Do Countries of The Same Development Degree Move on The... Rosmy Jean Louis* Daniel Simons**

advertisement

Do Countries of The Same Development Degree Move on The Same Wavelength?

Rosmy Jean Louis*

Daniel Simons**

Abstract

Research on business cycle linkages show a tendency to model countries of relatively the

same degree of economic development jointly. However, the issue of whether countries

with the same degree of development move along the same business cycles has not been

investigated formally. The recent push by regional/economic bloc of countries toward the

adoption of one currency tends to suggest an interdependence of macroeconomic

activities but not necessarily a common cycle. Using the World Development Indicators

classification of countries as a proxy for countries level of development and the MarkovSwitching Vector Autoregression technique, we examine the business cycles of each

category of countries to determine whether 1) each group of countries follows its own

dynamics and is therefore subjected to the same business cycle and 2) whether these

cycles are independent of each other across groups. The preliminary results indicate that

countries in the High Income per capita group tend to be guided by similar business

cycles while some countries in the Middle and Low income groups have varying cycles

within the groups. We also determined that across groups, the wavelength was common

in most of the countries lending support to the existence of a common world cycle.

Keywords: Economic Development, Business Cycles, Markov Switching Vector

Autoregression, economic integration and globalization

JEL Classification: C0, E0, F1, F3

_________________

*,** Preliminary: Please do not quote without authors’ permission. Authors’ corresponding

address: Department of Economics and Finance, Faculty of Management, Malaspina UniversityCollege, 900 Fifth Street, Nanaimo, BC V9R5S5. Emails: jeanlouir@mala.bc.ca and

simonsd@mala.bc.ca.

1

Introduction

The research on business cycle linkages that abounds in the literature shows a tendency to

model countries of relatively the same degree of economic development jointly. The

works of Mills and Holmes (1999), Lumsdaine and Prasad (2002); Backus and Kehoe

(1992), Artis, Krolzig, and Toro (1999) are examples of such practice. All these studies

used OECD countries in their search for an international business cycle.

There have also been some attempts to jointly model countries of different economic

backgrounds. For example, Jean Louis (2003) and Jean Louis and Simons (2005)

investigates the business cycle linkages between North American countries but could not

conclude that Mexico shares a common cycle with the United States and Canada

combined. Mejia-Reyes (1999) models the United States along with the major Latin

American economies and arrives at a similar conclusion. The business cycles of the

United States and most of these countries are idiosyncratic, on a pairwise comparison

basis. Focusing on Asia, Girardin (2002) found little evidence of symmetry between

Japan and other South East Asian countries’ business cycle in a comparison of univariate

results.

Although current studies on international business cycle linkages implicitly give

indication that there is a link between business cycle synchronization and levels of

economic development, this research question has not been formally addressed in the

literature. McAdam (2003) investigates the business cycle features of the US, Japan and

the Euro area using Markov-switching techniques and concluded that even though these

three areas have a high trade and financial integration, there was no synchronization of

their cycles. The study failed to uncover any commonality among the features of the

three cycles. Using annual data on per capita GDP for 76 countries, Kose et al (2003)

examined the effect of trade and financial integration on synchronization of business

cycles. They compared correlations of output growth rates in the individual countries

with a constructed composite world output. They concluded that industrial countries had

stronger correlation with the world output than developing economies. Their conclusion

lends limited support that idea that globalization synchronizes macroeconomic activities.

2

In response to studies on monetary cooperation in Asia, Girardin (2004) looked at growth

cycles between Japan and East Asia. He used both correlation and regime switching

techniques to determine if the synchronization is regime-dependent. Japan seemed to be

synchronized with 5 out of the 10 selected East Asian countries in both the growthrecession and rapid-growth regimes but diverge from this synchronization during the

normal-growth phase implying that the synchronization of the cycles was not complete.

Chauvet and Yu (2006) used a dynamic factor Markov-switching model to discover that

there was some commonality among OECD countries but could not conclude the same

for the G7 countries.

