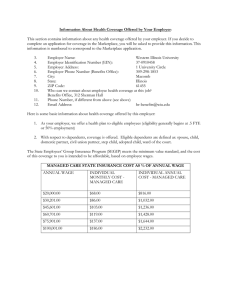

YOUR BENEFIT PLAN

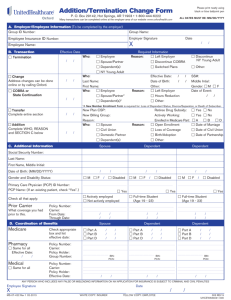

advertisement