2015 PAYABLE 2016 LEVY CERTIFICATION AGENDA Levy certification process

advertisement

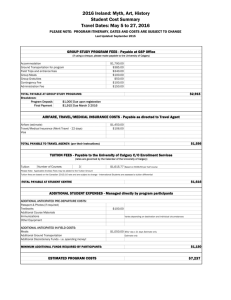

2015 PAYABLE 2016 LEVY CERTIFICATION Independent School District 196 Rosemount-Apple Valley-Eagan Public Schools December 14, 2015 Educating our students to reach their full potential AGENDA Levy certification process Basic school funding 2015 Payable 2016 Levy Analysis 1 LEVY CERTIFICATION PROCESS July/August – started with submission of data to Minnesota Department of Education September – School Board set levy limit November – County mailed proposed tax statements December – Final levy certification by School Board HOW SCHOOLS ARE FUNDED 2 SOURCE OF REVENUES – ALL FUNDS Federal Sources 3.41% Other 15.89% Property Taxes 19.18% State Sources 61.52% HOW ARE LOCAL SCHOOL TAXES DETERMINED? Voter approved Bond votes Operating levy votes School Board decisions (Other Local) Authority is limited through legislation Special levy authority…Safe Schools levy, Alternative Facilities levy, Health and Safety levy etc. 3 WHAT IS THE SCHOOL DISTRICT’S RECOMMENDED LEVY? Levy Payable 2016 Total Levy $85,581,695 Total Board Determined $44,833,473 52% Total Voter Approved $40,748,222 48% 4 Levy Payable 2016 By Fund Total Debt Service Total Community $17,452,940 20% Service $1,674,048 2% Total General Fund $66,454,707 78% HOW DOES THIS COMPARE TO PRIOR YEARS? 5 Total School Local Levies Millions 90 80 70 60 50 85.58 40 79.37 78.42 75.85 73.78 Payable 2010 Payable 2011 Payable 2012 Payable 2013 78.24 78.53 Payable 2014 Payable 2015 30 20 10 Payable 2016 Total General Fund Levy Millions 70.00 60.00 50.00 40.00 30.00 58.5 57.4 Payable 2010 Payable 2011 54.7 53.4 Payable 2012 Payable 2013 57.4 62.2 66.5 20.00 10.00 Payable 2014 Payable 2015 Payable 2016 6 Community Education Levy Millions 1.8 1.6 1.4 1.2 1.0 0.8 1.69 1.69 1.65 1.68 1.68 1.67 1.67 Payable 2010 Payable 2011 Payable 2012 Payable 2013 Payable 2014 Payable 2015 Payable 2016 0.6 0.4 0.2 - Total Debt Service Levy Millions 25.0 20.0 15.0 10.0 19.1 19.4 19.5 18.7 19.2 17.5 14.7 5.0 Payable 2010 Payable 2011 Payable 2012 Payable 2013 Payable 2014 Payable 2015 Payable 2016 7 How Will This Impact Taxes In the District 196 Community? School Taxes Payable on Avg. Value Home $300,000 284,871 278,570 1,186 1,179 1,145 239,506 246,221 232,258 $200,000 Home Value 1,165 1,066 256,714 1,144 1,153 1,128 216,768 $1,400 $1,200 255,795 $1,000 224,629 $800 $150,000 $600 School Tax $250,000 1,294 $100,000 $400 $50,000 $200 $0 $0 2008 2009 2010 2011 2012 2013 2014 2015 2016 Payable Tax Year Avg Home in ISD 196 School Tax 8 Questions? 9