Almost invariably, studies on business cycle synchronization have grouped

countries in regional blocs rather than on levels of development. Our contribution to the

literature is that we specifically model these countries based on income levels to

determine if there is a common component in the cycles of countries with the same

income level. There are at least three reasons for exploring this issue. First, there is the

idea that an All Americas’ Monetary Union could be a stronger economic bloc to

compete with the European Union and other rising economic powers such as India and

China. Second, there is the debate of “One World, One Money?” without abolishing

national currencies, which revisits the idea of a global money proposed by Keynes in

1944 (Mundell, 1995; 2001; Friedman 2001; Starr 2004). There has been a proliferation

of trade agreements among countries around the globe. On all accounts, our research

contributes to the overall debate.

3

Be it because of competition at the world level that gives rise to the creation of economic

blocs or because of globalization of markets that might necessitate a world currency to

facilitate international transactions, a study on business cycle linkages that accounts for

the level of economic development within and across blocs is enriching for the ongoing

debate. Moreover, business cycle synchronization is a prerequisite, in line with Mundell

(1961), for countries that contemplate higher forms of economic integration beyond

customs union. Countries forming those blocs must be subjected to similar shocks, hence

common cycle, in order for a “one-size-fits-all” monetary policy to be effective for each

member of the group. The absence of a common cycle in these unions may lead to severe

complications from monetary policies for the member nations.

Although there have been some research (Alesina and Barro 2002; Alesina, Barro, and

Tenreyro 2003) in the literature that explores the benefits of currency unions for countries

of different sizes and degree of specialization in the production of goods and services, it

still remains a subject of contention whether industrialized and less-developed nations

could find a mutually beneficial agreement. Disparities between the two groups of

countries in America and other continents are very well pronounced. Using Markovswitching vector autoregression technique and data on World Development Indicators

that classify countries according to their levels of income per capita, our paper sets out as

objectives to empirically estimate whether 1) each group of countries follows its own

dynamics and is therefore subjected to the same business cycle, and 2) whether these

cycles are independent of each other across groups.

The results indicate that countries in the High Income per capita group tend to be guided

by similar business cycles while those in Middle and Low income group have varying

cycles within each group. We also determined that across groups, there seem to be

symmetry in the cycles but some with lagged effects. Overall, our research supports the

view that the relative degree of economic development of countries does not matter for

synchronization of business cycle. The rest of the paper is organized as follows. Section 1

presents the methodology. Section 2 deals with the data and results and Section 3

concludes the paper.

4

Section 1

Methodology

The methodology of this paper is based on the original contribution of Hamilton (1989),

who

considers

a

univariate

Markov

switching

univariate

Markov-Switching

Autoregression (MS-AR) model with two regimes: recession and expansion, which

captures the changes in time series that can occur due to continuous shocks. The

Hamilton model has become one of the standard tools in time-series econometrics and

has been widely used in the literature. This model has been extended to accommodate

duration dependence in the transition probabilities (Durland and McCurdy 1994; Pelagatti

2005), three regimes: recession, normal growth, and high growth, and regime shifts in

intercepts (I), autoregressive parameters, and covariance matrix (H) (see Hamilton and

Raj 2002) for more advances in the field]. A substantial contribution is the generalization

to multivariate analysis, namely, MS-VAR or MS-VECM, which includes the works of

Krolzig (1997a, 1997b, 1998, 2000), Kim and Piger (2000), Clements and Krolzig(2002,

2004), and Sichel (1994). This paper follows the MSVAR generalization by Krolzig

(1997) and Artis et al. (2003) by estimating the final MSVAR models.

