024 (8.83)*** -0.013 (3.59)*** -2.073 (9.95)*** 1.537 (6.78)*** 0.141 (2.00)** 0.008 (7.34)*** -0.006 (3.93)*** 0.006 (1.84)* -0.611 (8.57)*** -0.013 (10.86)*** 0.010 (3.80)*** -0.006 (1.38) Yes Yes Yes 27855 0.42 developing wto tariff_dping ictbt_dping icl_dping icq_dping tariff_wto ictbt_wto icl_wto icq_wto Time FE Country FE Product FE Observations R-squared 23 Yes Yes Yes 27855 0.40 Annex1: Cost list of Supporting Documents Subject to Customs Control of PRC Code 1 2 3 4 5 6 7 8 9 A B D E Authorized Institution that issue the documents Name of Licences or Instruments of Ratification Import licence Import licence for dual-use item and technologies Export licence for dual-use item and technologies Export licence Textile products for interim export licence Used machinery and electrical products are on the list of prohibited import goods Automatic import goods Articles on the list of prohibited export goods Articles on the list of prohibited import goods Certificate of inspection for goods inward Certificate of inspection for goods outward Certificate of inspection for goods inward/outward (for semi-finished diamonds) Export licencing certificate for endangered species F Import licencing endangered species G Export licence for dual-use item and technologies Hongkong and Macao OPA textile certificate H I J K certificate for Import or export permit for psychotropic drugs Import or export permit for gold products Application form of transfer between-factories during further processing Quota & Licence Administrative Bureau Ministry of Commence or its authorized institution Ministry of commerce Ministry of commerce Quota & Licence Administrative Bureau Ministry of Commence or its authorized institution Ministry of commerce The importing of used electro-mechanical products with this code at the end of its code of goods is prohibited Ministry of commerce Products with this code are prohibited to be exported Products with this code are prohibited to be import The administration of quality supervision The administration of quality supervision The administration of quality supervision The administrative bureau Export of Endangered Wild relevant administrative The administrative bureau Export of Endangered Wild relevant administrative Ministry of commerce of the Import and Animal or by other of the Import and Animal or by other (1)Hongkong Trade and Industry Department releases OPA certificate of Textile Processing in Mainland china; (2)Macao Ministry of Economy releases certificate of Textile Processing in Mainland china State food and drug administration The people’s bank of China Local custom 24 Cost list of Supporting Documents Subject to Customs Control of PRC(cont’d) Code L O P Q R S T W X Y Name of Licences or Instruments of Ratification Import or export of medicines permit licence Automatic import licence (machinery and electrical products, whether used or not) Import permit for waste and scraps Report of inspection of soundness on import medicines Clearance form for import veterinary drugs Import or export registration certificate for pesticides Entry or exit permit for foreign currency cash transfer and reallocation between banks Import or export permit for narcolic drugs Environment control release notice for poisonous chemicals certificate of origin Z Issuance permit for audio/or video products, release for protolype tape a Certificate of examination and approval signed and sealed before-hand Domestic sales collect tax contact sheet Quota certificate for importing cotton beyond the tariff quota at a preferential rate Country-specific tariff quota certificates Pre-classified signs Relative certificate for ITA products issued by information industry ministry Certificate of customs quota c e q r s t Authorized Institution that issue the documents State food and drug administration and its authorize in institution Business Department, local institutions in charge of foreign trade or department of Electrical and Mechanical Services State environmental protection administration of china State food and drug administration and its authorized institution Ministry of Agriculture of the People’s Republic Ministry of Agriculture of the People’s Republic (1)”License for banks to transfer foreign currencies” released by state Administration of Foreign Exchange is required for the entry and exist of foreign currency; (2)Sanction from the Silver, Cold & Currency Department of People’s Bank of China is required for the entry and exit of RMB State food and drug Administration State environmental protection administration of china State environmental protection administration of china License for Importing and Exporting Visual Product released by the Department of Academy and Culture; List of Imported Movies and Television Programs released by the State Association of Broadcasting, Films & Television business association Local Custom Quota & License Administrative Bureau Ministry of Commerce or its authorized institution National development and Reform commission Local Custom duty department Quota & License Administrative Bureau Ministry of Commerce or its authorized institution 25 Annex2: TBT rocked products Chapter Description 98 99 00 01 02 03 04 05 06 01 Live animals √ √ √ √ √ √ √ √ √ 02 Meat and edible meat offal √ √ √ √ √ √ √ √ √ 03 Fish, crustaceans, molluscs, aquatic invertebrates ne √ √ √ √ √ √ √ √ √ 04 Dairy products, eggs, honey, edible animal product ne √ √ √ √ √ √ √ √ √ 05 Products of animal origin, nes √ √ √ √ √ √ √ √ √ 06 Live trees, plants, bulbs, roots, cut flowers etc √ √ √ √ √ √ √ √ √ 07 Edible vegetables and certain roots and tubers √ √ √ √ √ √ √ √ √ 08 Edible fruit, nuts, peel of citrus fruit, melons √ √ √ √ √ √ √ √ √ 09 Coffee, tea, mate and spices √ √ √ √ √ √ √ √ √ 10 Cereals √ √ √ √ √ √ √ √ √ 11 Milling products, malt, starches, inulin, wheat glute √ √ √ √ √ √ √ √ √ 12 Oil seed, oleagic fruits, grain, seed, fruit, etc, ne √ √ √ √ √ √ √ √ √ 13 Lac, gums, resins, vegetable saps and extracts nes √ √ √ √ √ √ √ √ √ 14 Vegetable plaiting materials, vegetable products nes √ √ √ √ √ √ √ √ √ 15 Animal, vegetable fats and oils, cleavage products, et √ √ √ √ √ √ √ √ √ 16 Meat, fish and seafood food preparations nes √ √ √ √ √ √ √ √ √ 17 Sugars and sugar confectionery √ √ √ √ √ √ √ √ √ 18 Cocoa and cocoa preparations √ √ √ √ √ √ √ √ √ 19 Cereal, flour, starch, milk preparations and products √ √ √ √ √ √ √ √ √ 20 Vegetable, fruit, nut, etc food preparations √ √ √ √ √ √ √ √ √ 21 Miscellaneous edible preparations √ √ √ √ √ √ √ √ √ 22 Beverages, spirits and vinegar √ √ √ √ √ √ √ √ √ 23 Residues, wastes of food industry, animal fodder √ √ √ √ √ √ √ √ √ 24 Tobacco and manufactured tobacco substitutes √ √ √ √ √ √ √ √ √ 30 Pharmaceutical products √ 31 Fertilizers √ √ √ √ √ √ √ √ 33 Essential oils, perfumes, cosmetics, toileteries √ √ √ √ √ √ √ √ 41 Raw hides and skins (other than furskins) and leather √ √ √ √ √ √ √ √ 42 Articles of leather, animal gut, harness, travel good √ √ √ √ 43 Furskins and artificial fur, manufactures thereof 44 √ √ √ √ √ Wood and articles of wood, wood charcoal √ √ √ √ √ √ √ √ √ 45 Cork and articles of cork √ √ √ √ √ √ √ √ √ 46 Manufactures of plaiting material, basketwork, etc. √ √ √ √ √ √ √ √ √ 47 Pulp of wood, fibrous cellulosic material, waste etc √ √ √ √ √ √ √ √ √ 50 Silk 51 Wool, animal hair, horsehair yarn and fabric thereof √ √ √ √ √ √ √ √ √ 72 Iron and Steel √ √ √ √ √ √ √ √ √ 76 Aluminium and articles thereof √ √ 80 Tin and articles thereof √ √ √ √ 26