In its broadest form, a Markov switching mean vector autoregression of order p with M

regimes [MSM(M) −VAR(p)] is given by:

yt − µ(st) = A1(st)(yt−1 − µ(st−1)) + ... + Ap(st)(yt−p − µ(st−p)) + ut

(1)

where ut ~ NID(0, Σ(st)) and µ(st) is K×1 dimensional mean of the k-th dimensional time

series vector yt, A1(st), ...,Ap(st) are slope coefficients, ut is a disturbance term whose

covariance matrix Σ(st) along with all parameters of the model is dependent on the

unobservable regime, st. For example, in a three-regime set up:

µ(st) = µ1 < 0, if st = 1 (’recession’) with σ2(st) = σ21

µ(st) = µ2 > 0, if st = 2 (’normal growth’) with σ2(st) = σ22

µ(st) = µ3 > 0, if st = 3 (’rapid growth’) with σ2(st) = σ23

It is also expected that σ22< σ21< σ23 because episodes of rapid growth are normally more

volatile than periods of recession, which in turn are more volatile than period of slow

growth (in the vicinity of the steady state). One characteristic of this modeling device,

5

however, is that it allows for an immediate one-time jump in the mean following a shift

in regime, which, according to Krolzig, does not account for the possibility that the mean

may smoothly approach a new level after the transition from one state to another. In order

to factor in this feature, Krolzig therefore suggests a regime-dependent intercept ν(st) that

can take into account the smooth transition of the mean:

yt = ν(st) + A1(st)yt−1 + ... + Ap(st)yt−p + ut

(2)

where ν(st) = µ(st)(I – ∑ j =1 Aj ( st ) )

p

As Krolzig (1997a, Ch.3; 1998) has demonstrated, the [MSM(M) − VAR(p)] and the

Markov switching intercept vector autoregression of order p with M states [MSI(M) −

VAR(p)] are two different models that imply two different dynamic adjustments of the

observed variables in response to a change in regime. The former implies that a

permanent regime shift leads to an immediate jump in the mean growth rate of the

process to its new level. For the latter, a once-and-for-all regime shift in the intercept

gives rise to a dynamic response of the growth rate of the observed variable that is

identical to an equivalent shock in the white noise series ut.

The unobservable regime, st, is generated by a first-order Markov chain defined by

transition probabilities:

M

∑

pij = Pr(st+1 = j|st = i)

j =1

p ij = 1

i,j = 1…M

(3)

Where pij is the probability of being in regime j given that regime i has already

materialized. The transition probability matrix contains all possible cases:

⎡ p11

⎢p

P = ⎢ 12

⎢ .

⎢

⎣⎢ p1M

p21

p22

.

p2 M

.

.

.

.

.

.

.

.

.

.

.

.

pM 1 ⎤

pM 2 ⎥⎥

. ⎥

⎥

pMM ⎦⎥

By using the MSVAR process, we are able to determine whether there is an underlying

common unobserved component that governs the dynamics of the mean growth rates of

output within and across groups of countries. But our focal point is on the impulse

6

response functions for non-linear models introduced by Krolzig and Toro (1998) and

employed by Artis et al. (2003). In their view: “if the unobservable variable is to be

interpreted as the state of the business cycle, an alternative procedure is to look at cyclical

fluctuations in terms of the response of the variables to changes in the regime of the state

variable.” Following these author, our paper will concentrate on the path followed by

each country’s or groups of countries’ output growth in response to changes in regime of

the state variable in order to establish whether there is a link between business cycles and

degree of economic development.

In summary, we decompose the vector of growth rate of output per capita for the

countries in each group and across groups as the sum of two terms: a non-Gaussian

component and a Gaussian component. The former would capture the contribution of a

specific group’s cycle to individual countries while the latter would reflect each country’s

specific shocks. Rewriting Equation 2:

∆yt = A( L) −1ν ( st ) + A( L) −1 ∑1/ 2 ( st )ut

(4)

The contribution of country specific shocks to the growth rate of output is given by:

∂Et (∆yt + j )

lim

∂ut

Where Et(∆yt+j) is the output forecasted at time t for j periods ahead. However, when

j →∞

there is a switch in regime from recession (st = 1) to expansion (st = 2) or vice versa, the

impact in the long-run future level of output is given by:

lim{E (∆y

j →∞

t

t+ j

| st = 2) − Et (∆yt + j | st = 1)}

Where Et(∆yt+j|st = i) is the output forecasted in time t for j periods ahead when the

economy is in state i. So the difference between the two terms reflect the impact on the

growth rate of output when there is a change in regimes, which can be interpreted as the

response of each country to the “group’s” recession or expansion.

7

Section 2

Data

Data and Results

We used the annual growth rate of per capita Gross National Income (GNI) over the

period 1961 - 2001.

This data is taken from the 2004 CD-ROM of the World

Development Indicators published by the World Bank, which classifies countries as High

Income OECD (HIC_OECD), High Income non-OECD (HIC_other), Upper MiddleIncome (UMC), Low Middle-Income (LMIC) and Low Income (LIC) as a proxy for the

relative degree of economic development of countries. Accordingly, countries are

grouped as low income if their income per capita is $825 or less; lower middle income,

$826–3,255; upper middle income, $3,256–10,065; and high income, $10,066 or more.

The World Bank views low-income and middle-income economies as developing

economies.1

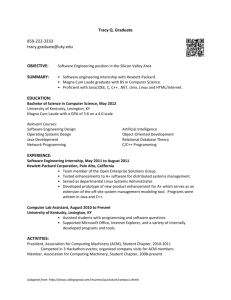

After cleaning up the data for missing values, we end up with an unbalanced panel of 24,

6, 22, 28, and 36 countries in the respective categories. From a presentation perspective,

since we are interested in the impulse responses, we surmise that our models could run

properly when a balanced panel of 6 countries in each category is used. We did not rely

on any specific criterion to choose the final sample shown in Table 1. We simply picked

the first six countries in each category, a justification for the alphabetical order observed

in Table 1. Therefore, our results are not tainted by the sample selection process or data

mining.

Table 1

Country Sample

HIC_OECD HIC_other

UMC

LMIC

LIC

AUS-Australia

DZA-Algeria

BGDBangladesh

BHSBahamas,

The

ARGArgentina

1

The use of the term is convenient; it is not intended to imply that all economies in the group are

experiencing similar development or that other economies have reached a preferred or final stage of

development. Classification by income does not necessarily reflect development status

8

AUT-Austria

BRBBarbados

BWABotswana

BLZ-Belize

BEN-Benin

BEL-Belgium

HKG-Hong

Kong, China

BRA-Brazil

BOL-Bolivia

BFA-Burkina

Faso

CAN-Canada

ISR-Israel

CHL-Chile

CHN-China

BDI-Burundi

DNKDenmark

MLT-Malta

CRI-Costa

Rica

COLColombia

CMRCameroon

FIN-Finland

SGPSingapore

GAB-Gabon

DOMDominican

Republic

CAF-Central

African

Republic

Since the data set on GNI is already expressed in growth rates and it is well known that

output per capita is integrated of order 1, all our series are stationary. We rely on the

Akaike Information Criterion in choosing the appropriate MSVAR models to run for each

group of countries. A Markov-switching intercept heteroskedastic vector autoregression

(MSIH(2)-VAR(1)) with 2 states and 1 lag reveals to be the best model for HIC_OECD,

HIC_other, and LIC countries; while UMC and LMIC data are better suited for a similar

model (MSMH(2)-VAR(1)) but with mean (M) instead. The two states are recession or

Regime 1 and expansion or Regime 2. These terms are used interchangeably.

Results

With the exception of Gabon (YGAB) in the Middle-Income group; Algeria (YDZA) in

the Lower-Middle-Income group; and Cameroon (YCMR) in the Low-Income group,

there is an underlying stochastic unobservable component that drives the business cycle

of each group of countries.2 Figures 1, 2, 3, 4, and 5 display our findings. The path of

output per capita forecasted over time is similar within groups. Of importance are the

2

There might be many reasons why these three countries exhibit such wild behavior but there are only two

that seem plausible to us at this point. The first might have to do with the fact certain countries might be at

the borderline of two categories while the remaining countries are right down or in the middle of a given

category of GNI per capita. The second might be due to shock events (e.g. a war) that create huge spikes in

growth rate of output per capita.

9

northwestern (Quadrant 2) and southeastern portion (Quadrant 3) of each figure that

shows the response of each country to the overall group’s recession and expansion, what

economists refer to as “cyclical shocks” or changes in the phases of the cycles.3

Figure 1

High-Income OECD Countries – Impulse Responses

Move to regime 1

YAUS

YBEL

YDNK

YAUT

YCAN

YFIN

Transition regime 2 to 1

0.0

0

-0.5

-1

-1.0

YAUS

YBEL

YDNK

YAUT

YCAN

YFIN

10

15

20

YAUS

YBEL

YDNK

YAUT

YCAN

YFIN

10

15

-2

0

5

10

Transition regime 1 to 2

2

YAUS

YBEL

YDNK

15

20

1.0

YAUT

YCAN

YFIN

0

5

Move to regime 2

0.5

1

0.0

0

0

5

10

15

20

0

5

20

3

For example, Quadrant 2 of Figure 1 is the response of each HIC_OECD country to a recession proper to

the develop world.

10

Figure 2

0.0

High-Income Other Countries – Impulse Responses

Move to regime 1

YBHS (cum)

YHKG (cum)

YMLT (cum)

0

YBRB (cum)

YISR (cum)

YSGP (cum)

Transition regime 2 to 1

YBHS (cum)

YHKG (cum)

YMLT (cum)

-5

-2.5

YBRB (cum)

YISR (cum)

YSGP (cum)

-10

-5.0

-15

-20

-7.5

25

0

5

10

Transition regime 1 to 2

15

20

0

5

Move to regime 2

10

15

20

15

20

15

10

10

YBHS (cum)

YHKG (cum)

YMLT (cum)

5

0

5

Figure 3

10

YBRB (cum)

YISR (cum)

YSGP (cum)

15

5

YBHS (cum)

YHKG (cum)

YMLT (cum)

20

0

5

10

YBRB (cum)

YISR (cum)

YSGP (cum)

15

20

Upper-Middle-Income Countries – Impulse Responses

Move to regime 1

Transition regime 2 to 1

0

0.0

YARG (cum)

YBRA (cum)

YCRI (cum)

YBWA (cum)

YCHL (cum)

YGAB (cum)

-2.5

YARG (cum)

YBRA (cum)

YCRI (cum)

-5

YBWA (cum)

YCHL (cum)

YGAB (cum)

-10

-5.0

0

5

10

Transition regime 1 to 2

15

20

7.5

10

0

5

Move to regime 2

10

15

20

5.0

5

YARG (cum)

YBRA (cum)

YCRI (cum)

YBWA (cum)

YCHL (cum)

YGAB (cum)

0

2.5

YARG (cum)

YBRA (cum)

YCRI (cum)

YBWA (cum)

YCHL (cum)

YGAB (cum)

0.0

0

5

10

15

20

0

5

10

15

20

11

Figure 4

2

Lower-Middle-Income Countries – Impulse Responses

Move to regime 1

Transition regime 2 to 1

YDZA (cum)

YBOL (cum)

YCOL (cum)

2.5

YBLZ (cum)

YCHN (cum)

YDOM (cum)

YDZA (cum)

YBOL (cum)

YCOL (cum)

0.0

0

YBLZ (cum)

YCHN (cum)

YDOM (cum)

-2.5

-2

-5.0

-7.5

0

5

10

Transition regime 1 to 2

15

20

4

0

5

Move to regime 2

10

15

20

7.5

5.0

2

2.5

0

0.0

YDZA (cum)

YBOL (cum)

YCOL (cum)

-2.5

0

5

Figure 5

10

YDZA (cum)

YBOL (cum)

YCOL (cum)

YBLZ (cum)

YCHN (cum)

YDOM (cum)

15

20

0

5

YBLZ (cum)

YCHN (cum)

YDOM (cum)

10

15

20

Low-Income Countries – Impulse Responses

Move to regime 1

Transition regime 2 to 1

0.0

0

-2.5

-5

-5.0

YBGD (cum)

YBFA (cum)

YCMR (cum)

YBEN (cum)

YBDI (cum)

YCAF (cum)

YBGD (cum)

YBFA (cum)

YCMR (cum)

-10

YBEN (cum)

YBDI (cum)

YCAF (cum)

-7.5

-15

0

5

10

Transition regime 1 to 2

15

20

0

5

Move to regime 2

10

15

20

15

YBGD (cum)

YBFA (cum)

YCMR (cum)

10

YBEN (cum)

YBDI (cum)

YCAF (cum)

4

YBGD (cum)

YBFA (cum)

YCMR (cum)

YBEN (cum)

YBDI (cum)

YCAF (cum)

2

5

0

0

0

5

10

15

20

0

5

10

15

20

12

In order to determine whether the synchronization of cycles that we observe within

groups for countries of similar degree of economic development also extends across

groups, we construct the growth rate of GNI for a representative country of each group by

taking the mean values over time. In this set up, a switch from Regime 2 to Regime 1 can

be interpreted as the response of each group of countries to a worldwide recession, while

the opposite is a worldwide expansion. As can be seen from Figure 6, irrespective of the

state of the world economy, developed countries as well as developing countries are

driven by the same unobserved component, hence, subjected to the same cycle.4 This is

by all account a surprising result, as one would expect each group’s cycle to be

independent of each other due to the huge disparities in the level of income per capita

across groups. Therefore, this research provides no supports to the claim that the current

World order of rich, poor, and super poor or the dominance of certain economic blocs

over others mainly has to do with worldwide shocks or bad luck.

4

There are a number of procedures that could be used to test for a common cycle. These include the

comparison of Log likelihoods by Hamilton and Quiros (1996); Peersman and Smets (2001); the Markovswitching identified VAR by Ehrmann et al. (2003), and the usual decomposition methods (HodrickPrescott 1980; Baxter and King 1995). Since we have 30 countries in total, any of these procedures adds a

lot of work with not much gain in terms of insights.

13

Figure 6

Impulse Responses Based on Worldwide Shocks

Move to regime 1

Transition regime 2 to 1

-2.5e-11

-1

-5e-11

-2

HICO

UMC6

LIC6

-7.5e-11

HICO

UMC6

LIC6

HIC

LMC6

HIC

LMC6

-3

-1e-10

0

5

10

Transition regime 1 to 2

15

20

3

0

5

Move to regime 2

3

HICO

UMC6

LIC6

2

1

1

0

5

10

HICO

UMC6

LIC6

HIC

LMC6

2

15

20

10

0

5

10

15

20

HIC

LMC6

15

20

Further analysis of the link between business cycles across groups of countries of similar

degree of economic development leads us to exclude those countries that have displayed

independent cycles within groups (namely, outlier countries) from the re-estimation of

World MSVAR. The main purpose is to account for the possibilities that these countries’

cycles could influence the world business cycle in our model. Figure 7 displays the

results. The message remains the same: the relative degree of economic development is

irrelevant for business cycles synchronization.

14

Figure 7

Impulse Responses with Exclusion of Outlier Countries

Move to regime 1

Transition regime 2 to 1

0.0

0

-0.5

-1

HICO

UMC5

LIC5

-1.0

HIC

LMC5

HIC

LMC5

-3

-1.5

-4

-2.0

5

HICO

UMC5

LIC5

-2

0

5

10

Transition regime 1 to 2

4

HICO

UMC5

LIC5

3

15

20

HIC

LMC5

0

5

Move to regime 2

2

2

10

15

HICO

UMC5

LIC5

HIC

LMC5

10

15

20

1

1

0

0

0

5

10

15

20

0

5

20

What can possibly explain the synchronization of cycles across countries of different

degree of economic development? First, there is large country and small country

hypothesis, which could easily be translated into developed and developing countries

hypothesis. From this perspective, whatever shocks that originate in a high income

country will easily permeate through the economies of lower income countries but the

converse is not true. Wars in Africa, guerilla in Latin America and in Asia, disturbances

in other parts of the world are not strong enough to deviate the develop world economies

from their long-run path.

The second explanation is also related to the first in that the justification of a world

business cycle might have to do mostly with trade across nations rather than capital

markets integration, though we do not model trade explicitly in our research. This line of

reasoning is consistent with Frankel and Rose (1998) Wynne and Koo (2000) that

countries with closer trade links are likely to have their business cycles synchronized.

Economic theory suggests that trade effects across countries can synchronize cycles. An

increase in domestic consumption generates increases in imports which in turn expands

15

the foreign economy showing a correlation between economic activities across countries.

A quick look at the data used in this research and in all research that use Real GDP to

uncover commonality in international business cycles indicates that trade is the main

connection of the underlying data generating process.5 For example, a developing country

that is in the midst of a civil war may not have much to export but its imports will

continue to grow to make up for the shortfall in domestic production. Its volume of trade

may even increase, irrespective of how large or small the common shocks that come from

the world are relative to the country’s specific shocks.

Our findings do not necessarily lend support to a world currency because it is not a study

on the feasibility of a single currency or a monetary union. Nonetheless, it does

contribute to further debate on the subject. The most important contribution of this paper

to the existing literature is that it is a formal attempt to establish whether our observations

about the way studies on international business cycle synchronization were carried out

responded to certain criterion in terms of the relative degrees of economic development

of the countries. We believe trade is likely the factor that could explain the

synchronization of individual countries’ cycles. For there may not be much connection

between Benin and Canada that could explain a common cycle between the two

countries, but sure enough there is a huge connection between Africa and America in

terms of trade, which these two countries are part, respectively. Hence, the

synchronization between high income and low income countries business cycles found in

this research.

5

Domestic output = Domestic absorption + Trade

16

Section 3

Conclusion

This paper has investigated the commonality in the business cycles of a panel of countries

that are classified according to their relative degree of economic development. There are

five groups with six countries each: High Income OECD, High Income non-OECD,

Upper Middle Income, Lower Middle Income, and Low income. The Markov-switching

vector autoregression is used to determine whether i) each group of countries follows the

same business cycle and ii) whether these cycles are independent of each other. We focus

mainly on the impulse responses of each country within groups in order to uncover

whether there is a common unobserved component that drives their business cycles.

Our findings show that countries of the same degree of economic development tend to

move according to the same wavelength. We then tackled the next question as to whether

there is a common unobserved component at the world level that governs the path of

output per capita for each group of countries. The results show that a World recession or

expansion has similar effects on both developed and developing economies. Overall, our

research suggests that the disparity in the levels of economic development across

countries is irrelevant for business cycles synchronization. We therefore argue that trade

in goods and services among countries is the potential factor underlying the common

cycle observed at the world level. Integration of financial markets still has a long way to

go before it could potentially undermine the gap between developed and developing

countries. For both physical and financial capital are relatively immobile across nations.

Although this paper contains a clear contribution to the existing literature, it is imperative

to interpret the results carefully within contexts. The paper is not intended to justify

monetary union at the world level nor is it an argument in favor of a world currency. It

can only contribute to the ongoing debate on these subjects. The strongest message of this

paper so far is that researchers might want to explore international business cycle

synchronization by relying on industrial product rather than other measures of output. All

these measures of output contain a trade component through which business cycle

transmission seems directly to take place. Therefore, there is a potential to finding

17

synchronization of business cycle where there might not be one. Industrial production

indexes might be less prone to this type of biasness, despite of the fact that some inputs

used in the production process are imported.

18

References

Artis, Michael, Hans-Martin Krolzig, and Juan Toro (2004). “The European Business

Cycle.” Oxford Economic Papers, 56, 1-44.

Backus, D. K., and P. J. Kehoe (1992). “International Evidence on the Historical

Properties of Business Cycles.” The American Economic Review, 82, Issue 4, 864-888.

Baxter, M., and R. King (1995). “Measuring Business Cycles: Approximate band-pass

filters for economic time series, Working Paper 5022, NBER, Cambridge, MA.

McAdam, Peter “US, Japan and the Euro Area: Comparing Business-Cycle Features”

European Central Bank Working Paper Series #283

Chauvet, M and C. Yu (2006) “International Business Cycles: G7 and OECD Countries”

Federal Reserve Bank of Atlanta. Economic Review: 1st Quarter 43-54

Durland J., and T. McCurdy (1994). “Duration-dependent Transitions in a Markov model

of U.S. GNP growth.” Journal of Business and Economic Statistics 12, 270-288.

Frankel, J., and A. Rose (1998). “The Endogeneity of the Optimum Currency Area

Criteria,” Economic Journal 108, pp. 1009-1025.

Girardin, Eric (2002). “Does Japan Share a Common Business Cycle With Other East

Asian Countries?” Université de la Mediterranée, Working Paper.

Girardin, Eric (2004) :”Regime –dependent synchronization of growth cycles between

Japan and East Asia”. Paper submitted to the MMF Annual Conference CASS Business

School London

Hodrick, R., and E. Prescott (1980). “Post-War US Business Cycles: An Empirical

investigation,” Working Paper, Carnegie-Mellon.

Hamilton, J. D. (1989). “A New Approach to the Economic Analysis of Nonstationary

Time Series and the Business Cycle. Econometrica, 57, 357-384.

Jean Louis, R. (2004). Three Essays on North American Monetary Union. Ph.D.

Dissertation. The University of Manitoba, Canada.

Jean Louis, R., and Daniel Simons (2005). “North American Business Cycle: Myth or

Reality? http://papers.ssrn.com/sol3/papers.cfm?abstract_id=874814.

Kim, C-J. and J. Piger (2000). “Common Stochastic Trends, Common Cycles, and

Asymmetry in Economic Fluctuations.” Board of Governors of the Federal Reserve

System, International Finance Discussion Papers, No. 681, September.

19

Kim, C-J. and C. R. Nelson(1999). “Friedman’s Plucking Model of Business

Fluctuations: Tests and Estimates of Permanent and Transitory Components.” Journal of

Money, Credit, and Banking, 31, 317-334.

Kose, A. M; Prasad, E. E and Terrones, M. E (2003). “How Does Globalization Affect

the Synchronization of Business Cycles?” IZA Discussion papers #702

Krolzig, Hans-Martin (1997a). Markov-Switching Vector Autoregressions: Modelling,

Statistical Inference, and Application to Business Cycle Analysis. Springer-Verlag.

Krolzig, Hans-Martin (1997b). “International Business Cycles: Regime Shifts in the

Stochastic Process of Economic Growth. Applied Economics Discussion Paper 194,

University of Oxford.

Krolzig, Hans-Martin (1998). “Econometric Modelling of Markov-switching Vector

Autoregressions using MSVAR for OX.” Institute of Economics and Statistics and

Nuffield College, Oxford. Http://www.economics.ox.ac.uk/research/krolzig/...

Krolzig, H-M and M. Sensier (2000). “A Disaggregated Markov-switching Model of the

Business Cycle in UK Manufacturing.” Manchester School 68(4), 442-460.

Krolzig, H-M (2005). MSVAR 1.32 for OX 3.4.

http://www.economics.ox.ac.uk/research/kr

Lumsdaine, R. L., and E. S. Prasad (2002). “Identifying the Common Component of

International Economic Fluctuations: A New Approach.” IZA Discussion Paper No. 487.

Mejía-Reyes, Pablo (1999). “Classical Business Cycles in Latin America: Turning Points,

Asymmetries and International synchronization.” School of Economic Studies, The

University of Manchester, Working Paper, May.

Mills, Terence C., and M. J. Holmes (1999). “Common Trends and Cycles in European

Industrial Production: Exchange Rate Regimes and Economic Convergence.” The

Manchester School, 67, Issue 4, 557-587.

Peersman, Gert, and Frank Smets (2001). “Are The Effects of Monetary Policy in The

Euro Area Greater in Recessions Than in Booms?” European Central Bank, Working

Paper No. 52, March.

Pelagatti, M. Matteo (2005). “Duration Dependent Markov-Switching Vector

Autoregression: Properties, Bayesian Inference, Software and Applications.” Elsevier

Science

Sichel, D. E. (1993). “Inventories and the three phases of the Business Cycle.” Journal of

Business and Economic Statistics, 12, 269-277.

20

Wynne, M., and J. Koo (2000). “Business Cycles Under Monetary Union: A comparison

of the EU and the US,” Economica 67, 347-374.

21